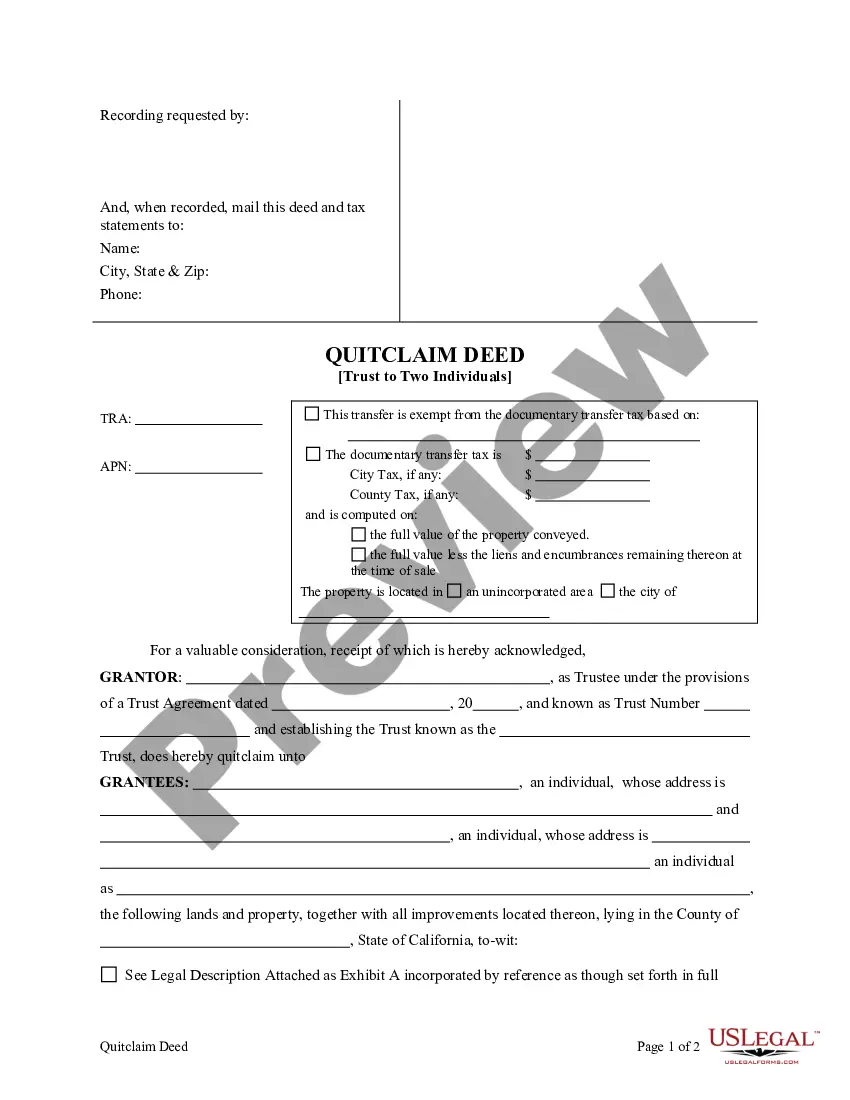

This form is a Quitclaim Deed where the grantor is the trustee of a trust and the grantees are two individuals. Grantor conveys and quitclaims any interest grantor might have in the described property to grantees. This deed complies with all state statutory laws.

Irvine California Quitclaim Deed — Trust to Two Individuals: A Detailed Description A quitclaim deed is a legal document used in Irvine, California, to transfer ownership of real estate property from one party to another, denoting the release or "quitclaim" of the former owner's interest in the property. In the case of a trust to two individuals, this type of deed is specifically used to transfer ownership of a property to a trust that involves two individuals as beneficiaries or trustees. The Irvine California Quitclaim Deed — Trust to Two Individuals is often utilized in estate planning, family transfers, or asset protection strategies. It allows for the transfer of property ownership to a trust, which is an entity created for the management and protection of assets or personal rights, in this case, to be shared by two individuals. There are several types/forms of the Irvine California Quitclaim Deed — Trust to Two Individuals, including: 1. Revocable Living Trust: This is a common type of trust where the two individuals (the granters) create a trust document during their lifetime, typically for personal or family purposes. They then retain the ability to modify or revoke the trust at any time, ensuring flexibility and control over the property. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of the beneficiaries. Once the property is transferred to an irrevocable trust, it becomes permanent, providing potential tax benefits and asset protection. 3. Testamentary Trust: This type of trust is established through a will and takes effect upon the granter's death. It allows the granter to specify how the property should be managed and distributed after their passing, providing guidance and protection to the two individuals designated as beneficiaries. Irvine, California, offers a streamlined process for executing these quitclaim deeds. Both granters and trustees should consult legal professionals familiar with California real estate laws to ensure the deed adheres to all necessary legal requirements and accurately reflects the intentions of the parties involved. In summary, the Irvine California Quitclaim Deed — Trust to Two Individuals allows for the transfer of property ownership to a trust involving two individuals as beneficiaries or trustees. The different types of quitclaim deeds include revocable living trusts, irrevocable living trusts, and testamentary trusts. It is essential to seek professional guidance to ensure compliance with California law and to protect the interests of all parties involved in the transfer of property ownership.