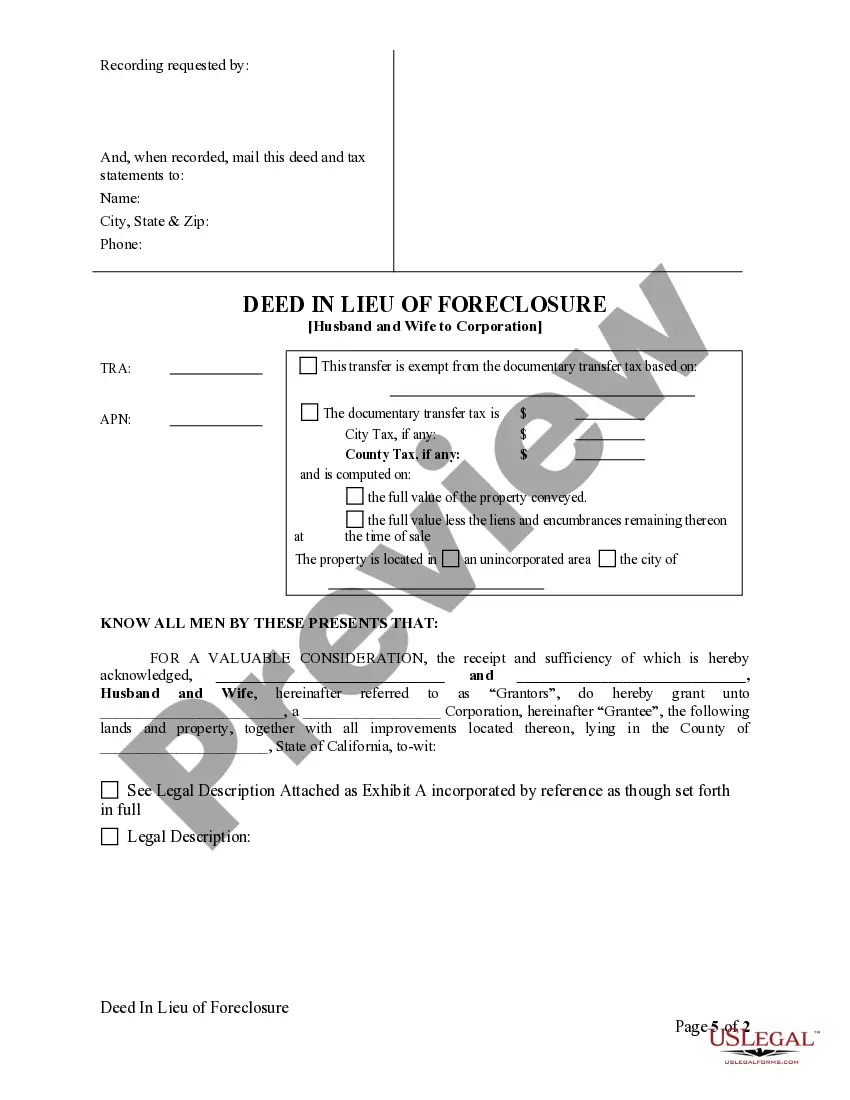

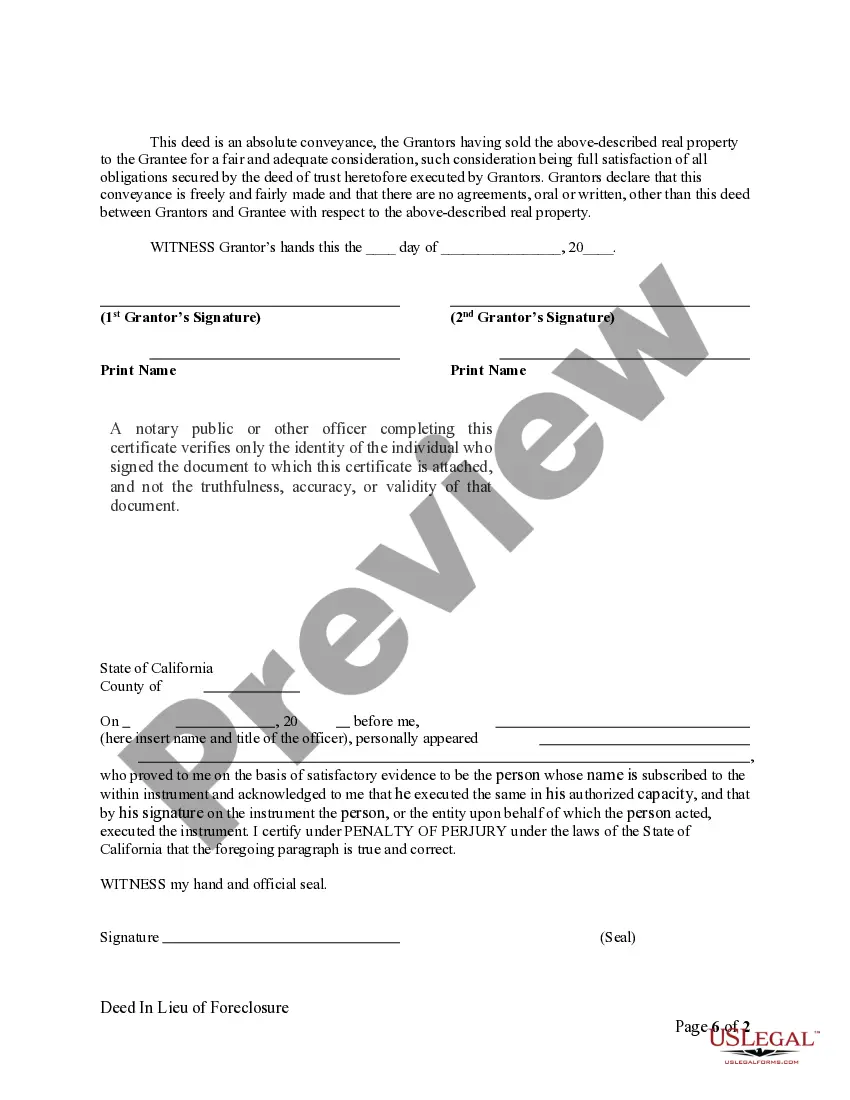

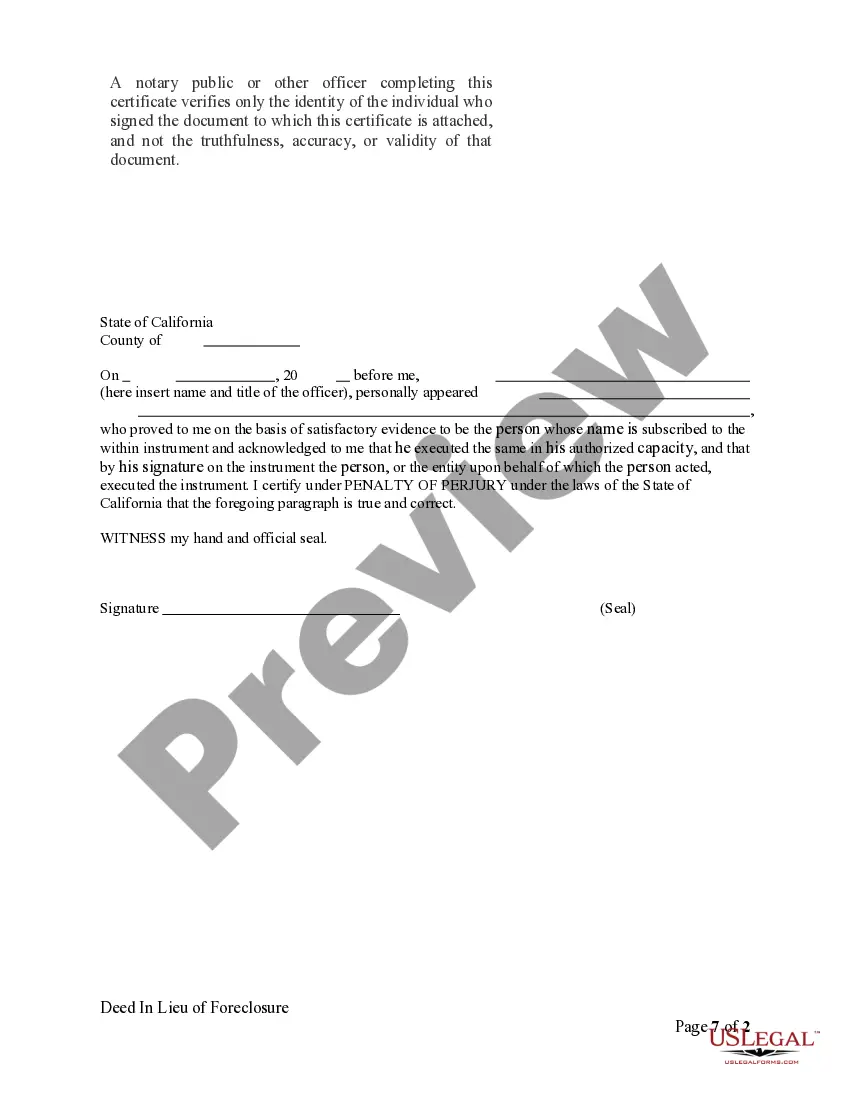

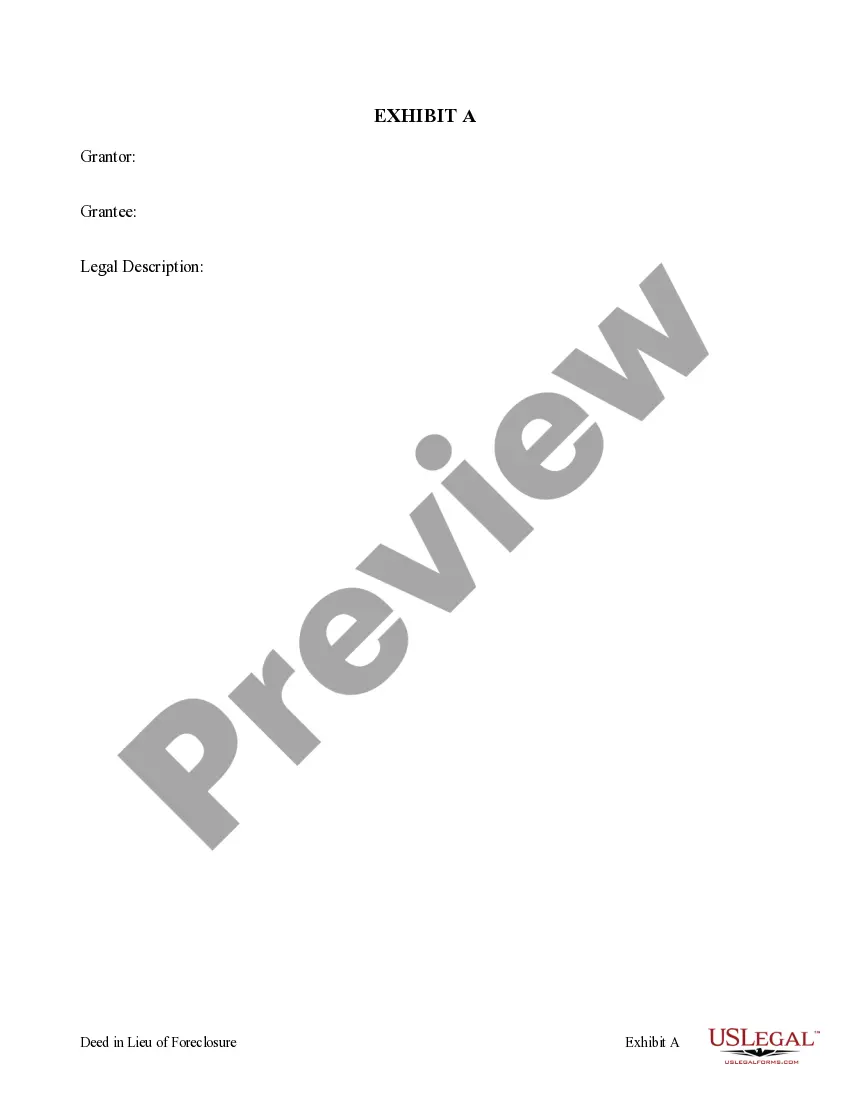

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Thousand Oaks California Deed in Lieu of Foreclosure — Husband and Wife to Corporation A Thousand Oaks California Deed in Lieu of Foreclosure is a legal agreement that allows homeowners facing foreclosure to transfer the ownership of their property to a corporation instead of going through the traditional foreclosure process. This option is specifically designed for married couples who jointly own the property and wish to transfer their ownership rights to a corporation. In this arrangement, the husband and wife voluntarily surrender their ownership rights to the property to a corporation, relieving themselves of mortgage debt and avoiding a formal foreclosure. The corporation assumes responsibility for the property, including any outstanding mortgages or liens, and the homeowners are released from any further financial obligations related to the property. This alternative to foreclosure can be beneficial in various scenarios, such as when homeowners are unable to keep up with mortgage payments, facing financial hardship, or when the property value has declined significantly. By opting for a Deed in Lieu of Foreclosure, the homeowners can avoid the negative consequences associated with a foreclosure on their credit history, offering them a fresh start in their financial journey. It's essential to note that Thousand Oaks California Deed in Lieu of Foreclosure — Husband and Wife to Corporation can have multiple variations depending on the specific terms and conditions agreed upon by the parties involved. Some common types include: 1. Voluntary Deed in Lieu of Foreclosure — This type occurs when the homeowners proactively approach the lender or corporation to initiate the agreement, demonstrating their willingness to cooperate and avoid foreclosure. 2. Negotiated Deed in Lieu of Foreclosure — In this variation, the homeowners and the corporation engage in negotiations to determine the terms of the agreement, such as the transfer of ownership, release from debt, and potential relocation assistance. 3. Right of Redemption Deed in Lieu of Foreclosure — This type of agreement allows the homeowners a specified period to repurchase the property from the corporation at an agreed-upon price, providing an opportunity to regain ownership after their financial situation stabilizes. Regardless of the specific type, a Thousand Oaks California Deed in Lieu of Foreclosure — Husband and Wife to Corporation serves as a viable alternative to foreclosure, offering homeowners a way to alleviate their financial burden and protect their credit while providing the corporation with an opportunity to acquire property.