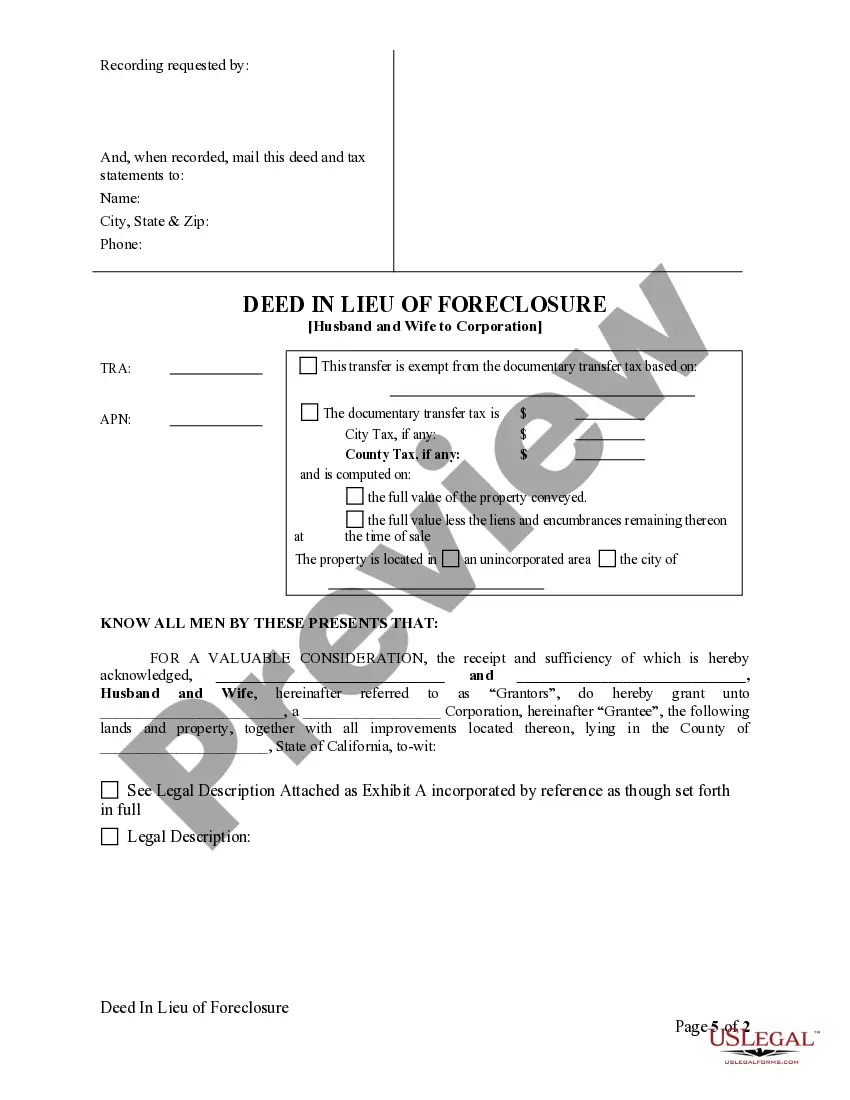

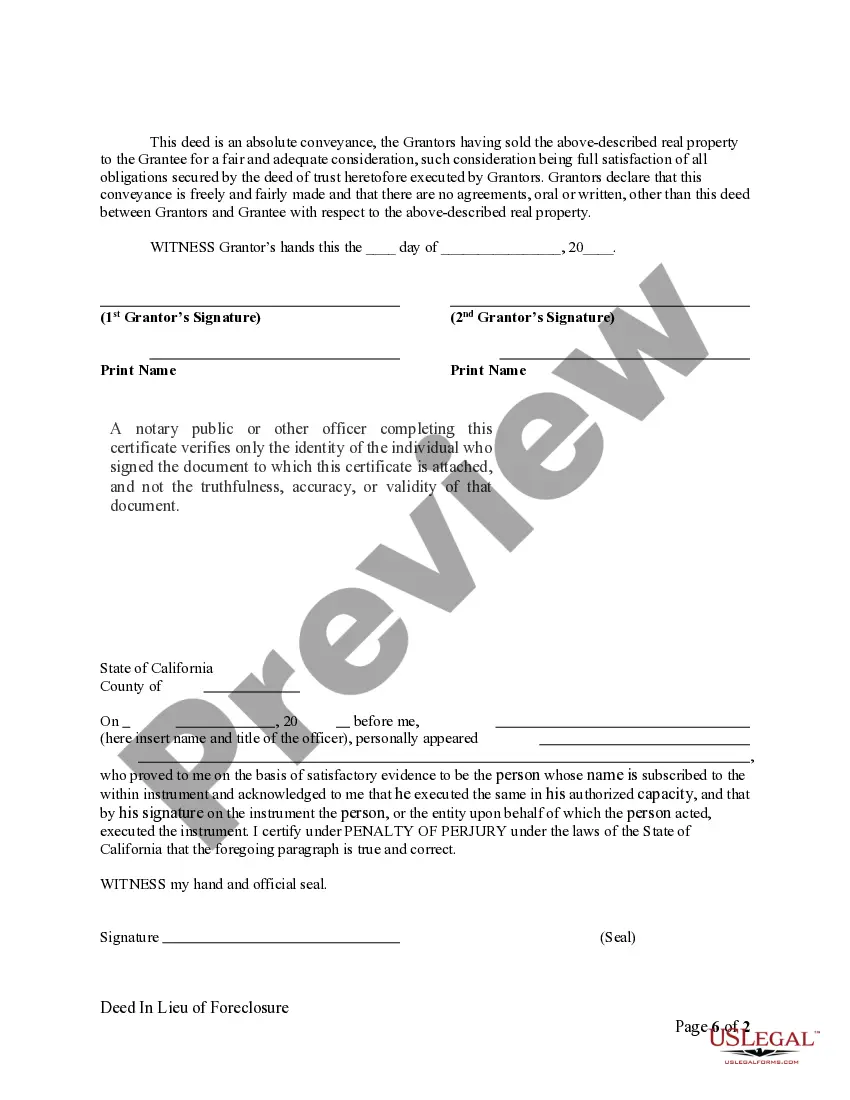

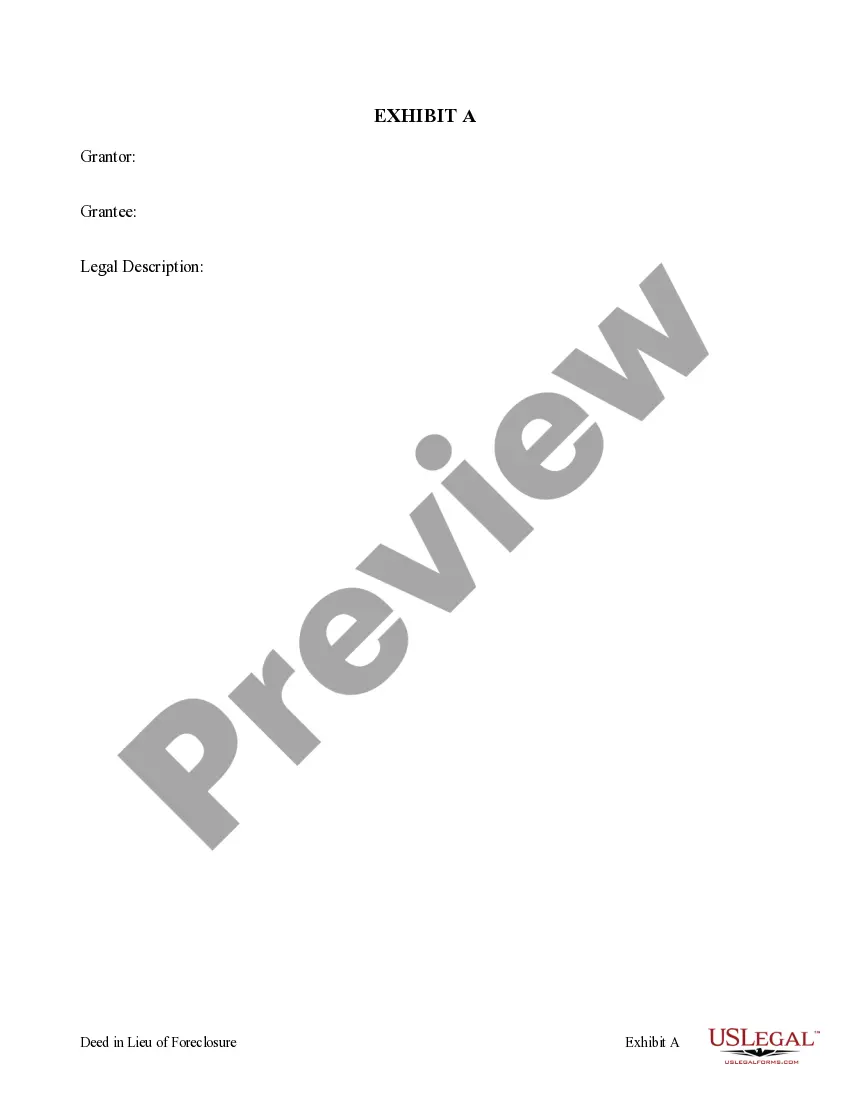

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Salinas California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process that allows a husband and wife to transfer ownership of their property to a corporation instead of going through the traditional foreclosure process. This can be a beneficial option for homeowners facing financial difficulties and wanting to avoid foreclosure and its negative consequences. Keywords: Salinas California, Deed in Lieu of Foreclosure, Husband and Wife, Corporation, foreclosure process, financial difficulties, homeowners. Different types of Salinas California Deed in Lieu of Foreclosure — Husband and Wife to Corporation may include: 1. Voluntary Deed in Lieu of Foreclosure: This occurs when the homeowners willingly choose to transfer the property to the corporation, usually after considering other alternatives and deciding that foreclosure is the best course of action. 2. Involuntary Deed in Lieu of Foreclosure: In certain cases, the lender may initiate the deed in lieu process when the homeowners are unable to meet their mortgage obligations, and foreclosure seems imminent. The homeowners may then have the option to transfer the property to the corporation rather than go through the traditional foreclosure process. 3. Strategic Deed in Lieu of Foreclosure: This type of deed in lieu involves homeowners who can still afford their mortgage payments but choose to transfer ownership to the corporation due to other strategic considerations. This may include reasons like negative equity, inability to sell the property at a desirable price, or to avoid potential future financial obligations. Regardless of the type of Salinas California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, it is crucial for homeowners to consult with legal professionals specializing in real estate and foreclosure to understand the legal implications, benefits, and potential drawbacks associated with this process. This ensures that they make an informed decision that best suits their unique financial situation and goals.Salinas California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process that allows a husband and wife to transfer ownership of their property to a corporation instead of going through the traditional foreclosure process. This can be a beneficial option for homeowners facing financial difficulties and wanting to avoid foreclosure and its negative consequences. Keywords: Salinas California, Deed in Lieu of Foreclosure, Husband and Wife, Corporation, foreclosure process, financial difficulties, homeowners. Different types of Salinas California Deed in Lieu of Foreclosure — Husband and Wife to Corporation may include: 1. Voluntary Deed in Lieu of Foreclosure: This occurs when the homeowners willingly choose to transfer the property to the corporation, usually after considering other alternatives and deciding that foreclosure is the best course of action. 2. Involuntary Deed in Lieu of Foreclosure: In certain cases, the lender may initiate the deed in lieu process when the homeowners are unable to meet their mortgage obligations, and foreclosure seems imminent. The homeowners may then have the option to transfer the property to the corporation rather than go through the traditional foreclosure process. 3. Strategic Deed in Lieu of Foreclosure: This type of deed in lieu involves homeowners who can still afford their mortgage payments but choose to transfer ownership to the corporation due to other strategic considerations. This may include reasons like negative equity, inability to sell the property at a desirable price, or to avoid potential future financial obligations. Regardless of the type of Salinas California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, it is crucial for homeowners to consult with legal professionals specializing in real estate and foreclosure to understand the legal implications, benefits, and potential drawbacks associated with this process. This ensures that they make an informed decision that best suits their unique financial situation and goals.