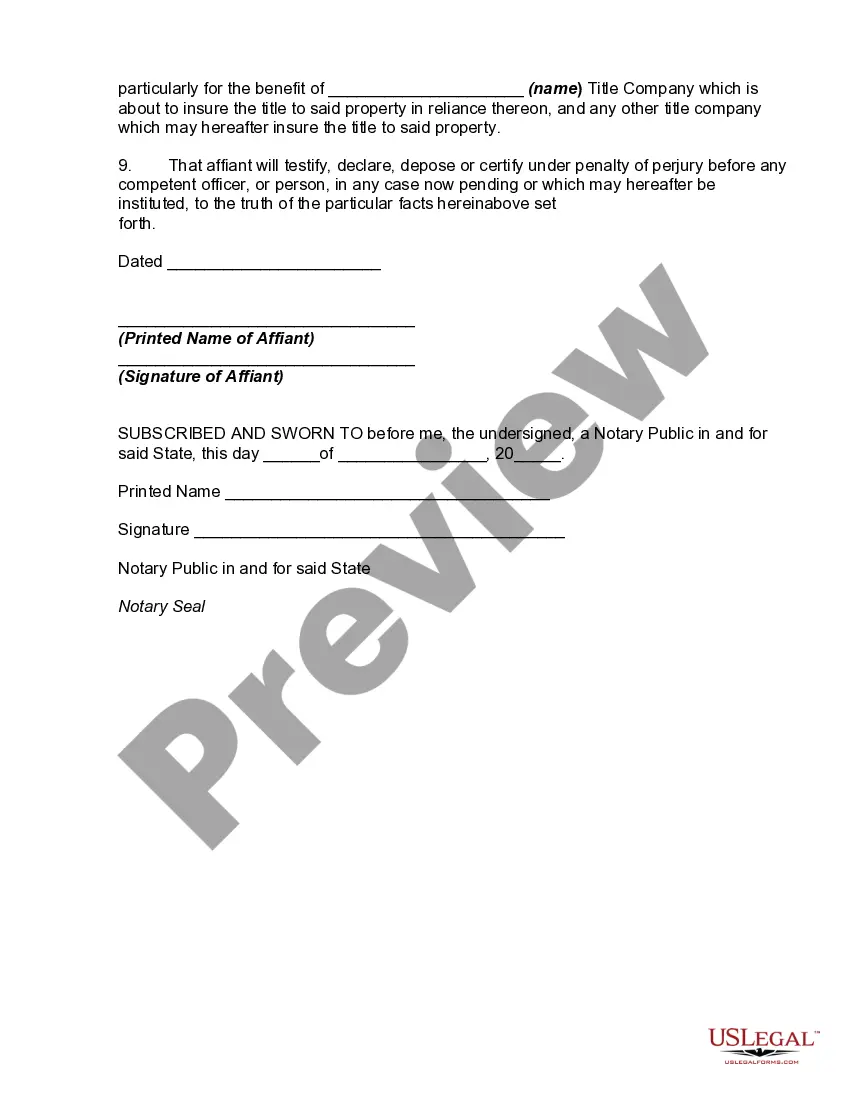

An estoppel affidavit enables a property owner, the grantor, to convey complete title of his property to the grantee so that the grantee assumes all obligations of the grantor. It can also act as a certificate in which a borrower certifies the amount owed on a mortgage loan and the rate of interest.

San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure

Description

How to fill out California Estoppel Affidavit Regarding Deed In Lieu Of Foreclosure?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our helpful website with a wide range of document templates enables you to locate and secure nearly any document sample you need.

You can download, complete, and validate the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure in just a matter of minutes instead of spending hours on the internet searching for the right template.

Using our collection is an excellent approach to enhance the security of your document filing.

Access the page containing the template you require. Verify that it is the template you seek: check its title and description, and use the Preview function when accessible. Otherwise, utilize the Search box to find the correct one.

Initiate the saving process. Click Buy Now and select the pricing option that works best for you. Then, register for an account and complete your order with a credit card or PayPal.

- Our experienced legal experts routinely review all the documents to ensure that the forms are suitable for a specific state and adhere to current laws and regulations.

- How do you access the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure.

- If you're already a subscriber, simply Log In to your account. The Download option will show up on every sample you view.

- Moreover, you can retrieve all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the instructions below.

Form popularity

FAQ

A California deed in lieu of foreclosure is a legal process allowing a borrower to transfer property ownership back to the lender to avoid foreclosure. It absolves the borrower of their mortgage responsibility while potentially affecting their credit score. Utilizing a document like the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can help clarify your intent and protect your rights during this process.

Writing a deed in lieu of foreclosure letter involves clearly stating your request and providing relevant details. Begin by addressing your lender and explaining your situation concisely. Include information about the property, action taken, and mention the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, as it will add credibility to your request.

To file a deed in lieu of foreclosure, start by communicating with your lender about your intention. Gather all necessary documents, and ensure you have the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure ready. Submit everything to your lender and follow their guidance to complete the filing successfully.

The timeline for a deed in lieu of foreclosure can vary, but it usually takes several weeks to months. Once you submit your request and documents, the lender needs time to review them. If you include the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, it can help streamline the process by providing essential information upfront.

Filing a deed in lieu of foreclosure involves several steps. First, you need to contact your lender to discuss the process and gather the necessary documentation. After you have obtained the required information, you can fill out the relevant forms, including the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, and submit them to your lender for review.

A deed in lieu of foreclosure accepted by the lender is a legal agreement where the borrower voluntarily transfers property ownership to the lender in exchange for the cancellation of the mortgage. This arrangement often occurs when a borrower finds it challenging to keep up with mortgage payments. It allows the lender to avoid the lengthy foreclosure process while potentially recuperating part of their investment. Familiarizing yourself with the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure is crucial when considering this option.

The biggest disadvantage for lenders accepting a deed in lieu of foreclosure includes the risk of an incomplete sale process. They may encounter issues regarding property conditions or tenant rights that complicate future sales. Moreover, lenders often lose the ability to outline strict repayment terms in situations of financial loss. Understanding the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can clarify the lender's position and obligations.

To execute a deed in lieu of foreclosure, the borrower should first negotiate with the lender to obtain their acceptance. Then, both parties must sign the deed, transferring the property back to the lender. It's also essential to record the deed with the local county office to ensure proper legal standing. Utilizing services like uslegalforms can streamline the creation of the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, ensuring all requirements are met.

No, a lender is not obligated to accept a deed in lieu of foreclosure. They retain the discretion to evaluate the specific circumstances surrounding the borrower's financial situation and property value. Various factors, including local law and internal policies, influence their decision. Knowing the implications of the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can be beneficial for both lenders and borrowers.

To execute a deed in lieu of foreclosure, start by contacting your lender and expressing your interest in this option. You will need to complete the necessary paperwork, including the San Bernardino California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, which outlines your agreement with the lender. Once you gather all required documents and reach an agreement with your lender, you can formally sign over the property, allowing for a smoother resolution to your financial situation.