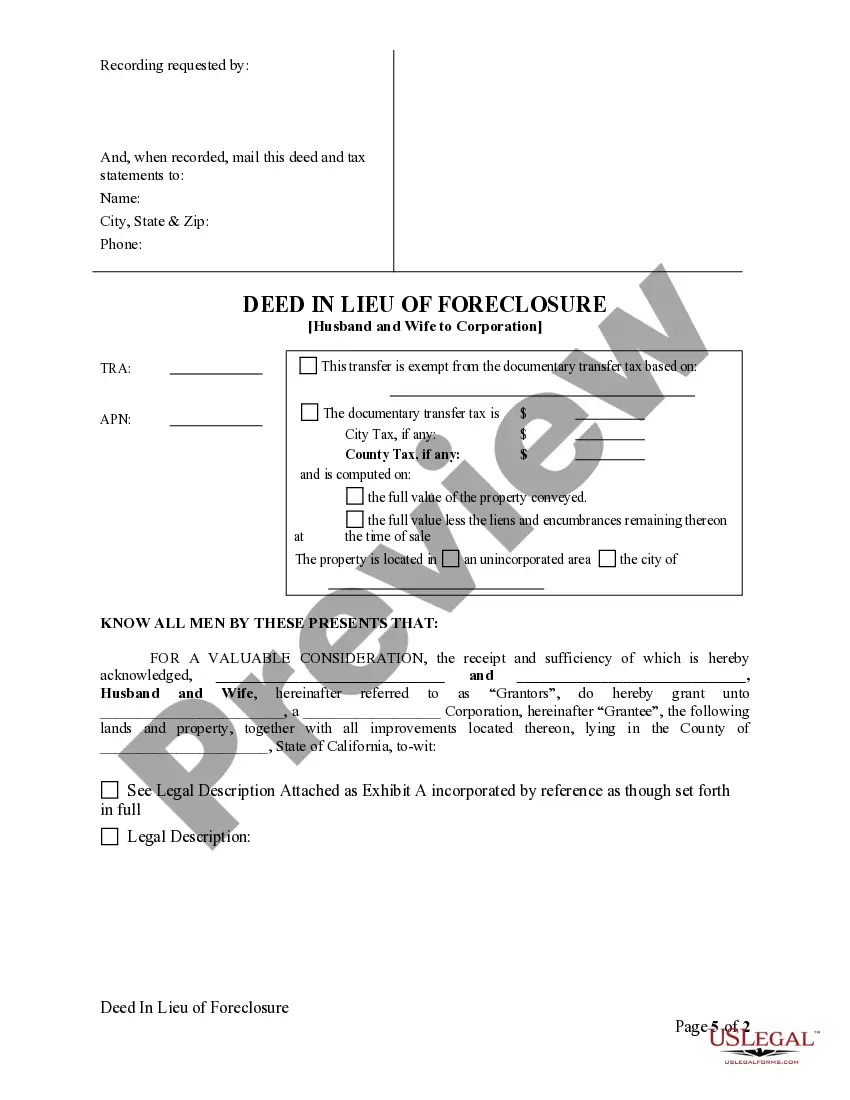

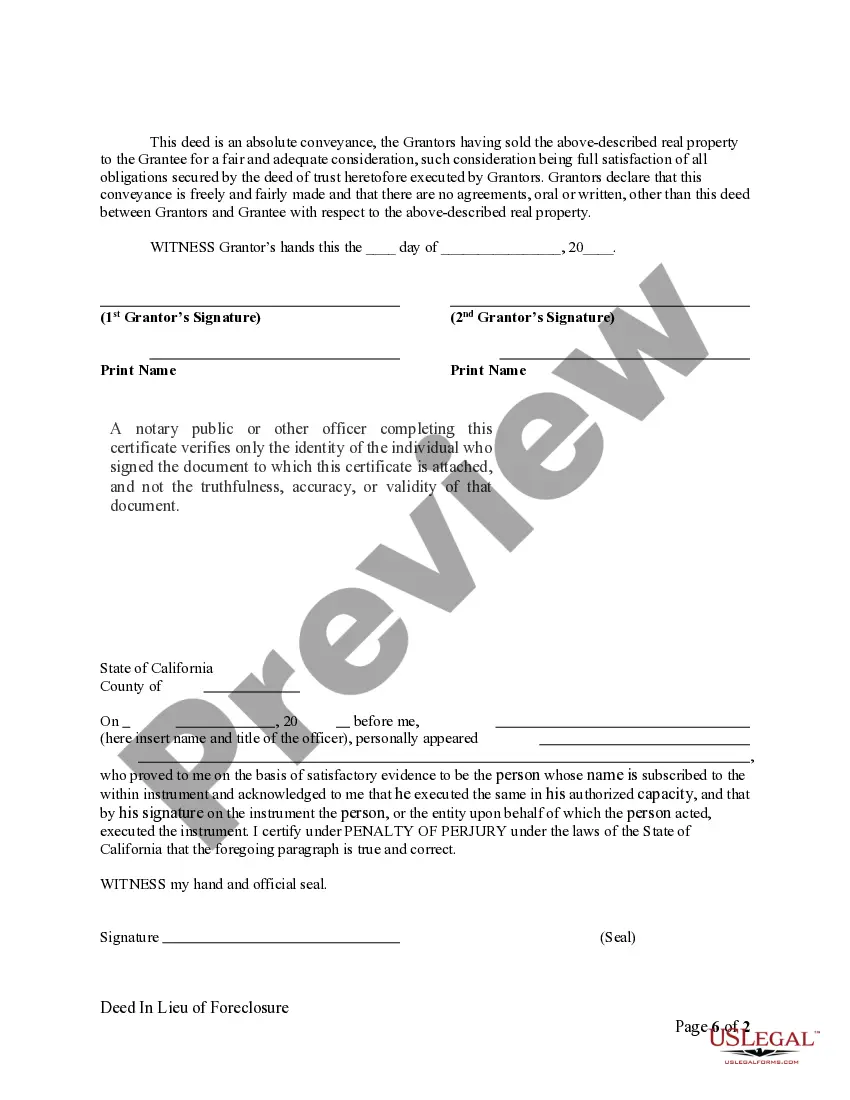

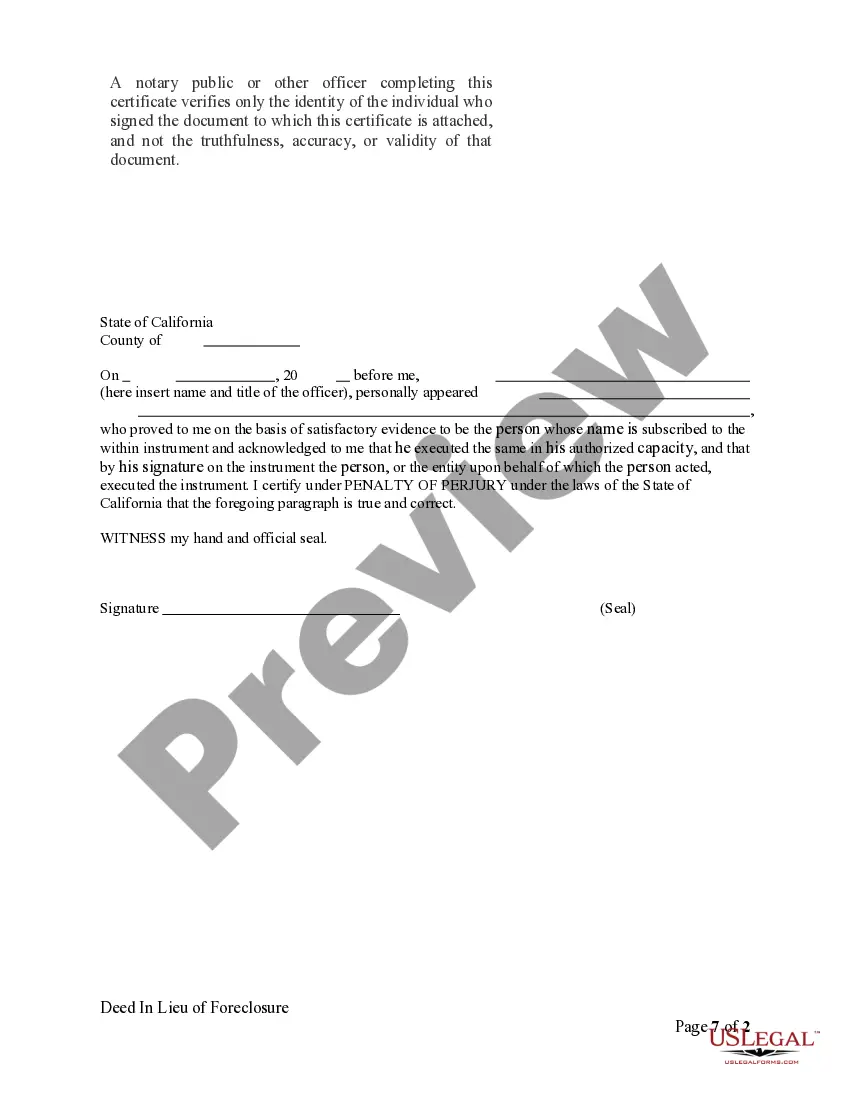

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Keywords: Contra Costa California, Deed in Lieu of Foreclosure, Husband and Wife, Corporation. Title: Understanding Contra Costa California Deed in Lieu of Foreclosure — Husband and Wife to Corporation Introduction: In Contra Costa, California, when faced with impending foreclosure, homeowners may consider a Deed in Lieu of Foreclosure as a viable solution. This transaction involves transferring the property's ownership from the homeowners (husband and wife) to a corporation. This article aims to provide a comprehensive understanding of the process, benefits, and different types available. Types of Contra Costa California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Voluntary Deed in Lieu: This type occurs when homeowners willingly surrender their property to a corporation to avoid foreclosure. It is a collaborative agreement between all parties involved. 2. Involuntary Deed in Lieu: In certain cases, lenders may initiate an involuntary Deed in Lieu of Foreclosure if homeowners fail to meet their mortgage obligations. This option, though less common, allows homeowners to avoid foreclosure proceedings. 3. Strategic Deed in Lieu: Homeowners may strategically choose this option when their property value significantly decreases, and they are unable to meet their mortgage obligations. It serves as a proactive approach to alleviate financial burdens. 4. Partnership Deed in Lieu: Sometimes, partnerships or joint property owners opt for this type when they wish to transfer ownership to a corporation as a collective resolution to foreclosure risks. Process of Contra Costa California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Contact a real estate attorney: Seek professional advice to determine if a Deed in Lieu of Foreclosure is suitable for your situation. 2. Negotiation with the corporation: Establish open communication with the desired corporation, ensuring a mutual understanding of transfer terms, obligations, and potential financial impacts. 3. Title search and preparation: Conduct a thorough title search to ensure no conflicting liens or encumbrances exist. Then, prepare the necessary legal documents required for the transaction. 4. Submission of application: Submit the Deed in Lieu of Foreclosure application to the lender or corporation, providing all requested information and supporting documentation. 5. Approval and acceptance: After careful review, the lender or corporation will either accept or reject the application. If approved, both parties will enter into a binding agreement. 6. Transfer of ownership: Once the agreement is in place, homeowners sign over the property's ownership to the corporation, relinquishing all rights and responsibilities. Benefits of Contra Costa California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Avoidance of foreclosure: Deed in Lieu allows homeowners to avoid the potentially devastating consequences of foreclosure, such as damaged credit and public auction. 2. Debt relief: By transferring ownership to the corporation, homeowners are released from their mortgage debt obligations, providing a fresh start. 3. Streamlined process: Compared to foreclosure proceedings, Deed in Lieu offers a more efficient and expedited resolution, reducing stress for all parties involved. 4. Potential financial incentives: In some cases, lenders or corporations may offer financial incentives, such as relocation assistance or debt forgiveness, to encourage cooperation. Conclusion: Contra Costa California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal transaction that enables homeowners to transfer property ownership to a corporation, providing an alternative to foreclosure. Understanding the different types, required steps, and potential benefits can empower homeowners to make informed decisions in challenging times. Consulting with legal professionals is crucial for personalized guidance throughout this process.