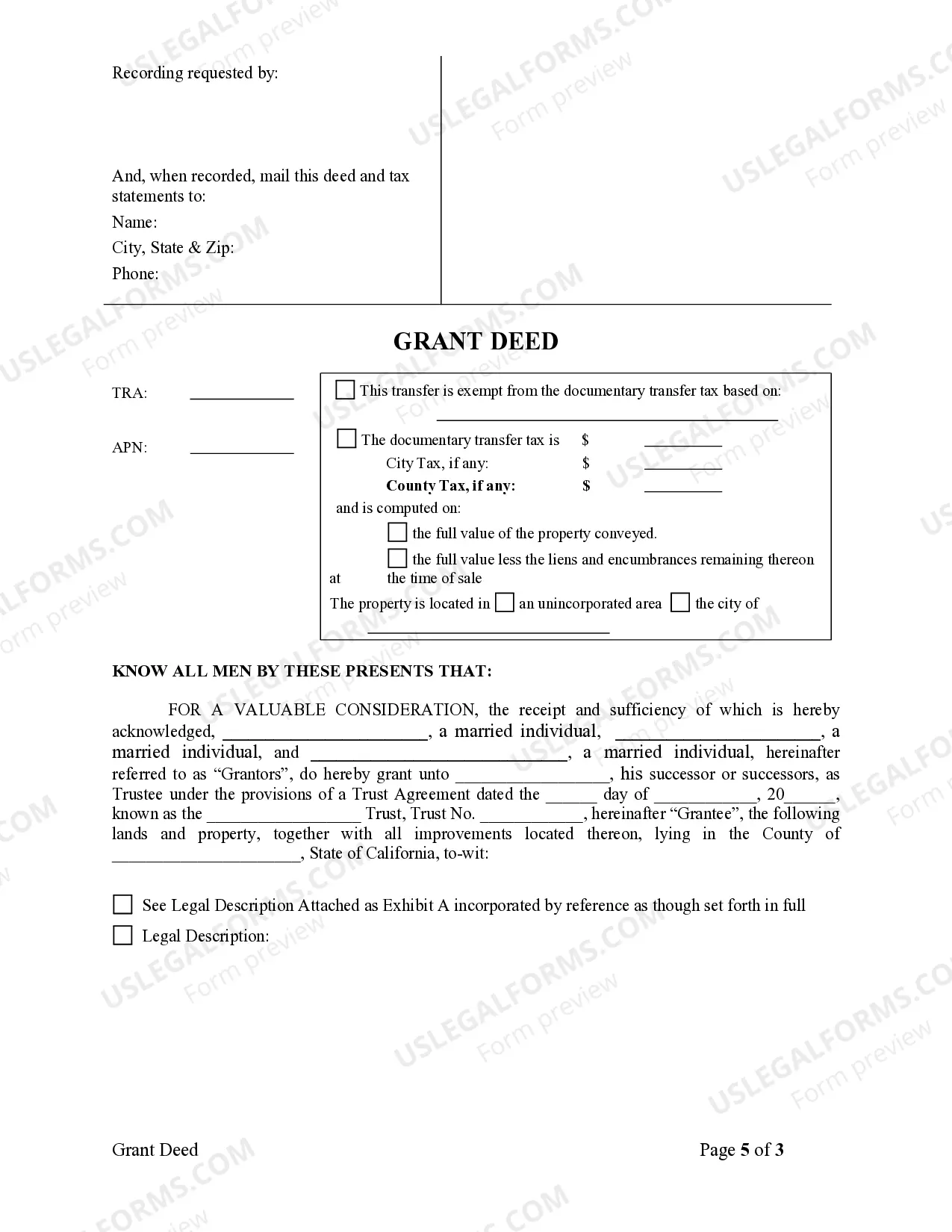

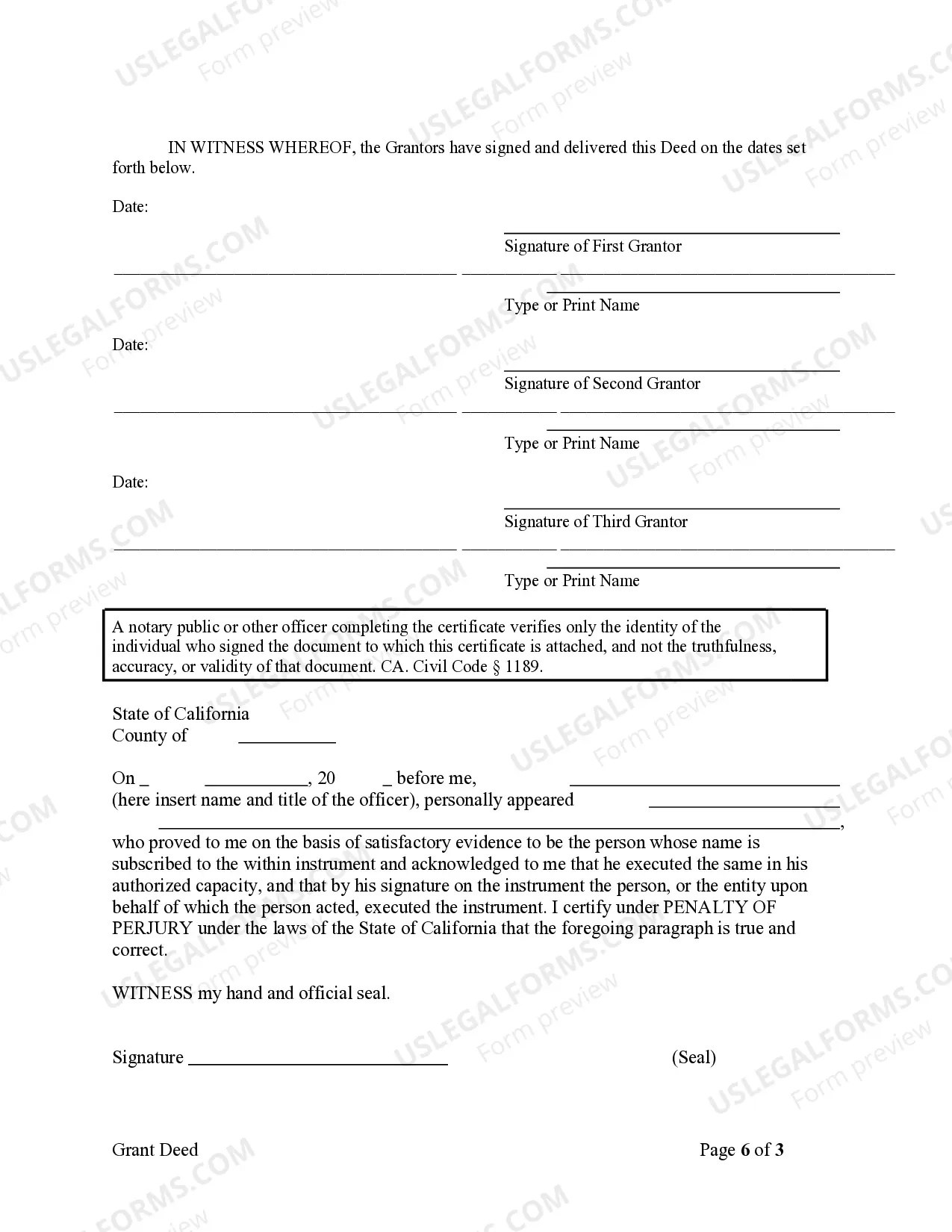

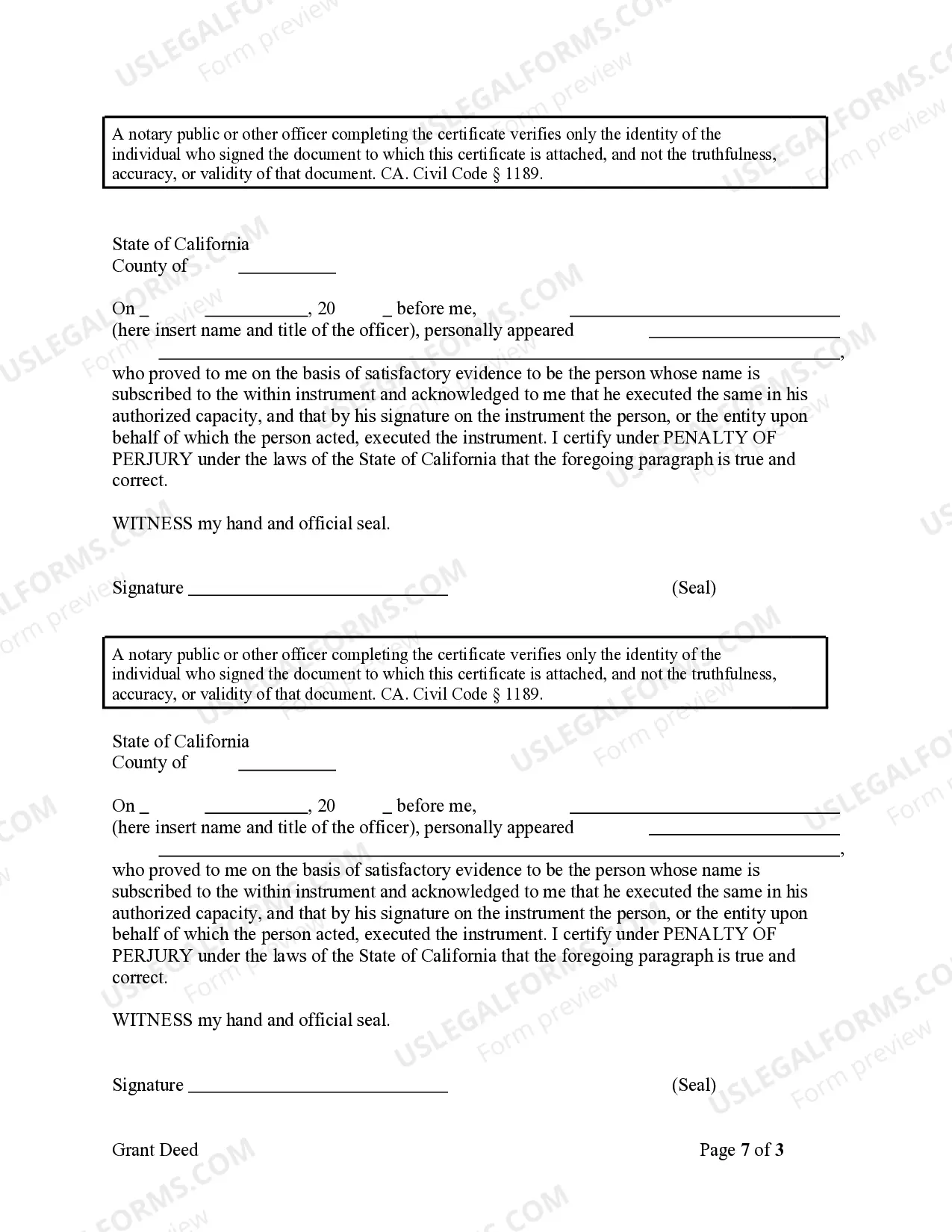

This form is a Grant Deed where the grantors are three individuals and the grantee is a trust. Grantors conveys and grant the described property to trustee of the grantee. This deed complies with all state statutory laws.

A Thousand Oaks California Grant Deed — Three Individuals to Trust is a legal document that transfers ownership of real property in Thousand Oaks, California from three specified individuals to a trust entity. This document is commonly used in estate planning and asset protection strategies. In this type of grant deed, three individuals, referred to as granters, are granting or transferring their interest in the property to a trust, known as the grantee. The trust is created to protect and manage the property for the benefit of specific beneficiaries, ensuring continuous and organized ownership. By utilizing a Thousand Oaks Grant Deed — Three Individuals to Trust, thgrantersrs can effectively convey the property into a trust without relinquishing complete control over the asset. They continue to have decision-making powers as trustees of the trust, while still benefiting from the protection offered by the trust structure. Different variations of the Thousand Oaks California Grant Deed — Three Individuals to Trust include the Irrevocable Trust Grant Deed and the Revocable Trust Grant Deed. The Irrevocable Trust Grant Deed establishes a trust that cannot be modified or revoked without the consent of the beneficiaries, providing a more permanent and stringent asset protection approach. On the other hand, the Revocable Trust Grant Deed creates a trust that can be altered or dissolved by the granters during their lifetime. The choice between the two types depends on the granters' specific needs and goals, such as tax planning, creditor protection, or future disposition of the property. Overall, the Thousand Oaks California Grant Deed — Three Individuals to Trust serves as a vital tool in estate planning, ensuring seamless property transfers and safeguarding assets for the granters and their beneficiaries. With the assistance of legal professionals, individuals can tailor the deed to their unique circumstances, utilizing the appropriate type of trust deed for their specific requirements.