An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

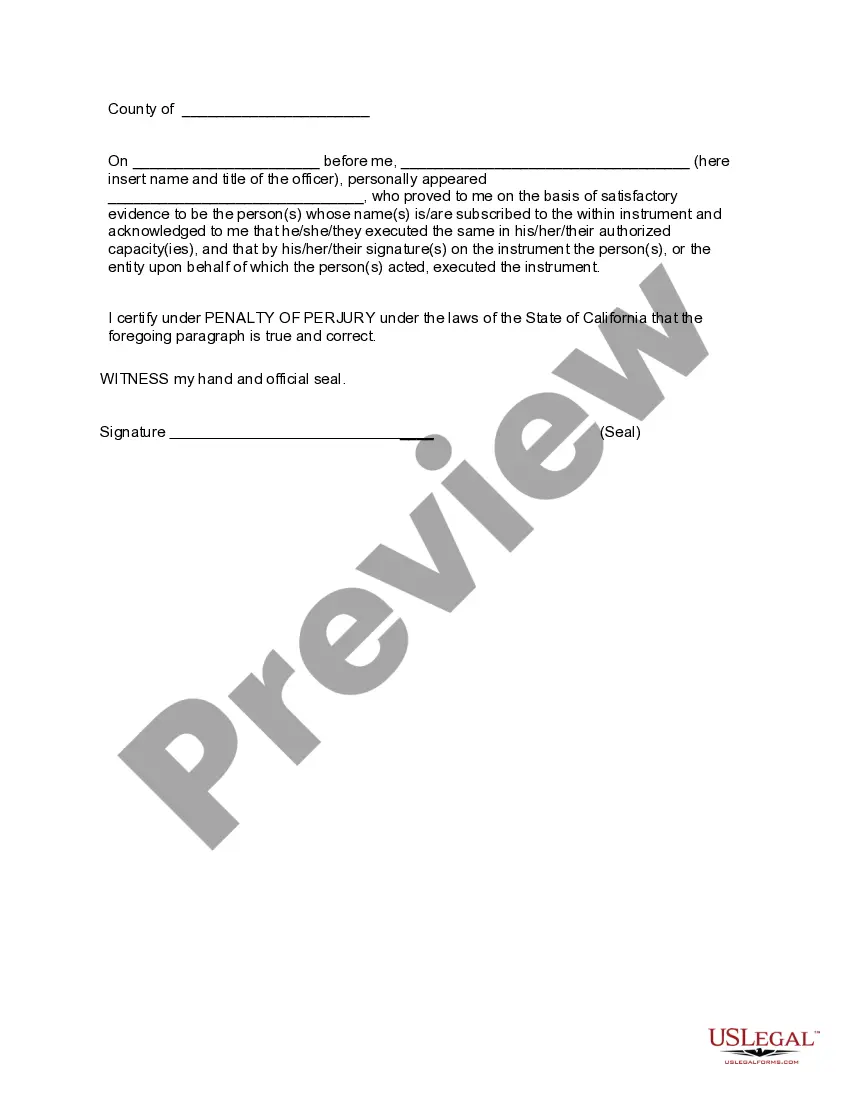

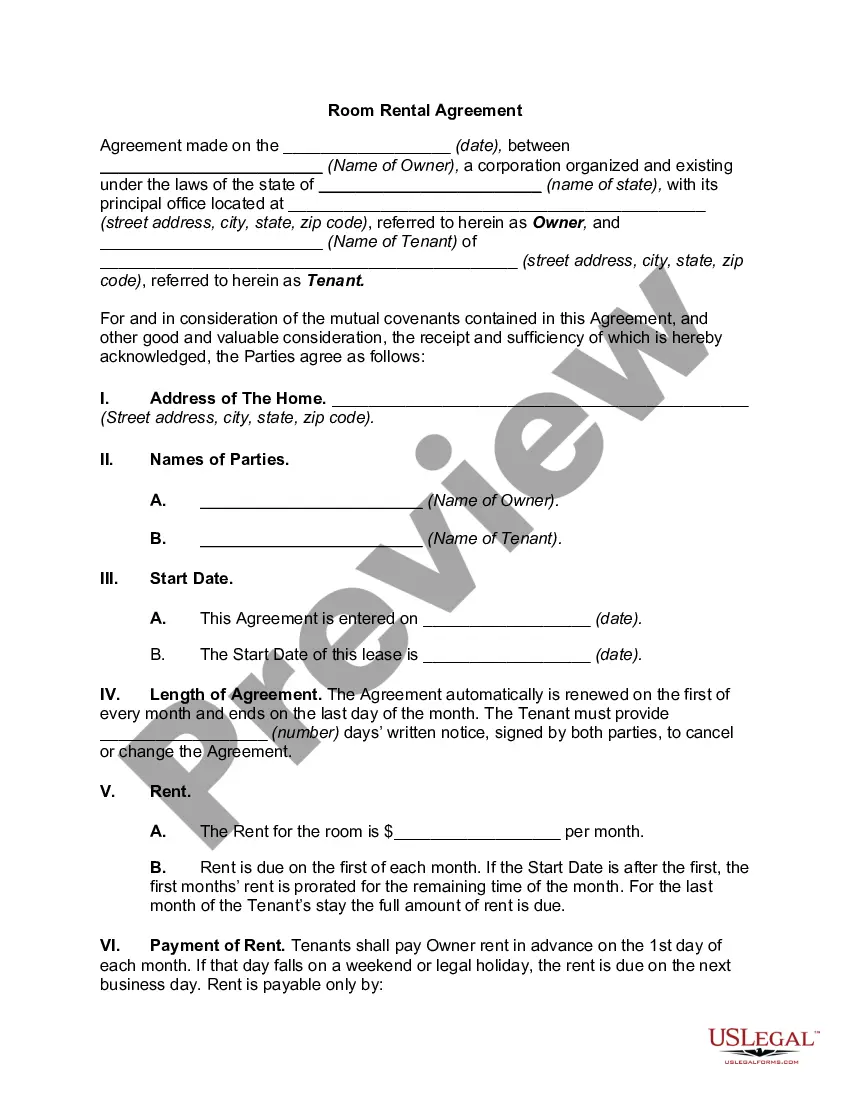

A Detailed Description of Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals Keywords: Inglewood California, amended and restated deed of trust, securing a debt, between individuals, types Introduction: The Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legal document that establishes a binding agreement between individuals involving the repayment of a debt. This deed serves as a security instrument to ensure that the borrower fulfills their obligations, allowing the lender to assert their rights if the borrower defaults on the loan. There may be different variations of this type of deed, each catering to specific circumstances and requirements. Let's explore the key elements and potential types of Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals in more detail. Key Elements: 1. Parties involved: The deed typically includes the names and contact information of both the borrower and the lender, including any co-signers or guarantors. 2. Property description: It outlines the physical address and legal description of the property being used as collateral to secure the debt. 3. Debt details: The deed specifies the amount of the debt, the interest rate, repayment terms, and any additional charges or fees that may apply. 4. Default provisions: This section outlines the circumstances in which the borrower would be considered in default and the remedies available to the lender in case of default. 5. Foreclosure procedures: It includes the procedures and processes the lender can undertake in the event of loan default, including the right to sell the property through foreclosure. Types: 1. Residential Deed of Trust: This type of deed is commonly used when an individual borrows money to finance the purchase of a residential property. The property serves as collateral until the debt is paid off. 2. Commercial Deed of Trust: In cases where the debt is obtained for commercial purposes, such as funding a business venture or buying commercial real estate, a commercial deed of trust may be used. The terms and conditions of this deed may differ from a residential one based on the nature of the loan. 3. Second Deed of Trust: A second deed of trust is created when an individual takes out a second loan on a property that already has an existing deed of trust securing the initial loan. The terms of the second deed may vary from the first, and it holds a secondary claim on the property in case of default. Conclusion: The Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legally binding document that outlines the terms and conditions of a loan between individuals, while also providing security for the lender. Although there may be variations based on the type of property and purpose of the loan, these deeds establish clear guidelines for repayment and protect the interests of both parties involved. It is crucial for individuals entering into such agreements to seek legal advice and fully understand the obligations and consequences specified in the deed.A Detailed Description of Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals Keywords: Inglewood California, amended and restated deed of trust, securing a debt, between individuals, types Introduction: The Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legal document that establishes a binding agreement between individuals involving the repayment of a debt. This deed serves as a security instrument to ensure that the borrower fulfills their obligations, allowing the lender to assert their rights if the borrower defaults on the loan. There may be different variations of this type of deed, each catering to specific circumstances and requirements. Let's explore the key elements and potential types of Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals in more detail. Key Elements: 1. Parties involved: The deed typically includes the names and contact information of both the borrower and the lender, including any co-signers or guarantors. 2. Property description: It outlines the physical address and legal description of the property being used as collateral to secure the debt. 3. Debt details: The deed specifies the amount of the debt, the interest rate, repayment terms, and any additional charges or fees that may apply. 4. Default provisions: This section outlines the circumstances in which the borrower would be considered in default and the remedies available to the lender in case of default. 5. Foreclosure procedures: It includes the procedures and processes the lender can undertake in the event of loan default, including the right to sell the property through foreclosure. Types: 1. Residential Deed of Trust: This type of deed is commonly used when an individual borrows money to finance the purchase of a residential property. The property serves as collateral until the debt is paid off. 2. Commercial Deed of Trust: In cases where the debt is obtained for commercial purposes, such as funding a business venture or buying commercial real estate, a commercial deed of trust may be used. The terms and conditions of this deed may differ from a residential one based on the nature of the loan. 3. Second Deed of Trust: A second deed of trust is created when an individual takes out a second loan on a property that already has an existing deed of trust securing the initial loan. The terms of the second deed may vary from the first, and it holds a secondary claim on the property in case of default. Conclusion: The Inglewood California Amended and Restated Deed of Trust Securing a Debt between Individuals is a legally binding document that outlines the terms and conditions of a loan between individuals, while also providing security for the lender. Although there may be variations based on the type of property and purpose of the loan, these deeds establish clear guidelines for repayment and protect the interests of both parties involved. It is crucial for individuals entering into such agreements to seek legal advice and fully understand the obligations and consequences specified in the deed.