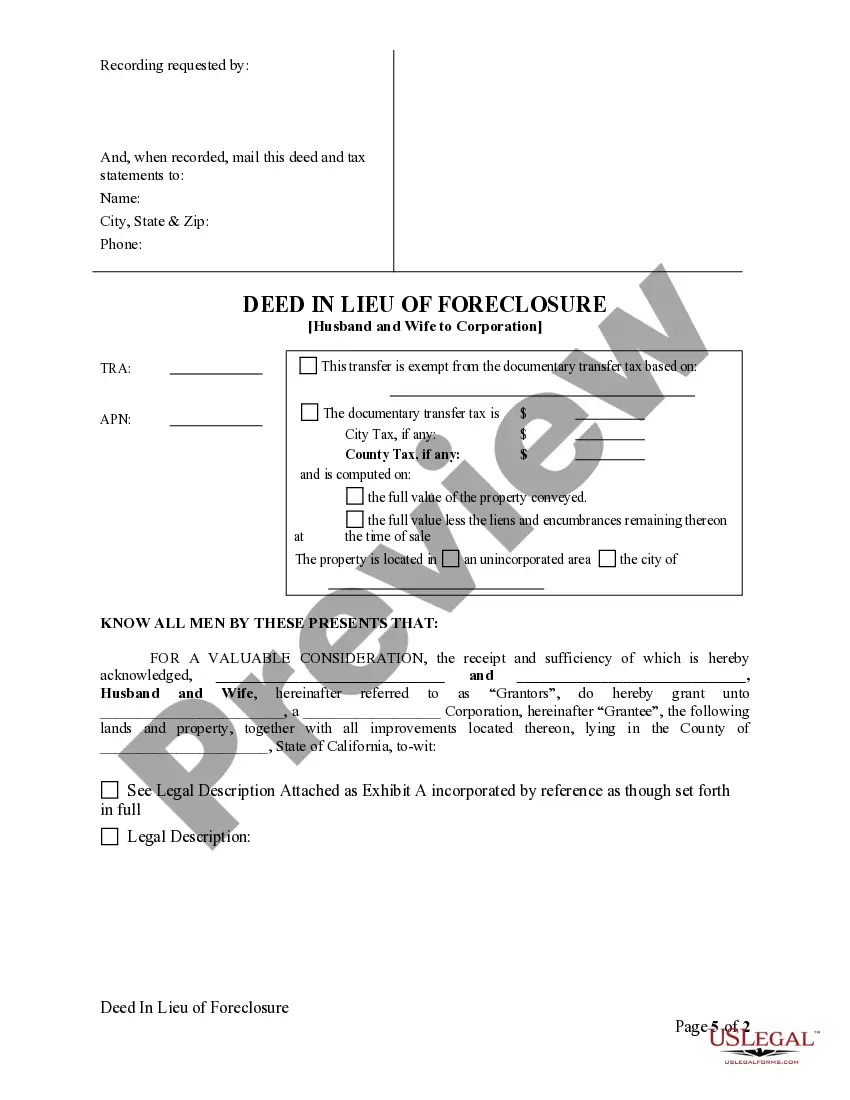

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Santa Clara California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process where a husband and wife voluntarily transfer ownership of their property to a corporation in order to avoid foreclosure. This mechanism allows the homeowners to surrender their property without going through the lengthy and often costly foreclosure process. It is important to note that deed in lieu of foreclosure is a complex legal process, and seeking the assistance of a qualified attorney is highly recommended. Below are some possible variations or types of Santa Clara California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Traditional Santa Clara California Deed in Lieu of Foreclosure — This is the standard process where the homeowners transfer the ownership of their property to the corporation, enabling them to avoid foreclosure and any potential deficiency judgments. 2. Expedited Santa Clara California Deed in Lieu of Foreclosure — This type involves expediting the process of transferring the property ownership to the corporation, often due to time constraints or specific circumstances. 3. Negotiated Santa Clara California Deed in Lieu of Foreclosure — In this scenario, the homeowners negotiate with the lender and come to an agreement regarding the terms and conditions of the deed in lieu of foreclosure, ensuring a smoother transfer of ownership. 4. Partial Santa Clara California Deed in Lieu of Foreclosure — Sometimes, homeowners may choose to only transfer a portion of their property to the corporation instead of the entire property, resulting in a partial deed in lieu of foreclosure. This can help them retain a certain portion of their property while still avoiding foreclosure. In any of these situations, it is critical for both the homeowners and the corporation to ensure that all legal requirements are met and all necessary documentation is properly prepared and executed. Seeking professional advice from a real estate attorney specializing in foreclosure and property transfer can be beneficial to navigate through the intricacies of this process.