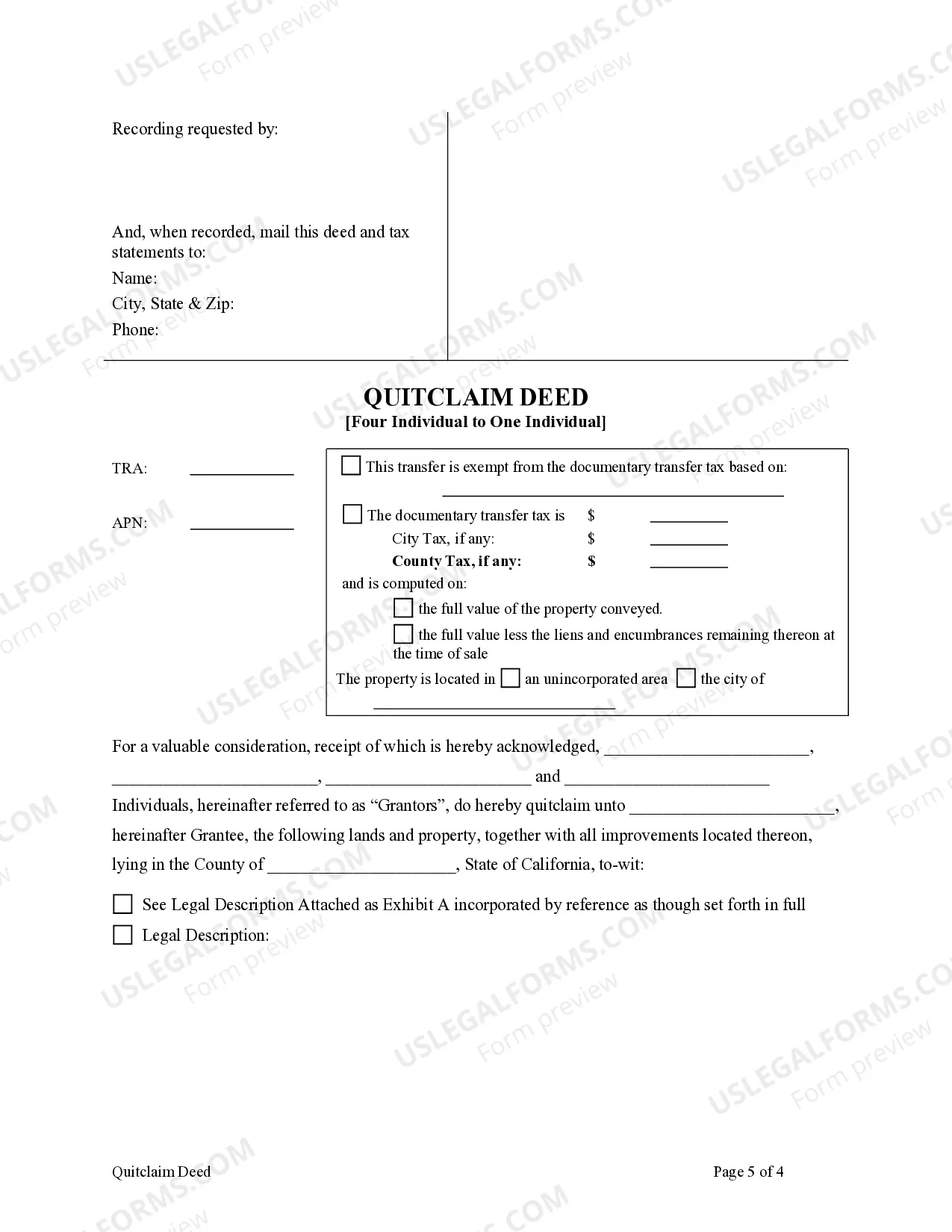

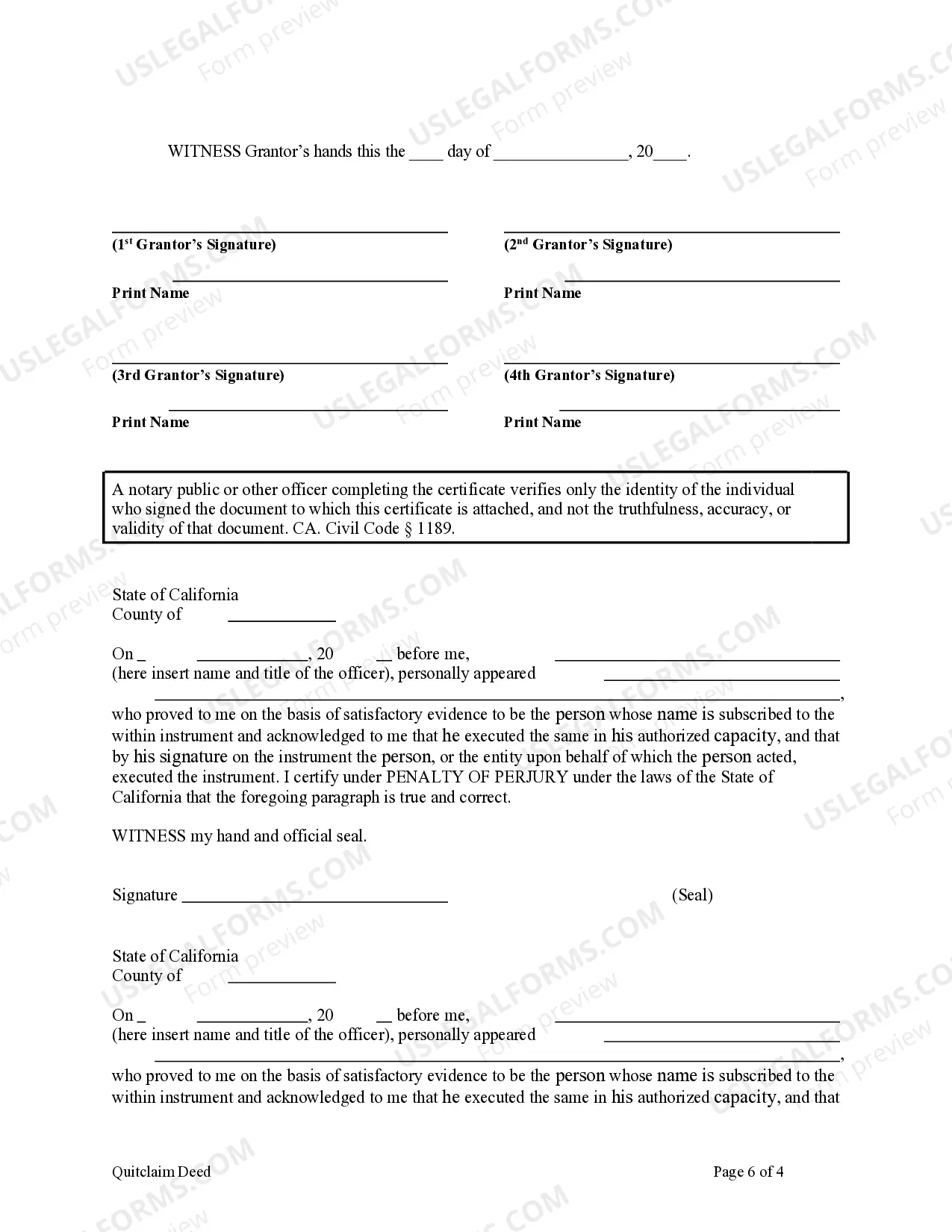

This form is a Quitclaim Deed where the grantors are individuals and the grantee is an individual. Grantors convey and quitclaim any interest they might have in the the described property to grantee. This deed complies with all state statutory laws.

A Thousand Oaks California Quitclaim Deed — Four Individuals to One Individual refers to a legal document that transfers the ownership of a property from four individuals to a single individual in Thousand Oaks, California. This type of deed is commonly used when individuals want to transfer their interest or rights in a property to one person without guaranteeing the validity of the title or any potential liens or claims. In essence, this type of transfer acts as a release and relinquishment of the rights and claims of the four individuals to the property, allowing the one individual to become the sole owner. It is important to note that a quitclaim deed does not provide any warranties or protections to the grantee (the individual receiving the property). The grantee essentially takes ownership "as is," assuming all risks and potential encumbrances associated with the property. It is advisable for the grantee to conduct a thorough title search and consult with legal professionals before accepting the property through a quitclaim deed. The Thousand Oaks California Quitclaim Deed — Four Individuals to One Individual can be further categorized into various types based on specific circumstances or relationships. Some of these include: 1. Joint Tenants to One Individual: This type of deed is used when four individuals hold joint tenancy, which means they have an equal and undivided interest in the property. By executing this quitclaim deed, the other three joint tenants transfer their interests to a single individual, who then becomes the sole owner. 2. Tenants in Common to One Individual: When four individuals own a property as tenants in common, each of them has a distinct share in the property. By using this quitclaim deed, the other three tenants in common release their share to one individual, resulting in the consolidation of ownership. 3. Family Members' Quitclaim Deed: This type of quitclaim deed is frequently employed when four family members, such as siblings or parents and children, jointly own a property. By executing this deed, three of the family members grant their interests to one individual, simplifying the ownership structure within the family. It is crucial for all parties involved in a Thousand Oaks California Quitclaim Deed — Four Individuals to One Individual transaction to fully understand the legal implications and consult with a qualified attorney or real estate professional. This ensures that the transfer is carried out accurately, protecting the rights and interests of all parties involved.