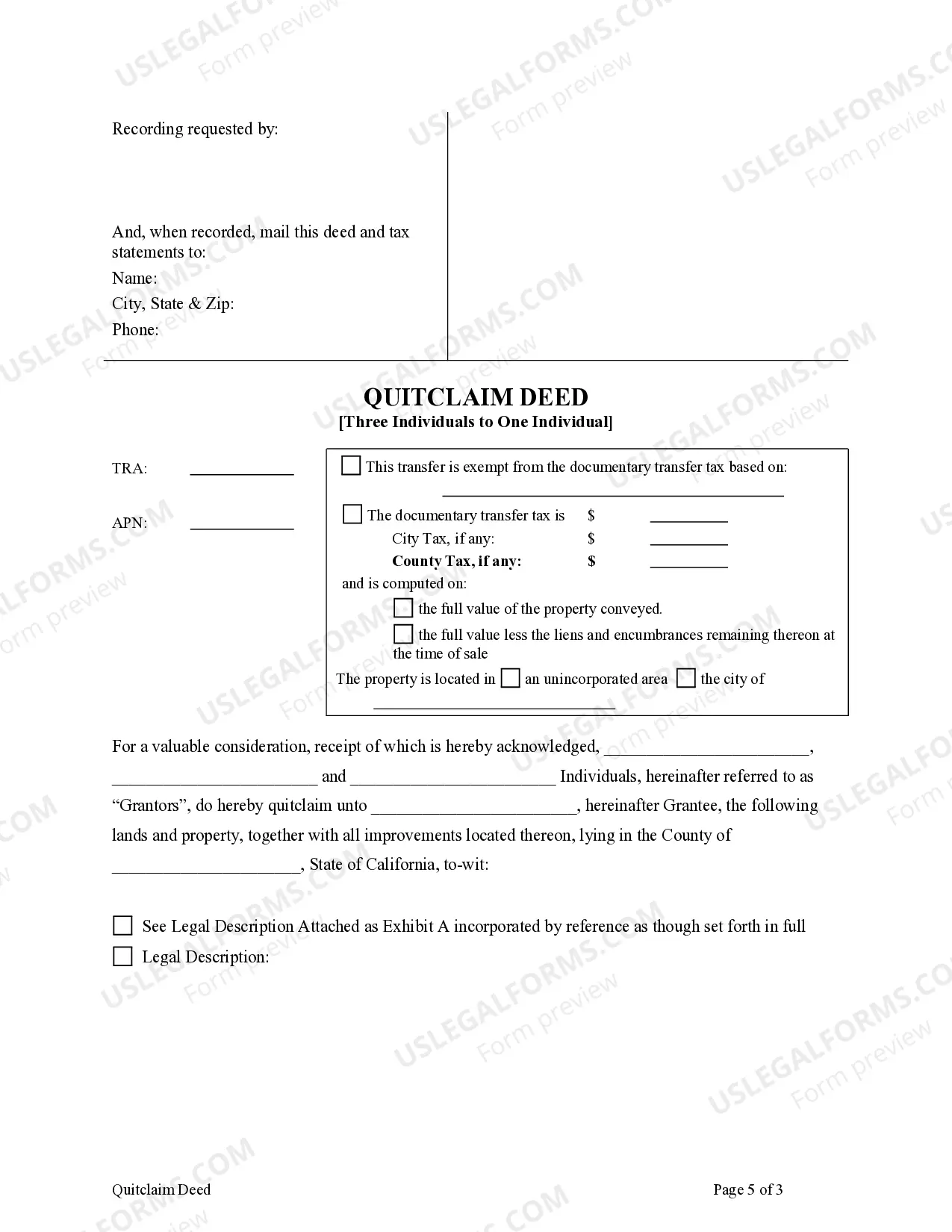

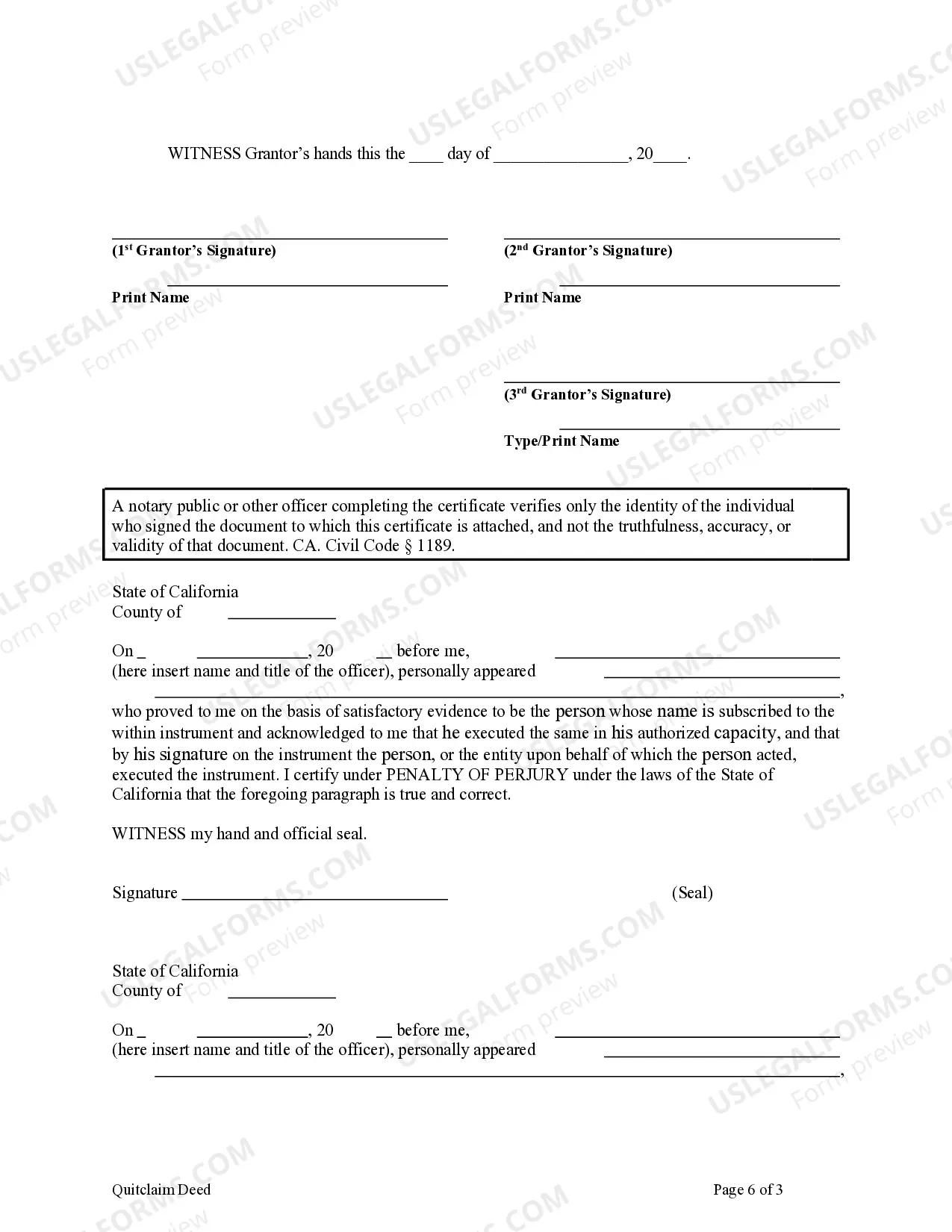

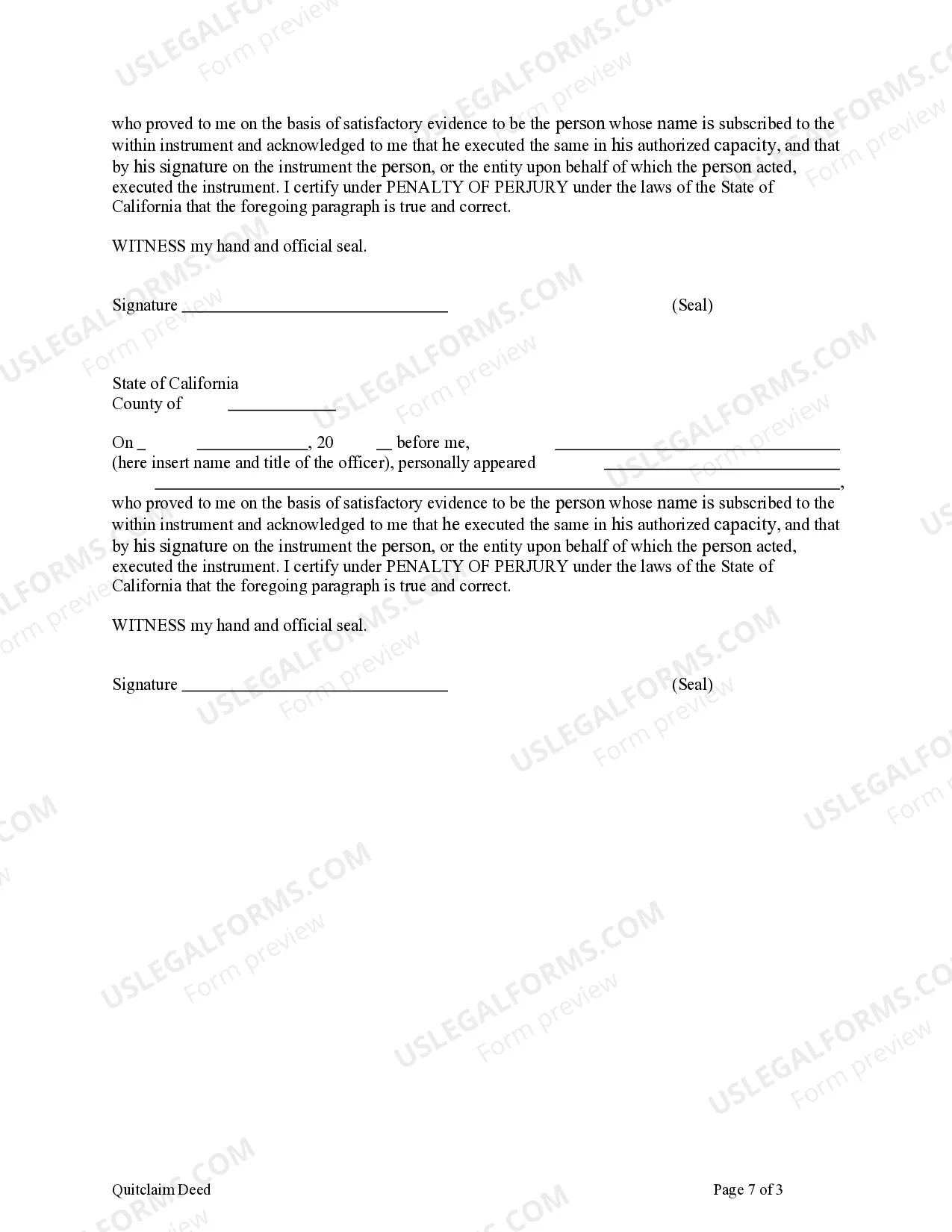

This form is a Quitclaim Deed where the grantors are three individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Contra Costa California Quitclaim Deed — Three Individuals to One Individual is a legal document used to transfer ownership of a property from three individuals to one individual in Contra Costa County, California. This deed type is commonly used to transfer property ownership between family members, spouses, or business partners. The Contra Costa California Quitclaim Deed — Three Individuals to One Individual is designed to release and convey the interest of the granters (the three individuals) in the property to the grantee (the one individual) without providing any warranties or guarantees about the property's title. It essentially transfers whatever interest the granters have in the property to the grantee, without ensuring that there are no claims or encumbrances on the property. Different types or variations of the Contra Costa California Quitclaim Deed — Three Individuals to One Individual may include: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed used in California. It transfers ownership without any warranties or guarantees. 2. Joint Tenancy Quitclaim Deed: In this type of quitclaim deed, the three individuals are joint tenants who collectively own the property. Upon transferring to one individual, the joint tenancy is dissolved, and the grantee becomes the sole owner. 3. Tenants in Common Quitclaim Deed: If the three individuals own the property as tenants in common, this type of quitclaim deed can be used to transfer their shares to one individual while maintaining the tenancy in common structure. The Contra Costa California Quitclaim Deed — Three Individuals to One Individual should include information such as the legal description of the property, the names and addresses of the granters and grantee, the consideration amount (if any), and any relevant property tax information. It is important to consult with a qualified attorney or real estate professional when drafting or executing a quitclaim deed to ensure that all legal requirements are met and to address any potential issues or concerns regarding the transfer of property ownership.A Contra Costa California Quitclaim Deed — Three Individuals to One Individual is a legal document used to transfer ownership of a property from three individuals to one individual in Contra Costa County, California. This deed type is commonly used to transfer property ownership between family members, spouses, or business partners. The Contra Costa California Quitclaim Deed — Three Individuals to One Individual is designed to release and convey the interest of the granters (the three individuals) in the property to the grantee (the one individual) without providing any warranties or guarantees about the property's title. It essentially transfers whatever interest the granters have in the property to the grantee, without ensuring that there are no claims or encumbrances on the property. Different types or variations of the Contra Costa California Quitclaim Deed — Three Individuals to One Individual may include: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed used in California. It transfers ownership without any warranties or guarantees. 2. Joint Tenancy Quitclaim Deed: In this type of quitclaim deed, the three individuals are joint tenants who collectively own the property. Upon transferring to one individual, the joint tenancy is dissolved, and the grantee becomes the sole owner. 3. Tenants in Common Quitclaim Deed: If the three individuals own the property as tenants in common, this type of quitclaim deed can be used to transfer their shares to one individual while maintaining the tenancy in common structure. The Contra Costa California Quitclaim Deed — Three Individuals to One Individual should include information such as the legal description of the property, the names and addresses of the granters and grantee, the consideration amount (if any), and any relevant property tax information. It is important to consult with a qualified attorney or real estate professional when drafting or executing a quitclaim deed to ensure that all legal requirements are met and to address any potential issues or concerns regarding the transfer of property ownership.