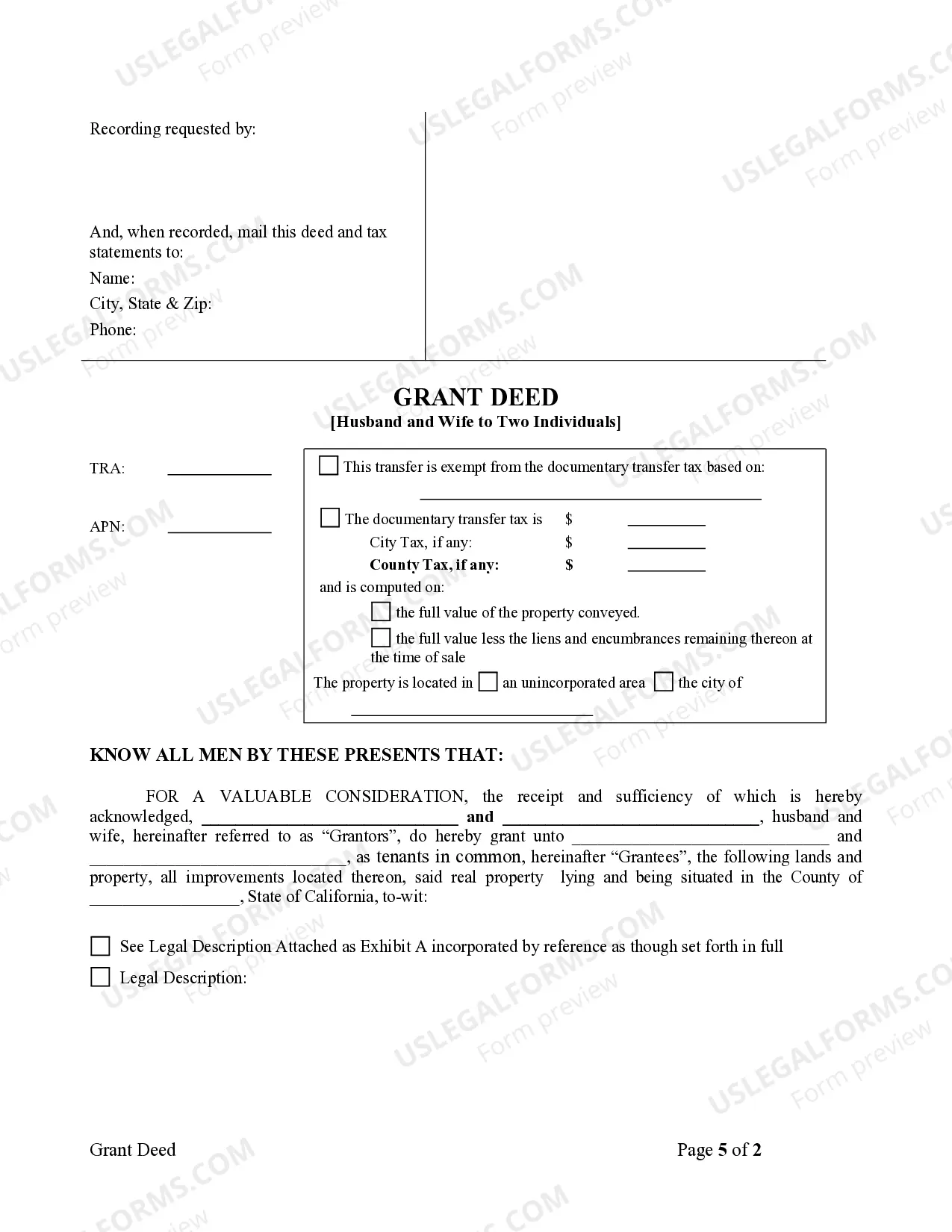

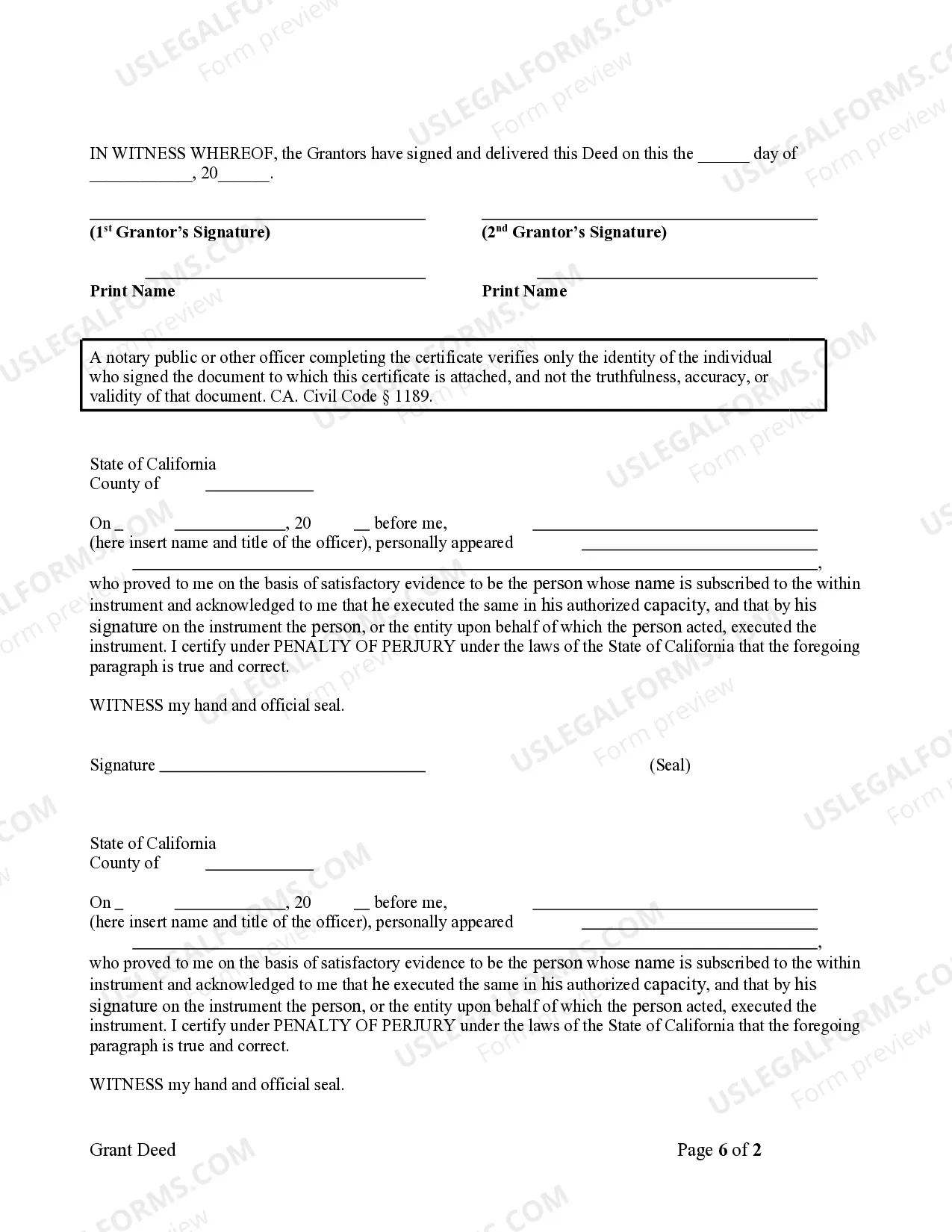

This form is a Grant Deed where the grantors are husband and wife and the grantees are two individuals. Grantors convey and grant the described property to the grantees. The grantees take the property as joint tenants with a right of survivorship or as tenants in common. This deed complies with all state statutory laws.

A Thousand Oaks California Grant Deed — Husband and Wife to Two Individuals is a legal document used to transfer ownership of real property in Thousand Oaks, California, from a married couple to two individuals. This type of grant deed ensures that the ownership rights of the property are granted to the two individuals jointly, with equal rights and responsibilities. The granter in this deed is the husband and wife, who are the current owners of the property, while the grantees are the two individuals who will receive ownership rights. This transfer of ownership is typically done when the husband and wife want to share ownership of the property with two other individuals, such as family members or business partners. There are two main variations or subtypes of Thousand Oaks California Grant Deed — Husband and Wife to Two Individuals: 1. Tenancy in Common: In this type of grant deed, each individual holds an undivided interest in the property. They have the right to sell, transfer, or mortgage their respective shares of the property independently. If one individual passes away, their share of the property will be transferred to their heirs or as directed in their will. 2. Joint Tenancy: With joint tenancy, the two individuals share equal ownership rights to the property. If one individual passes away, their share automatically transfers to the surviving individual(s) without going through probate. This form of ownership includes the right of survivorship, meaning that the last surviving owner will have full ownership rights. Both types of grant deed provide clear legal documentation of the transfer of property ownership, ensuring all parties involved are aware of their rights and responsibilities. It is important to consult with a qualified real estate attorney or title company to properly draft and execute these grant deeds to avoid any future disputes or complications. Furthermore, each grant deed should include accurate property descriptions, information about the granter and grantees, and any relevant provisions or restrictions associated with the property.A Thousand Oaks California Grant Deed — Husband and Wife to Two Individuals is a legal document used to transfer ownership of real property in Thousand Oaks, California, from a married couple to two individuals. This type of grant deed ensures that the ownership rights of the property are granted to the two individuals jointly, with equal rights and responsibilities. The granter in this deed is the husband and wife, who are the current owners of the property, while the grantees are the two individuals who will receive ownership rights. This transfer of ownership is typically done when the husband and wife want to share ownership of the property with two other individuals, such as family members or business partners. There are two main variations or subtypes of Thousand Oaks California Grant Deed — Husband and Wife to Two Individuals: 1. Tenancy in Common: In this type of grant deed, each individual holds an undivided interest in the property. They have the right to sell, transfer, or mortgage their respective shares of the property independently. If one individual passes away, their share of the property will be transferred to their heirs or as directed in their will. 2. Joint Tenancy: With joint tenancy, the two individuals share equal ownership rights to the property. If one individual passes away, their share automatically transfers to the surviving individual(s) without going through probate. This form of ownership includes the right of survivorship, meaning that the last surviving owner will have full ownership rights. Both types of grant deed provide clear legal documentation of the transfer of property ownership, ensuring all parties involved are aware of their rights and responsibilities. It is important to consult with a qualified real estate attorney or title company to properly draft and execute these grant deeds to avoid any future disputes or complications. Furthermore, each grant deed should include accurate property descriptions, information about the granter and grantees, and any relevant provisions or restrictions associated with the property.