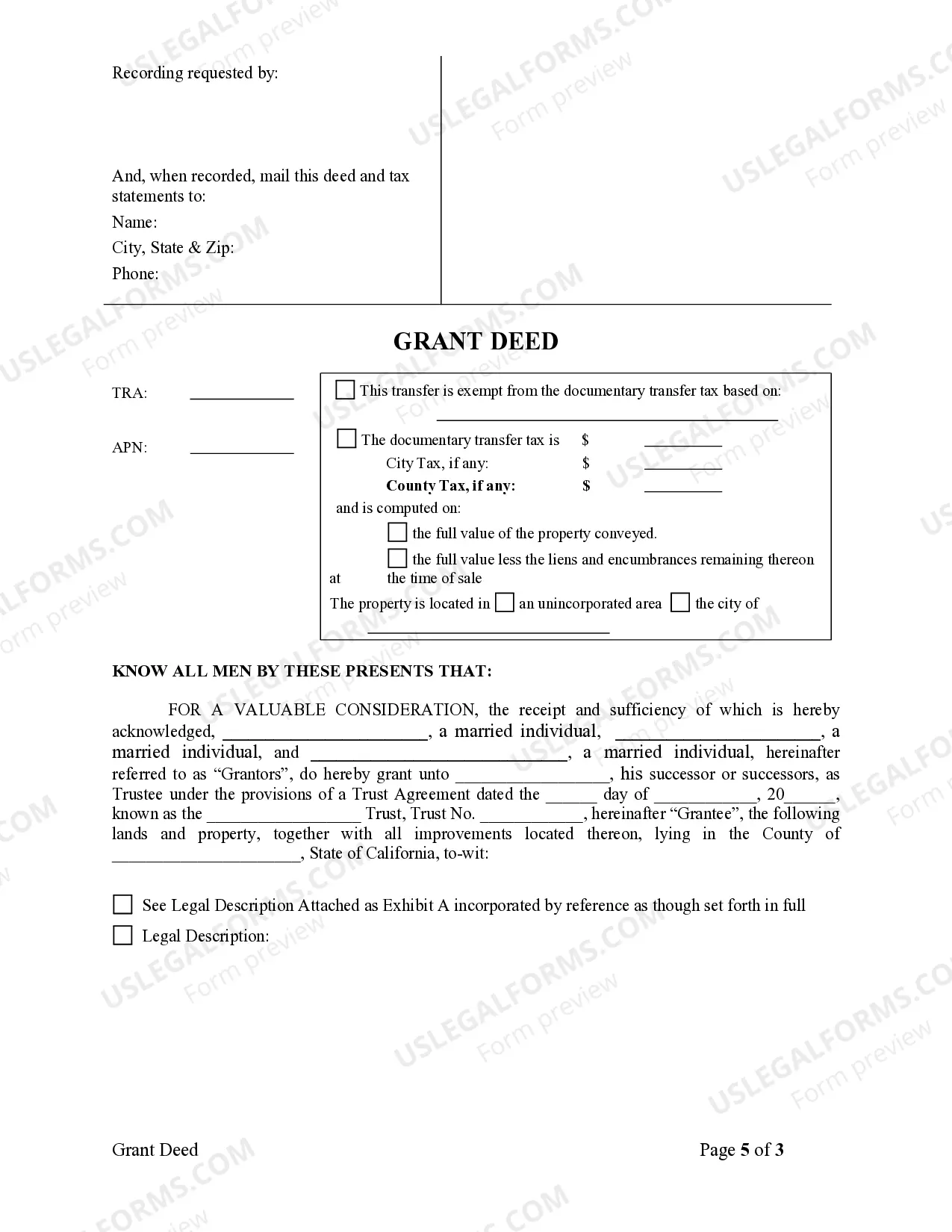

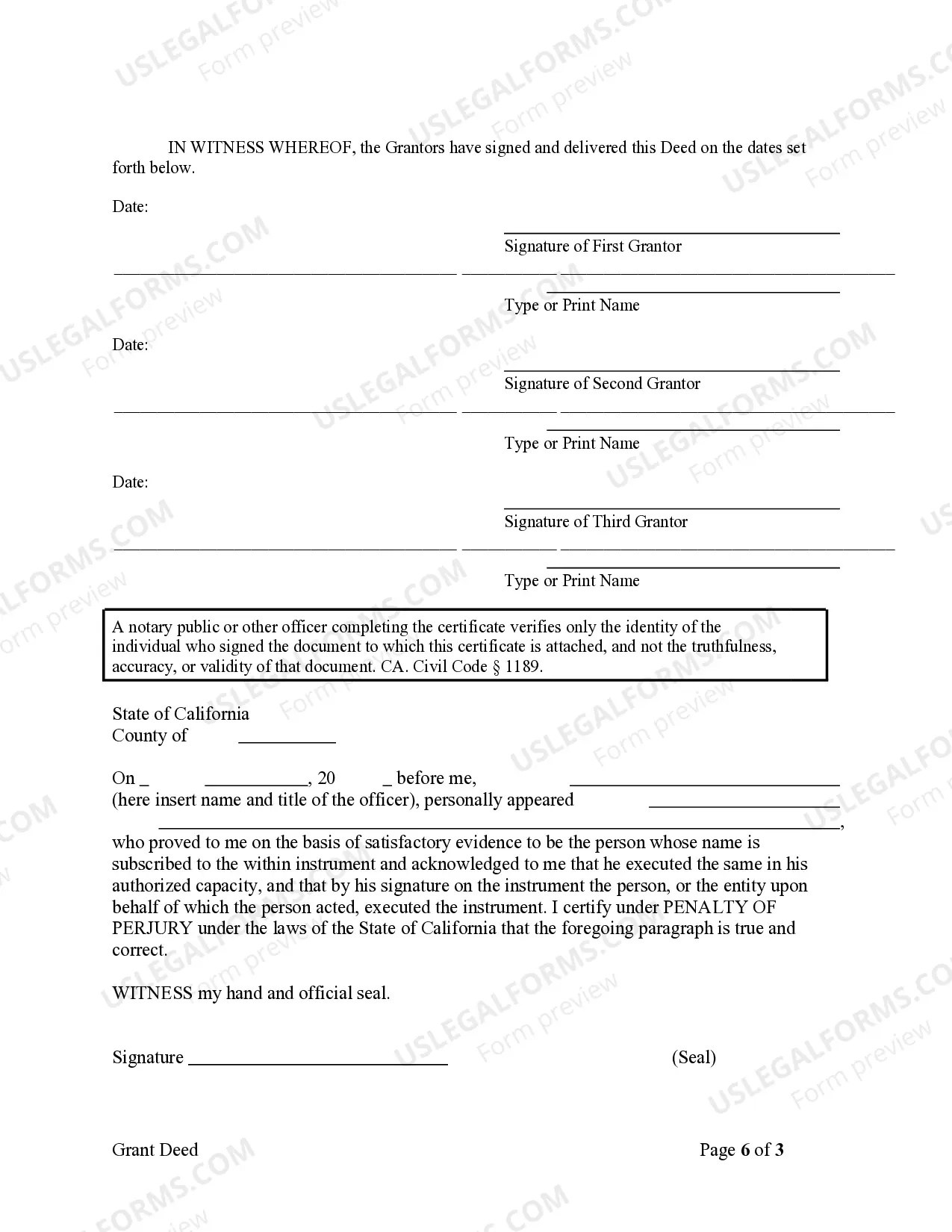

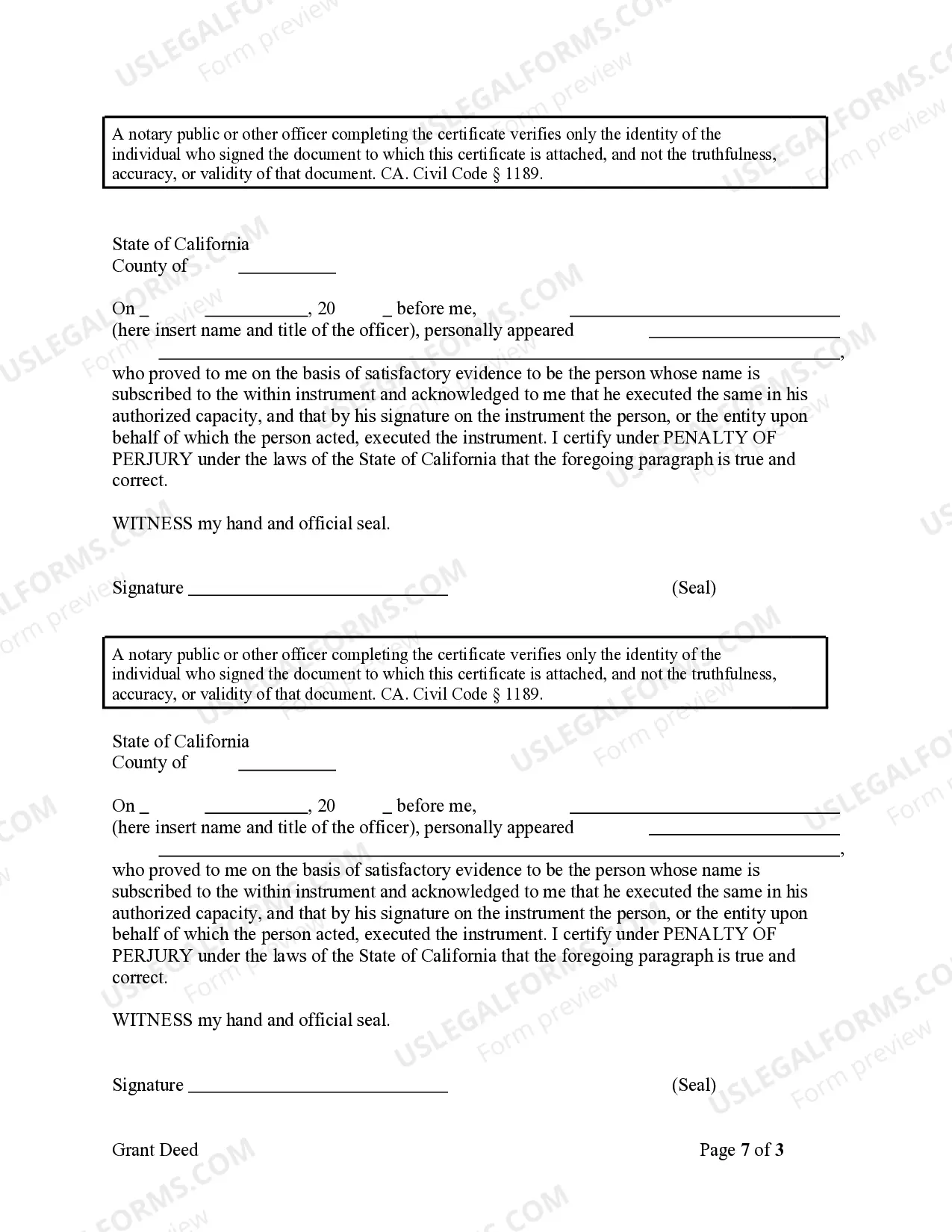

This form is a Grant Deed where the grantors are three individuals and the grantee is a trust. Grantors conveys and grant the described property to trustee of the grantee. This deed complies with all state statutory laws.

Keywords: San Diego California Grant Deed, Three Individuals to Trust, types A San Diego California Grant Deed — Three Individuals to Trust is a legal document that transfers the ownership of real property located in San Diego, California from three individuals to a trust. This type of deed is commonly used when individuals wish to place their property into a trust for various purposes, such as estate planning or asset protection. In this grant deed, the three individuals, also known as granters, voluntarily transfer their ownership rights to the trust, known as the grantee. The trust is created for the benefit of one or more beneficiaries, who may include family members, heirs, or charitable organizations. There are several types of San Diego California Grant Deeds — Three Individuals to Trust that can be utilized, depending on the specific circumstances and goals of the individuals involved: 1. Revocable Living Trust Grant Deed: This type of grant deed allows the granters to maintain control over the trust and make changes or revoke it during their lifetime. It provides flexibility and ensures a smooth transfer of assets upon the granter's death. 2. Irrevocable Trust Grant Deed: In contrast to the revocable living trust grant deed, this type cannot be altered or revoked once executed. It offers greater asset protection and may have tax implications, making it suitable for those seeking long-term estate planning solutions. 3. Testamentary Trust Grant Deed: This grant deed takes effect upon the death of the granter and is established through a provision in the granter's will or estate plan. It allows for property transfer into a trust that is created upon the granter's passing, providing control and distribution of assets according to their wishes. Regardless of the specific type, a San Diego California Grant Deed — Three Individuals to Trust ensures a smooth transition of ownership, avoids probate, and allows for efficient estate planning. It is essential to consult with an attorney or legal professional specializing in real estate law to ensure proper execution and compliance with relevant regulations.