An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

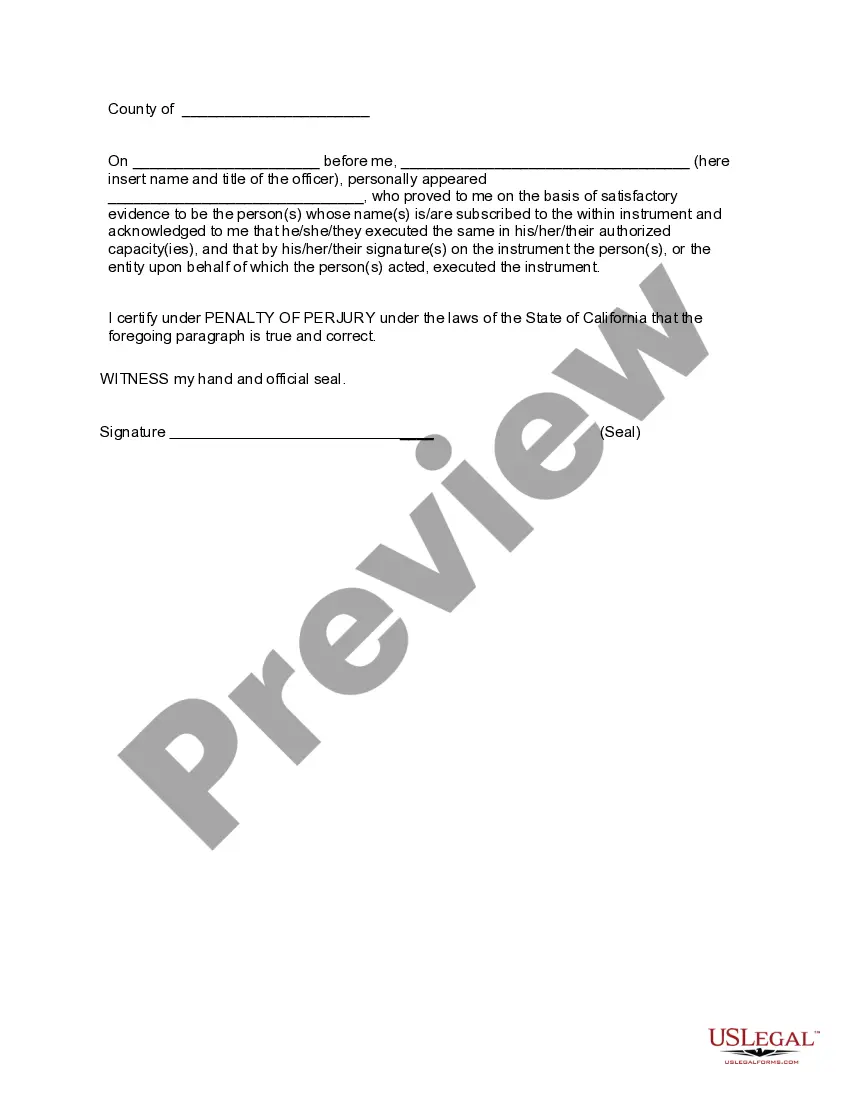

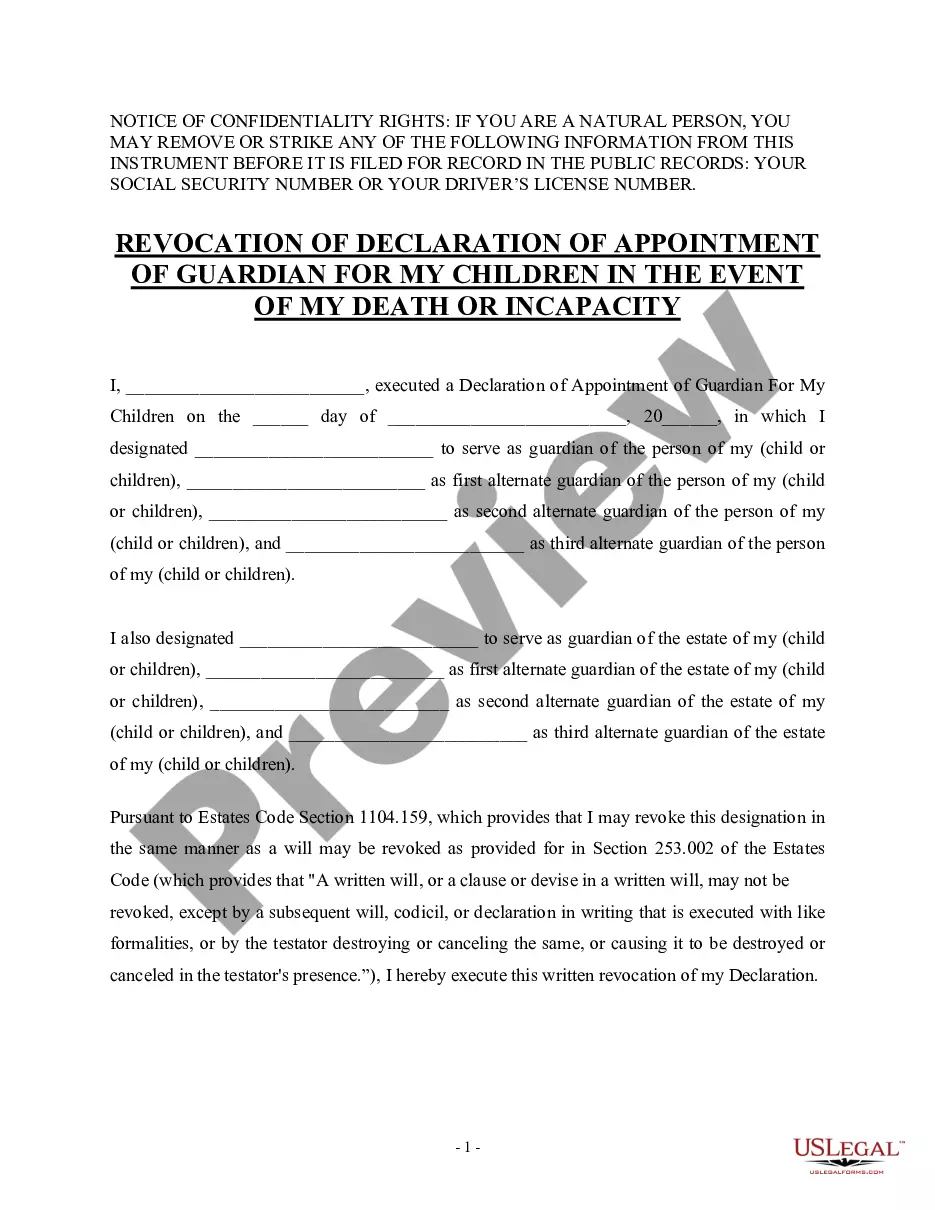

Title: Understanding Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals Introduction: The Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legal agreement that outlines the terms and conditions of borrowing money between private individuals. This document plays a crucial role in securing the debt by establishing the debtor's property as collateral. Let's delve into the details of this agreement to better understand its significance. Types of Concord California Amended and Restated Deed of Trust Securing a Debt: 1. Single-Family Residential Property Deed of Trust: This type of deed of trust is commonly used when an individual borrows money, typically for purchasing, refinancing, or securing a loan against a single-family residential property within the Concord, California area. It involves creating a lien against the property, enabling the lender to collect payment in case of default. 2. Multi-Unit Residential Property Deed of Trust: In scenarios where a borrower seeks financing for a multi-unit residential property, such as an apartment building or condominium complex in Concord, California, this type of deed of trust comes into play. It provides security to the lender by placing a lien on the property, ensuring repayment. 3. Commercial Property Deed of Trust: For individuals involved in commercial real estate transactions in Concord, California, the Amended and Restated Deed of Trust Securing a Debt can be used to formalize the lending agreement. This deed of trust is applicable when the borrower intends to use the funds for purchasing, refinancing, or developing commercial properties, such as retail spaces, offices, or industrial buildings. Key Elements in the Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals: 1. Identification of Parties: This section specifies the personal details of the borrower(s) and lender(s) involved in the transaction. It includes their legal names, addresses, contact information, and identification numbers. 2. Property Description: Here, an accurate description of the property that will serve as collateral is provided. It includes the address, legal description, and other relevant property identification details. 3. Loan Amount and Terms: This section outlines the principal amount borrowed and the agreed-upon repayment schedule. Additionally, it includes information about the interest rate, late payment penalties, and any other terms related to the debt. 4. Promissory Note: The deed of trust may reference a separate promissory note that contains additional terms and obligations pertaining to the loan. This note serves as the primary evidence of the debt. 5. Foreclosure Process: To protect the lender's interests, the deed of trust describes the foreclosure process in the event of default. It outlines the actions the lender can take to sell the property and recover the outstanding debt. 6. Signatures and Notarization: To ensure enforceability, the Concord California Amended and Restated Deed of Trust Securing a Debt requires signatures from all parties involved. Notarization is often necessary and serves to authenticate the document. Conclusion: The Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legally binding agreement that establishes a borrower's property as collateral for a debt. Whether applied to single-family residential, multi-unit residential, or commercial properties, this document ensures both parties' rights and obligations are clearly defined. Proper understanding and execution of this deed of trust are crucial for a secure lending process.Title: Understanding Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals Introduction: The Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legal agreement that outlines the terms and conditions of borrowing money between private individuals. This document plays a crucial role in securing the debt by establishing the debtor's property as collateral. Let's delve into the details of this agreement to better understand its significance. Types of Concord California Amended and Restated Deed of Trust Securing a Debt: 1. Single-Family Residential Property Deed of Trust: This type of deed of trust is commonly used when an individual borrows money, typically for purchasing, refinancing, or securing a loan against a single-family residential property within the Concord, California area. It involves creating a lien against the property, enabling the lender to collect payment in case of default. 2. Multi-Unit Residential Property Deed of Trust: In scenarios where a borrower seeks financing for a multi-unit residential property, such as an apartment building or condominium complex in Concord, California, this type of deed of trust comes into play. It provides security to the lender by placing a lien on the property, ensuring repayment. 3. Commercial Property Deed of Trust: For individuals involved in commercial real estate transactions in Concord, California, the Amended and Restated Deed of Trust Securing a Debt can be used to formalize the lending agreement. This deed of trust is applicable when the borrower intends to use the funds for purchasing, refinancing, or developing commercial properties, such as retail spaces, offices, or industrial buildings. Key Elements in the Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals: 1. Identification of Parties: This section specifies the personal details of the borrower(s) and lender(s) involved in the transaction. It includes their legal names, addresses, contact information, and identification numbers. 2. Property Description: Here, an accurate description of the property that will serve as collateral is provided. It includes the address, legal description, and other relevant property identification details. 3. Loan Amount and Terms: This section outlines the principal amount borrowed and the agreed-upon repayment schedule. Additionally, it includes information about the interest rate, late payment penalties, and any other terms related to the debt. 4. Promissory Note: The deed of trust may reference a separate promissory note that contains additional terms and obligations pertaining to the loan. This note serves as the primary evidence of the debt. 5. Foreclosure Process: To protect the lender's interests, the deed of trust describes the foreclosure process in the event of default. It outlines the actions the lender can take to sell the property and recover the outstanding debt. 6. Signatures and Notarization: To ensure enforceability, the Concord California Amended and Restated Deed of Trust Securing a Debt requires signatures from all parties involved. Notarization is often necessary and serves to authenticate the document. Conclusion: The Concord California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legally binding agreement that establishes a borrower's property as collateral for a debt. Whether applied to single-family residential, multi-unit residential, or commercial properties, this document ensures both parties' rights and obligations are clearly defined. Proper understanding and execution of this deed of trust are crucial for a secure lending process.