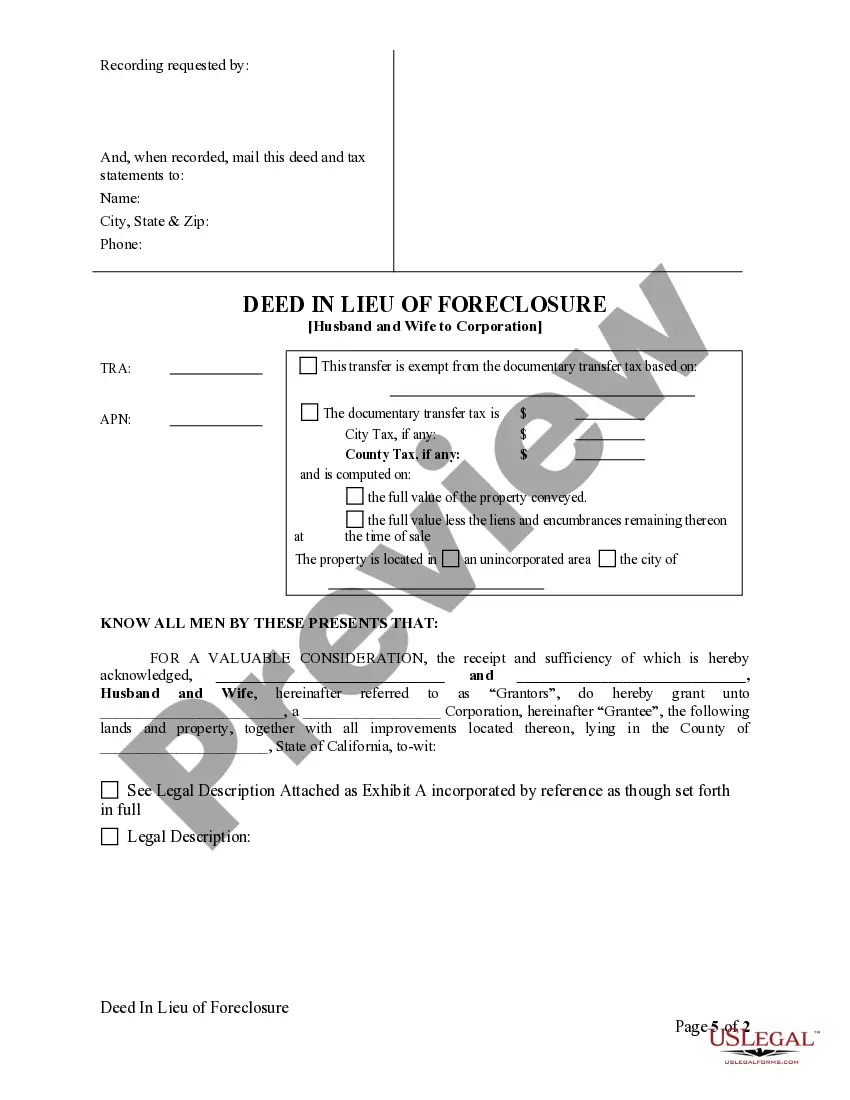

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation A Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation refers to a legal arrangement where a married couple transfers their property ownership rights to a corporation as an alternative to facing foreclosure. This method allows the property owners, spouses, to convey their interest in the property to the corporation, thereby avoiding the lengthy and costly foreclosure process. A deed in lieu of foreclosure is typically employed when homeowners find themselves unable to meet their mortgage obligations and are facing imminent foreclosure. By choosing this option, the couple voluntarily transfers the property title to a corporation rather than undergoing a foreclosure auction. This approach enables them to maintain some control over the process and potentially avoid the negative consequences associated with foreclosure, such as detrimental impact on their credit score. The Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation offers various benefits to both the homeowners and the acquiring corporation. Keywords to consider include: 1. Vacaville, California: This refers to the specific city and state where the Deed in Lieu of Foreclosure is taking place. Vacaville is a vibrant city in Solano County, known for its picturesque landscapes, family-friendly amenities, and proximity to cultural and recreational activities. 2. Deed in Lieu of Foreclosure: This legal agreement allows homeowners to voluntarily transfer the property title to the corporation, relieving them of their mortgage obligations and potentially avoiding foreclosure proceedings. 3. Husband and Wife to Corporation: This signifies the specific parties involved in the transaction. A married couple, as joint property owners, transfer their interests to a corporation of their choice. The involvement of a corporation in the process offers certain advantages and legal consequences for both parties. 4. Foreclosure: This term underscores the primary reason for considering a deed in lieu arrangement. When homeowners fail to make timely mortgage payments, their lender may initiate foreclosure proceedings to recover the outstanding debt by selling the property through a foreclosure auction. Different types or variations of Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation may include factors such as the size and type of the corporation involved, the specific terms negotiated between the homeowners and the corporation, and any additional agreements or stipulations involved in the transaction. Overall, a Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation offers homeowners an alternative solution to address financial difficulties while enabling corporations to potentially acquire properties at favorable terms. It is crucial to consult with legal and financial professionals to navigate the complexities and ensure all parties are adequately protected during the process.Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation A Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation refers to a legal arrangement where a married couple transfers their property ownership rights to a corporation as an alternative to facing foreclosure. This method allows the property owners, spouses, to convey their interest in the property to the corporation, thereby avoiding the lengthy and costly foreclosure process. A deed in lieu of foreclosure is typically employed when homeowners find themselves unable to meet their mortgage obligations and are facing imminent foreclosure. By choosing this option, the couple voluntarily transfers the property title to a corporation rather than undergoing a foreclosure auction. This approach enables them to maintain some control over the process and potentially avoid the negative consequences associated with foreclosure, such as detrimental impact on their credit score. The Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation offers various benefits to both the homeowners and the acquiring corporation. Keywords to consider include: 1. Vacaville, California: This refers to the specific city and state where the Deed in Lieu of Foreclosure is taking place. Vacaville is a vibrant city in Solano County, known for its picturesque landscapes, family-friendly amenities, and proximity to cultural and recreational activities. 2. Deed in Lieu of Foreclosure: This legal agreement allows homeowners to voluntarily transfer the property title to the corporation, relieving them of their mortgage obligations and potentially avoiding foreclosure proceedings. 3. Husband and Wife to Corporation: This signifies the specific parties involved in the transaction. A married couple, as joint property owners, transfer their interests to a corporation of their choice. The involvement of a corporation in the process offers certain advantages and legal consequences for both parties. 4. Foreclosure: This term underscores the primary reason for considering a deed in lieu arrangement. When homeowners fail to make timely mortgage payments, their lender may initiate foreclosure proceedings to recover the outstanding debt by selling the property through a foreclosure auction. Different types or variations of Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation may include factors such as the size and type of the corporation involved, the specific terms negotiated between the homeowners and the corporation, and any additional agreements or stipulations involved in the transaction. Overall, a Vacaville California Deed in Lieu of Foreclosure — Husband and Wife to Corporation offers homeowners an alternative solution to address financial difficulties while enabling corporations to potentially acquire properties at favorable terms. It is crucial to consult with legal and financial professionals to navigate the complexities and ensure all parties are adequately protected during the process.