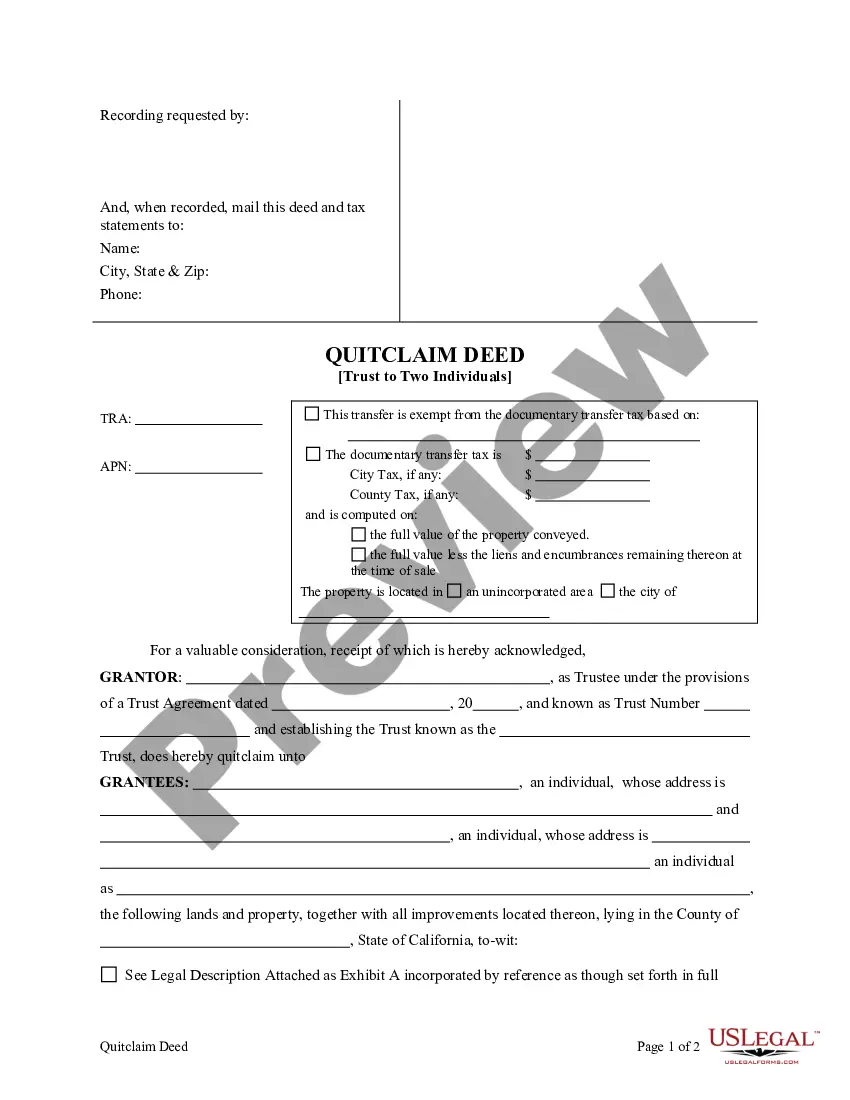

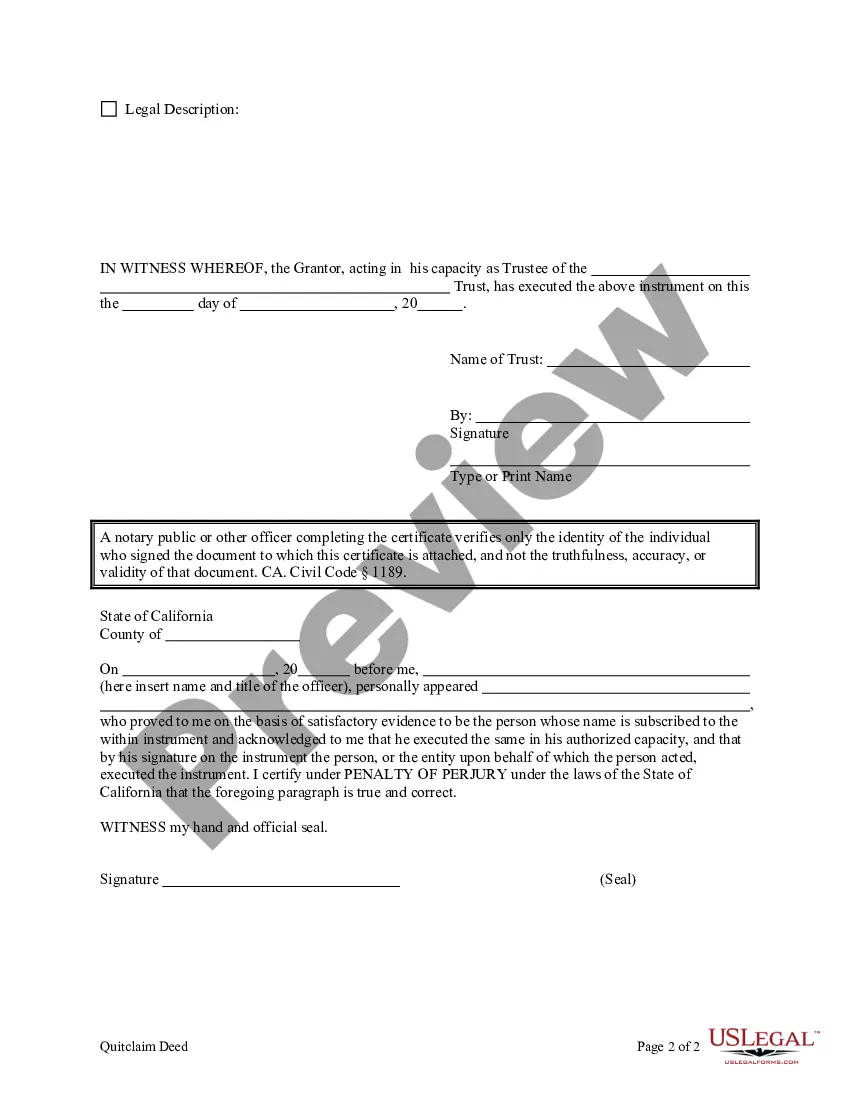

This form is a Quitclaim Deed where the grantor is the trustee of a trust and the grantees are two individuals. Grantor conveys and quitclaims any interest grantor might have in the described property to grantees. This deed complies with all state statutory laws.

A San Diego California Quitclaim Deed — Trust to Two Individuals is a legal document used to transfer ownership of real property in San Diego, California, from a trust to two individuals. This type of deed is commonly used in estate planning or to change the ownership of a property to reflect the desires of the trust beneficiaries. Keywords: San Diego California, Quitclaim Deed, Trust, Two Individuals, real property, ownership, estate planning, trust beneficiaries. Types of San Diego California Quitclaim Deed — Trust to Two Individuals: 1. Joint Tenancy Quitclaim Deed — Trust to Two Individuals: This type of quitclaim deed transfers ownership of the property to two individuals as joint tenants, meaning they share equal ownership and have the right of survivorship. If one owner passes away, the other owner automatically becomes the sole owner. 2. Tenancy in Common Quitclaim Deed — Trust to Two Individuals: This quitclaim deed transfers ownership of the property to two individuals as tenants in common. Each individual has a specific percentage of ownership, and their shares may not be equal. Unlike joint tenancy, there is no right of survivorship in tenancy in common. If one owner passes away, their share of the property will pass to their heirs or beneficiaries. 3. Community Property Quitclaim Deed — Trust to Two Individuals: In California, property acquired during a marriage is generally considered community property. This type of quitclaim deed transfers ownership of the property to two individuals who are married or in a registered domestic partnership. Each spouse or partner has equal ownership rights and shares in any appreciation or depreciation of the property during the marriage or partnership. 4. Separate Property Quitclaim Deed — Trust to Two Individuals: This type of quitclaim deed is used when one individual wants to transfer their separate property to two individuals. Separate property refers to property acquired before marriage, through inheritance, or as a gift. The deed ensures that both individuals have a legal interest in the property according to the terms of the trust. It is crucial to consult with an experienced real estate attorney or estate planning lawyer when creating and executing a San Diego California Quitclaim Deed — Trust to Two Individuals. They can ensure that the deed accurately reflects your intentions and complies with all applicable laws and regulations.