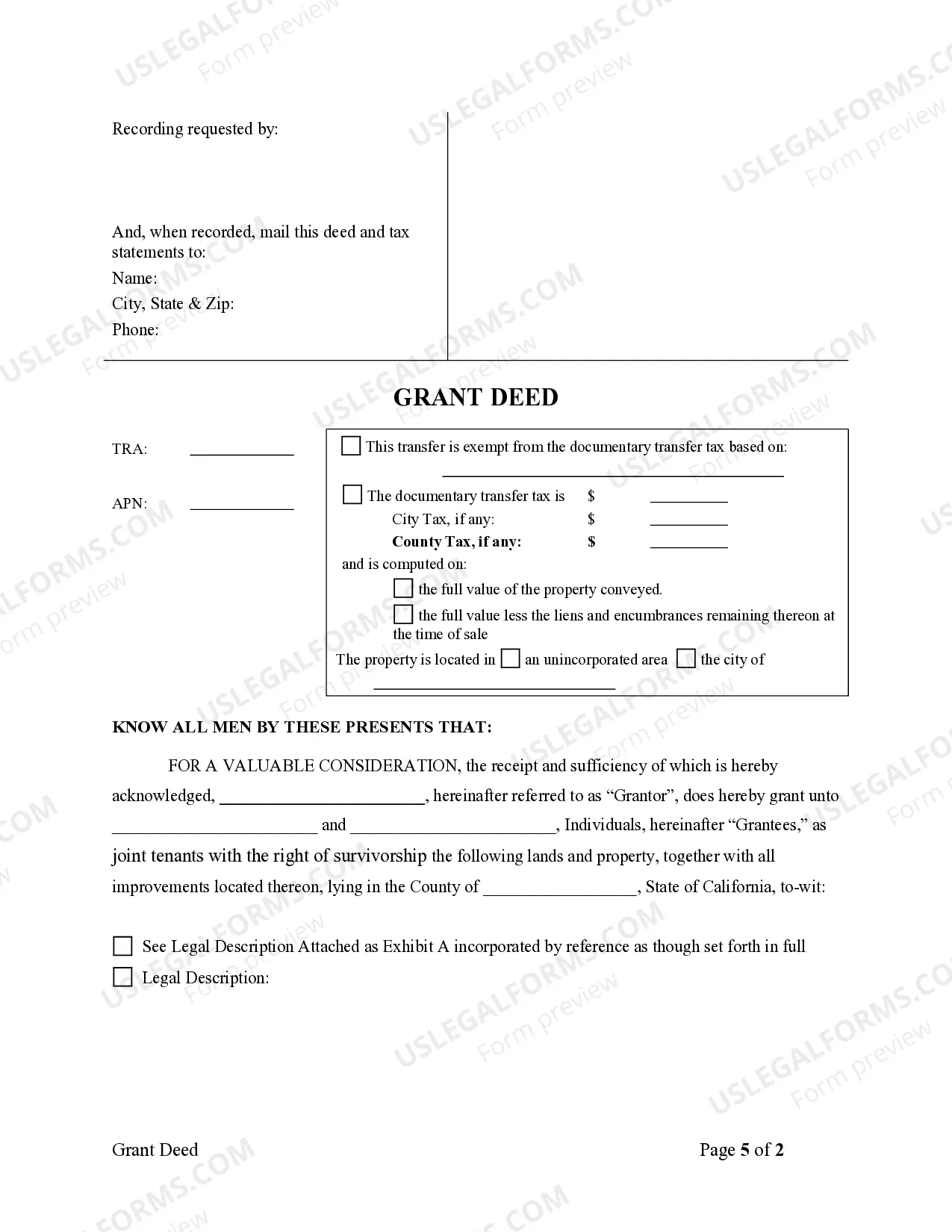

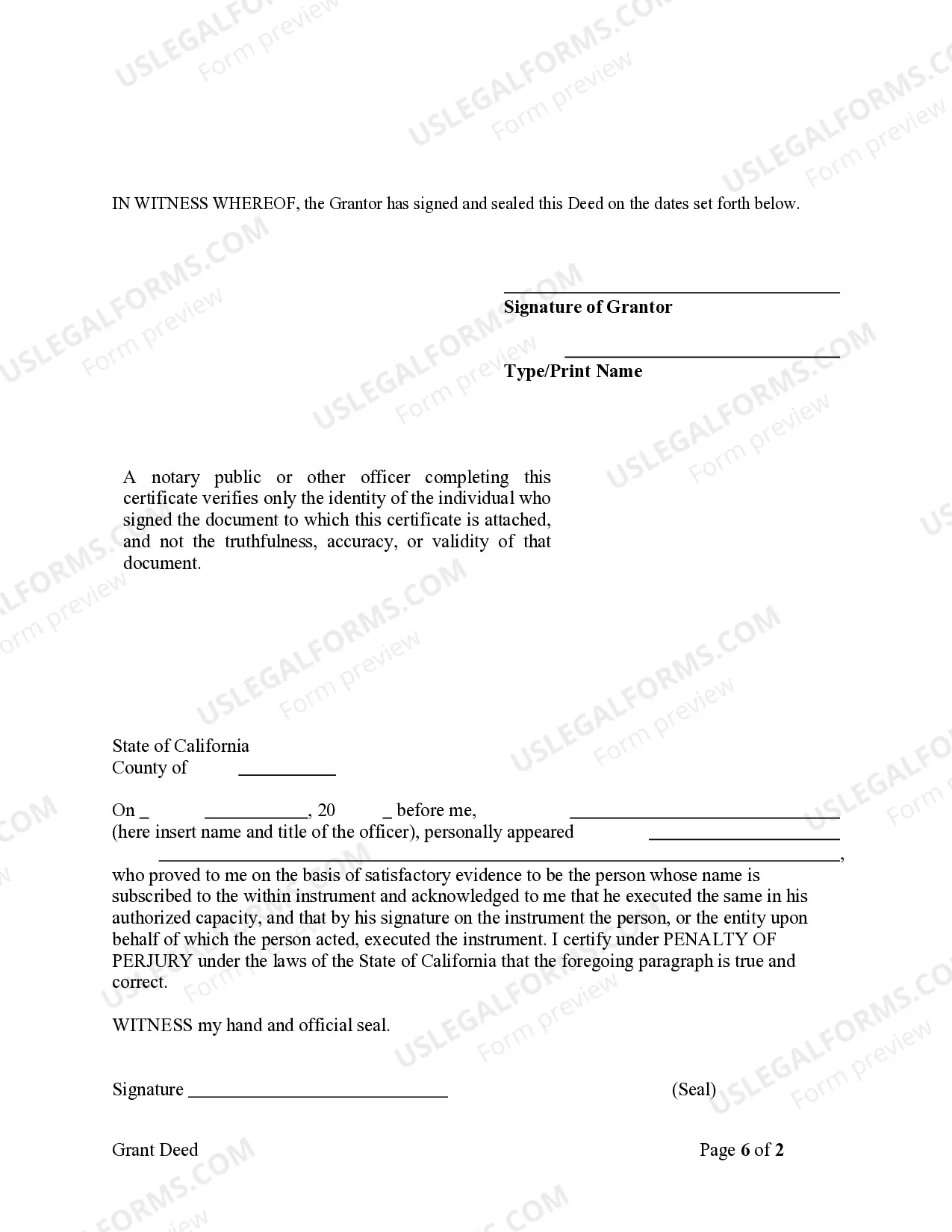

This form is a Grant Deed where the grantor is an individual and the grantees are two individuals. Grantor conveys and grants the described property to grantees as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Contra Costa California Grant Deed — One Individual to Two Individuals is a legal document used in real estate transactions to transfer ownership of property from one individual to two other individuals in Contra Costa County, California. This type of grant deed is commonly referred to as a "joint tenancy grant deed" or a "vesting deed." The Contra Costa California Grant Deed — One Individual to Two Individuals is a formal and binding agreement that outlines the specific details of the property transfer, including the names of the granter (the person transferring the ownership) and the grantees (the individuals receiving the ownership). It also includes a legal description of the property, which provides information about the location, boundaries, and dimensions of the property. This grant deed is typically used when two individuals intend to hold equal ownership rights over a property. It creates a joint tenancy, which means that both grantees will have an undivided and equal interest in the property. In the event of the death of one grantee, the surviving grantee will automatically inherit the deceased grantee's share of the property. The Contra Costa California Grant Deed — One Individual to Two Individuals is an essential document for property transfers in Contra Costa County. It ensures that the ownership rights are legally and officially transferred to the intended individuals. It is crucial to consult with a real estate attorney or professional to properly prepare and execute this grant deed to ensure its validity. In addition to the standard Contra Costa California Grant Deed — One Individual to Two Individuals, there may be variations or additional types of grant deeds used in specific situations. For example, there may be a specific grant deed designed for transferring property from multiple individuals to two other individuals. It is recommended to consult with a real estate professional or attorney to determine the most appropriate grant deed for specific circumstances.