An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

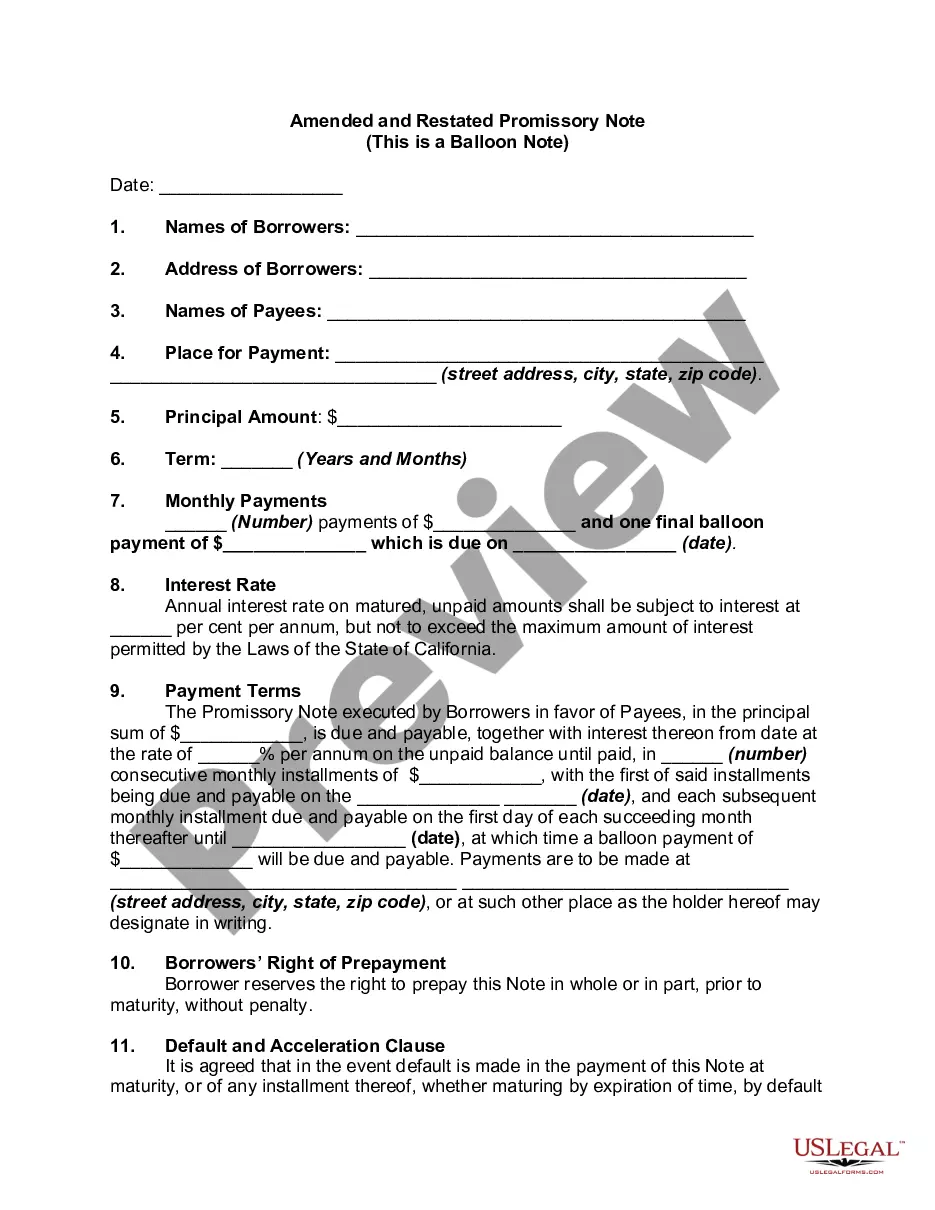

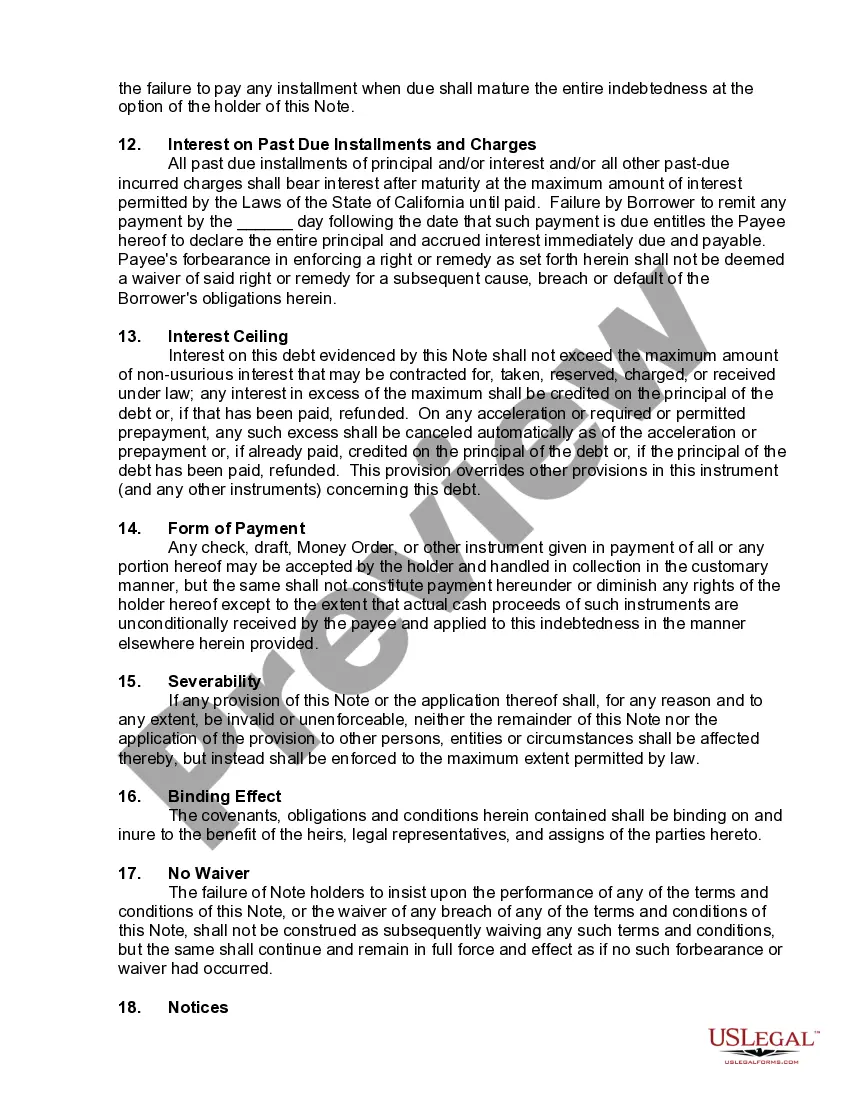

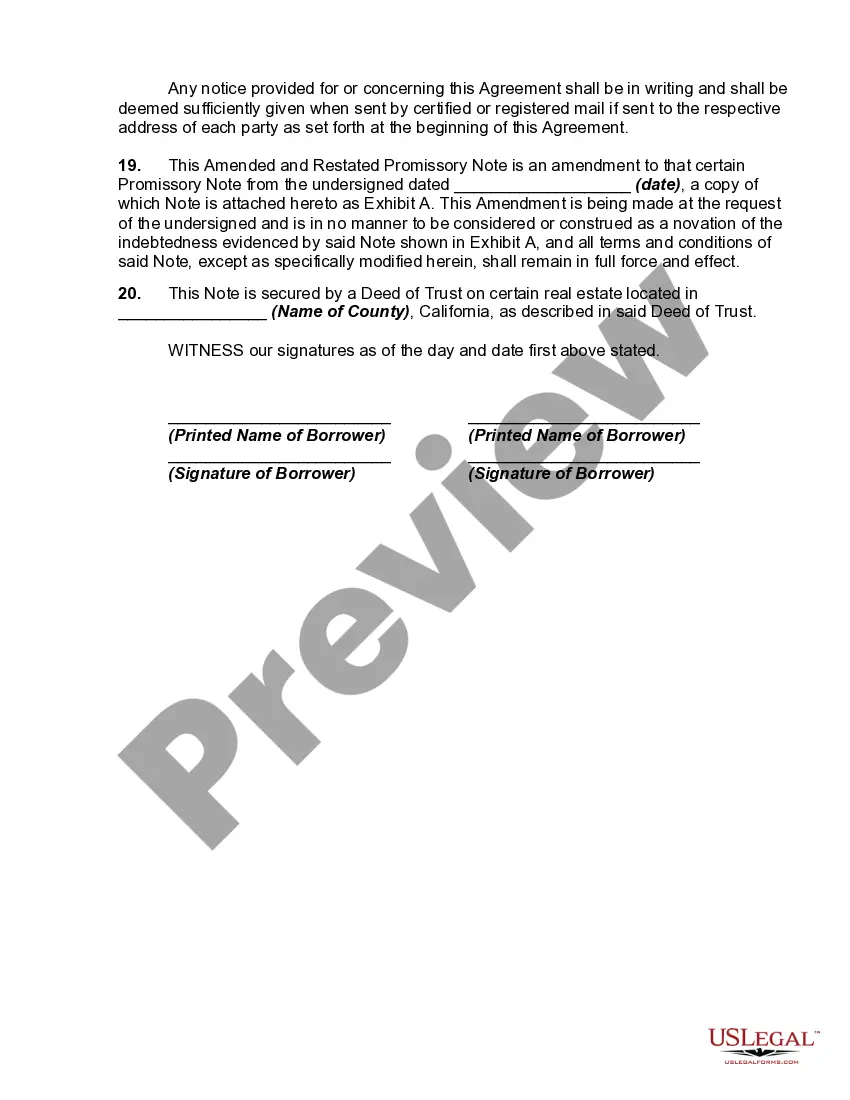

A Vacaville California Amended and Restated Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Vacaville, California. It serves as evidence of the borrower's promise to repay a specific amount of money to the lender within a specified period. This promissory note is an essential tool when borrowing or lending money in Vacaville, as it helps establish and protect the rights and obligations of both parties involved. It ensures that all terms and conditions of the loan, including interest rates, payment schedule, and any amendments or modifications, are clearly stated and agreed upon by both parties. There may be different types of Vacaville California Amended and Restated Promissory Notes, depending on the specific circumstances of the loan agreement. Some common variations include: 1. Secured Promissory Note: This type of promissory note involves the borrower providing collateral (such as property or assets) to secure the loan. In case of default, the lender can seize the collateral as compensation. 2. Unsecured Promissory Note: Unlike a secured promissory note, this type of agreement does not involve collateral. The lender relies solely on the borrower's promise to repay the loan, and in case of default, legal action is typically required to recover the funds. 3. Installment Promissory Note: This note requires the borrower to repay the loan in fixed periodic installments, often including principal and interest. The terms of repayment, such as the frequency and amount of each installment, are clearly specified in the document. 4. Demand Promissory Note: With this type of note, the lender has the right to request immediate repayment of the loan amount at any time. However, the borrower may still be given a reasonable notice period before they are required to repay the loan in full. 5. Amended and Restated Promissory Note: This refers to a revised version of an original promissory note. It is used when the parties involved agree to modify or amend the terms of the loan and wish to merge all changes into a single document while preserving the original terms that remain unchanged. When drafting or revising a Vacaville California Amended and Restated Promissory Note, it is crucial to ensure compliance with California and federal laws governing loans and debt. Consulting an attorney or legal expert experienced in this area can help ensure that the note accurately reflects the intentions of both parties and provides the necessary legal protection.A Vacaville California Amended and Restated Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Vacaville, California. It serves as evidence of the borrower's promise to repay a specific amount of money to the lender within a specified period. This promissory note is an essential tool when borrowing or lending money in Vacaville, as it helps establish and protect the rights and obligations of both parties involved. It ensures that all terms and conditions of the loan, including interest rates, payment schedule, and any amendments or modifications, are clearly stated and agreed upon by both parties. There may be different types of Vacaville California Amended and Restated Promissory Notes, depending on the specific circumstances of the loan agreement. Some common variations include: 1. Secured Promissory Note: This type of promissory note involves the borrower providing collateral (such as property or assets) to secure the loan. In case of default, the lender can seize the collateral as compensation. 2. Unsecured Promissory Note: Unlike a secured promissory note, this type of agreement does not involve collateral. The lender relies solely on the borrower's promise to repay the loan, and in case of default, legal action is typically required to recover the funds. 3. Installment Promissory Note: This note requires the borrower to repay the loan in fixed periodic installments, often including principal and interest. The terms of repayment, such as the frequency and amount of each installment, are clearly specified in the document. 4. Demand Promissory Note: With this type of note, the lender has the right to request immediate repayment of the loan amount at any time. However, the borrower may still be given a reasonable notice period before they are required to repay the loan in full. 5. Amended and Restated Promissory Note: This refers to a revised version of an original promissory note. It is used when the parties involved agree to modify or amend the terms of the loan and wish to merge all changes into a single document while preserving the original terms that remain unchanged. When drafting or revising a Vacaville California Amended and Restated Promissory Note, it is crucial to ensure compliance with California and federal laws governing loans and debt. Consulting an attorney or legal expert experienced in this area can help ensure that the note accurately reflects the intentions of both parties and provides the necessary legal protection.