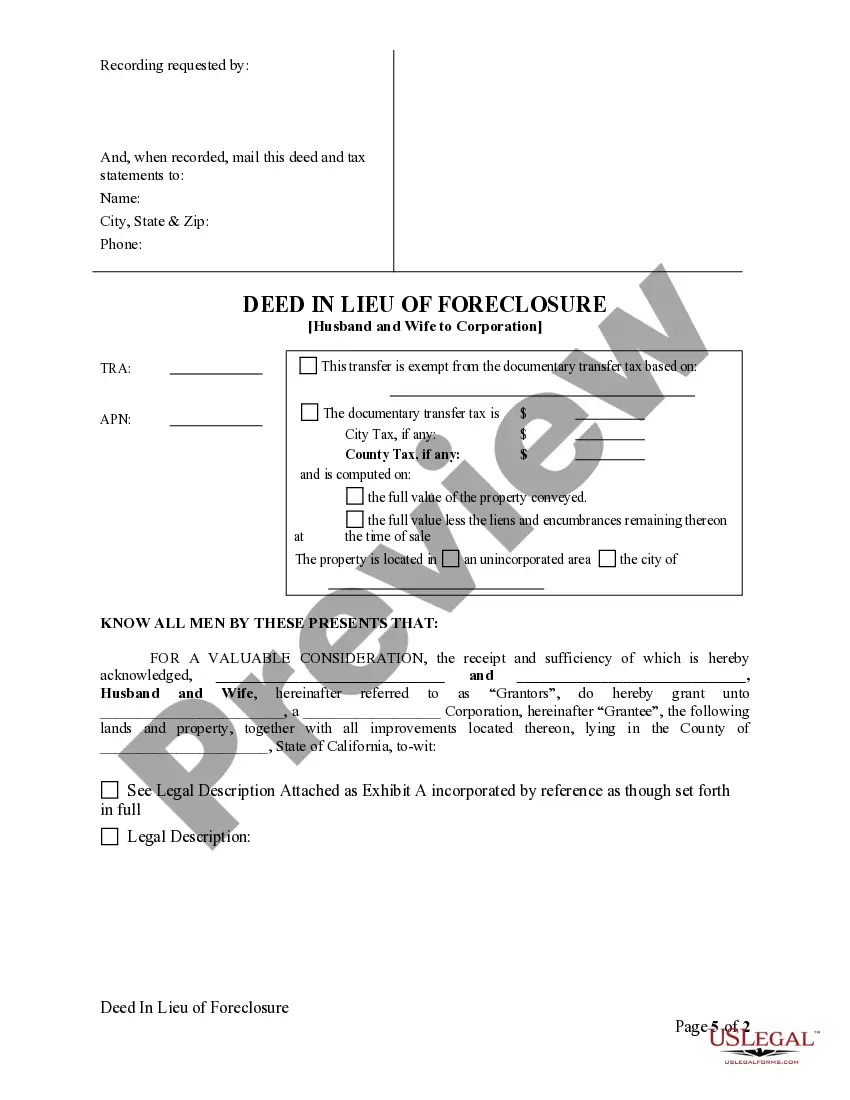

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Escondido California Deed in Lieu of Foreclosure — Husband and Wife to Corporation A Deed in Lieu of Foreclosure is a legal agreement between a homeowner and a mortgage lender, wherein the homeowner voluntarily transfers the property title to the lender in order to satisfy the debt owed. In the specific context of Escondido, California, a Deed in Lieu of Foreclosure can also involve a transfer of property from a husband and wife to a corporation. This type of transaction is typically sought when homeowners find themselves unable to keep up with their mortgage payments and facing imminent foreclosure. By opting for a Deed in Lieu of Foreclosure, homeowners can avoid the lengthy and costly foreclosure process, while lenders can mitigate their losses. When a husband and wife transfer their property to a corporation, the process involves several important steps. Firstly, both spouses need to agree and consent to the transfer, ensuring that the decision is mutually beneficial. This is followed by drafting and executing a deed, which officially transfers ownership from the couple to the corporation. The corporation accepting the property becomes the new legal owner and assumes responsibility for any remaining debts or encumbrances associated with the property. It is crucial for the corporation to thoroughly assess the property's condition, value, and any potential liabilities before accepting it. There may be variations in the types of Escondido California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, depending on individual circumstances. Some of these distinctions could include: 1. Traditional Deed in Lieu: This is a standard agreement encompassing the transfer of property ownership from the husband and wife to the corporation without any unique or additional circumstances. 2. Business Debt Exchange: In certain cases, a husband and wife may choose to transfer the property to a corporation they own or establish, in exchange for existing business debts that need to be settled. This type of Deed in Lieu of Foreclosure allows for consolidation of the couple's personal and business finances. 3. Corporate Merger or Acquisition: Occasionally, a husband and wife transferring property to a corporation through a Deed in Lieu of Foreclosure may occur due to a corporate merger or acquisition. In such cases, the transfer aligns with broader corporate restructuring. It is important to consult with a real estate attorney or a qualified professional well-versed in Escondido, California real estate laws and regulations to ensure proper execution of a Deed in Lieu of Foreclosure — Husband and Wife to Corporation. Such an expert can guide spouses through the legal requirements, facilitate the necessary documentation, and help safeguard their interests throughout the process.