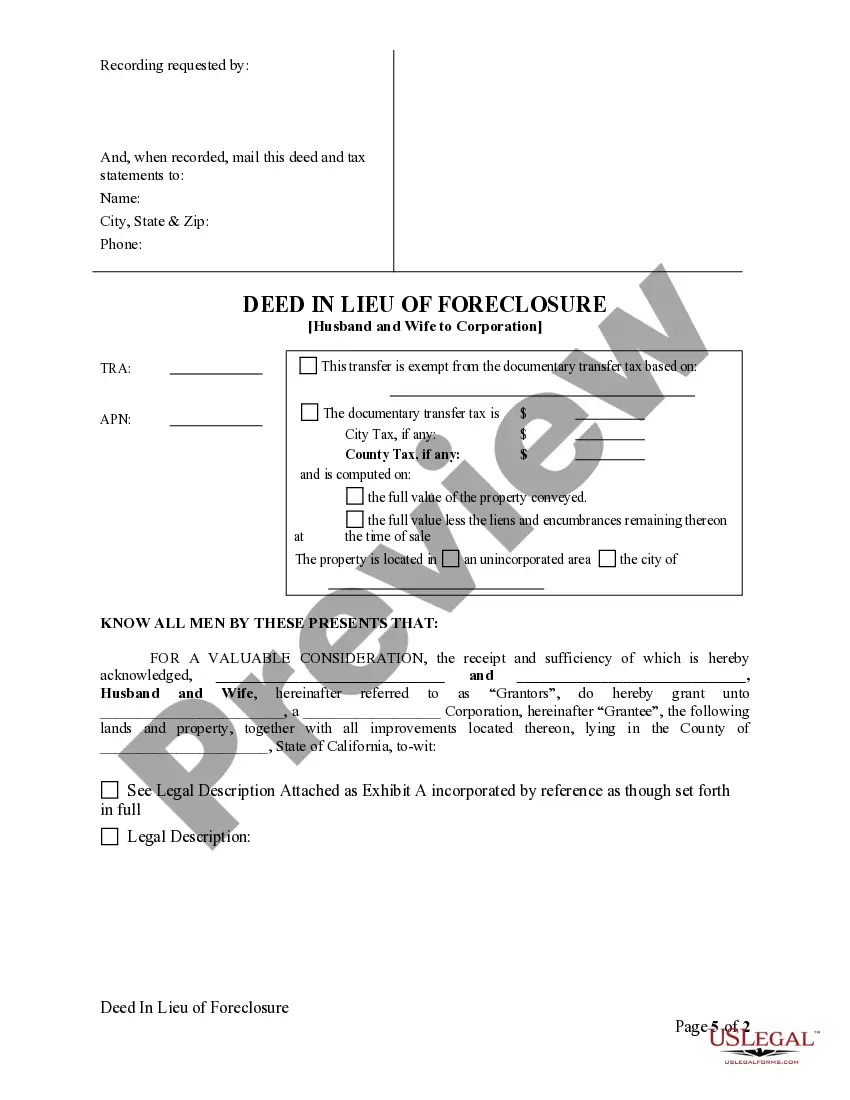

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Pomona California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal transaction that occurs when a married couple voluntarily transfers their property rights to a corporation in order to avoid foreclosure. This process is often chosen when the homeowners are unable to repay their mortgage and want to relinquish ownership without going through the foreclosure process. In this type of deed in lieu of foreclosure, the husband and wife transfer their property rights to a corporation. The corporation then becomes the new owner of the property, allowing the homeowners to avoid the negative consequences of foreclosure, such as credit damage and potential litigation. There are two main types of Pomona California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Traditional Deed in Lieu: This is the most common form of deed in lieu of foreclosure, where the homeowners willingly transfer the property rights to the corporation to satisfy the outstanding mortgage debt. Once the transfer is complete, the corporation becomes the legal owner of the property, relieving the homeowners of any further responsibility. 2. Deed in Lieu with Terms and Conditions: In some cases, a deed in lieu of foreclosure may be negotiated with specific terms and conditions. This could include negotiations regarding any outstanding mortgage debt, future financial obligations, or even an agreement for the homeowners to continue residing in the property as tenants, leasing it from the corporation. These terms and conditions can vary depending on the specific circumstances and agreements between the parties involved. The process of executing a Pomona California Deed in Lieu of Foreclosure — Husband and Wife to Corporation typically involves several steps: 1. Initiation: The homeowners initiate the process by contacting the corporation or mortgage lender and expressing their desire to explore a deed in lieu of foreclosure option. 2. Negotiation: The parties involved negotiate the terms and conditions of the deed in lieu, including potential financial arrangements, the transfer of property rights, and any additional agreements. 3. Agreement: Once both parties reach an agreement, a formal deed in lieu of foreclosure agreement is drafted and signed by the homeowners and the corporation. 4. Transfer of Property: The husband and wife legally transfer their property rights to the corporation through the execution of a deed document. 5. Release of Liability: Upon successful completion of the deed in lieu process, the homeowners are typically released from any further liability related to the property, including the outstanding mortgage debt. By opting for a Pomona California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, homeowners can avoid the negative consequences of foreclosure, while allowing the corporation to acquire the property. It is crucial to consult with legal and financial professionals to understand the specific nuances and legal implications of this process.