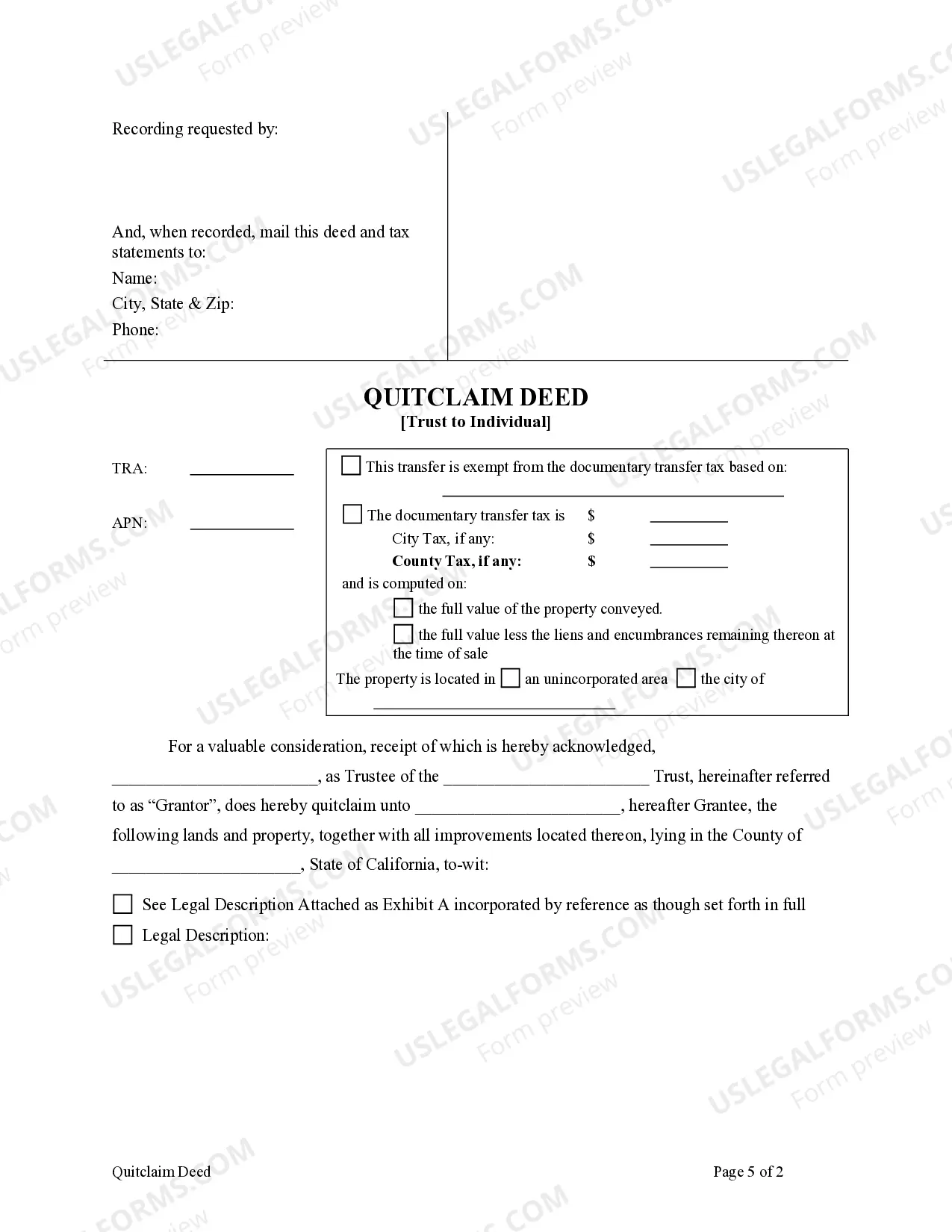

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A San Jose California Quitclaim Deed — Trust to an Individual is a legal document that allows a person, known as the granter, to transfer their ownership rights and interest in a property to another person, known as the grantee, without providing any guarantees or warranties regarding the property's title. This type of deed is commonly used in real estate transactions where there is an existing trust established. The purpose of a quitclaim deed is to transfer the granter's interest in the property to the grantee, without any assurance that the title is clear or free from encumbrances. This means that the granter does not guarantee that they have valid ownership or that there are no liens or claims against the property. The grantee is essentially taking on all risks associated with the property. In San Jose, California, there may be different types or variations of Quitclaim Deed — Trust to an Individual, depending on the specific circumstances of the transaction. Some common variations include: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed is used when multiple individuals, often married couples or domestic partners, want to jointly own a property with the right of survivorship. This means that if one owner passes away, their share automatically transfers to the surviving owner(s) without going through probate. 2. Tenancy in Common: In this type of quitclaim deed, multiple individuals are granted ownership of the property, but unlike joint tenancy, each owner's share can be transferred or inherited without the consent of the other owners. Each co-owner has a separate, undivided interest in the property. 3. Life Estate: A quitclaim deed with a life estate allows the granter to transfer ownership of the property to the grantee for the grantee's lifetime. After the grantee's death, the property then transfers to a designated remainder man. This type of deed is often used in estate planning to ensure the property is passed down to specific individuals after the grantee's passing. It is important to note that a quitclaim deed should be prepared and executed by a qualified attorney or a licensed real estate professional to ensure that it meets all legal requirements and accurately reflects the intentions of the parties involved. Additionally, it is recommended that both the granter and grantee seek independent legal advice before entering into any real estate transaction involving a quitclaim deed in order to protect their rights and interests.A San Jose California Quitclaim Deed — Trust to an Individual is a legal document that allows a person, known as the granter, to transfer their ownership rights and interest in a property to another person, known as the grantee, without providing any guarantees or warranties regarding the property's title. This type of deed is commonly used in real estate transactions where there is an existing trust established. The purpose of a quitclaim deed is to transfer the granter's interest in the property to the grantee, without any assurance that the title is clear or free from encumbrances. This means that the granter does not guarantee that they have valid ownership or that there are no liens or claims against the property. The grantee is essentially taking on all risks associated with the property. In San Jose, California, there may be different types or variations of Quitclaim Deed — Trust to an Individual, depending on the specific circumstances of the transaction. Some common variations include: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed is used when multiple individuals, often married couples or domestic partners, want to jointly own a property with the right of survivorship. This means that if one owner passes away, their share automatically transfers to the surviving owner(s) without going through probate. 2. Tenancy in Common: In this type of quitclaim deed, multiple individuals are granted ownership of the property, but unlike joint tenancy, each owner's share can be transferred or inherited without the consent of the other owners. Each co-owner has a separate, undivided interest in the property. 3. Life Estate: A quitclaim deed with a life estate allows the granter to transfer ownership of the property to the grantee for the grantee's lifetime. After the grantee's death, the property then transfers to a designated remainder man. This type of deed is often used in estate planning to ensure the property is passed down to specific individuals after the grantee's passing. It is important to note that a quitclaim deed should be prepared and executed by a qualified attorney or a licensed real estate professional to ensure that it meets all legal requirements and accurately reflects the intentions of the parties involved. Additionally, it is recommended that both the granter and grantee seek independent legal advice before entering into any real estate transaction involving a quitclaim deed in order to protect their rights and interests.