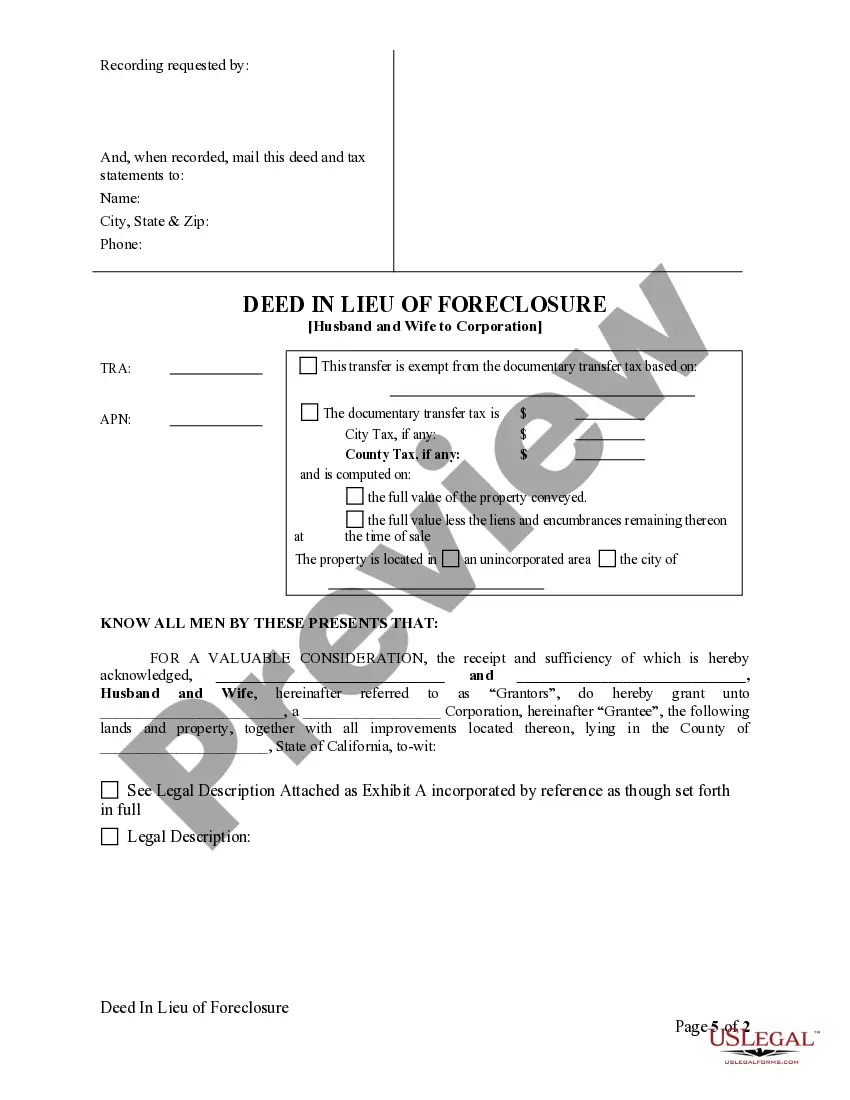

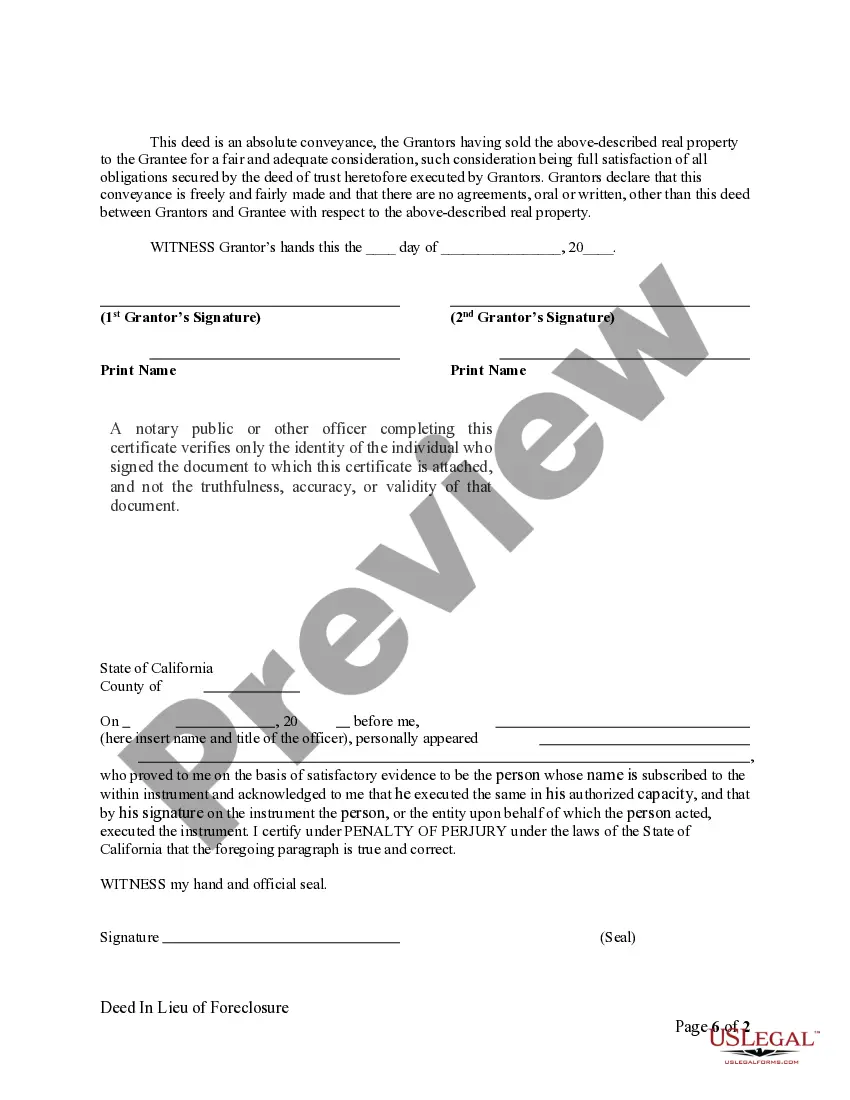

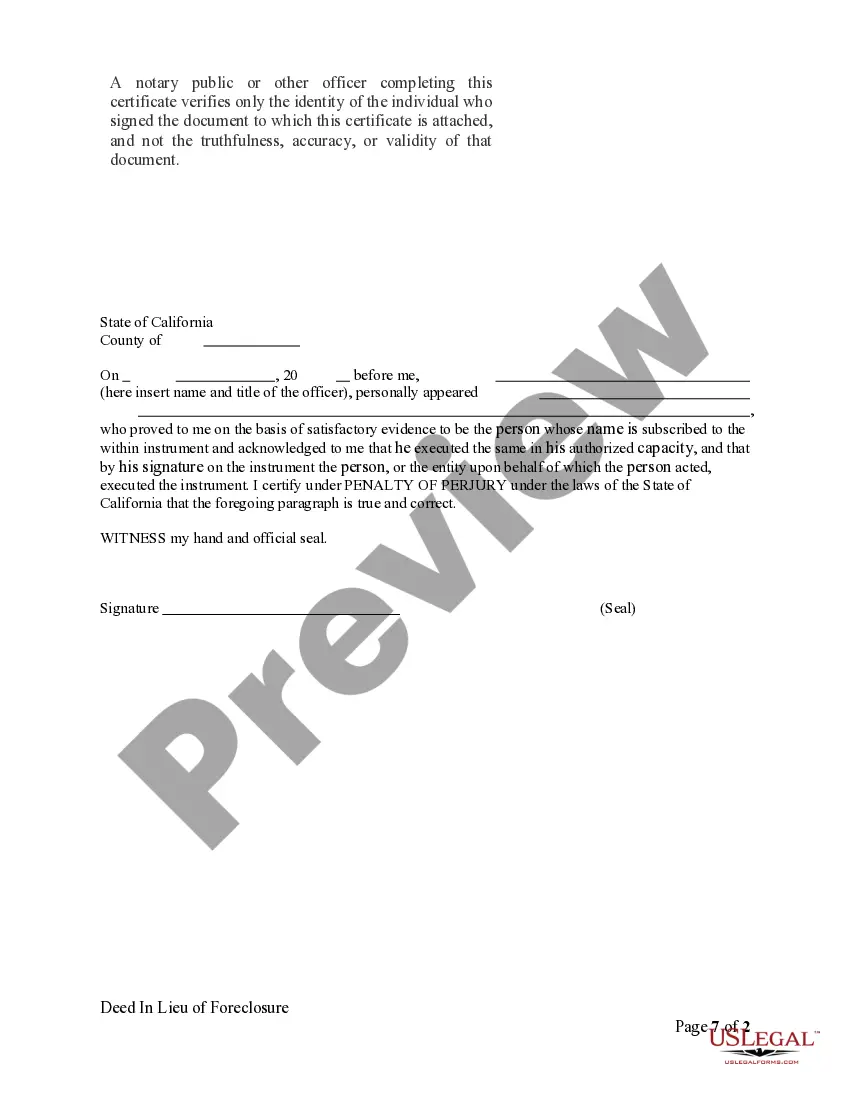

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

A San Jose California Deed in Lieu of Foreclosure is a legal document that allows a husband and wife to transfer the rights and ownership of their property to a corporation in order to avoid foreclosure. The purpose of this transaction is to relieve the family from the burden of mortgage payments they can no longer afford, while also providing an alternative to the lengthy and costly foreclosure process. When completing a deed in lieu of foreclosure, the husband and wife voluntarily transfer their interest in the property to the corporation, thereby relinquishing their rights as homeowners. In return, the corporation agrees to accept the property's title and assume responsibility for any outstanding debts attached to it, such as mortgages or liens. This transfer of ownership is expected to absolve the couple from further financial obligations related to the property. There are a few different types of San Jose California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, which include: 1. Traditional Deed in Lieu: This is the most common form of deed in lieu of foreclosure. It involves the husband and wife signing over the property's title to the corporation, with no additional conditions or agreements. 2. Cash for Keys: In certain cases, the corporation may offer financial incentives to the husband and wife for willingly transferring the property. This incentive, known as "cash for keys," serves as a form of compensation to help the family make a fresh start elsewhere. 3. Deficiency Waiver: A deficiency occurs when the sale of the property does not generate enough funds to cover the outstanding mortgage obligations. In some instances, the corporation may agree to waive the right to pursue the husband and wife for any remaining deficiency, allowing them to walk away from the property debt-free. It is crucial for both parties involved to consult with legal professionals, such as real estate attorneys or foreclosure specialists, to ensure the deed in lieu of foreclosure transaction is properly executed. Additionally, it is essential to have a thorough understanding of all the terms and conditions associated with the specific type of deed in lieu being pursued.A San Jose California Deed in Lieu of Foreclosure is a legal document that allows a husband and wife to transfer the rights and ownership of their property to a corporation in order to avoid foreclosure. The purpose of this transaction is to relieve the family from the burden of mortgage payments they can no longer afford, while also providing an alternative to the lengthy and costly foreclosure process. When completing a deed in lieu of foreclosure, the husband and wife voluntarily transfer their interest in the property to the corporation, thereby relinquishing their rights as homeowners. In return, the corporation agrees to accept the property's title and assume responsibility for any outstanding debts attached to it, such as mortgages or liens. This transfer of ownership is expected to absolve the couple from further financial obligations related to the property. There are a few different types of San Jose California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, which include: 1. Traditional Deed in Lieu: This is the most common form of deed in lieu of foreclosure. It involves the husband and wife signing over the property's title to the corporation, with no additional conditions or agreements. 2. Cash for Keys: In certain cases, the corporation may offer financial incentives to the husband and wife for willingly transferring the property. This incentive, known as "cash for keys," serves as a form of compensation to help the family make a fresh start elsewhere. 3. Deficiency Waiver: A deficiency occurs when the sale of the property does not generate enough funds to cover the outstanding mortgage obligations. In some instances, the corporation may agree to waive the right to pursue the husband and wife for any remaining deficiency, allowing them to walk away from the property debt-free. It is crucial for both parties involved to consult with legal professionals, such as real estate attorneys or foreclosure specialists, to ensure the deed in lieu of foreclosure transaction is properly executed. Additionally, it is essential to have a thorough understanding of all the terms and conditions associated with the specific type of deed in lieu being pursued.