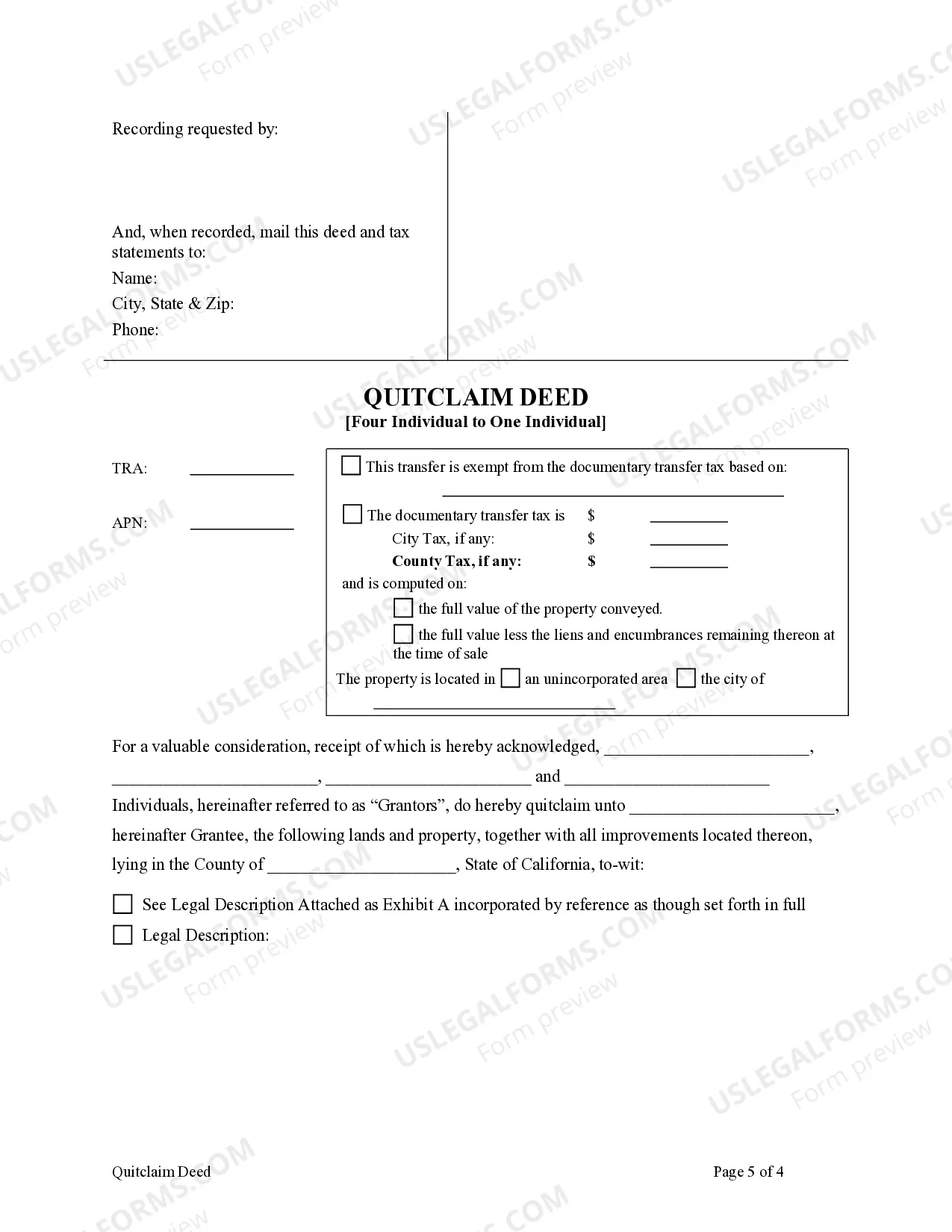

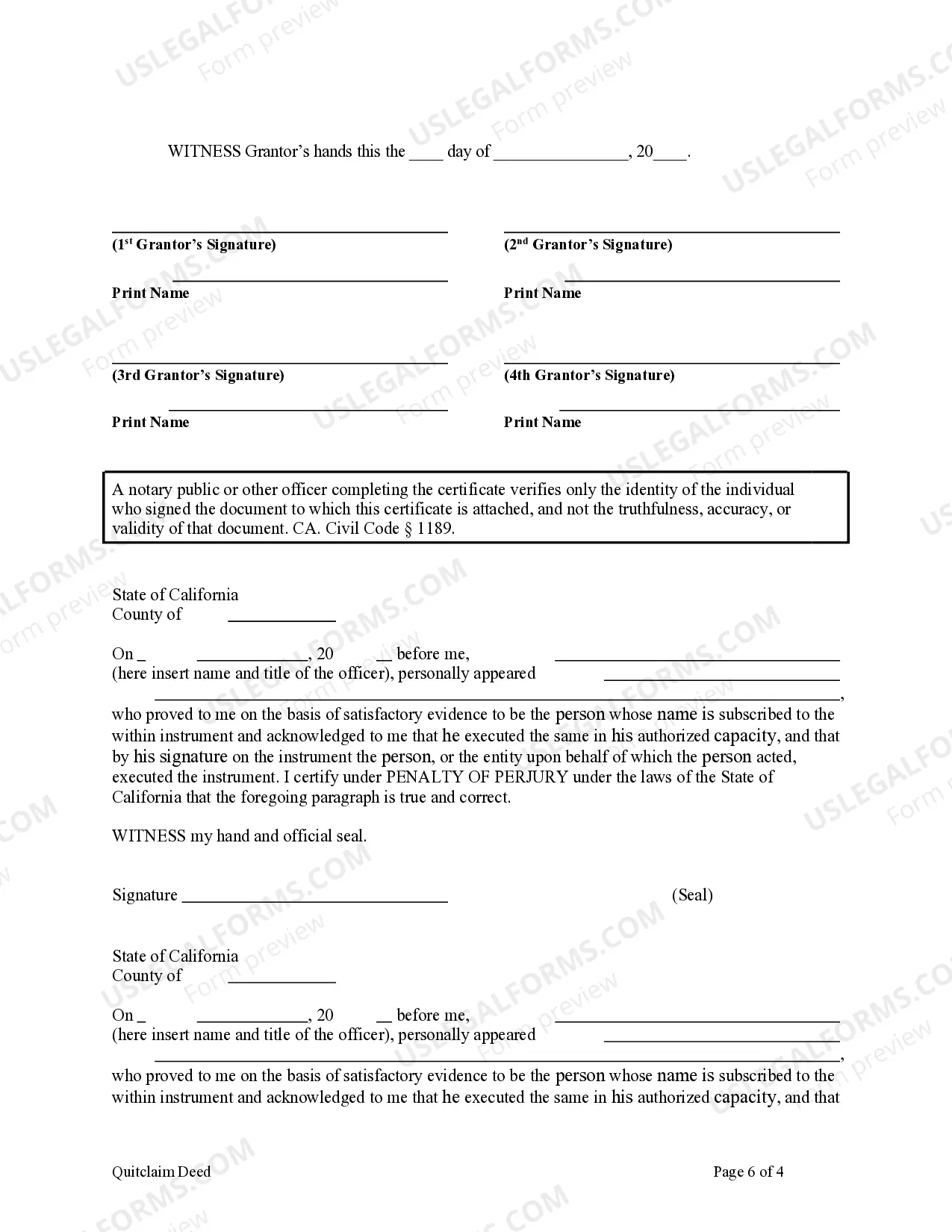

This form is a Quitclaim Deed where the grantors are individuals and the grantee is an individual. Grantors convey and quitclaim any interest they might have in the the described property to grantee. This deed complies with all state statutory laws.

A quitclaim deed is an important legal document used to transfer property ownership between individuals in San Diego, California. Specifically, the "Four Individuals to One Individual" quitclaim deed refers to a situation where four individuals collectively grant or convey their interest in a property to a single individual. This type of quitclaim deed is commonly used in various scenarios, such as when siblings inherit a property from their parents and decide to transfer their shared ownership to one sibling. It can also be used when multiple co-owners of a property decide to transfer their interests to one person, for instance, in cases of divorce or dissolution of a partnership. In San Diego County, California, there are different variations and requirements for executing a "Four Individuals to One Individual" quitclaim deed. It is essential to understand the specific requirements and consult a qualified attorney or real estate professional to ensure compliance with local regulations. Some keywords relevant to this topic include: — San Diego quitclaiDeeee— - California quitclaim deed — Property transfesaddenedeg— - Property ownership transfer — Co-ownershitransferfe— - San Diego County quitclaim deed — Transfer of shareownershiphi— - Quitclaim deed requirements — Real estate transfer in San Diego Additional types of quitclaim deeds in San Diego, California, include: 1. Individual to Individual: A quitclaim deed used when one individual transfers their interest in a property to another individual without any warranties or guarantees. 2. Married Couple to One Spouse: This quitclaim deed is often used when a married couple chooses to transfer their joint property to only one spouse, perhaps due to divorce or legal separation. 3. Trustee to Individual: Used when a property held in a trust is transferred to a designated individual. 4. Multiple Individuals to Multiple Individuals: In cases where more than four individuals co-own a property and are transferring their interests to other co-owners or new individuals, this type of quitclaim deed is employed. Remember, it is crucial to consult with a professional, such as a licensed attorney or experienced real estate agent, to ensure all legal requirements are met when executing any type of quitclaim deed in San Diego, California.