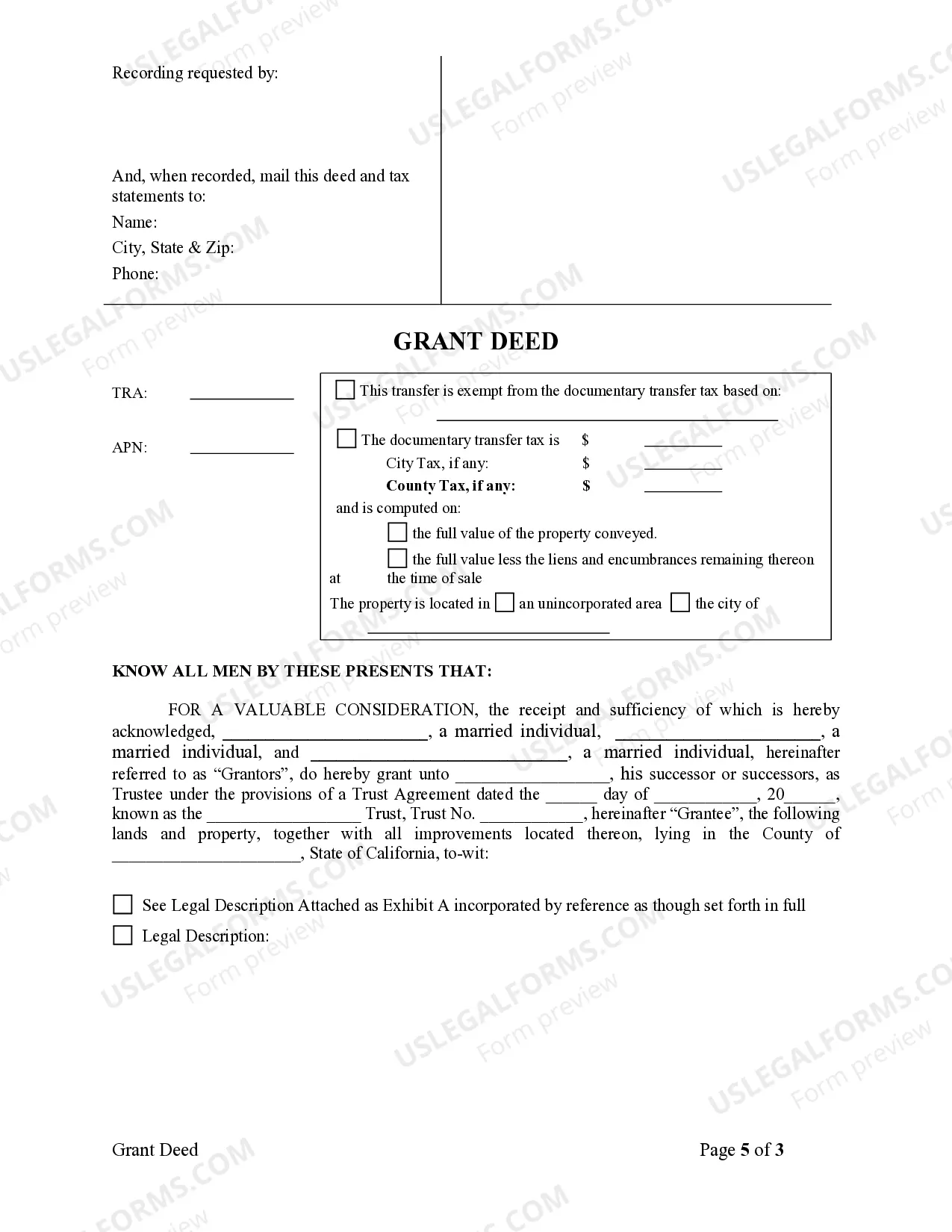

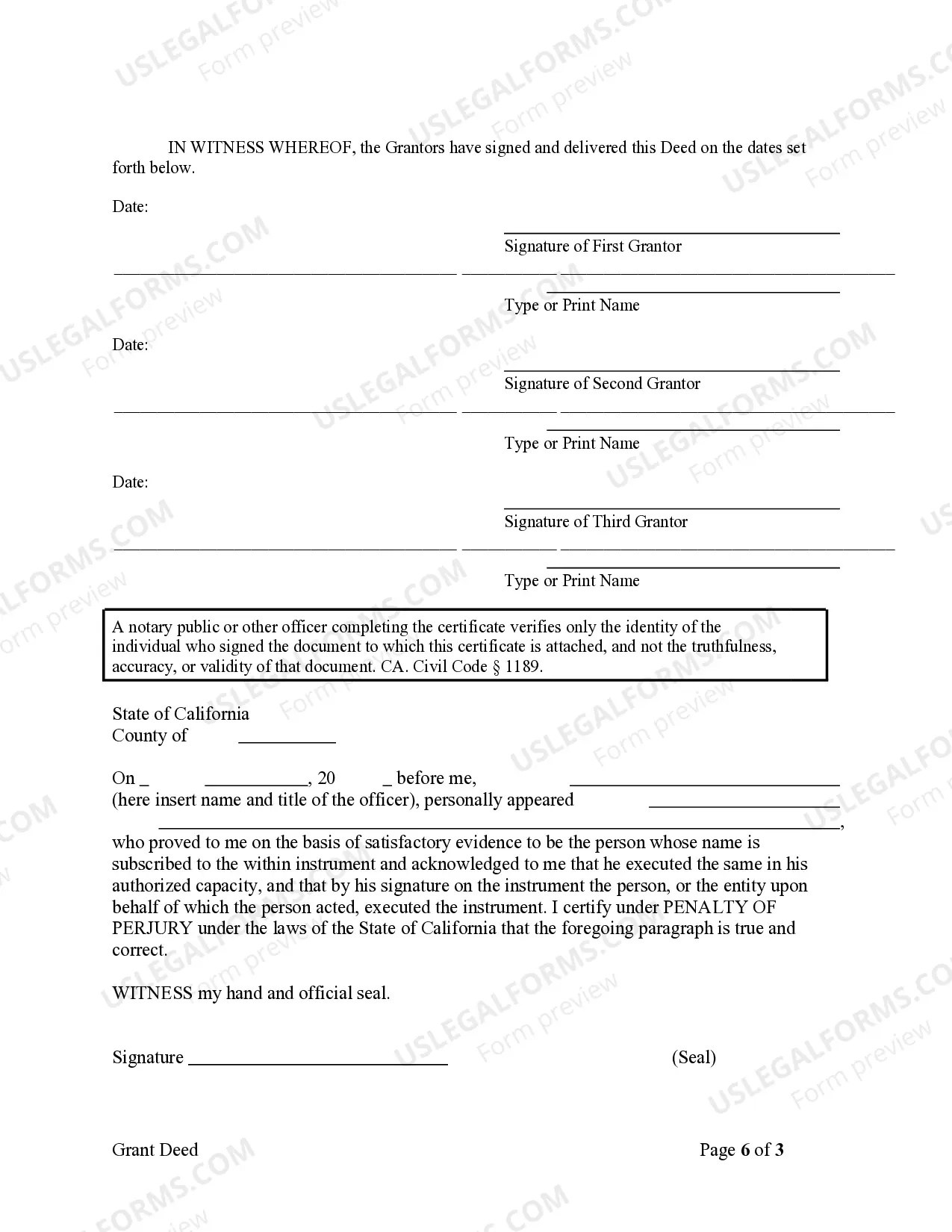

This form is a Grant Deed where the grantors are three individuals and the grantee is a trust. Grantors conveys and grant the described property to trustee of the grantee. This deed complies with all state statutory laws.

A Vallejo California Grant Deed — Three Individuals to Trust is a legal document used to transfer ownership of real estate in Vallejo, California, from three individuals to a trust. This type of deed is commonly used when individuals want to protect their assets and ensure a smooth transition of property ownership. The grant deed outlines the details of the transfer, including the names of the three individuals transferring the property ("granters") and the trust that will receive the property ("grantee"). It also includes a legal description of the property being transferred, such as the address and boundary lines, to ensure accuracy in the transaction. By utilizing a trust, the three individuals are able to place the property under the control and management of a trustee. The trust agreement stipulates how the property will be used, maintained, and distributed to beneficiaries in the future. This provides a level of protection and flexibility in managing the property while allowing for estate planning and potential tax benefits. It is important to note that there may be different types of Vallejo California Grant Deeds — Three Individuals to Trust, such as standard grant deeds, special warranty deeds, and quitclaim deeds. Each type of deed offers different levels of warranty and protection to the grantee. Consulting with a qualified real estate attorney can help determine the most suitable type of grant deed based on the specific circumstances of the transfer. In conclusion, a Vallejo California Grant Deed — Three Individuals to Trust is a crucial legal document enabling the transfer of real estate ownership from three individuals to a trust. By utilizing this type of deed, individuals can protect their assets, plan for estate distribution, and ensure a smooth transition of property ownership while taking advantage of potential tax benefits. Proper legal counsel is recommended to navigate the complexities and choose the most appropriate type of grant deed for the transaction at hand.A Vallejo California Grant Deed — Three Individuals to Trust is a legal document used to transfer ownership of real estate in Vallejo, California, from three individuals to a trust. This type of deed is commonly used when individuals want to protect their assets and ensure a smooth transition of property ownership. The grant deed outlines the details of the transfer, including the names of the three individuals transferring the property ("granters") and the trust that will receive the property ("grantee"). It also includes a legal description of the property being transferred, such as the address and boundary lines, to ensure accuracy in the transaction. By utilizing a trust, the three individuals are able to place the property under the control and management of a trustee. The trust agreement stipulates how the property will be used, maintained, and distributed to beneficiaries in the future. This provides a level of protection and flexibility in managing the property while allowing for estate planning and potential tax benefits. It is important to note that there may be different types of Vallejo California Grant Deeds — Three Individuals to Trust, such as standard grant deeds, special warranty deeds, and quitclaim deeds. Each type of deed offers different levels of warranty and protection to the grantee. Consulting with a qualified real estate attorney can help determine the most suitable type of grant deed based on the specific circumstances of the transfer. In conclusion, a Vallejo California Grant Deed — Three Individuals to Trust is a crucial legal document enabling the transfer of real estate ownership from three individuals to a trust. By utilizing this type of deed, individuals can protect their assets, plan for estate distribution, and ensure a smooth transition of property ownership while taking advantage of potential tax benefits. Proper legal counsel is recommended to navigate the complexities and choose the most appropriate type of grant deed for the transaction at hand.