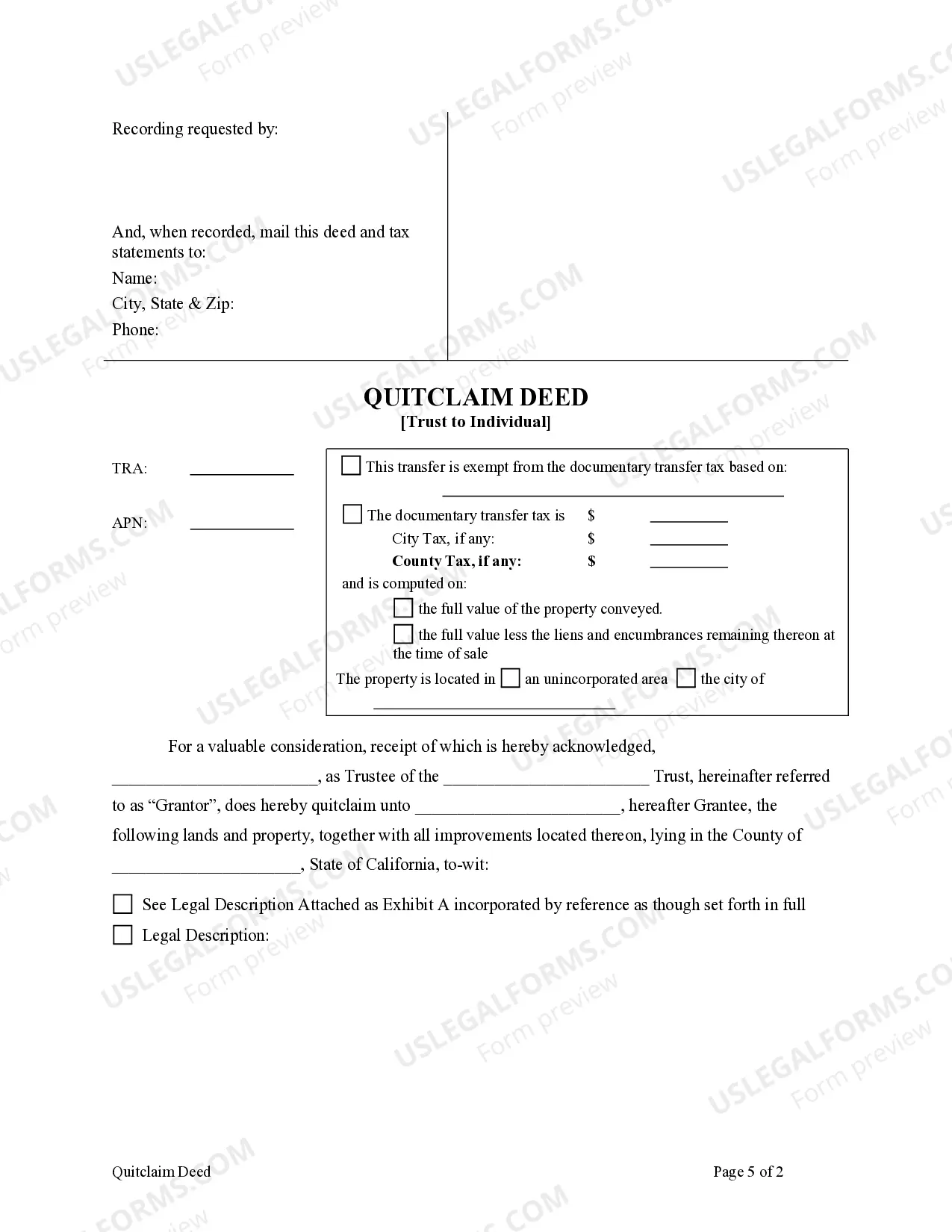

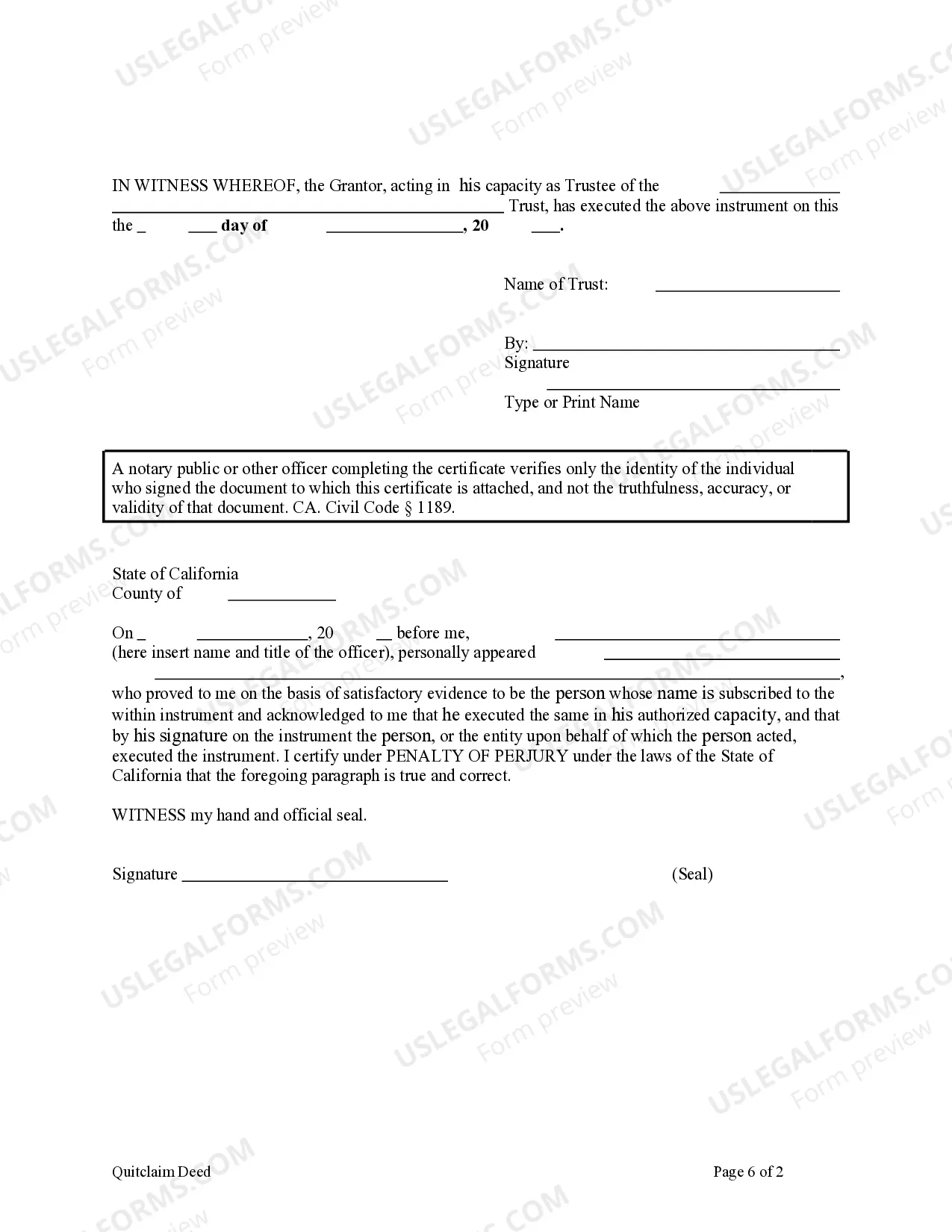

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Los Angeles California Quitclaim Deed - Trust to an Individual

Description

How to fill out California Quitclaim Deed - Trust To An Individual?

Are you seeking a reliable and cost-effective provider of legal documents to acquire the Los Angeles California Quitclaim Deed - Trust to an Individual? US Legal Forms is your ideal answer.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we've got you sorted. Our platform offers over 85,000 current legal document templates for personal and business usage. All templates we provide are not one-size-fits-all and are tailored according to the regulations of specific states and counties.

To obtain the document, you must Log In to your account, find the desired form, and click the Download button adjacent to it. Kindly note that you can access your previously purchased document templates at any moment from the My documents section.

Are you a newcomer to our platform? No need to be concerned. You can create an account within minutes, but prior to that, ensure to do the following.

You can now create your account. Then choose the subscription plan and proceed with the payment. Once the payment is finalized, download the Los Angeles California Quitclaim Deed - Trust to an Individual in any available format. You can revisit the website whenever you wish and redownload the document free of charge.

Acquiring up-to-date legal documents has never been more straightforward. Give US Legal Forms a try now, and eliminate the hassle of wasting your valuable time understanding legal paperwork online for good.

- Verify if the Los Angeles California Quitclaim Deed - Trust to an Individual aligns with the legislation of your state and locality.

- Review the document’s description (if accessible) to understand who and what the document is appropriate for.

- Restart the search if the document isn’t suitable for your particular circumstances.

Form popularity

FAQ

You can file a quitclaim deed in Los Angeles County at the Los Angeles County Registrar-Recorder/County Clerk’s office. Locate the nearest office or use their website to check for forms, fees, and business hours. It is important to ensure your quitclaim deed meets all local requirements to facilitate a smooth transaction. By utilizing resources from the US Legal Forms platform, you can find templates and guidance for the Los Angeles California Quitclaim Deed - Trust to an Individual.

To file a quitclaim deed in California, you must first complete the quitclaim deed form with accurate details about the grantor and grantee. After filling out the form, you need to have it signed by the grantor in front of a notary public to validate the document. Once notarized, submit the quitclaim deed to your local county recorder's office. This process is essential for the legality of transferring property rights under the Los Angeles California Quitclaim Deed - Trust to an Individual.

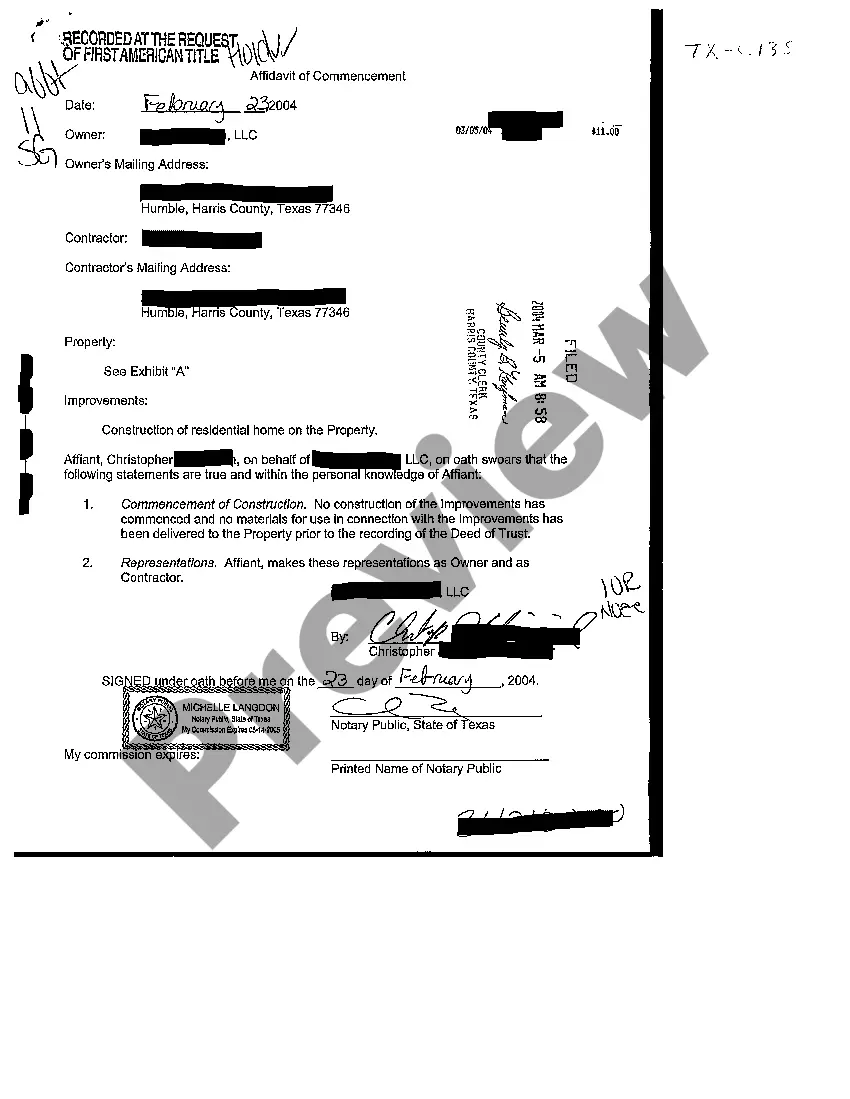

To record a deed of trust in California, start by preparing the document, ensuring it meets all legal requirements. After that, you need to submit the deed of trust to the county recorder's office in the county where the property is located. For those specifying a Los Angeles California Quitclaim Deed - Trust to an Individual, be sure to include complete details about the involved parties and the property. Utilizing platforms like USLegalForms can simplify this process, guiding you through the necessary steps with ease.

A quitclaim deed grants ownership rights as soon as it is executed and recorded, meaning that the new owner has immediate access to the property. However, this type of deed does not include guarantees about the title's condition or previous claims. Therefore, it’s advisable to conduct a title search for full assurance. For detailed guidance on quitclaim deeds in Los Angeles, professionals from US Legal Forms can be invaluable.

To transfer property from a trust to an individual in California, you must create a deed that officially documents the transfer. A quitclaim deed is commonly used in these situations, as it clearly conveys the property rights held by the trust. Always consult with a qualified attorney to navigate California's legal requirements effectively. US Legal Forms can provide templates and guidance to ensure a seamless transfer.

A quitclaim deed from a trust to an individual is a document that transfers property ownership from a trust to a named person. This is often done when a beneficiary of the trust is receiving their share of the property. It's essential to ensure all legal requirements are met during this transaction. Resources provided by platforms like US Legal Forms can aid in completing this process smoothly.

A quitclaim deed transfers any ownership interest you have in a property, but it does not guarantee complete ownership. If the grantor holds any claim to the property, that interest will pass to the new owner. This means that due diligence is essential before using a quitclaim deed in Los Angeles, California. For safe transactions, consider accessing resources from US Legal Forms.

Yes, you can transfer property from a trust to an individual in California. This typically involves executing a quitclaim deed that clearly identifies the change in ownership. The individual receiving the property must understand the implications of this transfer. Utilizing services like US Legal Forms can help simplify the technical aspects of the deed.

To prove ownership of a house in California, you can provide a copy of the title deed or a recent property tax statement. If you've used a quitclaim deed, this document is crucial in establishing ownership. Additionally, you may need to verify your identity and any associated claims on the property. Residents in Los Angeles can find useful resources through platforms like US Legal Forms.

To transfer property out of a trust in California, you typically need to execute a deed that removes the property from the trust's ownership. This process often involves filing a quitclaim deed to ensure proper documentation of the transfer. It's important to work with legal professionals to ensure compliance with state laws. Using the US Legal Forms platform can streamline this process effectively.