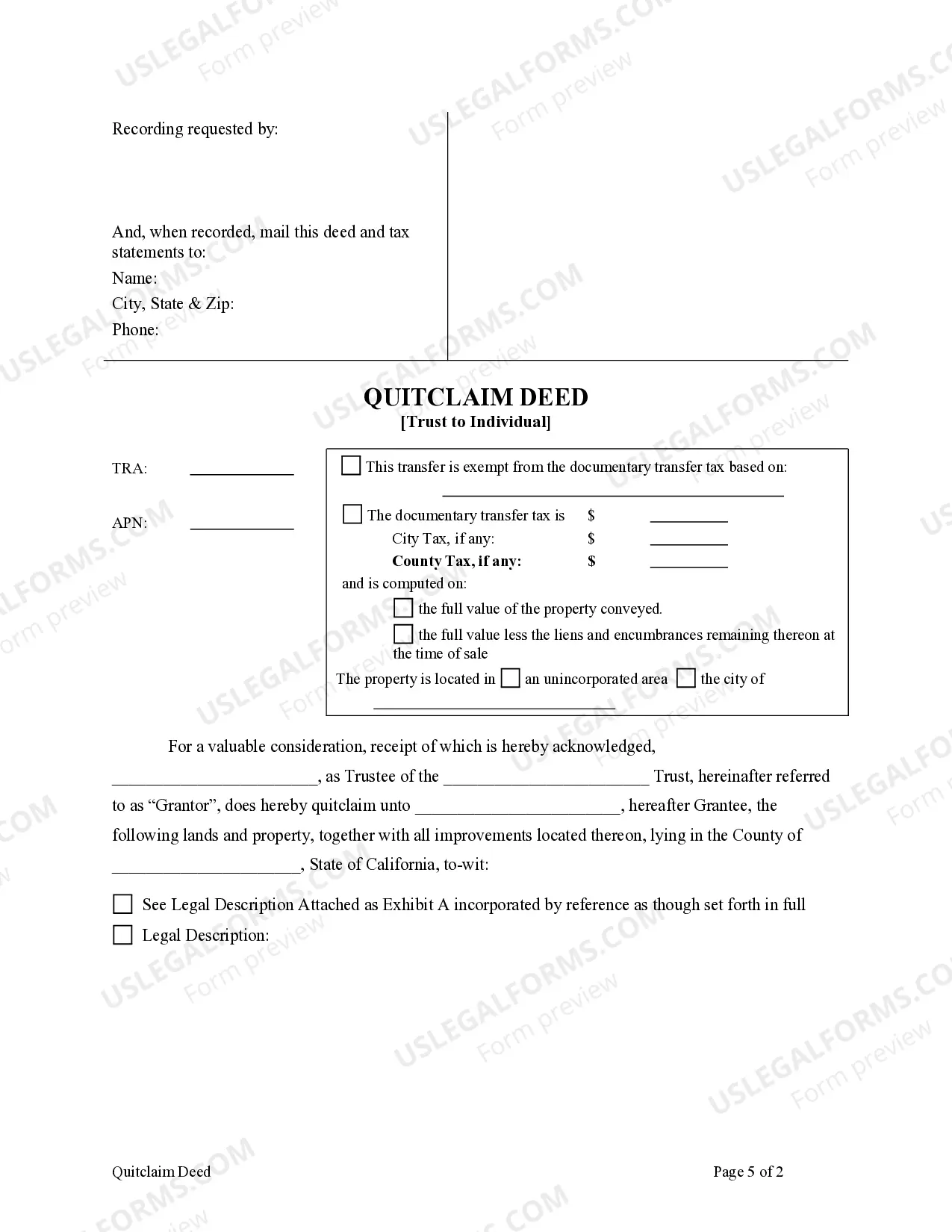

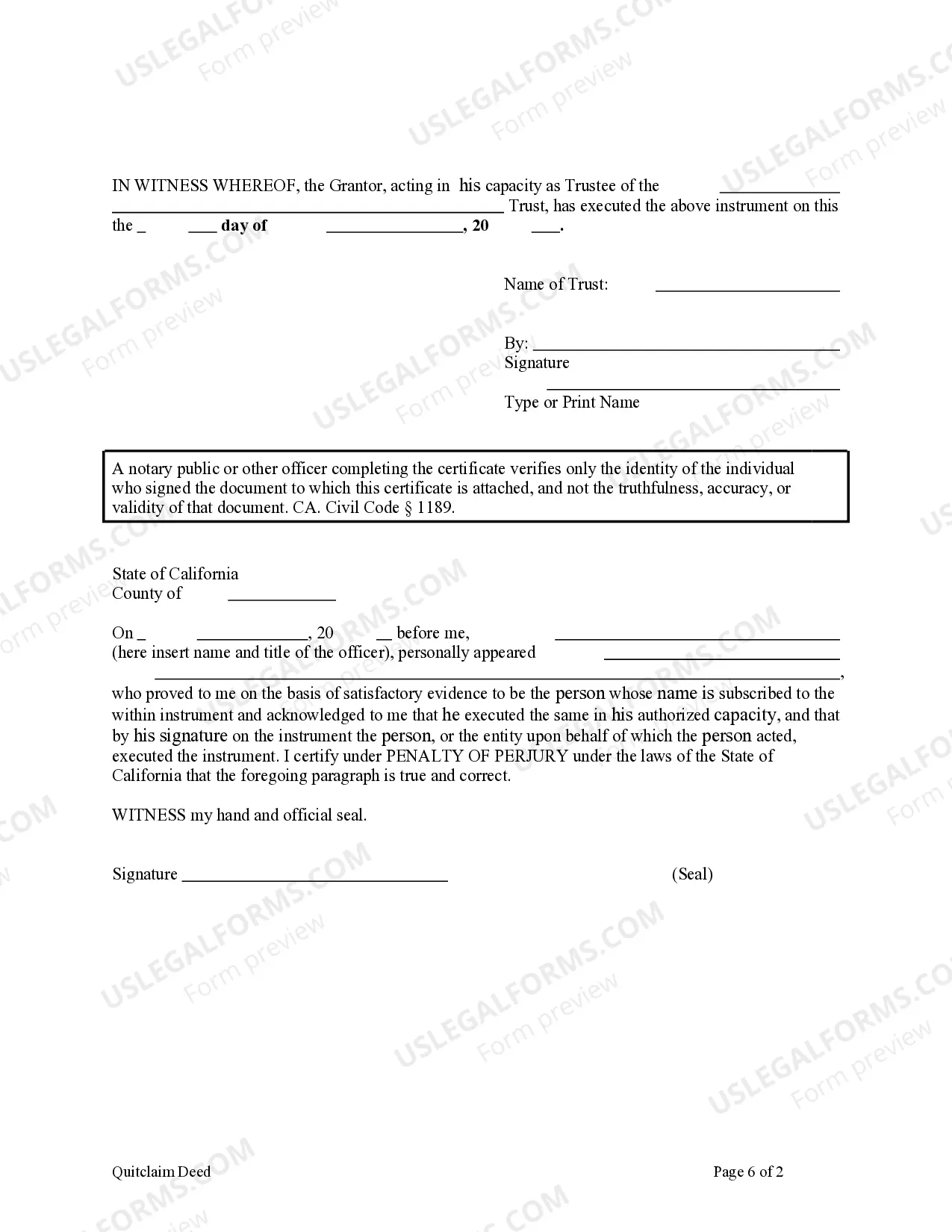

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

El Cajon California Quitclaim Deed — Trust to an Individual is a legal document used to transfer ownership of real estate or property interests from a trust to an individual. This type of deed is commonly used when a property held in a trust is being transferred to an individual beneficiary. The El Cajon California Quitclaim Deed — Trust to an Individual provides a streamlined process for transferring property ownership without warranties or guarantees from the trust. The deed transfers only the interest or rights held by the trust, without any assurance of clear title or absence of liens. It is essential for both the trust and individual to seek legal advice before executing the quitclaim deed to fully understand its implications and potential risks. Different types of El Cajon California Quitclaim Deed — Trust to an Individual may include: 1. Trust Distribution Deed: This type of quitclaim deed is commonly used when a trust is being dissolved, and the property is being distributed to a named individual beneficiary. It transfers the interest or rights held by the trust to the beneficiary. 2. Gift Quitclaim Deed: In some cases, a trust may transfer property to an individual as a gift. This type of quitclaim deed relinquishes the trust's interest or rights in the property without any consideration or payment from the individual. 3. Inheritance Quitclaim Deed: When property held in a trust is being inherited by an individual beneficiary, an inheritance quitclaim deed may be used. This document transfers the trust's interest or rights in the property to the beneficiary as part of their inheritance. It is important to note that each specific quitclaim deed may have different requirements and instructions based on the unique circumstances of the trust and the individuals involved. Seeking legal guidance is always recommended ensuring compliance with El Cajon, California laws and to protect the interests of all parties involved in the transfer of property ownership.