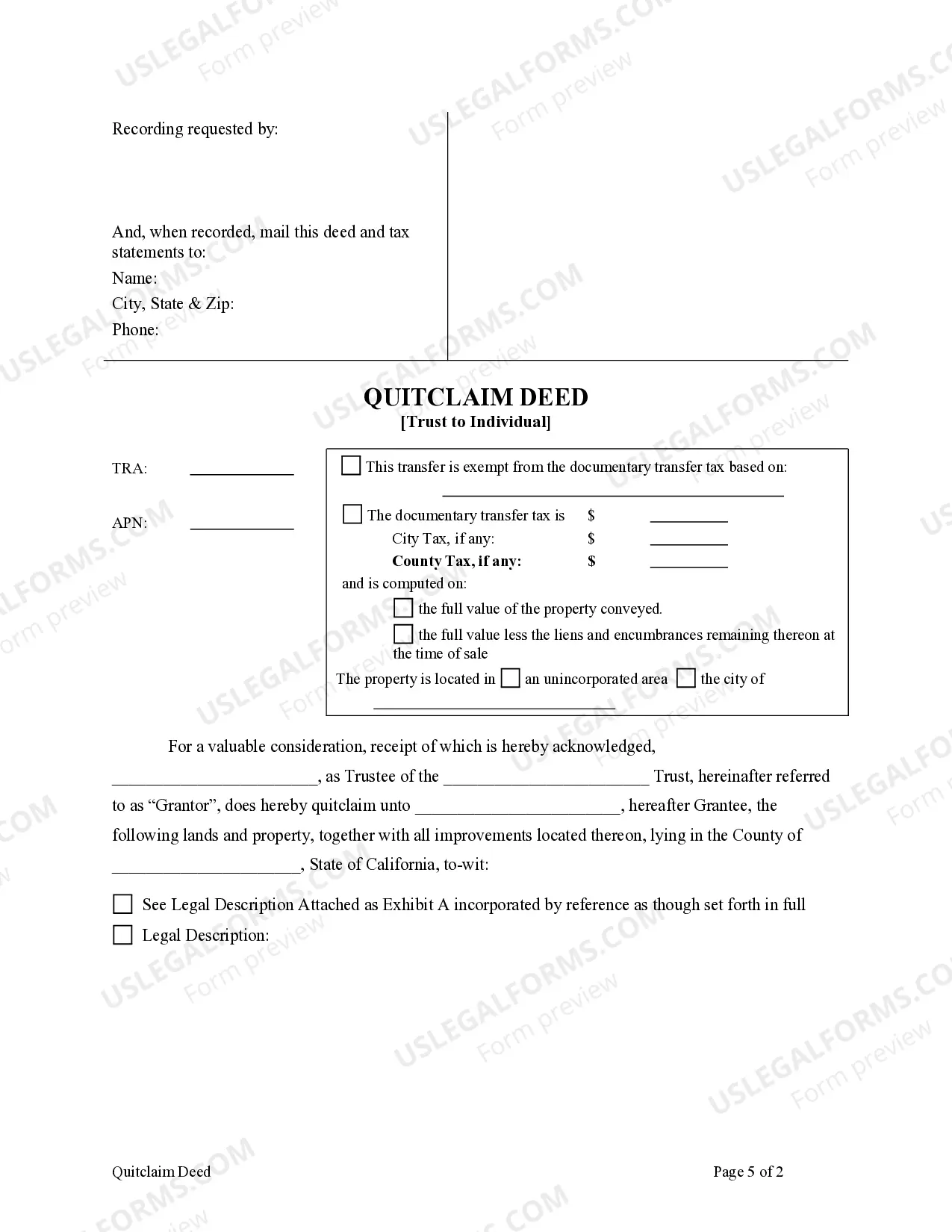

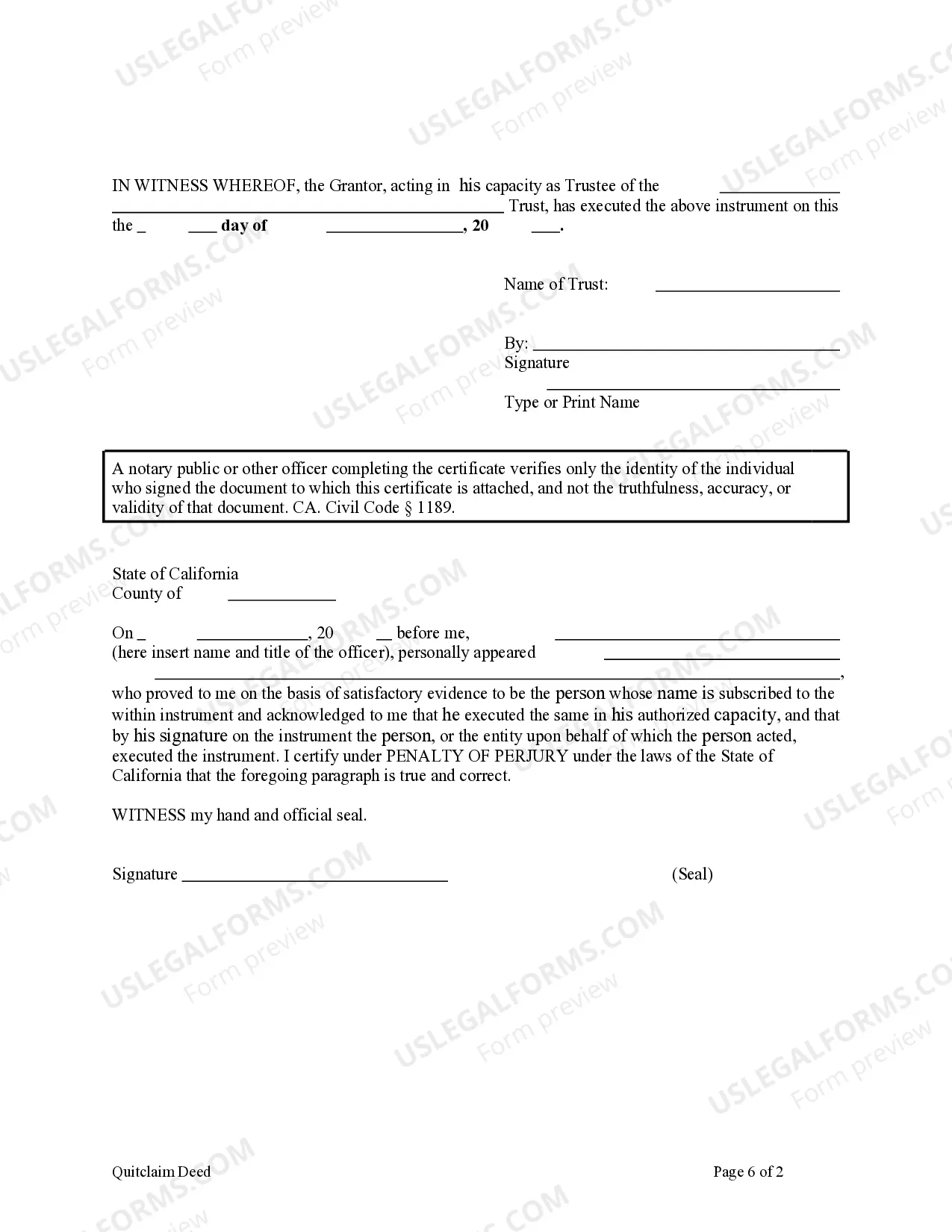

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Alameda California Quitclaim Deed - Trust to an Individual

Description

How to fill out Alameda California Quitclaim Deed - Trust To An Individual?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Alameda California Quitclaim Deed - Trust to an Individual or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Alameda California Quitclaim Deed - Trust to an Individual complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Alameda California Quitclaim Deed - Trust to an Individual is suitable for you, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

If you need to remove a name from a title deed for a property with a mortgage on it, you will need written consent to do so from the lender. Generally, it is easier to obtain this if the person(s) left on the title deed is (are) sufficiently financially secure.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Each one has its own requirements and works best in different circumstances.

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

Quitclaim Deeds in California Anyone can give someone a quitclaim deed, but if the grantor doesn't actually own the property, the deed is worthless. As the grantee of a quitclaim deed, you don't have the right to sue the grantor for damages, making a quitclaim deed risky.

When owning a home together is no longer an option, you can remove him from your mortgage by refinancing. You do not need his consent to refinance. However, the co-owner must agree to relinquish ownership rights. By completing a quit claim deed, the owner quits his interest in the home.

When owning a home together is no longer an option, you can remove him from your mortgage by refinancing. You do not need his consent to refinance. However, the co-owner must agree to relinquish ownership rights. By completing a quit claim deed, the owner quits his interest in the home.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

More info

An agreement to buy or sell property will need to be signed in California with the California Department of Finance (Calvin) prior to the real estate transaction. California State Laws About Real Estate Tax. California's Proposition 13 provides a refundable tax credit for lower and moderate income taxpayers. The California Residential Landlord and Tenant act provides for an equal protection right to buy a vacant or abandoned property. The California Residential Tenant Property Act provides a refundable property maintenance tax exemption for certain rental property. California Government Finance Act. All public debt in California is subject to taxation, and may be assessed by either the state or by a local government. The California State Treasurer also has the authority to impose a tax on the gross revenues of the state and to make payments to any local taxing authority within the state.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.