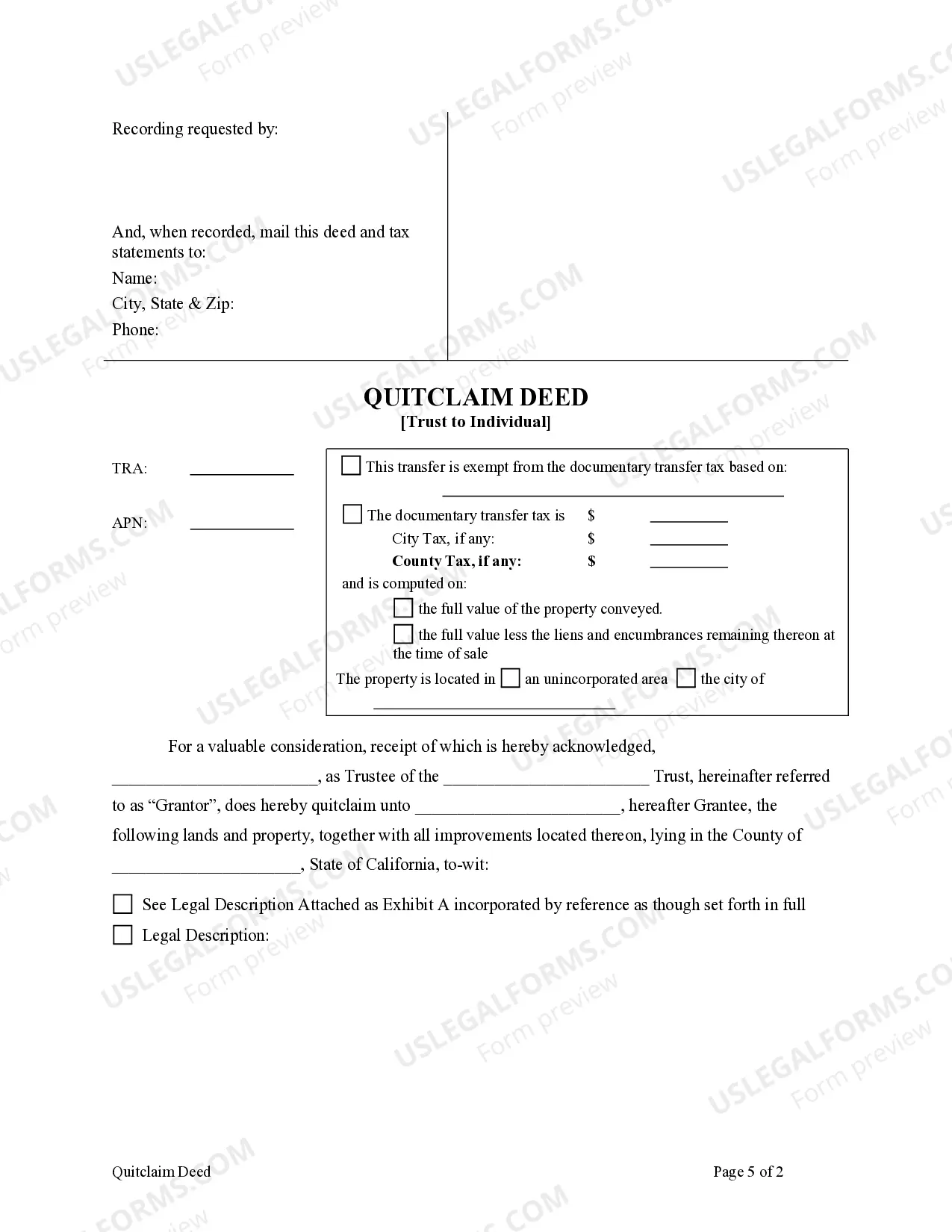

This form is a Quitclaim Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Vista California Quitclaim Deed — Trust to an Individual is a legal document used for transferring ownership of real estate in Vista, California. This type of deed allows an individual, known as the granter, to transfer their interest in a property to another individual, known as the grantee, without making any claims or guarantees about the property's title or condition. In a Vista California Quitclaim Deed — Trust to an Individual, thgranteror, who holds the property in a trust, transfers the property's title to an individual beneficiary, the grantee. This transfer usually occurs when the trust is terminated, or the beneficiary wishes to take ownership of the property. There are different variations of Vista California Quitclaim Deed — Trust to an Individual, including: 1. Revocable Living Trust Quitclaim Deed — This type of quitclaim deed is often used when the granter intends to transfer the property held in a revocable living trust to an individual beneficiary. The trust can be changed or revoked by the granter during their lifetime, providing flexibility. 2. Irrevocable Trust Quitclaim Deed — In this case, the property is held in an irrevocable trust, meaning the granter cannot alter or revoke the trust terms without the consent of the beneficiaries. The granter transfers the property's title to an individual beneficiary using a quitclaim deed. 3. Testamentary Trust Quitclaim Deed — This type of Vista California Quitclaim Deed — Trust to an Individual is used when the transfer of property occurs after the granter's death through a testamentary trust. The property is transferred to the individual beneficiary named in the trust document. It is important to note that a quitclaim deed does not offer the same level of protection as a warranty deed. The granter does not provide any warranties or guarantees regarding the property's title or condition. This type of deed is commonly used when the granter and grantee have a pre-existing relationship and trust each other. To execute a Vista California Quitclaim Deed — Trust to an Individual, thgranteror must prepare the deed, sign it in front of a notary public, and record it with the County Recorder's Office in Vista, California. This recording ensures the public has notice of the change in ownership. Additionally, it is recommended for both the granter and grantee to consult with legal professionals or real estate experts to ensure a smooth and valid transfer of property.