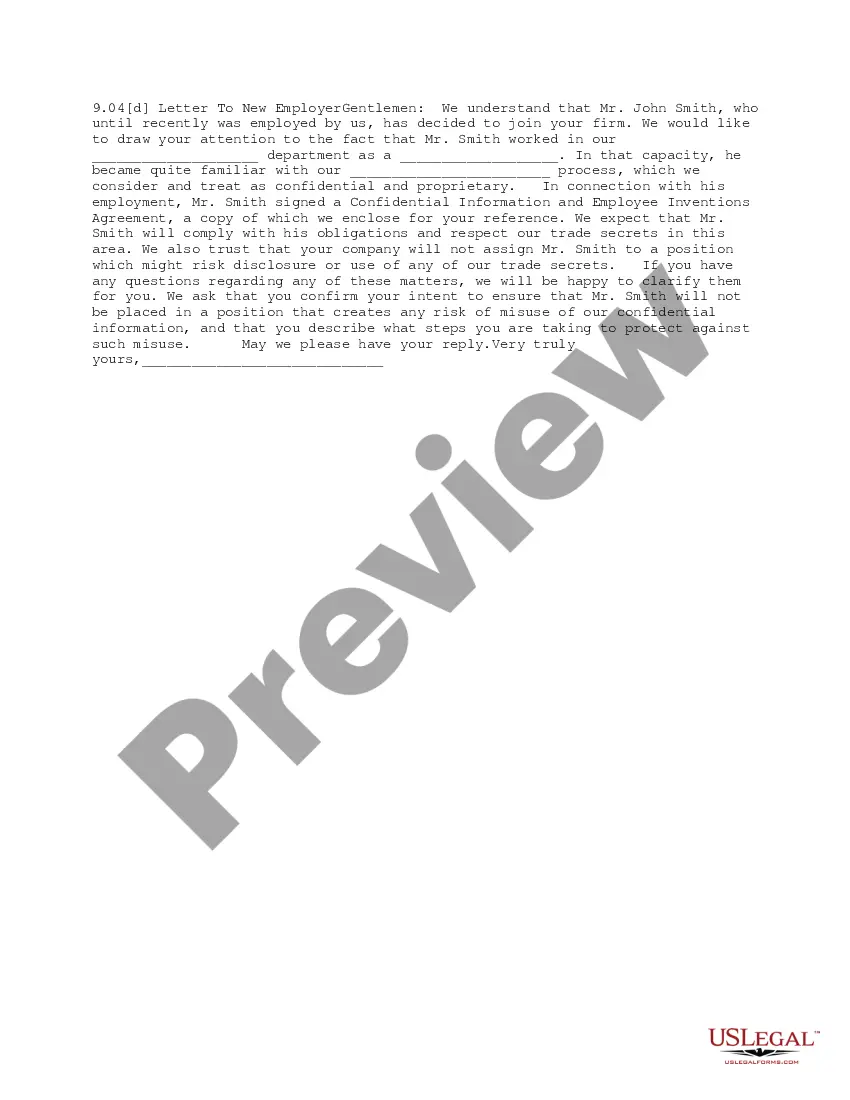

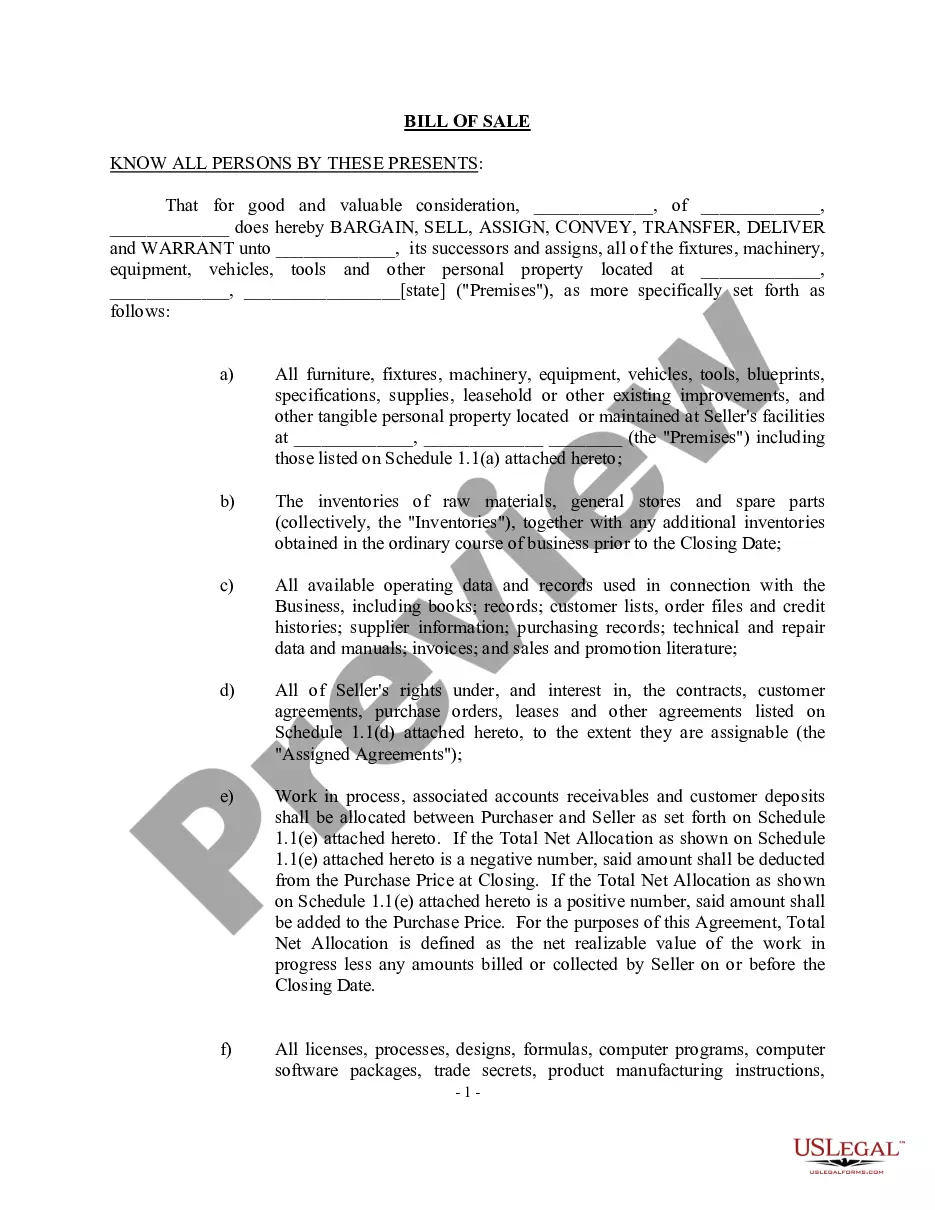

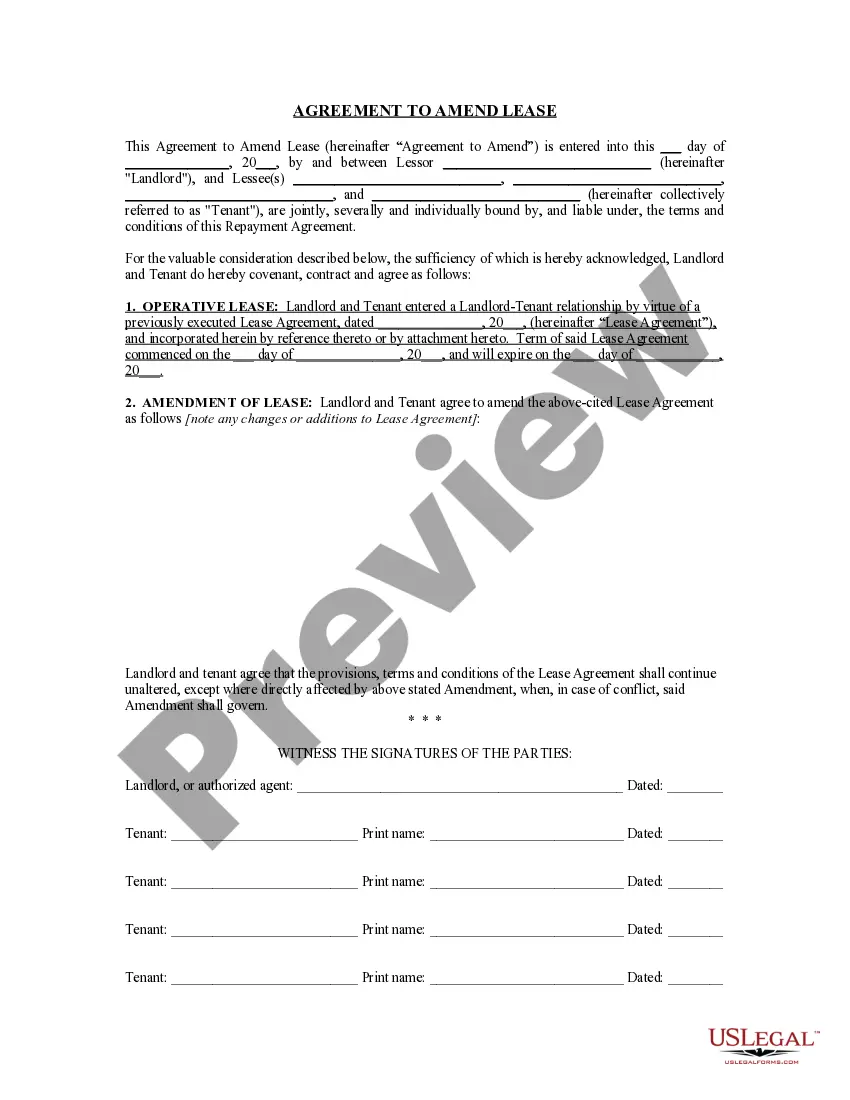

An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

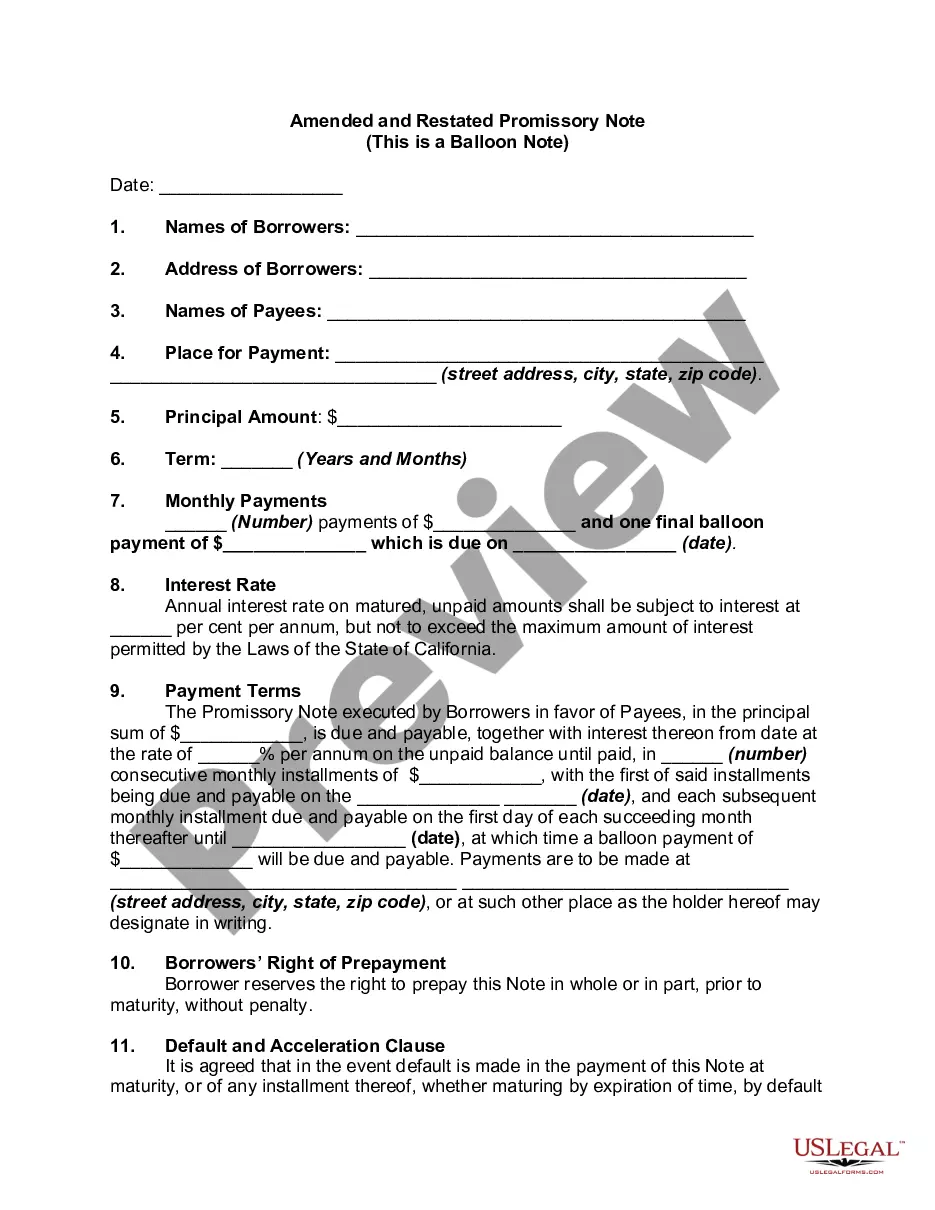

Fullerton California Amended and Restated Promissory Note

Description

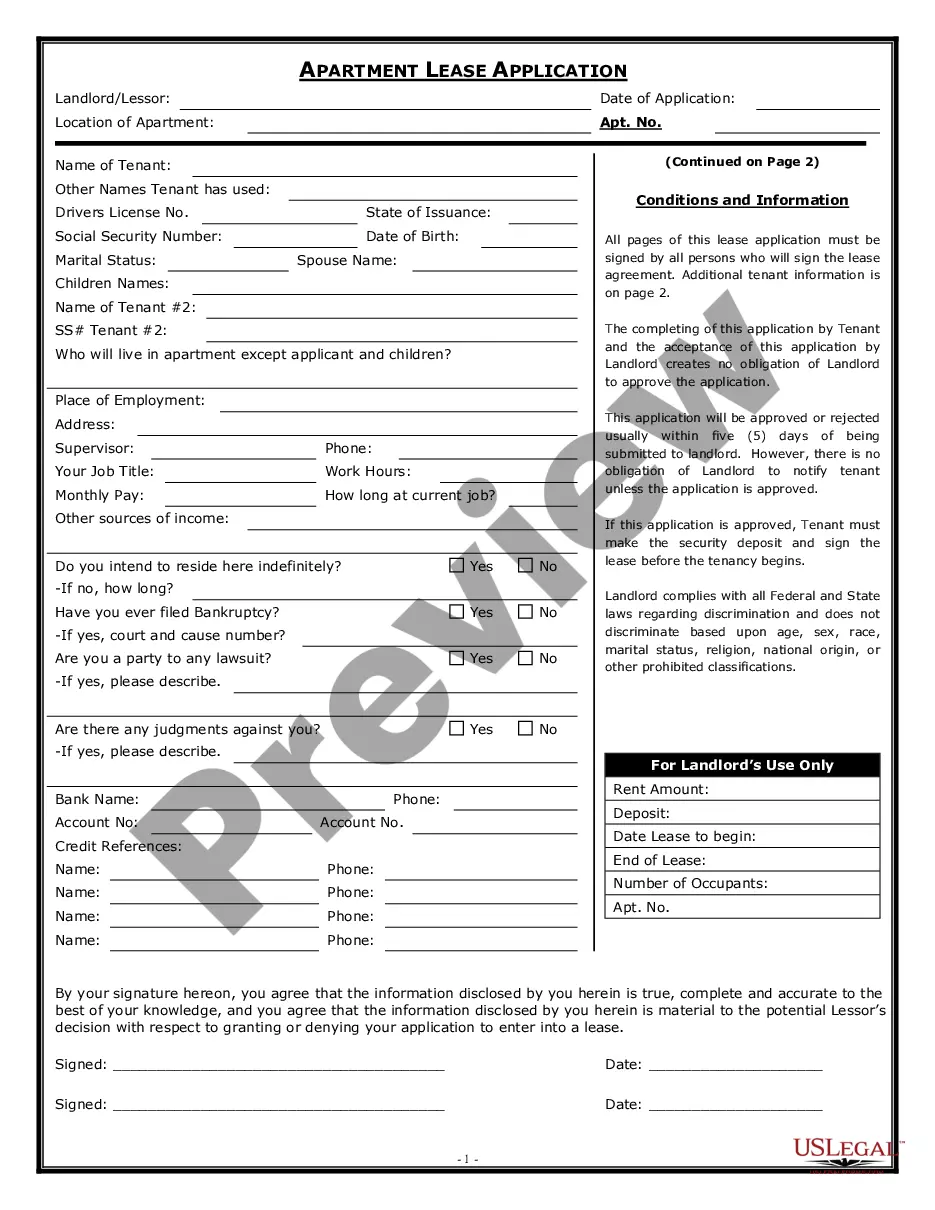

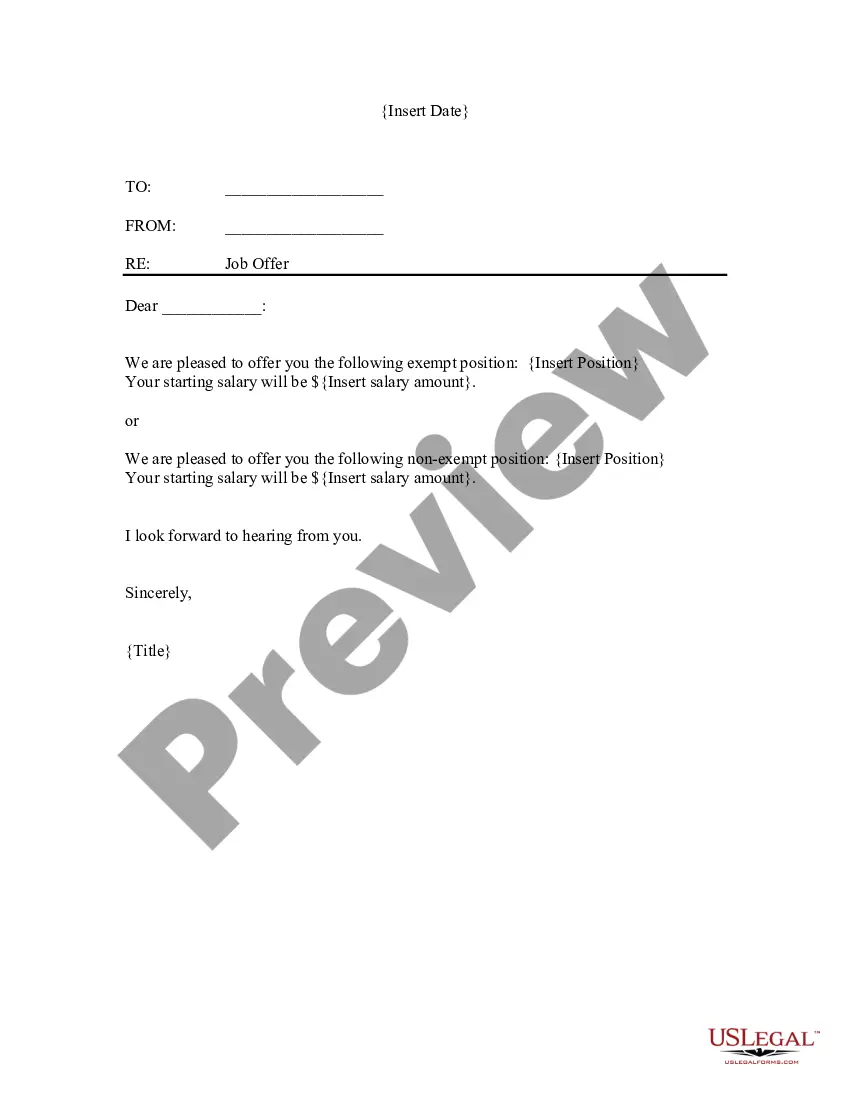

How to fill out California Amended And Restated Promissory Note?

Regardless of social or professional standing, filling out legal documents is an unfortunate requirement in today’s work environment.

Often, it’s nearly impossible for someone without legal education to draft these types of papers from the ground up, primarily due to the complex terminology and legal subtleties they entail.

This is where US Legal Forms can come to the rescue.

Ensure the form you have found is valid for your locality, as the laws of one state or county do not apply to another.

Review the document and read a brief description (if available) of the scenarios the document can be used for.

- Our service provides a vast assortment of over 85,000 ready-to-use state-specific forms that suit virtually any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to save time using our DIY forms.

- No matter if you require the Fullerton California Amended and Restated Promissory Note or any other document that will be applicable in your state or county, everything is readily available with US Legal Forms.

- Here’s how you can quickly obtain the Fullerton California Amended and Restated Promissory Note using our dependable service.

- If you are already a current customer, you can proceed to Log In to your account to acquire the necessary form.

- However, if you are new to our platform, ensure to follow these steps before obtaining the Fullerton California Amended and Restated Promissory Note.

Form popularity

FAQ

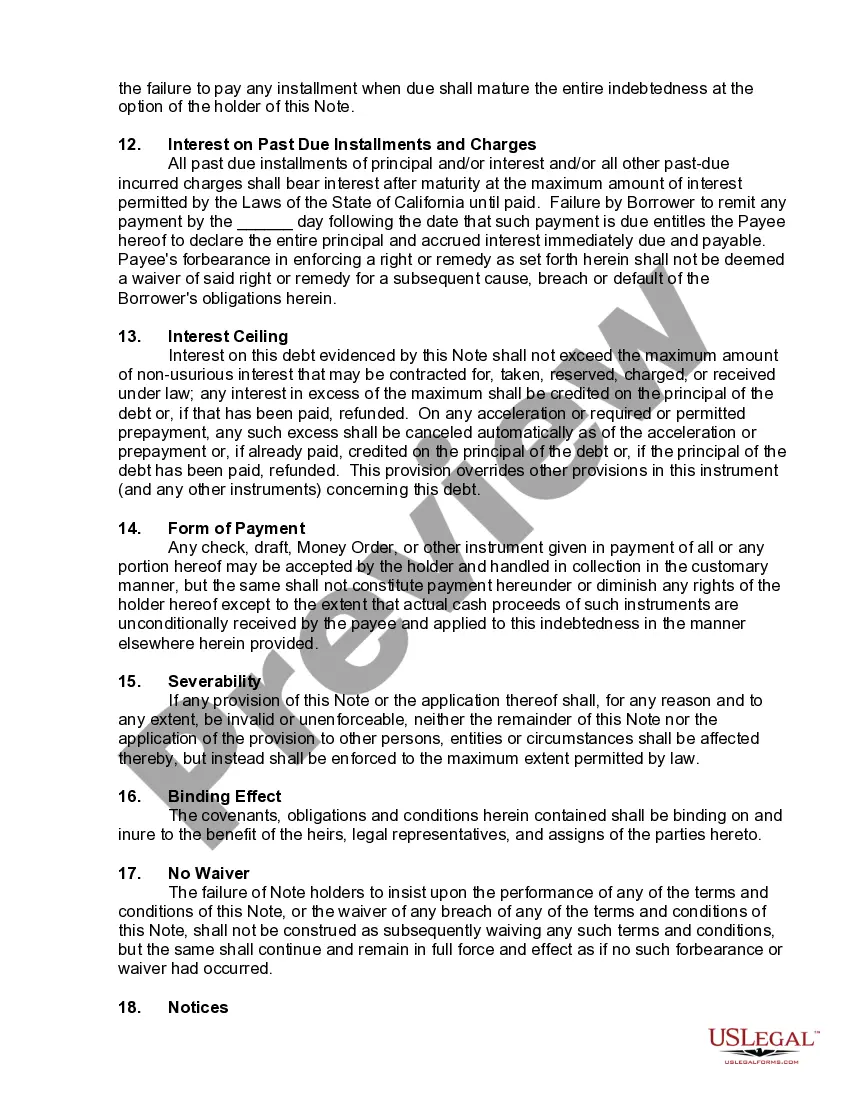

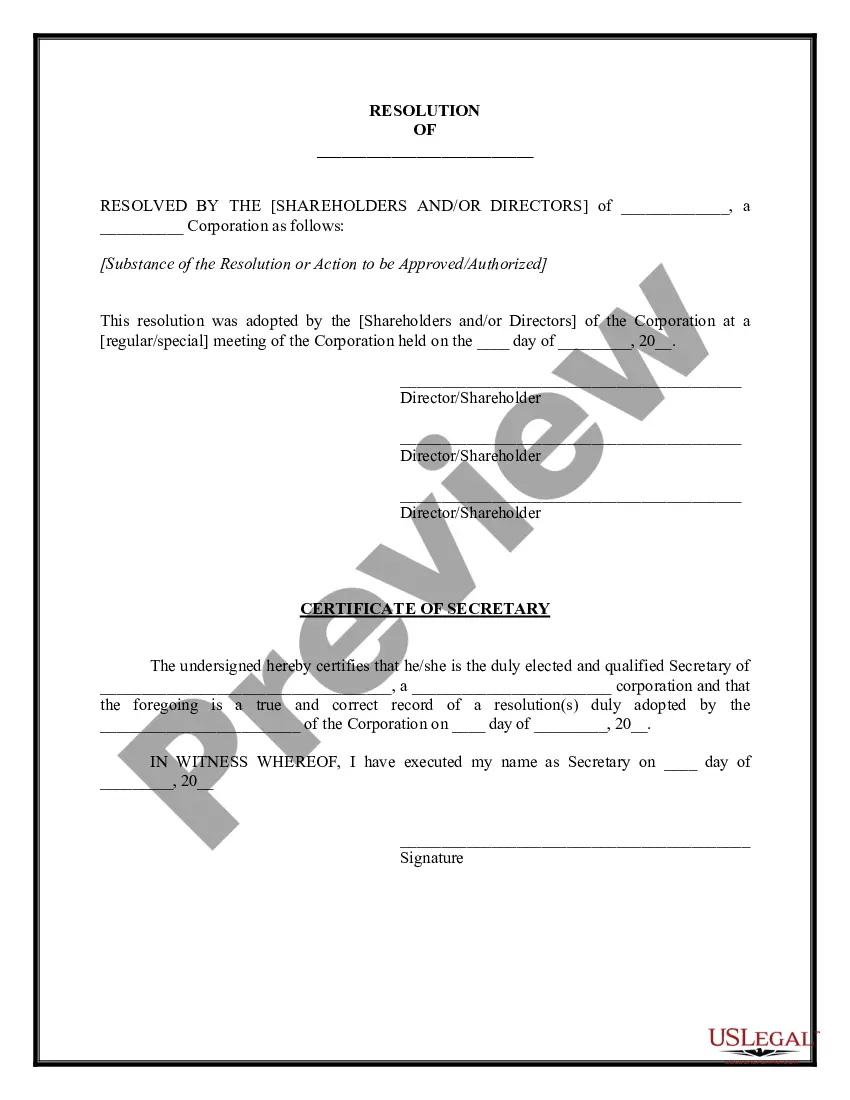

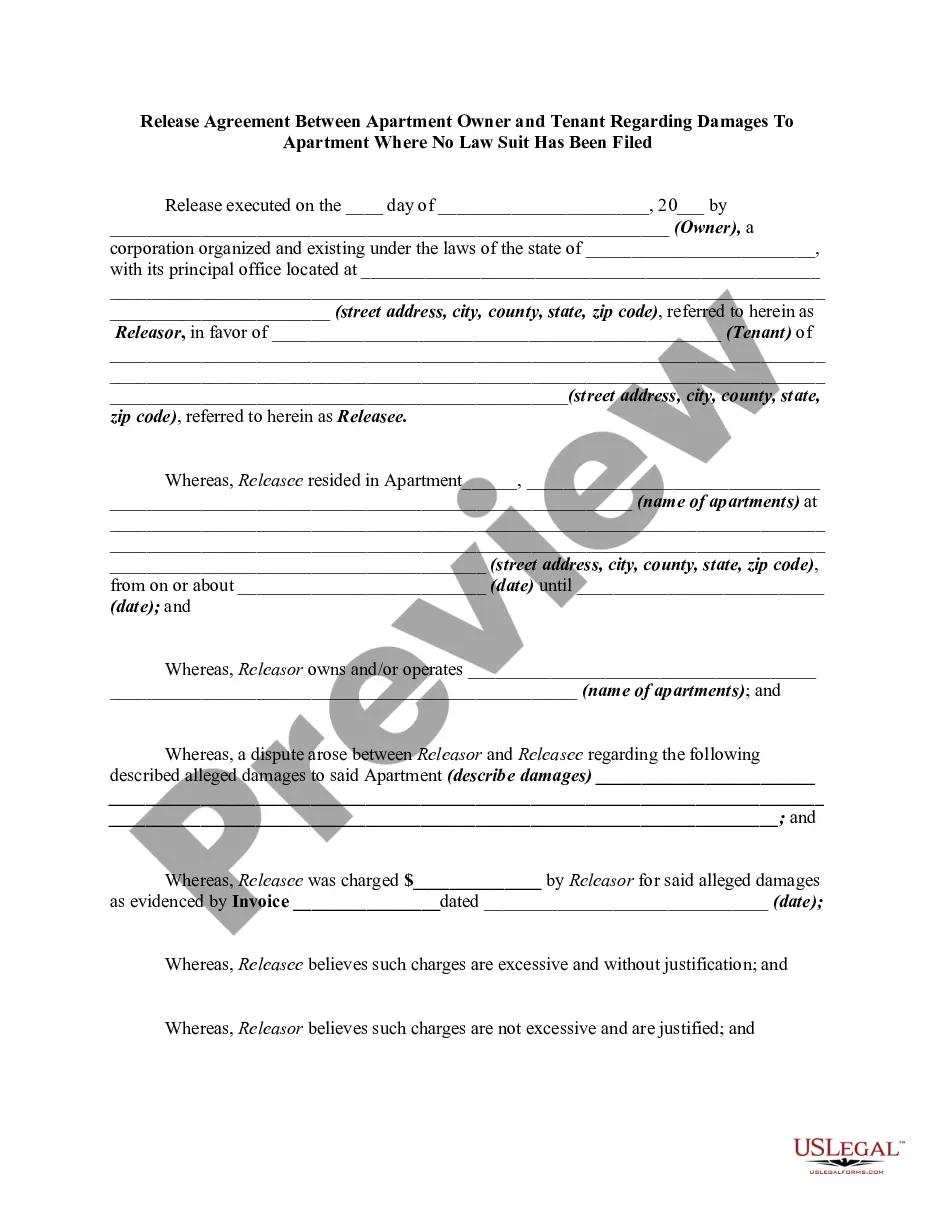

Yes, you can modify a promissory note, including a Fullerton California Amended and Restated Promissory Note. To make changes, both parties must agree to the modifications and document them properly. This process ensures legal compliance and outlines new terms clearly. By revisiting the note, you reinforce the terms to meet current circumstances.

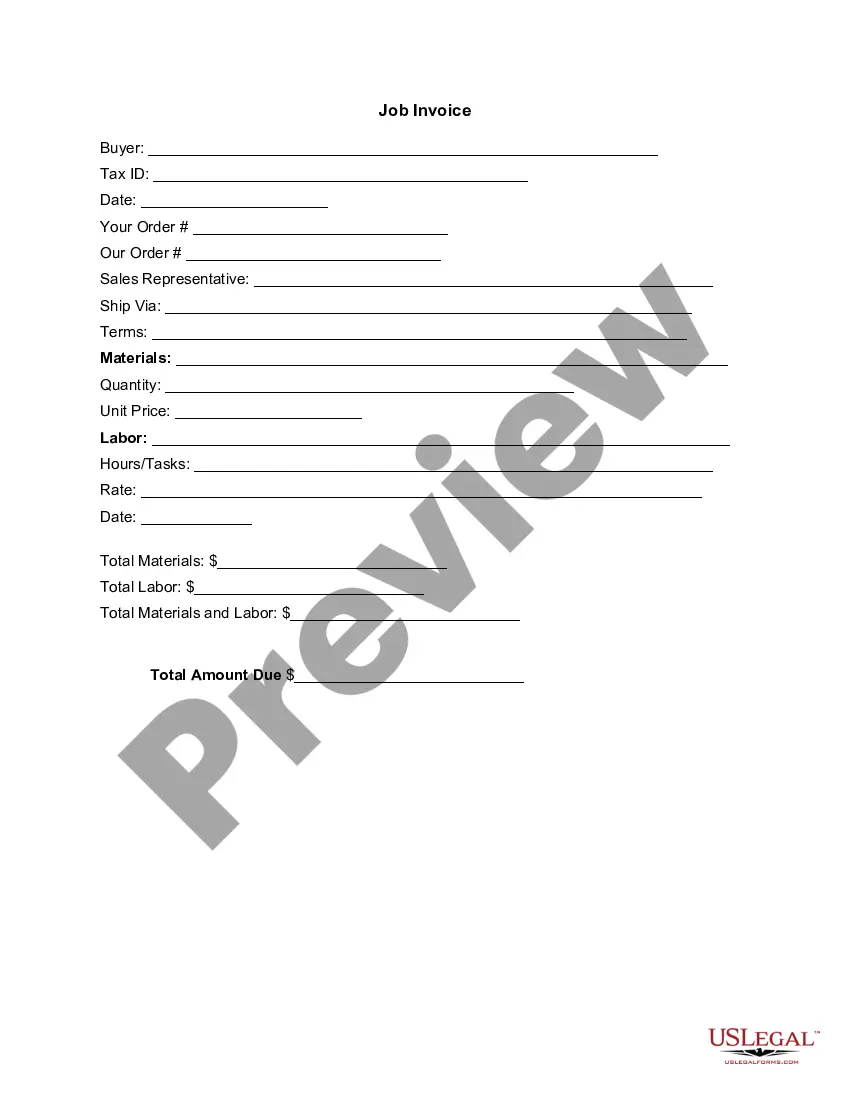

To change a promissory note, you typically need to draft an amendment that specifies what changes you intend to make. Both parties must agree to and sign the amendment for it to be valid. It’s advisable to consult a legal professional to ensure compliance with Fullerton, California laws. Utilizing a Fullerton California Amended and Restated Promissory Note form can provide clarity in this process.

If a doctor’s note contains errors, contact the doctor’s office promptly to request corrections. Document the errors as clearly as possible for accurate communication. This ensures that the corrected information is recorded properly. Understanding how these documents affect matters, like a Fullerton California Amended and Restated Promissory Note, can help you address related issues.

To addend a note in Epic, navigate to the specific note you wish to modify and select the option to create an addendum. Clearly state the changes or additional information required. This process helps ensure that all details are accurate and legally binding. Using a Fullerton California Amended and Restated Promissory Note template can help manage such additions effectively.

To amend a note, you need to create an amendment document that specifies the changes to be made. Clearly outline the original terms and the new terms in the amended section. Consulting a legal expert is beneficial to ensure compliance with laws in Fullerton, California. Using a Fullerton California Amended and Restated Promissory Note template can simplify this process significantly.

In California, a promissory note is invalid if it lacks essential components like clarity in payment details or if it involves illegal or unethical transactions. Furthermore, if it is missing the necessary signatures or was signed under coercion, it may also be deemed invalid. Therefore, it is vital to carefully draft your Fullerton California Amended and Restated Promissory Note.

Yes, a promissory note can be modified as long as all parties involved agree to the changes. This may involve altering payment schedules, interest rates, or other terms. When you modify a Fullerton California Amended and Restated Promissory Note, it is often beneficial to document the changes clearly.

Several factors can render a promissory note invalid, such as lack of consideration, unclear terms, or if it was signed under duress. Additionally, if the responsible party is legally incompetent, the note may lose its validity. It’s essential to understand these aspects when drafting a Fullerton California Amended and Restated Promissory Note.

Yes, you can amend and restate a promissory note to reflect changes to the terms agreed upon by both parties. This process helps clarify any new conditions and ensures that both parties are on the same page. If you want to create a Fullerton California Amended and Restated Promissory Note, consider using resources like US Legal Forms for guidance.

In California, a promissory note typically remains valid for four years from the date it's due. After this period, it may be considered void unless you have taken action to enforce it. Understanding the time limits is crucial for anyone dealing with a Fullerton California Amended and Restated Promissory Note.