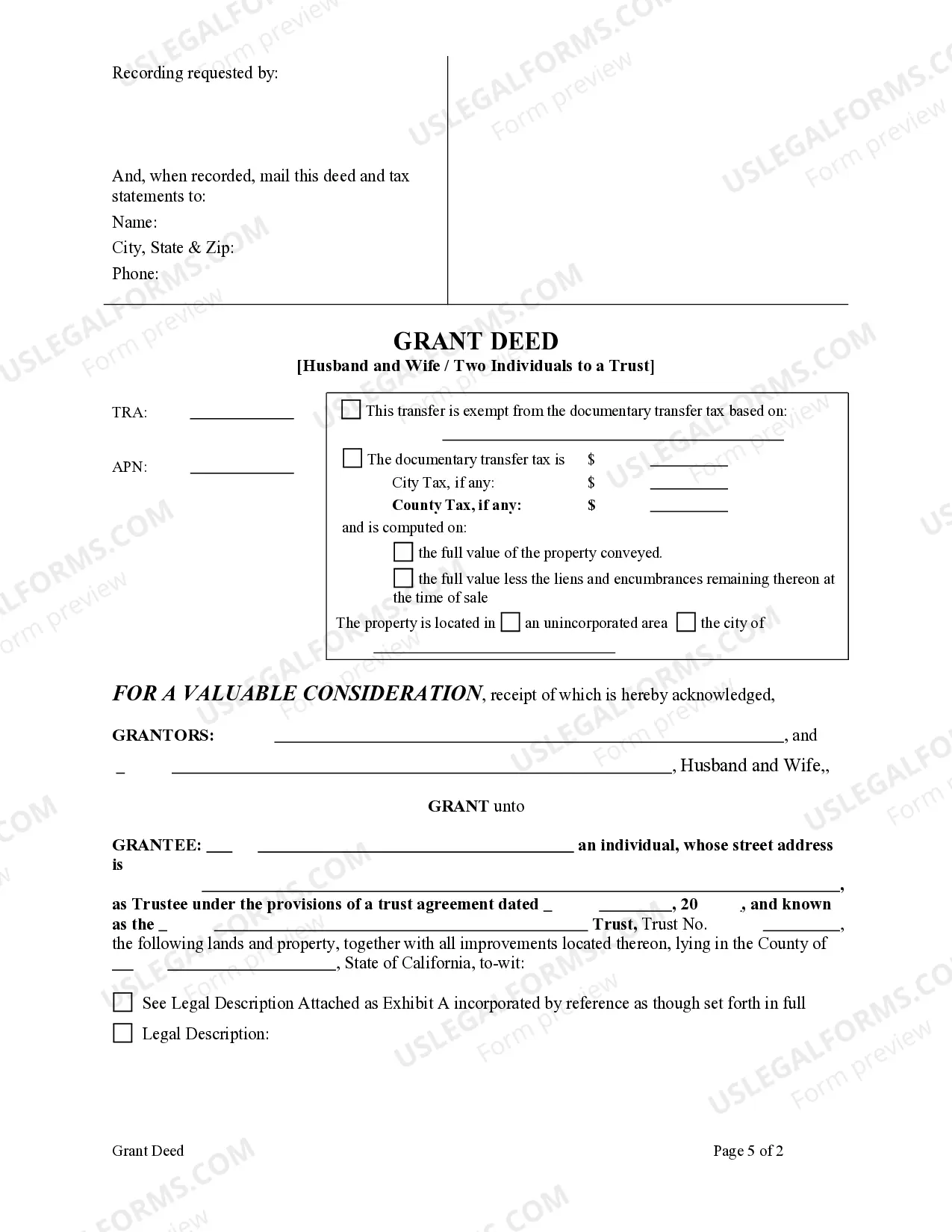

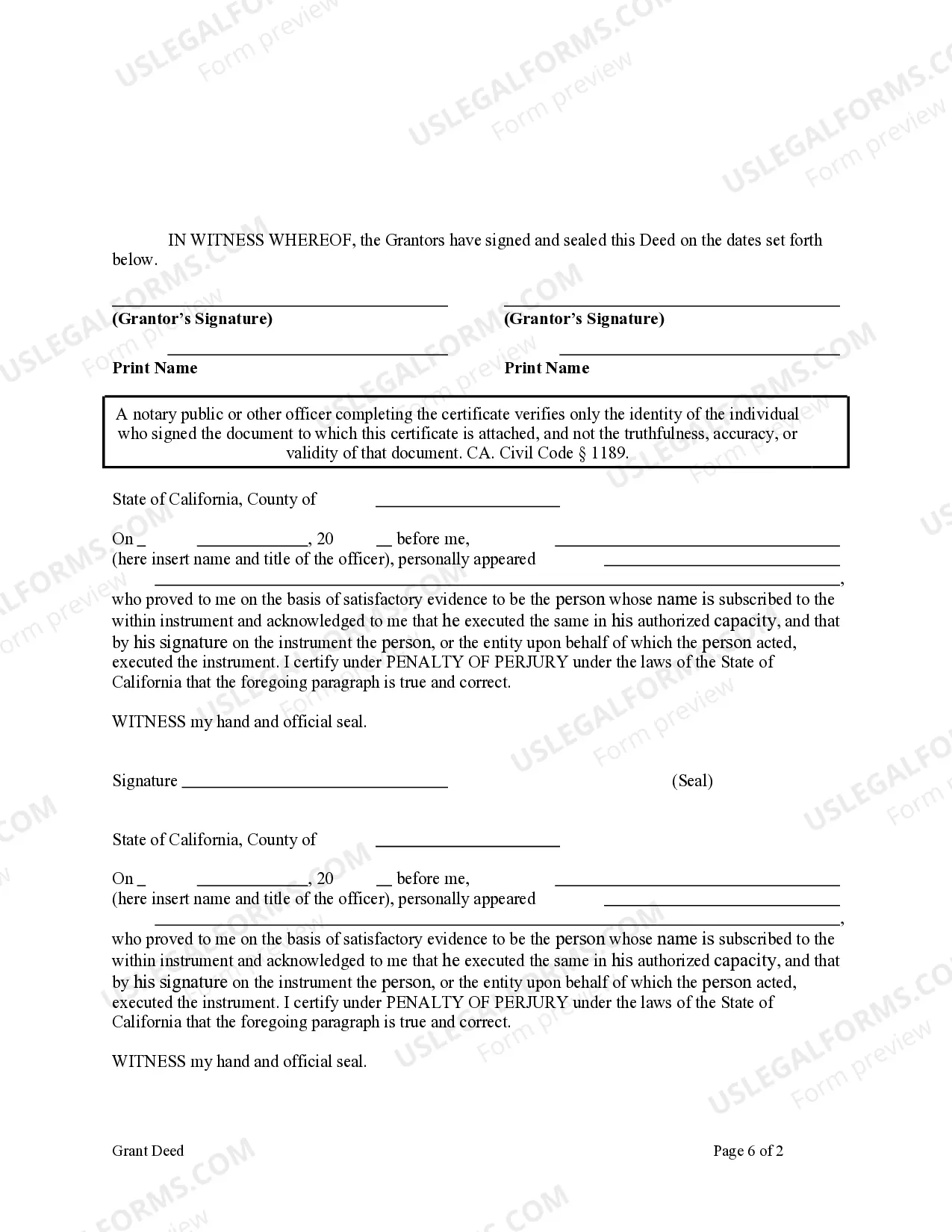

This form is a Grant Deed where the grantors are husband and wife and the grantee is a trust. Grantors conveys and grant the described property to grantee. This deed complies with all state statutory laws.

A Santa Clara California Grant Deed — Husband and Wife to a Trust is a legal document used to transfer ownership of real property from a married couple (the granters) to a trust (the grantee). This particular type of grant deed is commonly used in estate planning and asset protection strategies in Santa Clara, California. The purpose of transferring property to a trust is to ensure that it is properly managed, protected, and ultimately distributed according to the wishes of the granters. By placing the property in a trust, the granters can stipulate how the property should be used during their lifetime and how it should be distributed upon their death, without the need for probate court involvement. There are several types of Santa Clara California Grant Deed — Husband and Wife to a Trust, depending on the specific circumstances and requirements of the granters. Some of these variations include: 1. Revocable Living Trust: In this type of grant deed, the granters transfer the property to a revocable living trust, allowing them to maintain control and make changes to the trust terms during their lifetime. This type of trust is often used for estate planning purposes to avoid probate and ensure a smooth transfer of assets after death. 2. Irrevocable Trust: With an irrevocable trust, the granters transfer ownership of the property to the trust, and they cannot make changes or revoke the trust without the consent of the beneficiaries. This type of trust provides more asset protection and can be used for tax planning or Medicaid eligibility purposes. 3. Special Needs Trust: If the granters have a disabled or special needs beneficiary, they may choose to transfer the property to a special needs trust. This type of trust allows the beneficiary to receive the benefits of the property without jeopardizing their eligibility for government assistance programs. 4. Charitable Remainder Trust: A grant deed to a charitable remainder trust involves the transfer of property to a trust, with the granters retaining an income interest for a specified period or for life. This allows the granters to receive income from the property during their lifetime while benefiting a charitable organization upon their death. Regardless of the specific type, a Santa Clara California Grant Deed — Husband and Wife to a Trust is a crucial legal instrument for transferring property ownership to a trust, ensuring the granters' intentions are carried out and their assets are protected. It is advisable to consult with an experienced attorney to navigate the complexities and legal requirements associated with creating and executing such a grant deed.A Santa Clara California Grant Deed — Husband and Wife to a Trust is a legal document used to transfer ownership of real property from a married couple (the granters) to a trust (the grantee). This particular type of grant deed is commonly used in estate planning and asset protection strategies in Santa Clara, California. The purpose of transferring property to a trust is to ensure that it is properly managed, protected, and ultimately distributed according to the wishes of the granters. By placing the property in a trust, the granters can stipulate how the property should be used during their lifetime and how it should be distributed upon their death, without the need for probate court involvement. There are several types of Santa Clara California Grant Deed — Husband and Wife to a Trust, depending on the specific circumstances and requirements of the granters. Some of these variations include: 1. Revocable Living Trust: In this type of grant deed, the granters transfer the property to a revocable living trust, allowing them to maintain control and make changes to the trust terms during their lifetime. This type of trust is often used for estate planning purposes to avoid probate and ensure a smooth transfer of assets after death. 2. Irrevocable Trust: With an irrevocable trust, the granters transfer ownership of the property to the trust, and they cannot make changes or revoke the trust without the consent of the beneficiaries. This type of trust provides more asset protection and can be used for tax planning or Medicaid eligibility purposes. 3. Special Needs Trust: If the granters have a disabled or special needs beneficiary, they may choose to transfer the property to a special needs trust. This type of trust allows the beneficiary to receive the benefits of the property without jeopardizing their eligibility for government assistance programs. 4. Charitable Remainder Trust: A grant deed to a charitable remainder trust involves the transfer of property to a trust, with the granters retaining an income interest for a specified period or for life. This allows the granters to receive income from the property during their lifetime while benefiting a charitable organization upon their death. Regardless of the specific type, a Santa Clara California Grant Deed — Husband and Wife to a Trust is a crucial legal instrument for transferring property ownership to a trust, ensuring the granters' intentions are carried out and their assets are protected. It is advisable to consult with an experienced attorney to navigate the complexities and legal requirements associated with creating and executing such a grant deed.