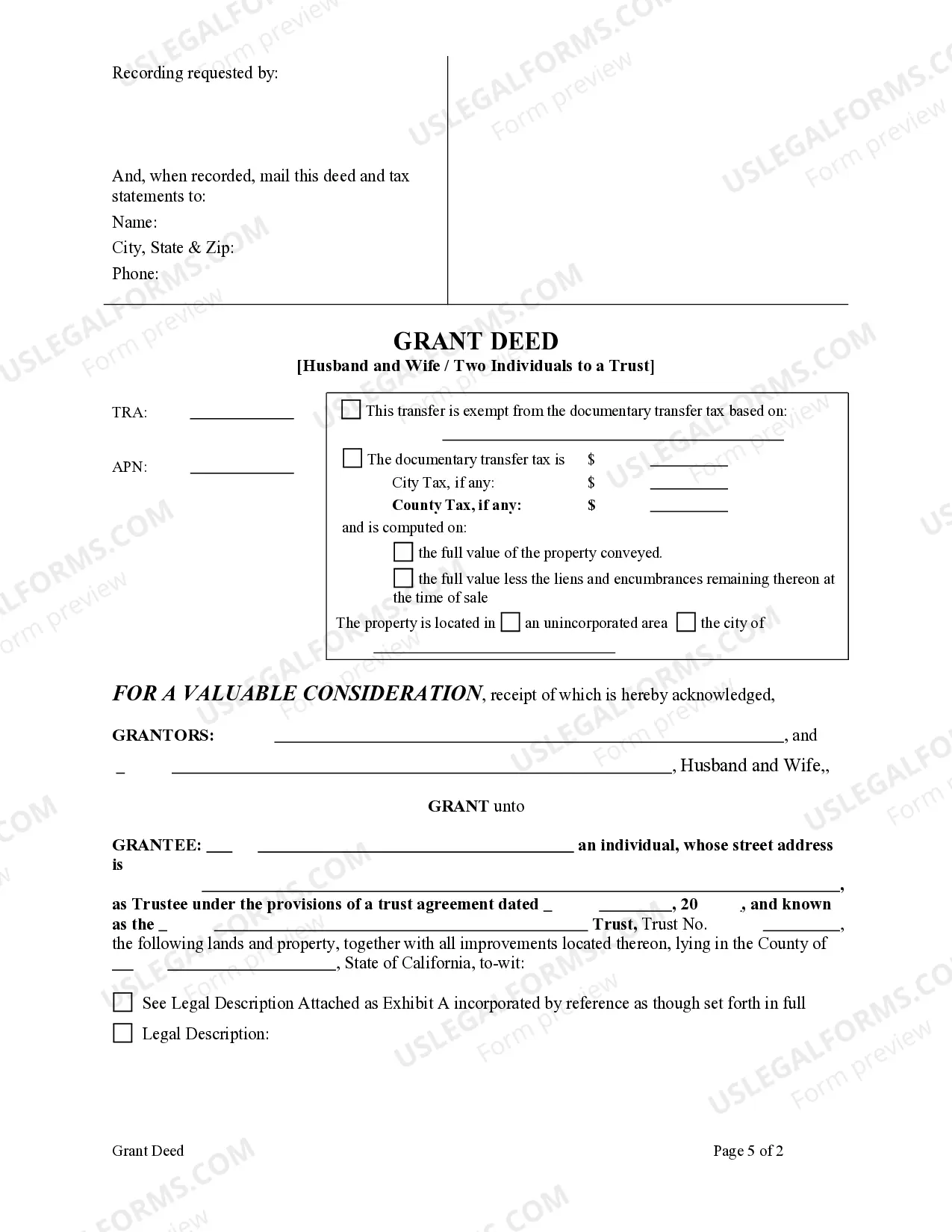

This form is a Grant Deed where the grantors are husband and wife and the grantee is a trust. Grantors conveys and grant the described property to grantee. This deed complies with all state statutory laws.

A Santa Maria California Grant Deed — Husband and Wife to a Trust is a legal document that allows a married couple to transfer ownership of their property to a trust that they have established. This form of deed is commonly used to protect assets and ensure a smooth transfer of property in estate planning and asset management. A grant deed is a legal instrument used to transfer real estate property from one party to another. In this case, the property is being transferred from a husband and wife to the trust they have created. The trust acts as the new owner of the property, and the couple becomes the trustees who manage the property within the trust. By transferring the property to a trust, the husband and wife can gain various benefits, including: 1. Asset Protection: Placing the property in a trust helps protect it from potential creditors or legal claims. In the event of a lawsuit or bankruptcy, the trust becomes an additional layer of protection, shielding the property from being seized or used to settle debts. 2. Estate Planning: Transfer of property to a trust allows for efficient estate planning, ensuring a smooth transfer of assets to beneficiaries upon the death of the husband and wife. By avoiding the probate process, the heirs can quickly access the property and avoid potential delays and expenses associated with probate. 3. Tax Benefits: Depending on the specific goals of the trust, there may be potential tax advantages. If structured correctly, a grant deed to a trust can help reduce estate taxes and provide tax benefits for the beneficiaries. It's important to note that there are various types of Santa Maria California Grant Deed — Husband and Wife to a Trust, including: 1. Irrevocable Trust Grant Deed: With an irrevocable trust, the transfer of property is permanent, and the trust becomes the legal owner. This type of deed offers maximum asset protection but limits the ability to modify or revoke the trust. 2. Revocable Trust Grant Deed: A revocable trust allows flexibility as it can be modified or revoked during the lifetime of the husband and wife. The trust retains control of the property, and the couple can change the trust's terms or designate different beneficiaries as needed. 3. Interviews Trust Grant Deed: An interviews trust, also known as a living trust, takes effect during the lifetime of the husband and wife. It allows them to transfer property to the trust while retaining control and use of the property. This type of deed facilitates a seamless transition of assets upon their death or incapacity. In summary, a Santa Maria California Grant Deed — Husband and Wife to a Trust is a legal document that enables a married couple to transfer ownership of their property to a trust they have established. It provides asset protection, efficient estate planning, and potential tax benefits. Different types of grant deeds to a trust include irrevocable, revocable, and interviews trusts.