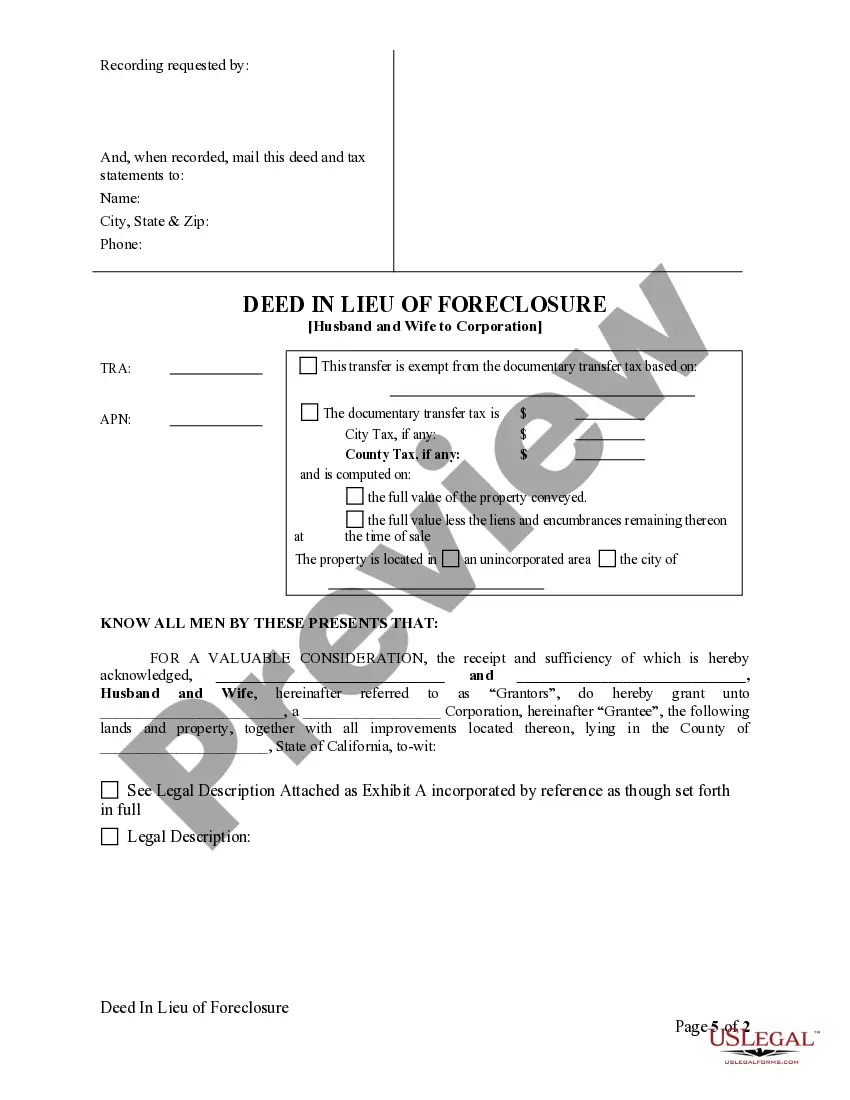

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Huntington Beach California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process whereby a married couple transfers ownership of their property to a corporation to avoid foreclosure. In this scenario, the husband and wife willingly surrender their property rights to the corporation, effectively releasing themselves from any outstanding mortgage debt. This type of deed in lieu of foreclosure is a viable option for couples facing financial difficulties and unable to maintain their mortgage payments. By transferring the property to a corporation, the couple can potentially protect their personal assets and limit their liability. Different variations of Huntington Beach California Deed in Lieu of Foreclosure — Husband and Wife to Corporation may include: 1. Voluntary Transfer: This is a non-coercive agreement, where the couple voluntarily chooses to transfer the property to the corporation. 2. Financial Hardship: The couple may seek this option due to a significant financial hardship, such as unemployment, medical expenses, or other unforeseen circumstances. 3. Negotiated Settlement: In some cases, the couple may negotiate with the corporation to reach a settlement agreement, which may include reduced or forgiven debt in exchange for the property transfer. 4. Corporate Liability Protection: By transferring the property to a corporation, the husband and wife can potentially shield themselves from personal liability associated with the mortgage debt, protecting their personal assets from seizure. 5. Credit Implications: Although a deed in lieu of foreclosure can still negatively impact credit scores, it is generally considered less damaging than going through a foreclosure process. This option allows the couple to avoid the foreclosure stigma and start rebuilding their credit sooner. When considering a Huntington Beach California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, it is crucial for the couple to seek legal advice and consult with a real estate attorney or a qualified professional well-versed in the intricacies of deed in lieu of foreclosure transactions. They can guide the couple through the process, analyzing the potential ramifications and ensuring all legal requirements are met.Huntington Beach California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process whereby a married couple transfers ownership of their property to a corporation to avoid foreclosure. In this scenario, the husband and wife willingly surrender their property rights to the corporation, effectively releasing themselves from any outstanding mortgage debt. This type of deed in lieu of foreclosure is a viable option for couples facing financial difficulties and unable to maintain their mortgage payments. By transferring the property to a corporation, the couple can potentially protect their personal assets and limit their liability. Different variations of Huntington Beach California Deed in Lieu of Foreclosure — Husband and Wife to Corporation may include: 1. Voluntary Transfer: This is a non-coercive agreement, where the couple voluntarily chooses to transfer the property to the corporation. 2. Financial Hardship: The couple may seek this option due to a significant financial hardship, such as unemployment, medical expenses, or other unforeseen circumstances. 3. Negotiated Settlement: In some cases, the couple may negotiate with the corporation to reach a settlement agreement, which may include reduced or forgiven debt in exchange for the property transfer. 4. Corporate Liability Protection: By transferring the property to a corporation, the husband and wife can potentially shield themselves from personal liability associated with the mortgage debt, protecting their personal assets from seizure. 5. Credit Implications: Although a deed in lieu of foreclosure can still negatively impact credit scores, it is generally considered less damaging than going through a foreclosure process. This option allows the couple to avoid the foreclosure stigma and start rebuilding their credit sooner. When considering a Huntington Beach California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, it is crucial for the couple to seek legal advice and consult with a real estate attorney or a qualified professional well-versed in the intricacies of deed in lieu of foreclosure transactions. They can guide the couple through the process, analyzing the potential ramifications and ensuring all legal requirements are met.