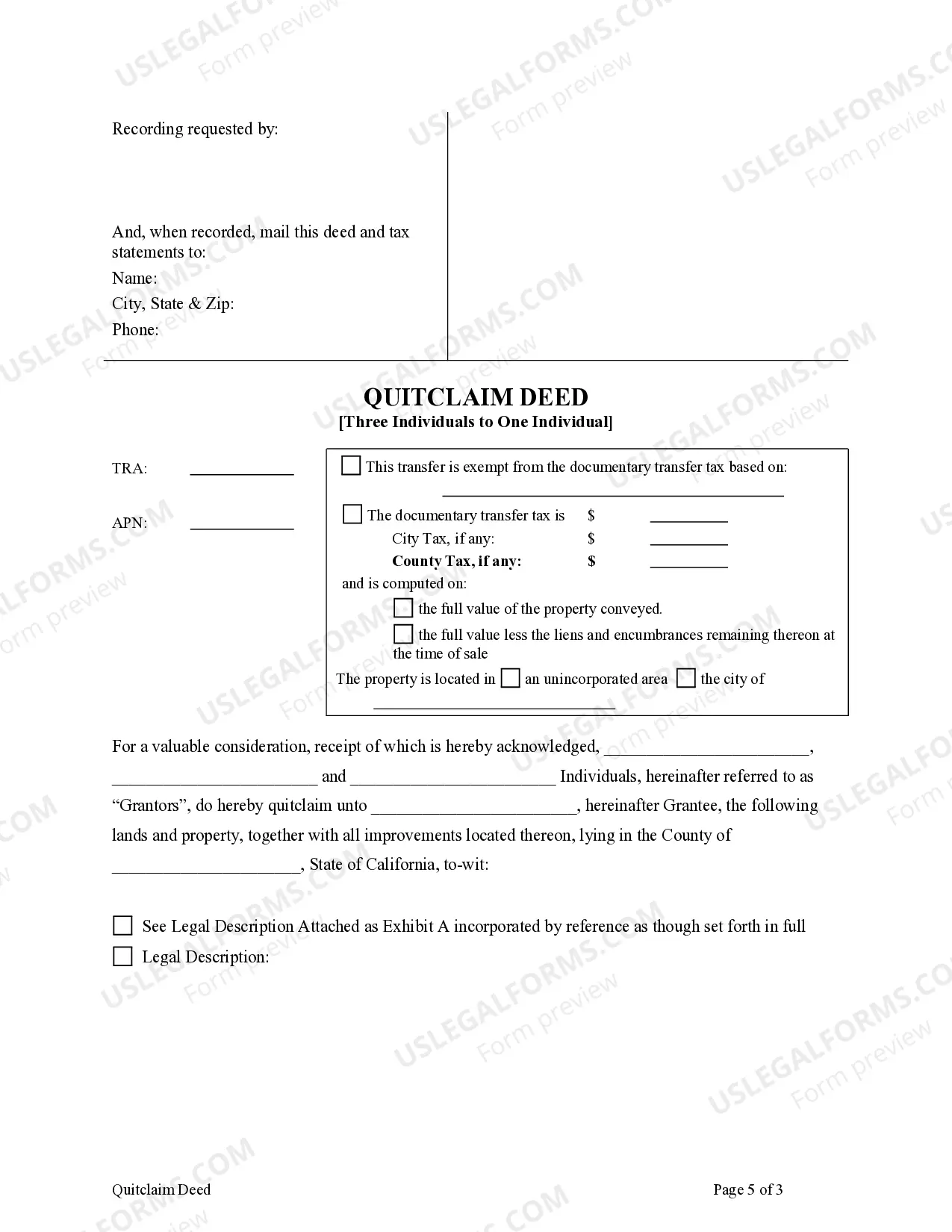

This form is a Quitclaim Deed where the grantors are three individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A quitclaim deed is a legal document used to transfer the ownership of real property from one person or group of individuals to another. Specifically, a "Santa Maria California Quitclaim Deed — Three Individuals to One Individual" refers to a specific type of quitclaim deed that involves the transfer of property owned jointly by three individuals to a single individual. In Santa Maria, California, there are several variations of quitclaim deeds applicable to this scenario, including: 1. Santa Maria California Joint Tenancy Quitclaim Deed — Three Individuals to One Individual: This type of quitclaim deed is used when the three individuals jointly own the property as tenants in common and want to transfer their interests to a single individual. 2. Santa Maria California Tenants in Common Quitclaim Deed — Three Individuals to One Individual: This type of quitclaim deed is used when the three individuals own the property as tenants in common and wish to transfer their respective interests to a single individual. 3. Santa Maria California Community Property Quitclaim Deed — Three Individuals to One Individual: This type of quitclaim deed is applicable when the three individuals are married and the property is considered community property. It allows for the transfer of their interests to a single individual. In a Santa Maria California Quitclaim Deed — Three Individuals to One Individual, certain elements should be included: 1. Names and addresses of all three individuals transferring their interests as granters. 2. Name and address of the individual who will become the sole owner as the grantee. 3. A legal description of the property being transferred, including specific boundaries and any improvements situated on it. 4. Consideration paid for the transfer, if any. A quitclaim deed can be executed without any monetary exchange. 5. Signatures of all three individuals as granters, along with their acknowledgement in front of a notary public. 6. Notarized signatures of witnesses, if required by local regulations. It is essential to consult with a qualified real estate attorney or a title company to ensure the proper preparation and execution of a Santa Maria California Quitclaim Deed — Three Individuals to One Individual. This will help avoid any issues or disputes regarding the transfer of property ownership.