An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

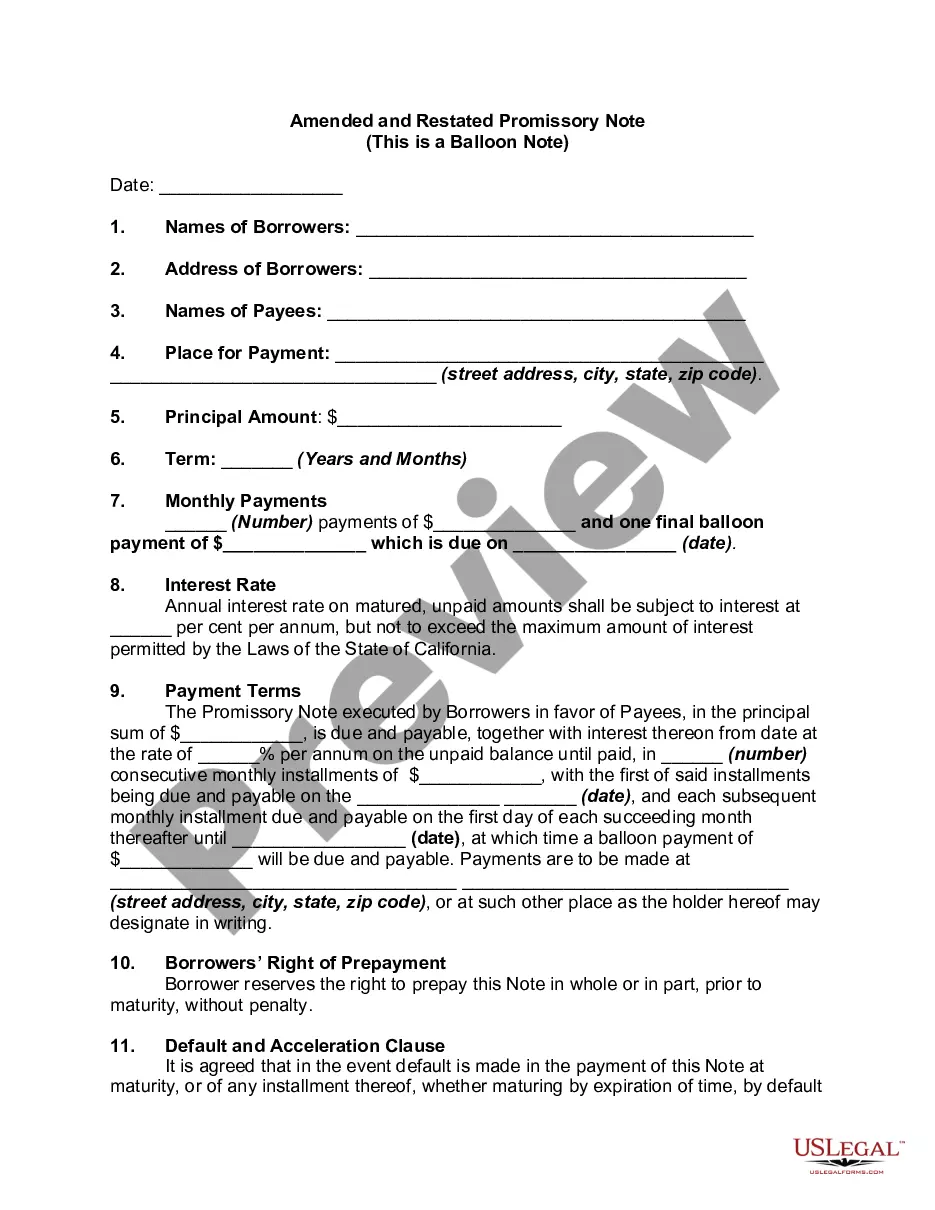

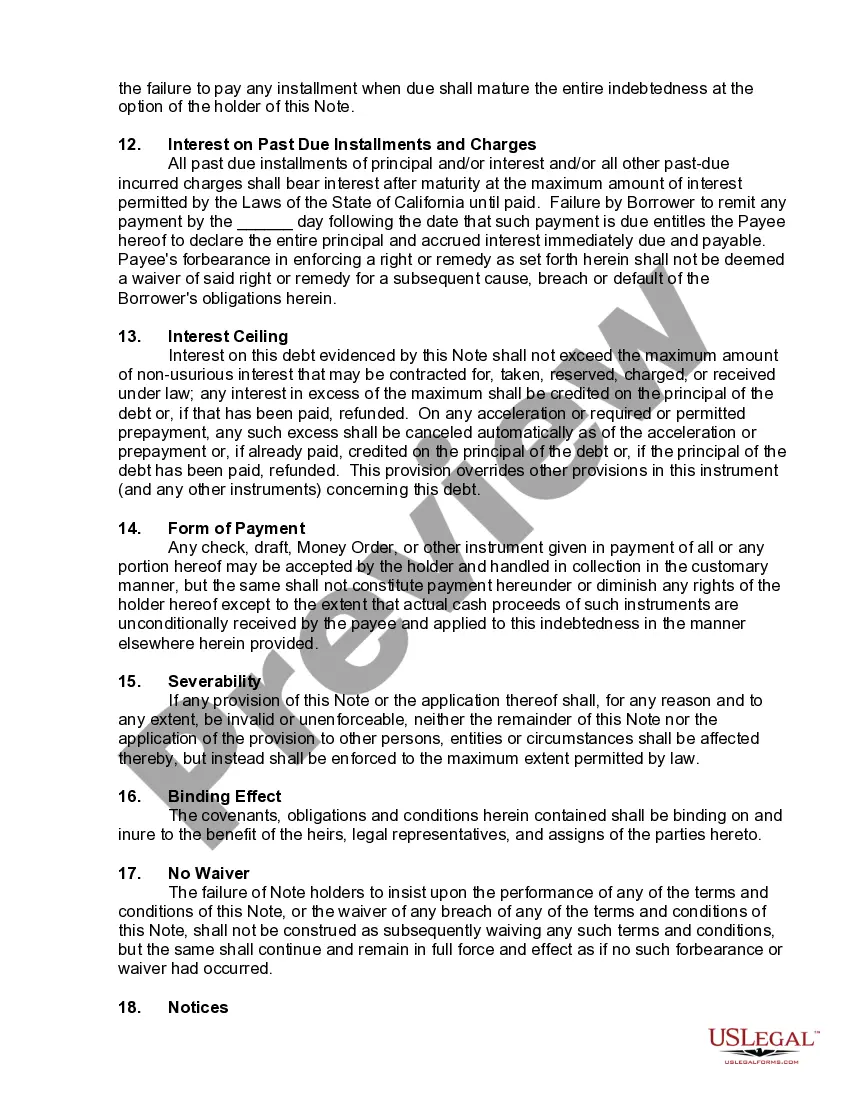

A Pomona California Amended and Restated Promissory Note refers to a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Pomona, California. It is a revised and updated version of the original promissory note, which has been modified to incorporate any changes agreed upon by both parties. This promissory note acts as evidence of a debt owed by the borrower to the lender. It serves as a legally binding agreement that obligates the borrower to repay the loan amount within a specified time frame and at an agreed-upon interest rate. By signing this document, both parties fully understand and acknowledge their respective rights and responsibilities regarding the loan arrangement. The Amended and Restated Promissory Note in Pomona, California, may include various types depending on the nature of the loan or specific provisions agreed upon by the parties involved. Some common types might include: 1. Fixed-Rate Promissory Note: This type of note establishes a fixed interest rate that will remain constant throughout the loan term. The borrower and the lender agree upon an interest rate at the beginning, and it remains unchanged over the course of repayment. 2. Adjustable-Rate Promissory Note: In contrast to a fixed-rate note, an adjustable-rate promissory note stipulates that the interest rate may vary based on predetermined factors, such as changes in a designated financial index. The interest rate adjustments are usually made at specified intervals and are outlined within the note. 3. Secured Promissory Note: A secured note is backed by collateral provided by the borrower, such as real estate or valuable assets. This collateral provides the lender with added security in the event of default by the borrower. Should the borrower fail to repay the loan as agreed, the lender has the right to seize and sell the collateral to recover the outstanding debt. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require any collateral. The borrower's promise to repay the loan stands alone, making it a riskier option for the lender. To compensate for the increased risk, the interest rates for unsecured loans are usually higher than those for secured loans. The Amended and Restated Promissory Note serves as a crucial legal instrument for formalizing a loan agreement in Pomona, California. It protects the interests of both parties and ensures that the loan terms are clearly defined, minimizing the possibility of disputes or disagreements down the line. Whether it is a fixed-rate, adjustable-rate, secured, or unsecured note, this legally binding document provides a solid foundation for a successful loan transaction.A Pomona California Amended and Restated Promissory Note refers to a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Pomona, California. It is a revised and updated version of the original promissory note, which has been modified to incorporate any changes agreed upon by both parties. This promissory note acts as evidence of a debt owed by the borrower to the lender. It serves as a legally binding agreement that obligates the borrower to repay the loan amount within a specified time frame and at an agreed-upon interest rate. By signing this document, both parties fully understand and acknowledge their respective rights and responsibilities regarding the loan arrangement. The Amended and Restated Promissory Note in Pomona, California, may include various types depending on the nature of the loan or specific provisions agreed upon by the parties involved. Some common types might include: 1. Fixed-Rate Promissory Note: This type of note establishes a fixed interest rate that will remain constant throughout the loan term. The borrower and the lender agree upon an interest rate at the beginning, and it remains unchanged over the course of repayment. 2. Adjustable-Rate Promissory Note: In contrast to a fixed-rate note, an adjustable-rate promissory note stipulates that the interest rate may vary based on predetermined factors, such as changes in a designated financial index. The interest rate adjustments are usually made at specified intervals and are outlined within the note. 3. Secured Promissory Note: A secured note is backed by collateral provided by the borrower, such as real estate or valuable assets. This collateral provides the lender with added security in the event of default by the borrower. Should the borrower fail to repay the loan as agreed, the lender has the right to seize and sell the collateral to recover the outstanding debt. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require any collateral. The borrower's promise to repay the loan stands alone, making it a riskier option for the lender. To compensate for the increased risk, the interest rates for unsecured loans are usually higher than those for secured loans. The Amended and Restated Promissory Note serves as a crucial legal instrument for formalizing a loan agreement in Pomona, California. It protects the interests of both parties and ensures that the loan terms are clearly defined, minimizing the possibility of disputes or disagreements down the line. Whether it is a fixed-rate, adjustable-rate, secured, or unsecured note, this legally binding document provides a solid foundation for a successful loan transaction.