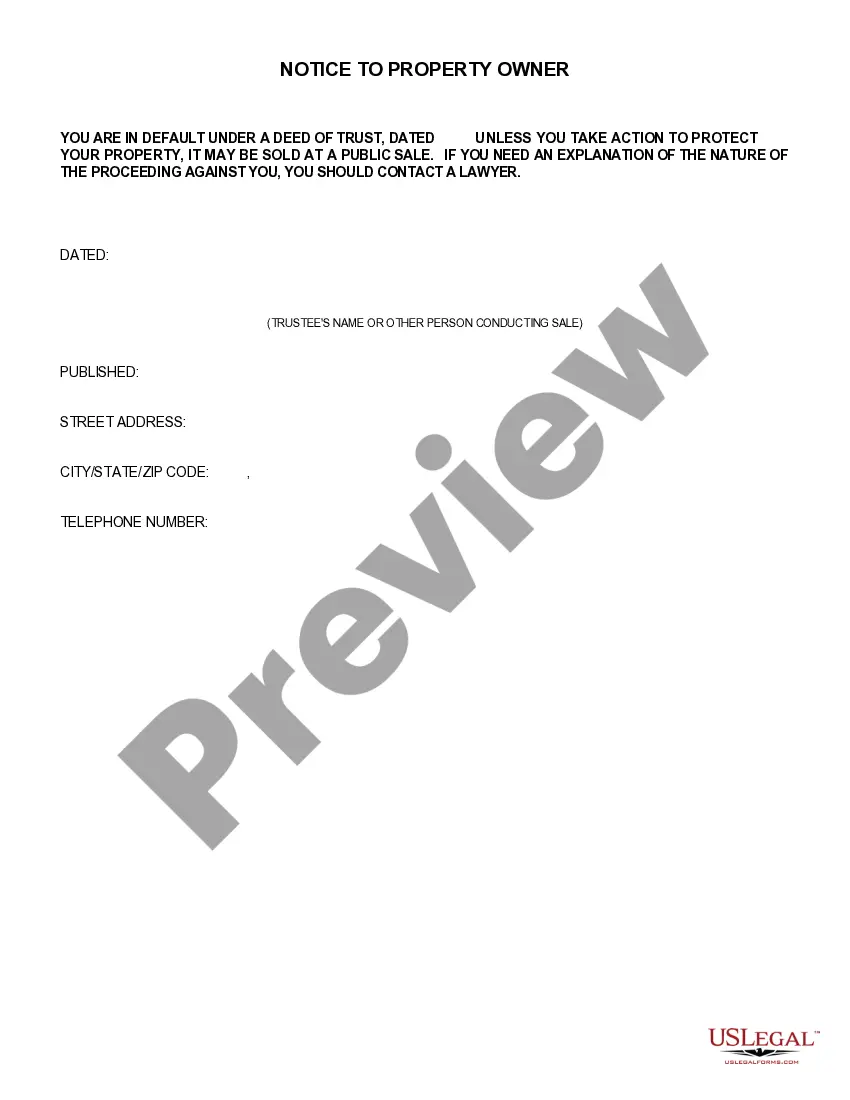

This notice informs the mortgagor that he/she is in default under a deed of trust. Unless prompt action is taken, the mortgagors property may be sold at a public sale to the highest bidder. The form also lists the date of the sale, place of the sale, the property address, and the newspaper responsible for printing the notice of the trustee sale.

Title: Understanding the Thousand Oaks California Notice of Trustee's Sale — A Comprehensive Overview Keywords: Thousand Oaks California, Notice of Trustee's Sale, foreclosure process, non-judicial foreclosure, trustee sale, foreclosure auction Description: The Thousand Oaks California Notice of Trustee's Sale is an official document that serves as an essential part of the foreclosure process in the city of Thousand Oaks, California. This notice signifies the initiation of foreclosure proceedings for a property due to default in mortgage payments or an inability to meet the loan obligations. The notice is typically filed by the lender or the trustee and is an important step towards the eventual sale of the property through a foreclosure auction. Types of Thousand Oaks California Notice of Trustee's Sale: 1. Notice of Trustee's Sale: This is the most common type of notice issued by the lender or trustee and marks the beginning of the foreclosure process. It includes important details such as the borrower's name, property address, foreclosure sale date, and the amount owed. The notice is recorded in the County Recorder's Office and must be posted at least twenty (20) days before the scheduled sale date. 2. Postponement Notice: In some cases, the foreclosure sale date mentioned in the initial Notice of Trustee's Sale may be postponed or rescheduled. When this occurs, a Postponement Notice is issued, providing updated information on the new sale date, time, and location. These notices are essential for bidders, interested parties, and potential buyers, enabling them to adjust their plans accordingly. 3. Notice of Default: Before the Notice of Trustee’s Sale is issued, the lender may send a Notice of Default to the borrower, stating the number of missed payments and demanding immediate payment to avoid foreclosure. This notice serves as a warning, giving the borrower an opportunity to address the default and bring the mortgage account current. 4. Notice of Sale: Following the Notice of Trustee's Sale, a Notice of Sale is issued, further confirming the sale details, including the exact time, date, and location of the foreclosure auction. Prospective bidders or interested parties can obtain this notice to stay informed about the auction process. It is crucial for borrowers who receive a Thousand Oaks California Notice of Trustee's Sale to seek legal and financial advice promptly, as there may be options available to prevent the foreclosure process or explore alternatives such as loan modification, short sale, or deed in lieu of foreclosure. In summary, the Thousand Oaks California Notice of Trustee's Sale signifies the beginning of the foreclosure process and ultimately leads to the sale of the property through a foreclosure auction. Understanding the different types of notices associated with this process can help borrowers, bidders, and interested parties navigate the foreclosure landscape more effectively.Title: Understanding the Thousand Oaks California Notice of Trustee's Sale — A Comprehensive Overview Keywords: Thousand Oaks California, Notice of Trustee's Sale, foreclosure process, non-judicial foreclosure, trustee sale, foreclosure auction Description: The Thousand Oaks California Notice of Trustee's Sale is an official document that serves as an essential part of the foreclosure process in the city of Thousand Oaks, California. This notice signifies the initiation of foreclosure proceedings for a property due to default in mortgage payments or an inability to meet the loan obligations. The notice is typically filed by the lender or the trustee and is an important step towards the eventual sale of the property through a foreclosure auction. Types of Thousand Oaks California Notice of Trustee's Sale: 1. Notice of Trustee's Sale: This is the most common type of notice issued by the lender or trustee and marks the beginning of the foreclosure process. It includes important details such as the borrower's name, property address, foreclosure sale date, and the amount owed. The notice is recorded in the County Recorder's Office and must be posted at least twenty (20) days before the scheduled sale date. 2. Postponement Notice: In some cases, the foreclosure sale date mentioned in the initial Notice of Trustee's Sale may be postponed or rescheduled. When this occurs, a Postponement Notice is issued, providing updated information on the new sale date, time, and location. These notices are essential for bidders, interested parties, and potential buyers, enabling them to adjust their plans accordingly. 3. Notice of Default: Before the Notice of Trustee’s Sale is issued, the lender may send a Notice of Default to the borrower, stating the number of missed payments and demanding immediate payment to avoid foreclosure. This notice serves as a warning, giving the borrower an opportunity to address the default and bring the mortgage account current. 4. Notice of Sale: Following the Notice of Trustee's Sale, a Notice of Sale is issued, further confirming the sale details, including the exact time, date, and location of the foreclosure auction. Prospective bidders or interested parties can obtain this notice to stay informed about the auction process. It is crucial for borrowers who receive a Thousand Oaks California Notice of Trustee's Sale to seek legal and financial advice promptly, as there may be options available to prevent the foreclosure process or explore alternatives such as loan modification, short sale, or deed in lieu of foreclosure. In summary, the Thousand Oaks California Notice of Trustee's Sale signifies the beginning of the foreclosure process and ultimately leads to the sale of the property through a foreclosure auction. Understanding the different types of notices associated with this process can help borrowers, bidders, and interested parties navigate the foreclosure landscape more effectively.