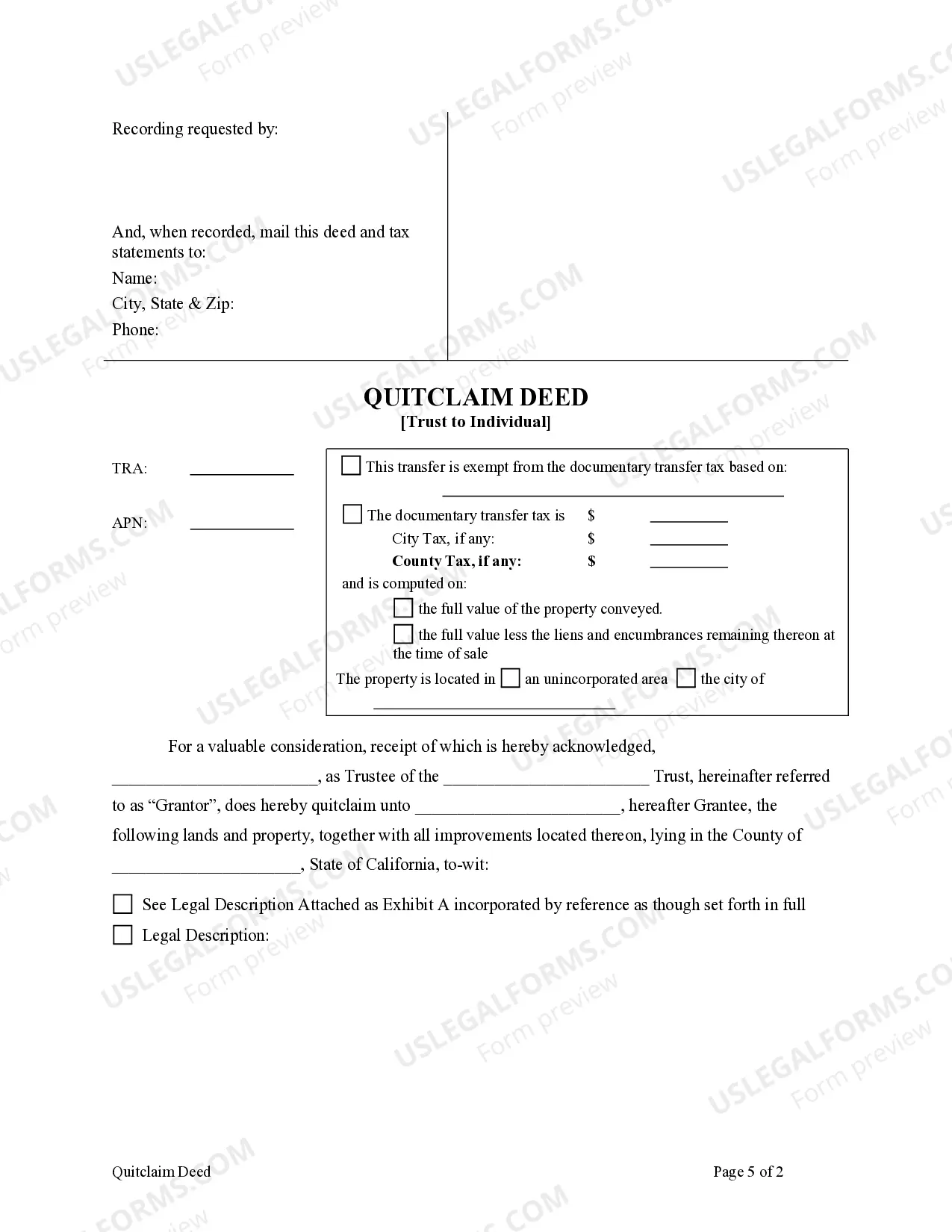

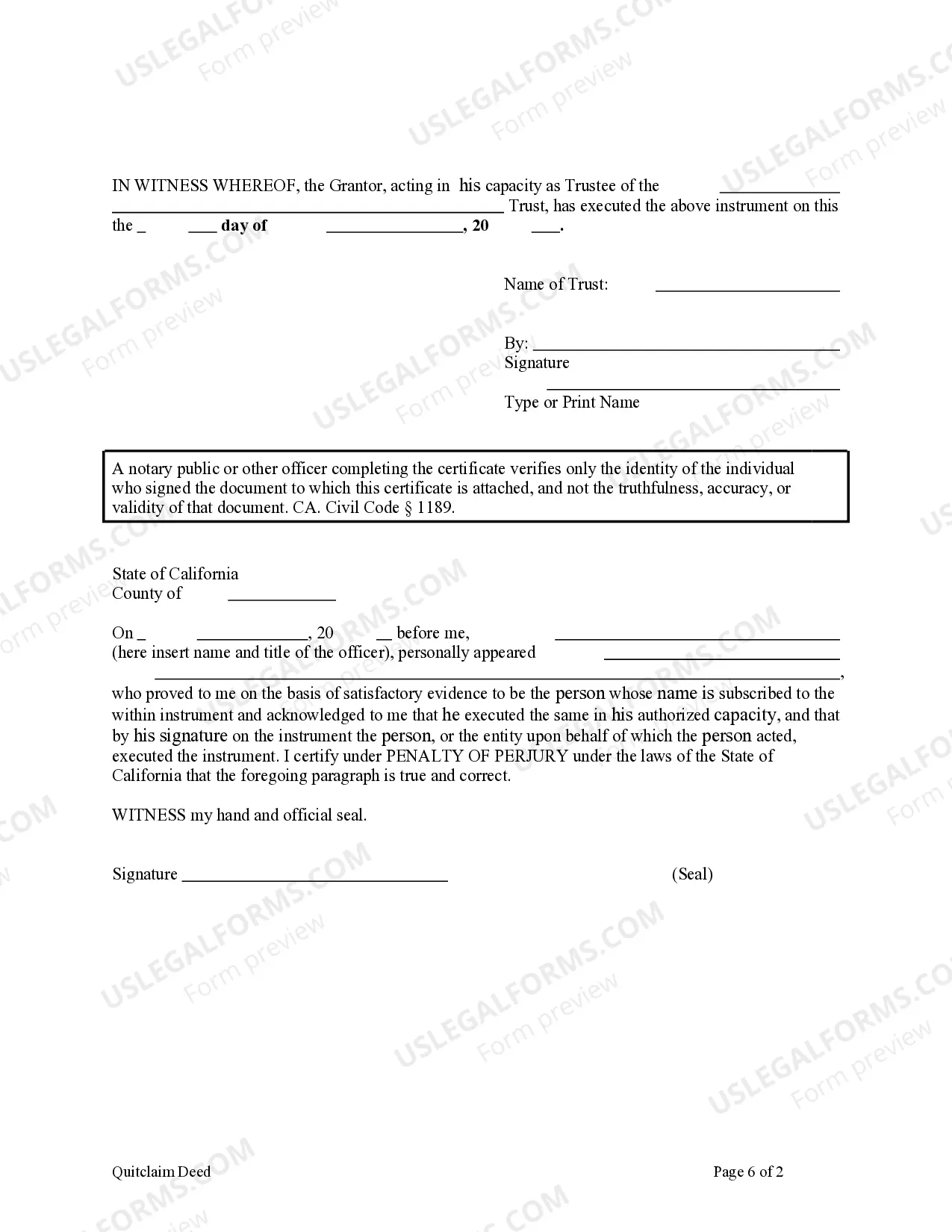

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Hayward California Quitclaim Deed — Trust to an Individual is a legal document that allows an individual to transfer their ownership interest in a property located in Hayward, California, to another individual, known as the grantee, through a trust arrangement. This type of deed is often used when a property owner wishes to transfer their interest in a property to a trustee, who will then hold and manage the property on behalf of a designated beneficiary. The trustee, as the grantee of the quitclaim deed, becomes the legal owner of the property and is responsible for maintaining it, paying property taxes, and managing any rental income if applicable. One common type of Hayward California Quitclaim Deed — Trust to an Individual is the revocable living trust deed. This deed allows the granter (property owner) to transfer their property into a trust during their lifetime, while still retaining the ability to revoke or amend the terms of the trust. Another type of quitclaim deed to an individual through a trust is the irrevocable trust deed. With this deed, the transfer of the property interest is permanent and cannot be revoked or amended by the granter. The granter relinquishes all control and ownership rights to the property, which can provide certain estate planning benefits. When considering a Hayward California Quitclaim Deed — Trust to an Individual, it is essential to seek guidance from a qualified attorney or real estate professional with experience in trust and estate planning. They can ensure that all legal requirements are met and provide advice on the most appropriate type of trust and deed for your specific needs. By executing a Hayward California Quitclaim Deed — Trust to an Individual, property owners can effectively transfer their property to a trustee for the benefit of a designated beneficiary. This type of arrangement can provide flexibility, privacy, and potential tax advantages, making it an attractive option for individuals looking to plan their estates or ensure the smooth transfer of property.A Hayward California Quitclaim Deed — Trust to an Individual is a legal document that allows an individual to transfer their ownership interest in a property located in Hayward, California, to another individual, known as the grantee, through a trust arrangement. This type of deed is often used when a property owner wishes to transfer their interest in a property to a trustee, who will then hold and manage the property on behalf of a designated beneficiary. The trustee, as the grantee of the quitclaim deed, becomes the legal owner of the property and is responsible for maintaining it, paying property taxes, and managing any rental income if applicable. One common type of Hayward California Quitclaim Deed — Trust to an Individual is the revocable living trust deed. This deed allows the granter (property owner) to transfer their property into a trust during their lifetime, while still retaining the ability to revoke or amend the terms of the trust. Another type of quitclaim deed to an individual through a trust is the irrevocable trust deed. With this deed, the transfer of the property interest is permanent and cannot be revoked or amended by the granter. The granter relinquishes all control and ownership rights to the property, which can provide certain estate planning benefits. When considering a Hayward California Quitclaim Deed — Trust to an Individual, it is essential to seek guidance from a qualified attorney or real estate professional with experience in trust and estate planning. They can ensure that all legal requirements are met and provide advice on the most appropriate type of trust and deed for your specific needs. By executing a Hayward California Quitclaim Deed — Trust to an Individual, property owners can effectively transfer their property to a trustee for the benefit of a designated beneficiary. This type of arrangement can provide flexibility, privacy, and potential tax advantages, making it an attractive option for individuals looking to plan their estates or ensure the smooth transfer of property.