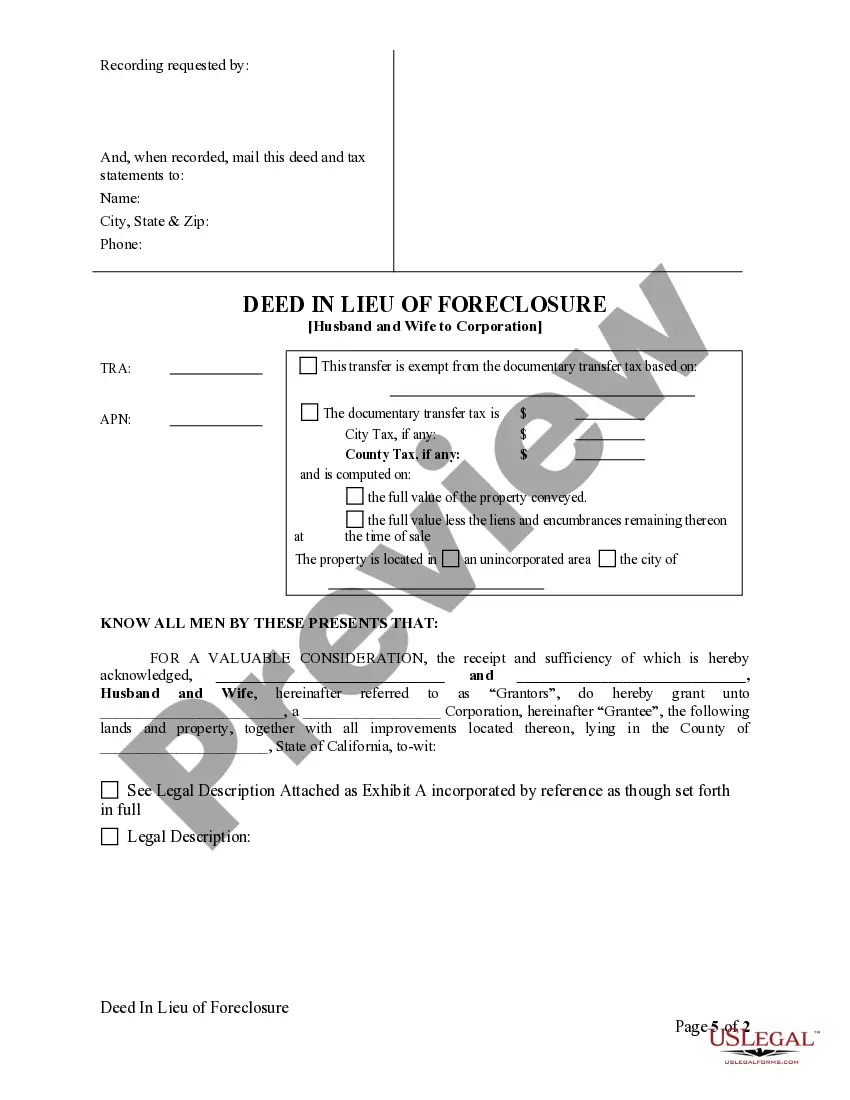

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Burbank, California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: A Comprehensive Guide Keywords: Burbank California, Deed in Lieu of Foreclosure, Husband and Wife, Corporation In Burbank, California, when homeowners find themselves facing financial difficulties and are unable to continue with their mortgage payments, one option they might consider is a Deed in Lieu of Foreclosure. This legal agreement allows homeowners to transfer the property's ownership directly to their mortgage lender, in this case, a Corporation, to avoid the foreclosure process. This transfer occurs voluntarily, with the agreement mutually benefiting all parties involved. The Deed in Lieu of Foreclosure process in Burbank, California is specifically designed for situations involving a married couple who jointly own a property and wish to convey ownership to a Corporation. This type of transaction involves important legal considerations, and it's essential to understand the different aspects and potential variations involved. Here are a few types of Burbank California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Standard Deed in Lieu of Foreclosure — Husband and Wife to Corporation: This is the most common type of Deed in Lieu of Foreclosure in Burbank, California. It involves a married couple voluntarily transferring their property's title to a Corporation instead of pursuing the foreclosure process. By doing so, they avoid the financial and emotional burdens associated with foreclosure and provide an alternative resolution to the lender. 2. Deficiency Release Agreement — Husband and Wife to Corporation: In some cases, homeowners may owe more on their mortgage loan than the property's current market value. If the Corporation agrees to accept the property as full satisfaction of the debt, a Deficiency Release Agreement may be included in the Deed in Lieu of Foreclosure. This agreement states that the Corporation will release the couple from any further liability for the remaining mortgage balance, preventing future legal actions or claims against them. 3. Tax Implications and Provisions — Husband and Wife to Corporation: Transferring property ownership through a Deed in Lieu of Foreclosure may have certain tax implications. Burbank, California homeowners should consult legal and tax professionals to understand the potential consequences, exemptions, or deductions. Additionally, it's important to include detailed provisions within the Deed, addressing who will be responsible for any outstanding property taxes or assessments at the time of transfer. 4. Terms and Conditions — Husband and Wife to Corporation: The terms and conditions of a Deed in Lieu of Foreclosure vary depending on the agreement between the homeowners and the Corporation. These terms may include the timeframe for homeowners to vacate the property, any financial or non-financial relocation assistance provided, and the eventual sale or disposal of the property by the Corporation. In conclusion, a Burbank, California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is an option for homeowners facing financial hardships who wish to avoid foreclosure. It allows married couples to voluntarily transfer the property's ownership to a Corporation, resolving their mortgage debt. However, it is essential for homeowners to seek legal advice, understand the tax implications, and consider various terms and conditions that may apply in their specific situation.Burbank, California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: A Comprehensive Guide Keywords: Burbank California, Deed in Lieu of Foreclosure, Husband and Wife, Corporation In Burbank, California, when homeowners find themselves facing financial difficulties and are unable to continue with their mortgage payments, one option they might consider is a Deed in Lieu of Foreclosure. This legal agreement allows homeowners to transfer the property's ownership directly to their mortgage lender, in this case, a Corporation, to avoid the foreclosure process. This transfer occurs voluntarily, with the agreement mutually benefiting all parties involved. The Deed in Lieu of Foreclosure process in Burbank, California is specifically designed for situations involving a married couple who jointly own a property and wish to convey ownership to a Corporation. This type of transaction involves important legal considerations, and it's essential to understand the different aspects and potential variations involved. Here are a few types of Burbank California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Standard Deed in Lieu of Foreclosure — Husband and Wife to Corporation: This is the most common type of Deed in Lieu of Foreclosure in Burbank, California. It involves a married couple voluntarily transferring their property's title to a Corporation instead of pursuing the foreclosure process. By doing so, they avoid the financial and emotional burdens associated with foreclosure and provide an alternative resolution to the lender. 2. Deficiency Release Agreement — Husband and Wife to Corporation: In some cases, homeowners may owe more on their mortgage loan than the property's current market value. If the Corporation agrees to accept the property as full satisfaction of the debt, a Deficiency Release Agreement may be included in the Deed in Lieu of Foreclosure. This agreement states that the Corporation will release the couple from any further liability for the remaining mortgage balance, preventing future legal actions or claims against them. 3. Tax Implications and Provisions — Husband and Wife to Corporation: Transferring property ownership through a Deed in Lieu of Foreclosure may have certain tax implications. Burbank, California homeowners should consult legal and tax professionals to understand the potential consequences, exemptions, or deductions. Additionally, it's important to include detailed provisions within the Deed, addressing who will be responsible for any outstanding property taxes or assessments at the time of transfer. 4. Terms and Conditions — Husband and Wife to Corporation: The terms and conditions of a Deed in Lieu of Foreclosure vary depending on the agreement between the homeowners and the Corporation. These terms may include the timeframe for homeowners to vacate the property, any financial or non-financial relocation assistance provided, and the eventual sale or disposal of the property by the Corporation. In conclusion, a Burbank, California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is an option for homeowners facing financial hardships who wish to avoid foreclosure. It allows married couples to voluntarily transfer the property's ownership to a Corporation, resolving their mortgage debt. However, it is essential for homeowners to seek legal advice, understand the tax implications, and consider various terms and conditions that may apply in their specific situation.