An estoppel affidavit enables a property owner, the grantor, to convey complete title of his property to the grantee so that the grantee assumes all obligations of the grantor. It can also act as a certificate in which a borrower certifies the amount owed on a mortgage loan and the rate of interest.

Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure

Description

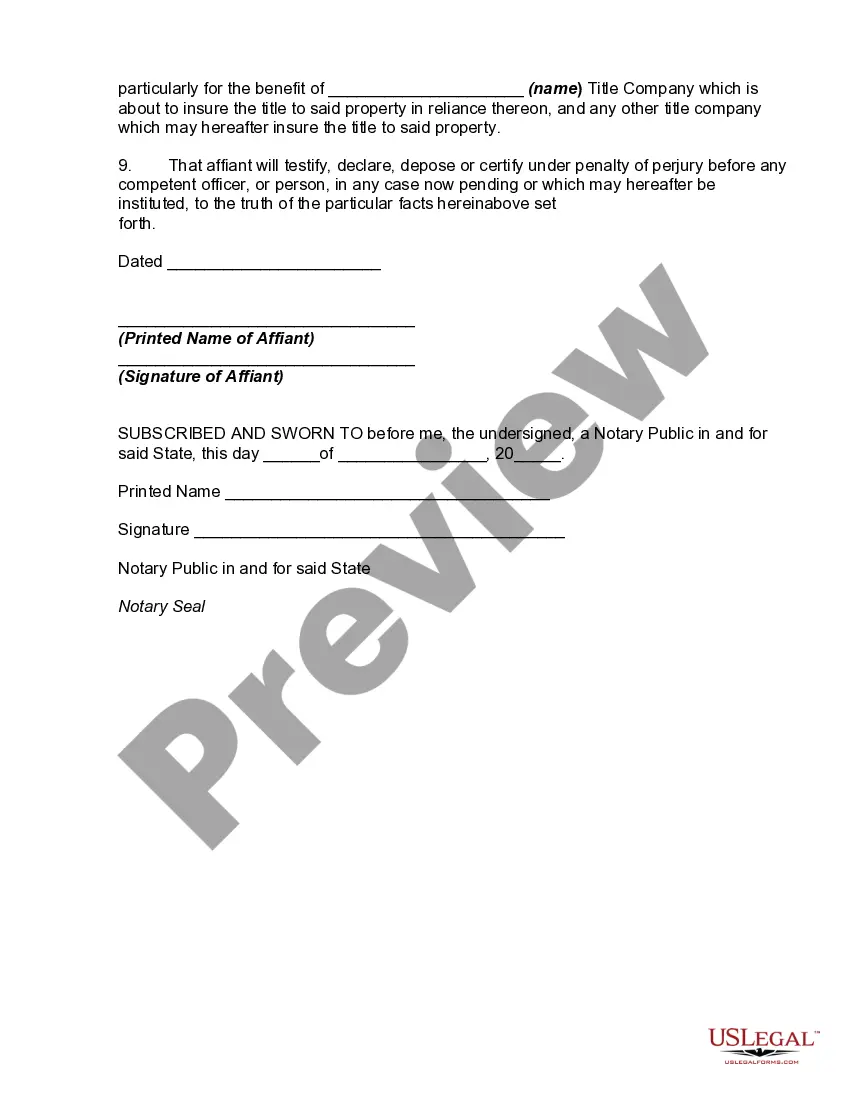

How to fill out California Estoppel Affidavit Regarding Deed In Lieu Of Foreclosure?

We consistently endeavor to diminish or avert legal harm when managing intricate law-related or financial issues.

To achieve this, we seek attorney services that are typically quite expensive.

Nevertheless, not every legal matter is so complicated.

Most of them can be managed independently.

Utilize US Legal Forms whenever you need to acquire and download the Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure or any other form promptly and securely.

- US Legal Forms is an online repository of current DIY legal paperwork ranging from wills and powers of attorney to incorporation articles and petitions for dissolution.

- Our library enables you to handle your affairs independently without the requirement of consulting a lawyer.

- We offer access to legal form templates that are not always readily available to the public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

A key disadvantage of a deed in lieu of foreclosure is that it may not be accepted by all lenders, leaving borrowers with limited options. Additionally, homeowners may face tax implications or deficiencies that arise from the property value. This situation can create financial distress if not carefully managed. Utilizing resources like the Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure helps clarify these concerns and aids in the transaction.

A deed in lieu of foreclosure is often considered a favorable alternative, allowing homeowners to avoid the lengthy foreclosure process. This option permits homeowners to transfer property ownership back to the lender voluntarily. For many, this route is less damaging to credit and mental wellbeing. Additionally, incorporating a Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can help facilitate this process smoothly.

One significant disadvantage of a deed is the possibility of liens or other claims that may still exist against the property. A borrower might unknowingly transfer ownership along with existing debts, complicating the process for the new owner. Furthermore, the impact on the borrower's credit score can be severe. This is where a well-prepared Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure may provide clarity and assurance.

The primary disadvantage for a lender considering a deed in lieu of foreclosure is the potential loss of recovery value. When a lender accepts a deed in lieu, they typically must absorb any loss if the property's market value has declined. Additionally, lenders may face complications related to the borrower's outstanding liabilities. Understanding the importance of a Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can help lenders navigate these challenges.

Yes, you can still buy a house after experiencing a deed in lieu of foreclosure, although there may be a waiting period. Typically, lenders may require you to wait around two to four years before qualifying for a new mortgage. During this time, it's essential to focus on rebuilding your credit score. Utilizing resources such as a Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can provide clarity in your process and help manage any outstanding concerns.

The primary drawback for lenders accepting a deed in lieu of foreclosure is the potential for a loss of value in the property. If the property is worth less than the remaining mortgage, lenders face financial setbacks. This transaction can also be complicated by local regulations, making it crucial to address all legal requirements, such as the Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure.

A California deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender, effectively settling the mortgage debt. This option can be beneficial to both homeowners and lenders, as it allows for a smoother transition without the formal foreclosure process. Furthermore, utilizing a Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can help clarify any outstanding conditions related to this transaction.

A deed in lieu of foreclosure offers several advantages for homeowners facing financial difficulties. Primarily, it allows you to avoid the lengthy and stressful foreclosure process. Additionally, it can help maintain a better credit score compared to a foreclosure. By submitting a Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, you can simplify the transition away from your mortgage obligations.

Accepting a deed in lieu of foreclosure can present significant disadvantages for a lender. One key concern is the potential loss of collateral value, as lenders often do not receive the full market value of the property. Additionally, by accepting this agreement, the lender may inadvertently assume liability for any existing liens or claims against the property. To safeguard against such issues, lenders in Santa Clarita should consider utilizing a Santa Clarita California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure to clarify obligations and responsibilities.