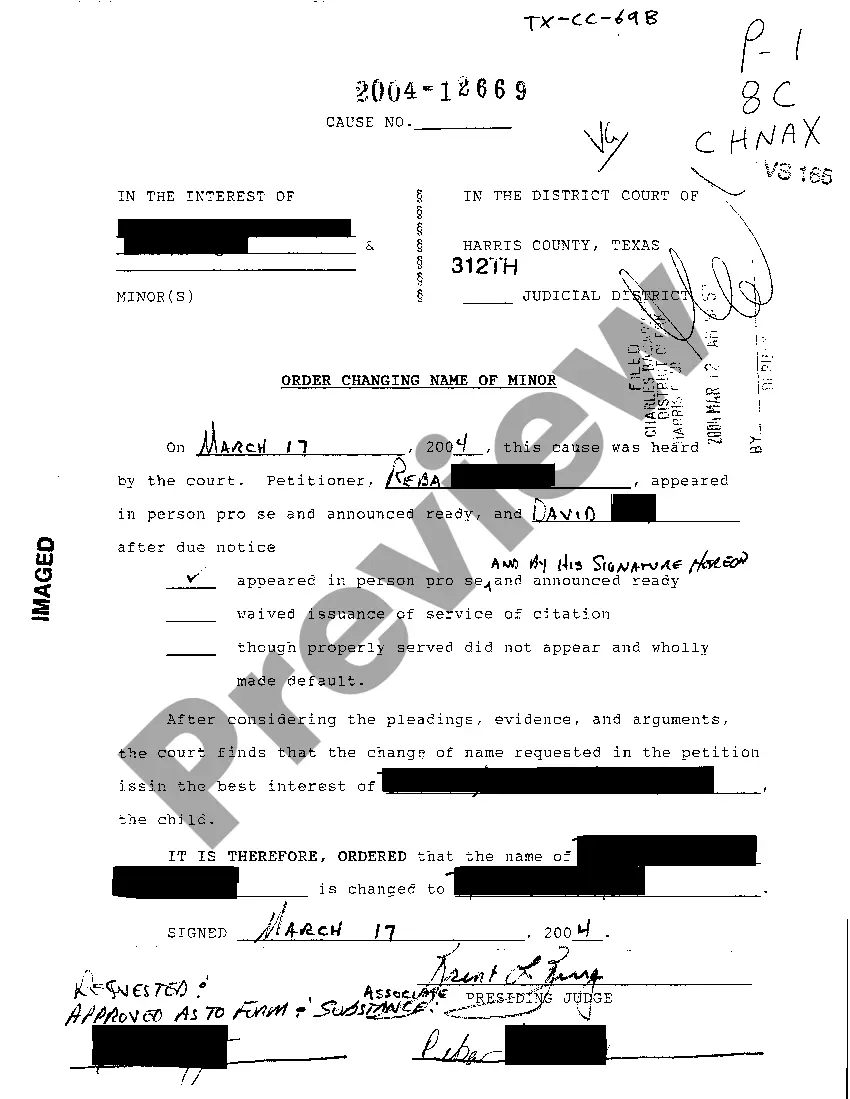

An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

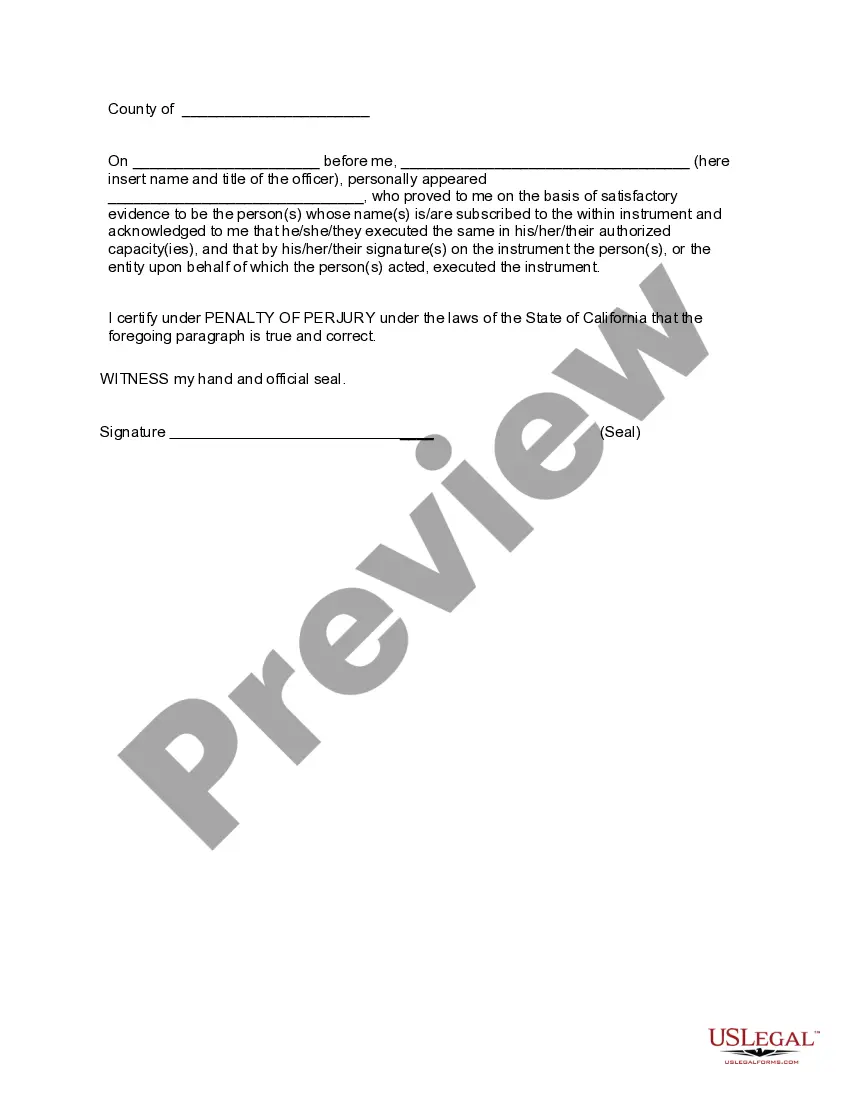

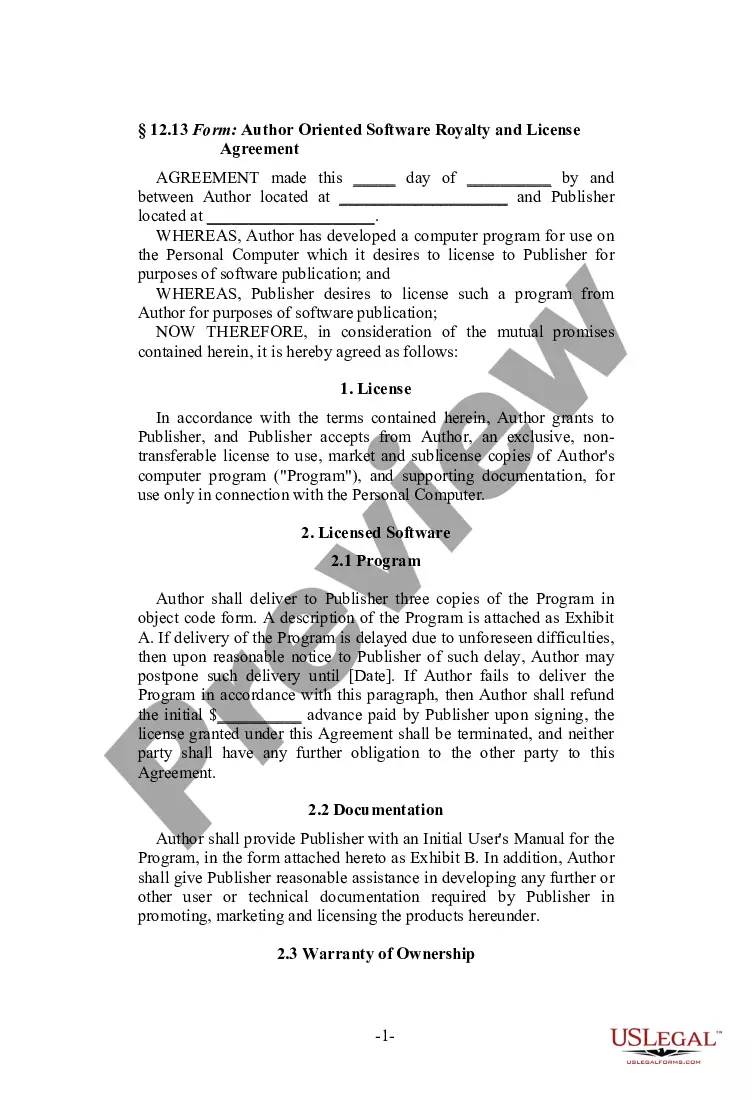

Title: Understanding the Antioch California Amended and Restated Deed of Trust Securing a Debt between Individuals Introduction: The Antioch California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legally binding document that outlines the terms and conditions of a loan or debt agreement between two parties in Antioch, California. This agreement ensures that the lender has a secured interest in the borrower's property until the debt is repaid. In this article, we will explore the key components of this deed of trust, discuss its significance, and highlight any different types that may exist. 1. Key Components of the Antioch California Amended and Restated Deed of Trust Securing a Debt between Individuals: — Parties Involved: The deed of trust identifies the lender (also known as the beneficiary) and the borrower (also known as the trust or). — Property Description: This document includes a detailed description of the property pledged as collateral, such as its address, legal description, and any relevant encumbrances. — Debt Terms: The deed of trust outlines the amount of money borrowed, repayment terms, interest rate, late fees, and any other financial obligations. — Security Agreement: This document specifies that the property mentioned will act as collateral to secure the debt. If the borrower defaults on the loan, the lender may initiate foreclosure proceedings. — Trustee: A third-party trustee is often designated to hold the deed of trust and act on the lender's behalf in the event of default or foreclosure. — Amendments and Restatement: The deed of trust can be amended or restated to accommodate the changes in the loan terms or to reflect the parties' agreement. 2. Significance of the Antioch California Amended and Restated Deed of Trust Securing a Debt between Individuals: — Security: By entering into this legally binding agreement, borrowers pledge their property as collateral, giving the lender a secured interest. This increases the lender's confidence in lending money as they have a means of recourse if the borrower defaults. — Clarity: The deed of trust provides a written record of the terms and conditions agreed upon by the parties involved, reducing the chances of misunderstandings or disputes. — Enforcement: In case of default, the lender can initiate foreclosure proceedings, allowing them to reclaim the pledged property to recoup their investment. Types of Antioch California Amended and Restated Deed of Trust Securing a Debt between Individuals: While there may not be different types of this specific deed of trust, it is essential to note that variations may arise based on factors such as loan amount, interest rate, repayment terms, and conditions specified by individual lenders. However, the core purpose and structure of securing a debt between individuals remain consistent. Conclusion: The Antioch California Amended and Restated Deed of Trust Securing a Debt between Individuals is a vital legal document that protects both the lender and borrower in a financial arrangement. By understanding its contents, individuals involved in lending or borrowing transactions can make informed decisions while ensuring the smooth enforcement of the agreement. It is advisable to consult a legal professional to clarify any doubts or tailor the document to specific needs.