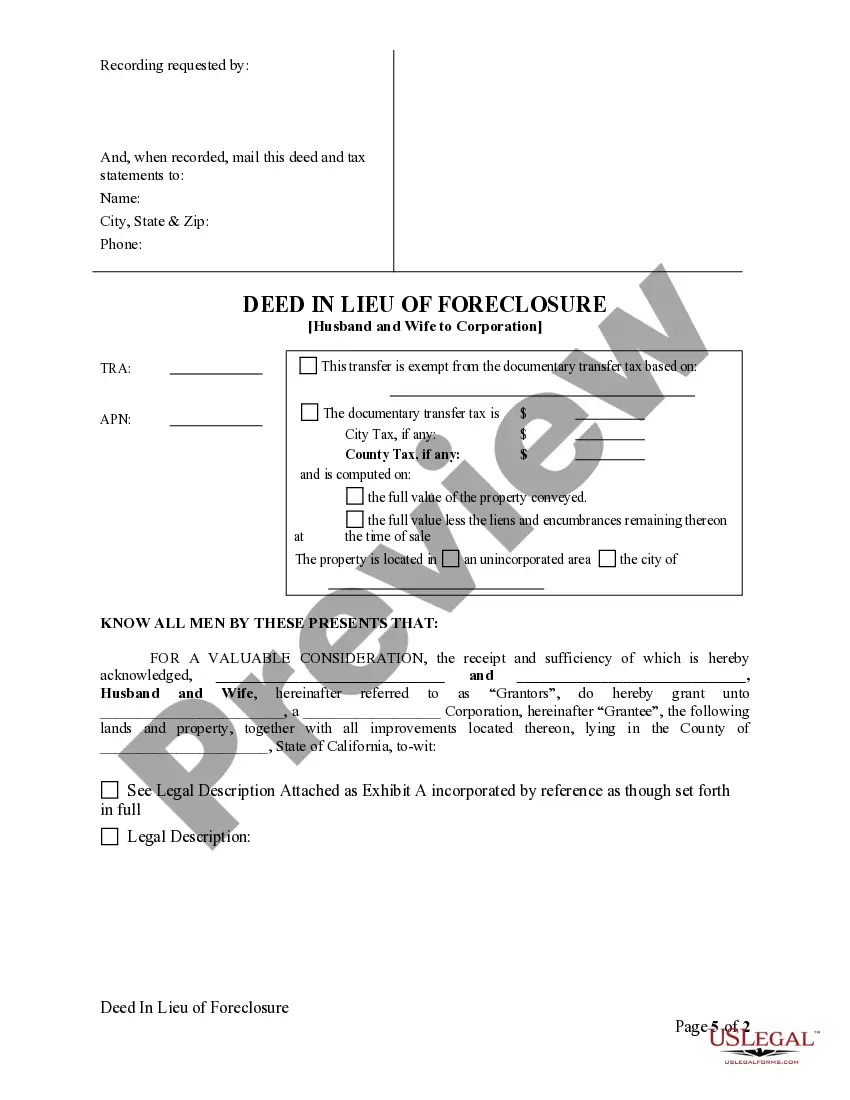

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Concord California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process where a married couple transfers ownership of their property to a corporation as an alternative to going through a foreclosure. This deed in lieu of foreclosure option is applicable in Concord, California, and helps homeowners avoid the extensive and time-consuming foreclosure procedure. When a husband and wife opt for a Deed in Lieu of Foreclosure in Concord, California, they voluntarily transfer the property title to a corporation that may be affiliated with their mortgage lender, allowing the corporation to assume ownership and responsibility for the mortgage. This process releases the couple from their obligations, preventing the foreclosure from negatively impacting their credit score. Here are different types of Concord California Deed in Lieu of Foreclosure — Husband and Wife to Corporation that homeowners should be aware of: 1. Traditional Deed in Lieu of Foreclosure: This is the standard option, where the homeowners sign over the deed to the corporation, absolving themselves from the mortgage and avoiding foreclosure. 2. Junior Lien Deed in Lieu of Foreclosure: This type is applicable when there are multiple liens or mortgages on the property. In this case, the corporation assumes ownership of the property subject to the senior lien mortgages, while the junior liens may be discharged or restructured. 3. Tax Lien Deed in Lieu of Foreclosure: If the property has outstanding tax liens, the process involves transferring the property to the corporation, which may then negotiate the tax payment or seek tax lien relief. 4. Deficiency Release Deed in Lieu of Foreclosure: This type protects homeowners from a potential deficiency judgment, where the lender could pursue them for any remaining mortgage balance after the property is sold. By opting for a deficiency release, the homeowners may be relieved of this potential liability. 5. Leaseback Deed in Lieu of Foreclosure: In certain cases, homeowners may have the option to lease the property back from the corporation after transferring ownership. This allows them to continue living in the home for a predetermined period, avoiding the immediate disruption caused by foreclosure. Concord California Deed in Lieu of Foreclosure — Husband and Wife to Corporation provides a way for homeowners facing financial difficulties to resolve their mortgage obligations without going through the foreclosure process. However, it is crucial to consult with legal and financial professionals to fully understand the implications and potential consequences of this option. The availability of specific types of Deed in Lieu of Foreclosure may vary depending on the individual circumstances and the lender's policies.Concord California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process where a married couple transfers ownership of their property to a corporation as an alternative to going through a foreclosure. This deed in lieu of foreclosure option is applicable in Concord, California, and helps homeowners avoid the extensive and time-consuming foreclosure procedure. When a husband and wife opt for a Deed in Lieu of Foreclosure in Concord, California, they voluntarily transfer the property title to a corporation that may be affiliated with their mortgage lender, allowing the corporation to assume ownership and responsibility for the mortgage. This process releases the couple from their obligations, preventing the foreclosure from negatively impacting their credit score. Here are different types of Concord California Deed in Lieu of Foreclosure — Husband and Wife to Corporation that homeowners should be aware of: 1. Traditional Deed in Lieu of Foreclosure: This is the standard option, where the homeowners sign over the deed to the corporation, absolving themselves from the mortgage and avoiding foreclosure. 2. Junior Lien Deed in Lieu of Foreclosure: This type is applicable when there are multiple liens or mortgages on the property. In this case, the corporation assumes ownership of the property subject to the senior lien mortgages, while the junior liens may be discharged or restructured. 3. Tax Lien Deed in Lieu of Foreclosure: If the property has outstanding tax liens, the process involves transferring the property to the corporation, which may then negotiate the tax payment or seek tax lien relief. 4. Deficiency Release Deed in Lieu of Foreclosure: This type protects homeowners from a potential deficiency judgment, where the lender could pursue them for any remaining mortgage balance after the property is sold. By opting for a deficiency release, the homeowners may be relieved of this potential liability. 5. Leaseback Deed in Lieu of Foreclosure: In certain cases, homeowners may have the option to lease the property back from the corporation after transferring ownership. This allows them to continue living in the home for a predetermined period, avoiding the immediate disruption caused by foreclosure. Concord California Deed in Lieu of Foreclosure — Husband and Wife to Corporation provides a way for homeowners facing financial difficulties to resolve their mortgage obligations without going through the foreclosure process. However, it is crucial to consult with legal and financial professionals to fully understand the implications and potential consequences of this option. The availability of specific types of Deed in Lieu of Foreclosure may vary depending on the individual circumstances and the lender's policies.