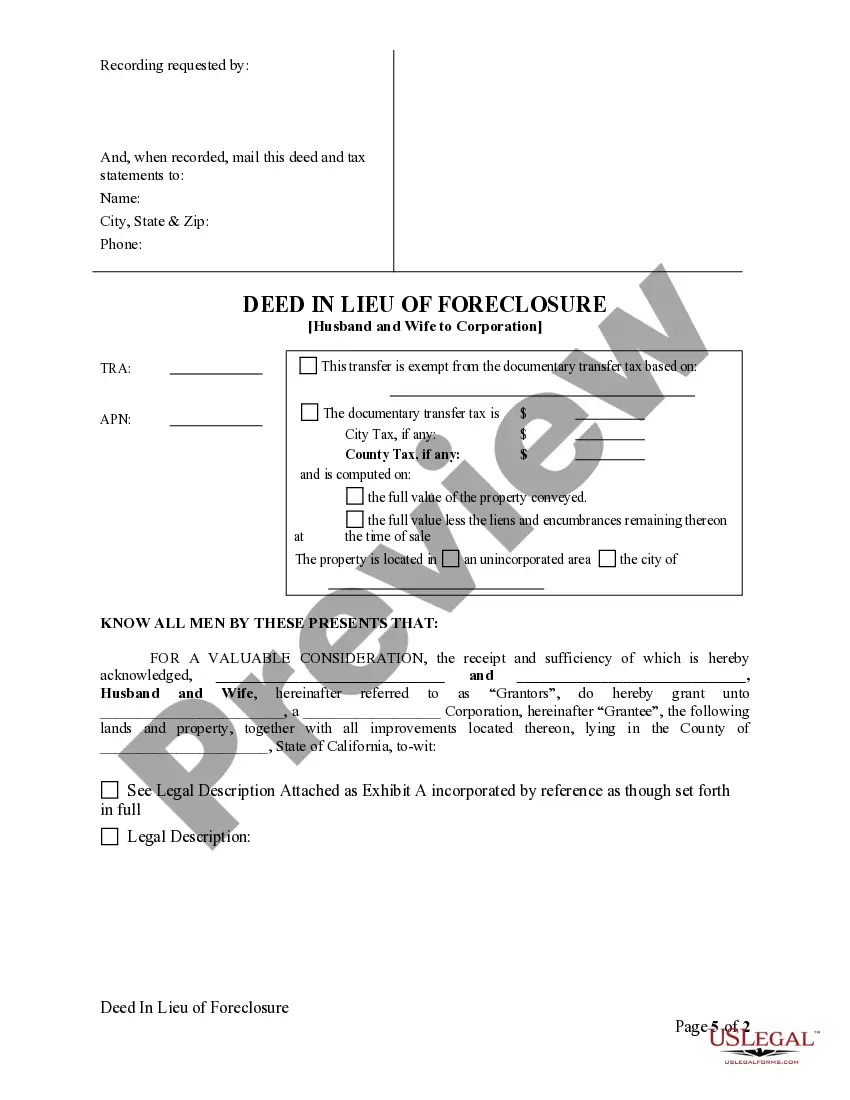

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Hayward California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process through which married homeowners can transfer the title of their property to a corporation as an alternative to foreclosure. This can help them avoid the negative impact of foreclosure on their credit scores and financial stability. Here are some key points to understand about this process: 1. Definition: Deed in Lieu of Foreclosure — Husband and Wife to Corporation, also known as a deed in lieu of foreclosure with spousal conveyance, is a legal arrangement where the husband and wife transfer ownership of their property to a corporation rather than going through the foreclosure process. 2. Process: The homeowners voluntarily surrender the ownership rights to their property to the corporation by signing a deed. This deed transfers the title and ownership of the property to the corporation and releases the homeowners from their mortgage obligations. 3. Benefits: Choosing a deed in lieu of foreclosure — husband and wife to corporation has several advantages. Firstly, it allows the homeowners to avoid the lengthy, expensive, and emotionally draining foreclosure process. Secondly, it helps protect their credit scores from the severe impact of foreclosure, allowing them to recover financially faster. Finally, by transferring the property to a corporation, the homeowners can also potentially negotiate additional benefits, such as financial incentives or relocation assistance. 4. Considerations: Before pursuing a deed in lieu of foreclosure — husband and wife to corporation, homeowners should consult with legal professionals and consider various factors. These may include the corporation's willingness to accept the property, any outstanding liens or taxes on the property, potential tax consequences, and the agreement on any remaining mortgage debt. 5. Different types: While the general concept remains the same, there can be variations in the specific types of deeds in lieu of foreclosure — husband and wife to corporation in Hayward, California. These can include specific terms and conditions set by the involved parties, tailored agreements based on the homeowners' financial circumstances, or alternative arrangements made with the corporation. It is crucial for homeowners to understand these variations and seek expert guidance to navigate the specific type that suits their situation best. In summary, a Hayward California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal arrangement that enables married homeowners to transfer the property's title to a corporation instead of undergoing foreclosure. This process provides them with various benefits, including avoiding foreclosure's negative consequences on credit scores and potential negotiation of additional advantages. However, homeowners should consider multiple factors and consult professionals to choose the most suitable type of deed in lieu of foreclosure.Hayward California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process through which married homeowners can transfer the title of their property to a corporation as an alternative to foreclosure. This can help them avoid the negative impact of foreclosure on their credit scores and financial stability. Here are some key points to understand about this process: 1. Definition: Deed in Lieu of Foreclosure — Husband and Wife to Corporation, also known as a deed in lieu of foreclosure with spousal conveyance, is a legal arrangement where the husband and wife transfer ownership of their property to a corporation rather than going through the foreclosure process. 2. Process: The homeowners voluntarily surrender the ownership rights to their property to the corporation by signing a deed. This deed transfers the title and ownership of the property to the corporation and releases the homeowners from their mortgage obligations. 3. Benefits: Choosing a deed in lieu of foreclosure — husband and wife to corporation has several advantages. Firstly, it allows the homeowners to avoid the lengthy, expensive, and emotionally draining foreclosure process. Secondly, it helps protect their credit scores from the severe impact of foreclosure, allowing them to recover financially faster. Finally, by transferring the property to a corporation, the homeowners can also potentially negotiate additional benefits, such as financial incentives or relocation assistance. 4. Considerations: Before pursuing a deed in lieu of foreclosure — husband and wife to corporation, homeowners should consult with legal professionals and consider various factors. These may include the corporation's willingness to accept the property, any outstanding liens or taxes on the property, potential tax consequences, and the agreement on any remaining mortgage debt. 5. Different types: While the general concept remains the same, there can be variations in the specific types of deeds in lieu of foreclosure — husband and wife to corporation in Hayward, California. These can include specific terms and conditions set by the involved parties, tailored agreements based on the homeowners' financial circumstances, or alternative arrangements made with the corporation. It is crucial for homeowners to understand these variations and seek expert guidance to navigate the specific type that suits their situation best. In summary, a Hayward California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal arrangement that enables married homeowners to transfer the property's title to a corporation instead of undergoing foreclosure. This process provides them with various benefits, including avoiding foreclosure's negative consequences on credit scores and potential negotiation of additional advantages. However, homeowners should consider multiple factors and consult professionals to choose the most suitable type of deed in lieu of foreclosure.