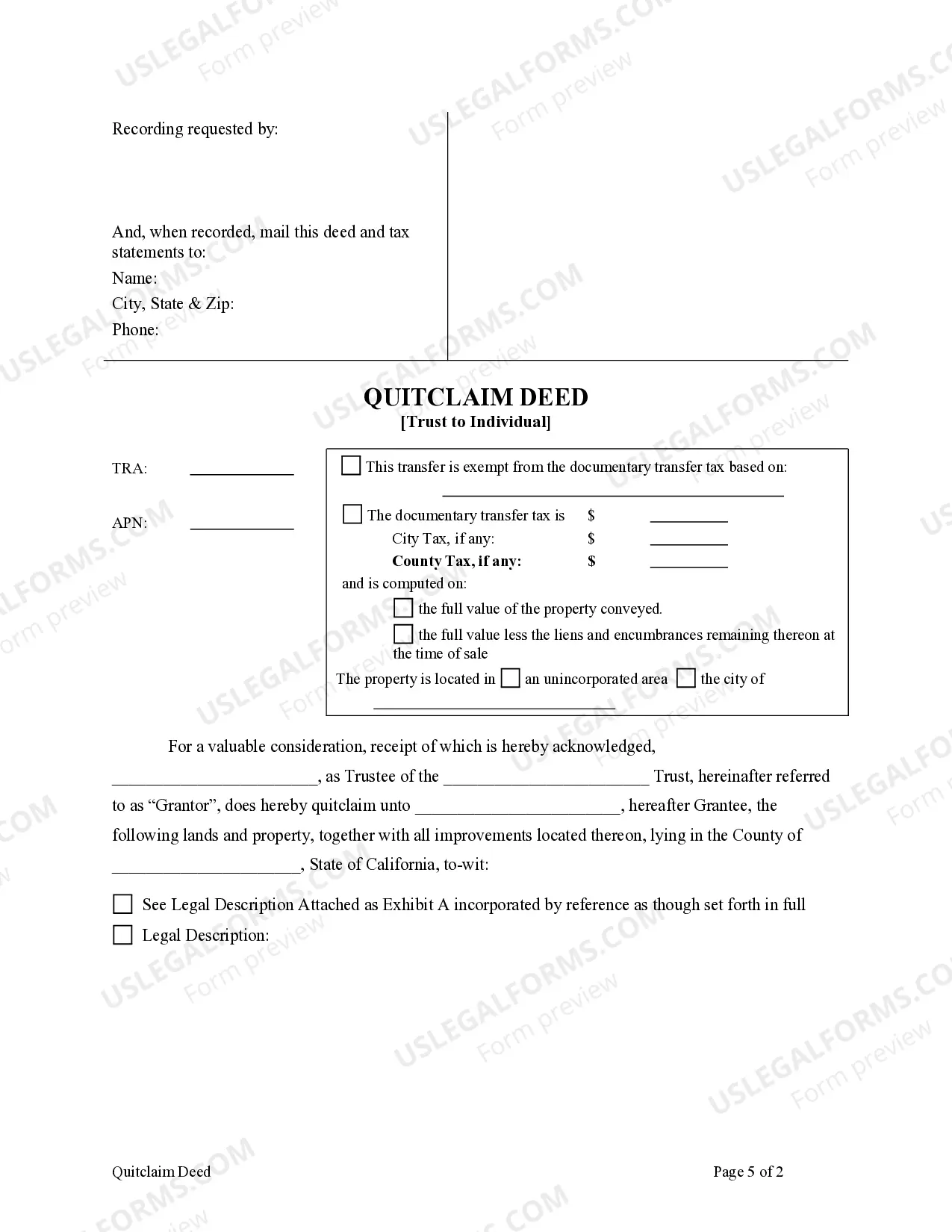

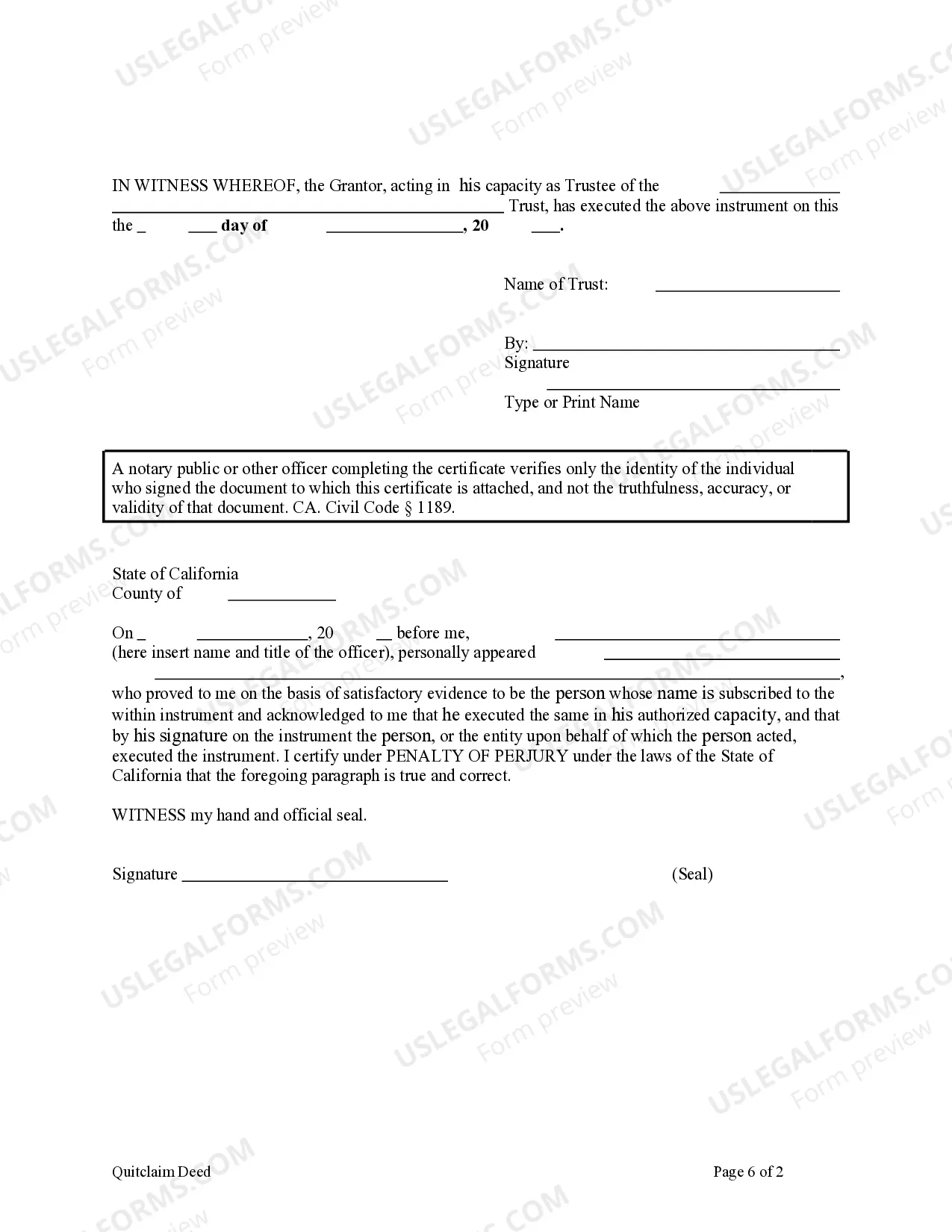

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Riverside California Quitclaim Deed — Trust to an Individual is a legal document used in real estate transactions to transfer ownership of a property from a trust to an individual. It serves as a formal agreement between the trust or and the trustee, outlining the transfer of the property's title to a designated individual. This type of quitclaim deed is commonly used for estate planning purposes or when a property held in trust needs to be passed on to a specific beneficiary. In Riverside, California, there are several types of Quitclaim Deeds — Trust to an Individual that may be used depending on the specific circumstances: 1. Living Trust to Individual: A Living Trust to an Individual Quitclaim Deed is commonly used when a property owner wishes to transfer ownership from their living trust to a specific individual. This often occurs during estate planning or when the trust or wants to pass down their property as part of their inheritance planning. 2. Testamentary Trust to Individual: A Testamentary Trust to an Individual Quitclaim Deed is utilized when ownership of a property is transferred from a testamentary trust, which is established through a will, to an individual beneficiary. This type of deed is commonly utilized when the trust or has passed away, and the property is being distributed according to their will. 3. Revocable Trust to Individual: A Revocable Trust to an Individual Quitclaim Deed refers to the transfer of property from a revocable trust to a specific individual. This type of trust allows the trust or to modify or revoke the trust during their lifetime, providing flexibility for asset distribution. 4. Irrevocable Trust to Individual: An Irrevocable Trust to an Individual Quitclaim Deed is used when ownership of a property held in an irrevocable trust is being passed on to an individual beneficiary. In this case, the trust or cannot make changes or revoke the trust once it is created, thereby ensuring the property is transferred according to their wishes. When executing a Riverside California Quitclaim Deed — Trust to an Individual, it is crucial to consult with an experienced real estate attorney or a licensed title company to ensure that the deed is properly prepared and recorded. This will help protect the rights of both the trust or and the beneficiary and ensure a smooth transfer of property ownership.