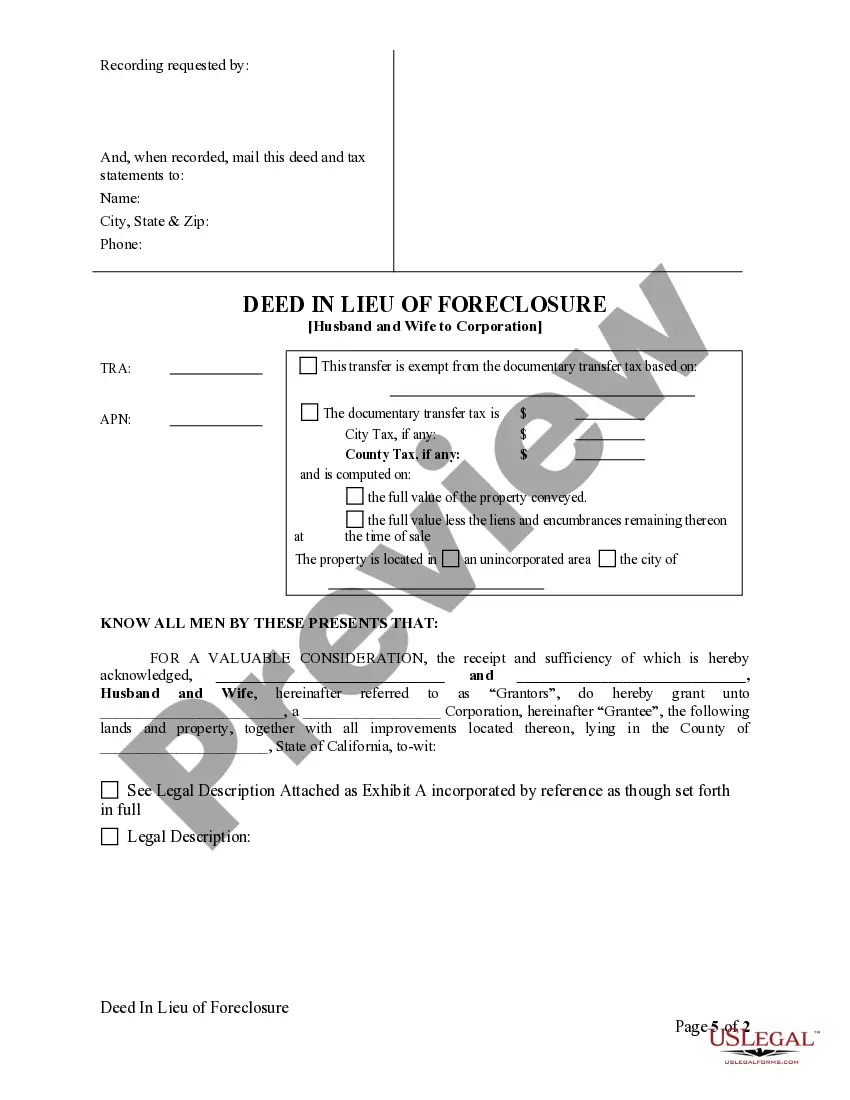

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Elk Grove California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process that allows a married couple to transfer ownership of their property to a corporation in order to satisfy a mortgage debt. This alternative to foreclosure can be beneficial for both parties involved, as it allows the homeowners to avoid the lengthy and costly foreclosure process while providing the corporation with a property asset. By opting for a Deed in Lieu of Foreclosure, the corporation can potentially acquire the property at a fair value, reducing the financial burden on the homeowners. It also spares them the damaging effects of foreclosure on their credit scores and provides them with a more dignified exit from their financial obligations. There are different types of Elk Grove California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, which include: 1. Voluntary Deed in Lieu: This type of deed is exercised willingly by the homeowners, who approach the mortgage lender or corporation to propose the transfer of property ownership. Both parties negotiate terms and conditions, including the release of the homeowners from their mortgage obligations. 2. Involuntary Deed in Lieu: In some cases, the mortgage lender or corporation may initiate the Deed in Lieu process if the homeowners are unable or unwilling to fulfill their mortgage obligations. This option usually arises when foreclosure is imminent, and the lender seeks to mitigate potential losses. 3. Cash for Keys Deed in Lieu: This variation involves the homeowners receiving financial incentives from the corporation to voluntarily transfer the property's title. In return, the homeowners agree to vacate the premises promptly and without causing damage, allowing for a smoother transition of ownership. 4. Hybrid Deed in Lieu: This type combines elements of a traditional Deed in Lieu with a loan modification agreement. The corporation may renegotiate the mortgage terms, such as reducing the interest rate or extending the loan period, to make it more manageable for the homeowners. If these modifications are impossible, the homeowners proceed with the Deed in Lieu. 5. Deed in Lieu as a Last Resort: This specific type of Elk Grove California Deed in Lieu is typically pursued when all other foreclosure alternatives have been exhausted, including loan modifications, repayment plans, or short sales. It serves as a final attempt for the homeowners to relinquish the property's ownership to the corporation. In summary, Elk Grove California Deed in Lieu of Foreclosure — Husband and Wife to Corporation offers a mutually beneficial solution for homeowners facing financial distress and corporations seeking to acquire property assets. Understanding the different types of Deed in Lieu options available can help homeowners navigate the process more effectively and choose the most suitable course of action.Elk Grove California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process that allows a married couple to transfer ownership of their property to a corporation in order to satisfy a mortgage debt. This alternative to foreclosure can be beneficial for both parties involved, as it allows the homeowners to avoid the lengthy and costly foreclosure process while providing the corporation with a property asset. By opting for a Deed in Lieu of Foreclosure, the corporation can potentially acquire the property at a fair value, reducing the financial burden on the homeowners. It also spares them the damaging effects of foreclosure on their credit scores and provides them with a more dignified exit from their financial obligations. There are different types of Elk Grove California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, which include: 1. Voluntary Deed in Lieu: This type of deed is exercised willingly by the homeowners, who approach the mortgage lender or corporation to propose the transfer of property ownership. Both parties negotiate terms and conditions, including the release of the homeowners from their mortgage obligations. 2. Involuntary Deed in Lieu: In some cases, the mortgage lender or corporation may initiate the Deed in Lieu process if the homeowners are unable or unwilling to fulfill their mortgage obligations. This option usually arises when foreclosure is imminent, and the lender seeks to mitigate potential losses. 3. Cash for Keys Deed in Lieu: This variation involves the homeowners receiving financial incentives from the corporation to voluntarily transfer the property's title. In return, the homeowners agree to vacate the premises promptly and without causing damage, allowing for a smoother transition of ownership. 4. Hybrid Deed in Lieu: This type combines elements of a traditional Deed in Lieu with a loan modification agreement. The corporation may renegotiate the mortgage terms, such as reducing the interest rate or extending the loan period, to make it more manageable for the homeowners. If these modifications are impossible, the homeowners proceed with the Deed in Lieu. 5. Deed in Lieu as a Last Resort: This specific type of Elk Grove California Deed in Lieu is typically pursued when all other foreclosure alternatives have been exhausted, including loan modifications, repayment plans, or short sales. It serves as a final attempt for the homeowners to relinquish the property's ownership to the corporation. In summary, Elk Grove California Deed in Lieu of Foreclosure — Husband and Wife to Corporation offers a mutually beneficial solution for homeowners facing financial distress and corporations seeking to acquire property assets. Understanding the different types of Deed in Lieu options available can help homeowners navigate the process more effectively and choose the most suitable course of action.