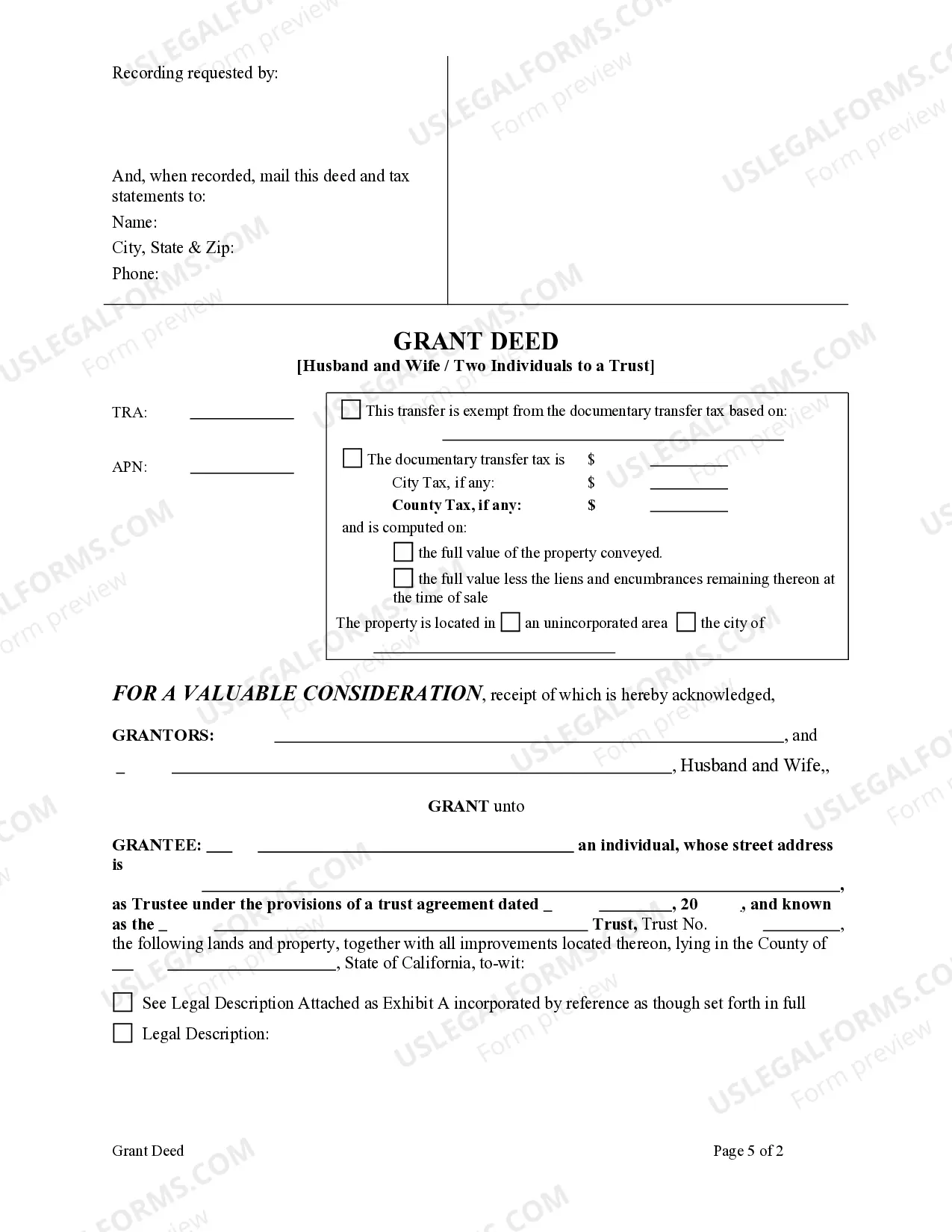

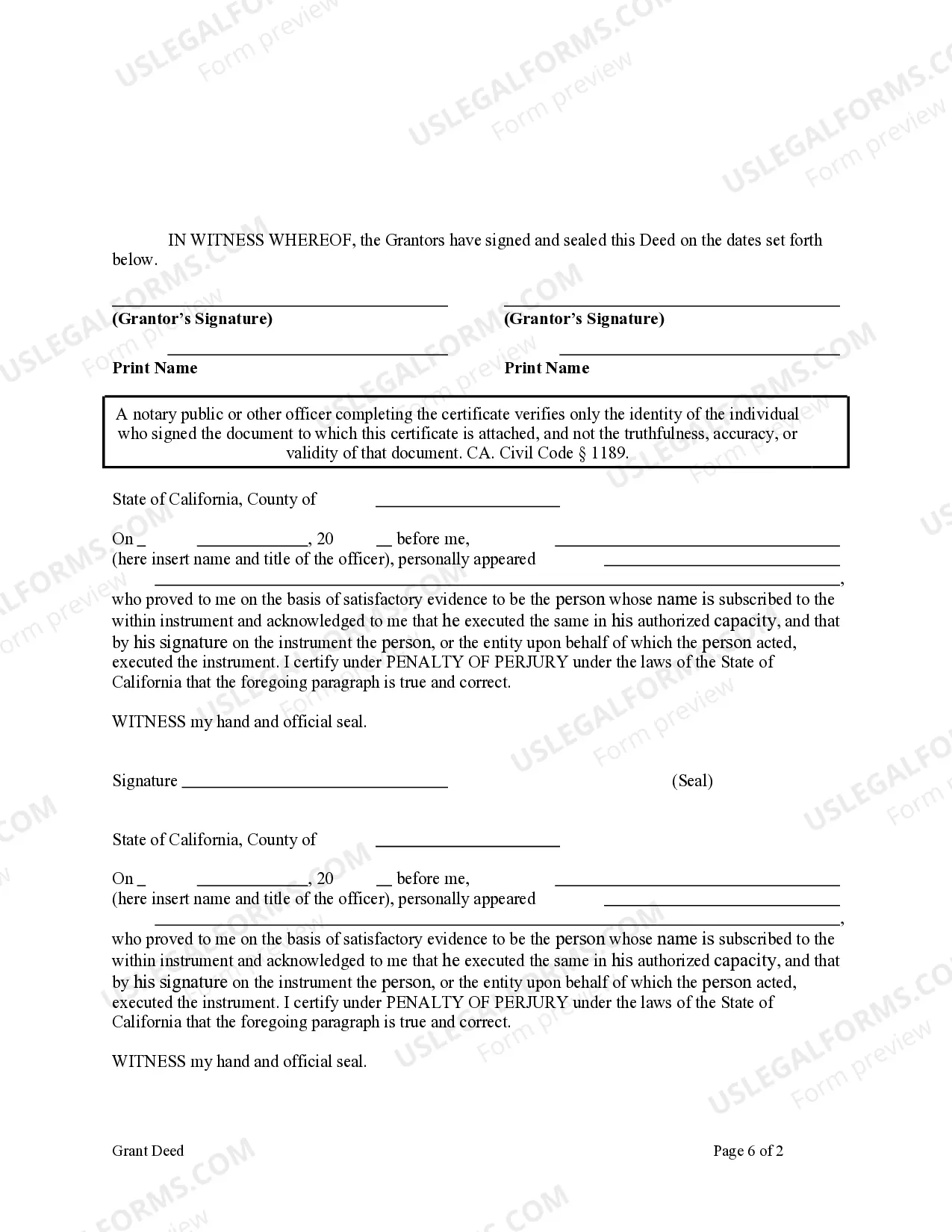

This form is a Grant Deed where the grantors are husband and wife and the grantee is a trust. Grantors conveys and grant the described property to grantee. This deed complies with all state statutory laws.

A Long Beach California Grant Deed — Husband and Wife to a Trust is a legal document that allows a married couple to transfer their real estate property to a trust they have established. This type of deed is primarily used for estate planning purposes, ensuring the seamless transfer of property ownership to the trust in case of incapacitation or death. The main objective of the grant deed is to provide protection, flexibility, and control over the property assets owned by the couple. By transferring the property to their trust, the couple can benefit from various advantages such as avoiding probate, minimizing estate taxes, and facilitating smoother asset distribution to beneficiaries designated in the trust. Here are a few important points to consider for a Long Beach California Grant Deed — Husband and Wife to a Trust: 1. Legal Protection: By transferring the property to a trust, it becomes an asset under the trust's umbrella, providing protection against potential creditors or lawsuits. This can safeguard the property from being seized or sold to satisfy judgments. 2. Avoiding Probate: Using a trust-based transfer, the property can bypass the probate process, which is often lengthy and expensive. This allows for a more efficient transfer of ownership, ensuring the property remains in the hands of intended beneficiaries. 3. Flexibility: A grant deed to a trust provides flexibility for the couple to modify or revoke the trust terms during their lifetime if circumstances change. It also allows the couple to retain control over the property by serving as trustees and managing the property as they choose. 4. Tax Advantages: Transferring the property to a trust can help reduce estate taxes by utilizing exemptions and deductions available under law. This can potentially save considerable amounts of money that would otherwise go towards taxes upon the passing of one or both spouses. Different types of Long Beach California Grant Deeds — Husband and Wife to a Trust may include variations based on specific circumstances, preferences, or legal requirements. Some common variations may include: 1. Joint Revocable Living Trust: This type of grant deed allows a married couple to transfer property ownership to a revocable living trust under their joint control. It ensures that the trust terms can be modified or revoked as long as both spouses are alive and agree on the changes. 2. Irrevocable Trust Grant Deed: Unlike a revocable living trust, this type of grant deed transfers the property ownership to an irrevocable trust, meaning that the terms of the trust cannot be altered or revoked without the consent of the beneficiaries. 3. Family Trust Grant Deed: This grant deed involves transferring property ownership to a trust established by a married couple for the benefit of themselves and their family members. It can provide comprehensive estate planning and asset protection benefits for the entire family. In conclusion, a Long Beach California Grant Deed — Husband and Wife to a Trust is a valuable legal instrument that empowers married couples to transfer their property to a trust they have created. It offers protection, flexibility, and tax advantages, while avoiding the complexities and costs associated with probate. Different variations of this grant deed exist to cater to specific needs and circumstances, ensuring the couple's wishes are carried out efficiently and according to their desires.A Long Beach California Grant Deed — Husband and Wife to a Trust is a legal document that allows a married couple to transfer their real estate property to a trust they have established. This type of deed is primarily used for estate planning purposes, ensuring the seamless transfer of property ownership to the trust in case of incapacitation or death. The main objective of the grant deed is to provide protection, flexibility, and control over the property assets owned by the couple. By transferring the property to their trust, the couple can benefit from various advantages such as avoiding probate, minimizing estate taxes, and facilitating smoother asset distribution to beneficiaries designated in the trust. Here are a few important points to consider for a Long Beach California Grant Deed — Husband and Wife to a Trust: 1. Legal Protection: By transferring the property to a trust, it becomes an asset under the trust's umbrella, providing protection against potential creditors or lawsuits. This can safeguard the property from being seized or sold to satisfy judgments. 2. Avoiding Probate: Using a trust-based transfer, the property can bypass the probate process, which is often lengthy and expensive. This allows for a more efficient transfer of ownership, ensuring the property remains in the hands of intended beneficiaries. 3. Flexibility: A grant deed to a trust provides flexibility for the couple to modify or revoke the trust terms during their lifetime if circumstances change. It also allows the couple to retain control over the property by serving as trustees and managing the property as they choose. 4. Tax Advantages: Transferring the property to a trust can help reduce estate taxes by utilizing exemptions and deductions available under law. This can potentially save considerable amounts of money that would otherwise go towards taxes upon the passing of one or both spouses. Different types of Long Beach California Grant Deeds — Husband and Wife to a Trust may include variations based on specific circumstances, preferences, or legal requirements. Some common variations may include: 1. Joint Revocable Living Trust: This type of grant deed allows a married couple to transfer property ownership to a revocable living trust under their joint control. It ensures that the trust terms can be modified or revoked as long as both spouses are alive and agree on the changes. 2. Irrevocable Trust Grant Deed: Unlike a revocable living trust, this type of grant deed transfers the property ownership to an irrevocable trust, meaning that the terms of the trust cannot be altered or revoked without the consent of the beneficiaries. 3. Family Trust Grant Deed: This grant deed involves transferring property ownership to a trust established by a married couple for the benefit of themselves and their family members. It can provide comprehensive estate planning and asset protection benefits for the entire family. In conclusion, a Long Beach California Grant Deed — Husband and Wife to a Trust is a valuable legal instrument that empowers married couples to transfer their property to a trust they have created. It offers protection, flexibility, and tax advantages, while avoiding the complexities and costs associated with probate. Different variations of this grant deed exist to cater to specific needs and circumstances, ensuring the couple's wishes are carried out efficiently and according to their desires.