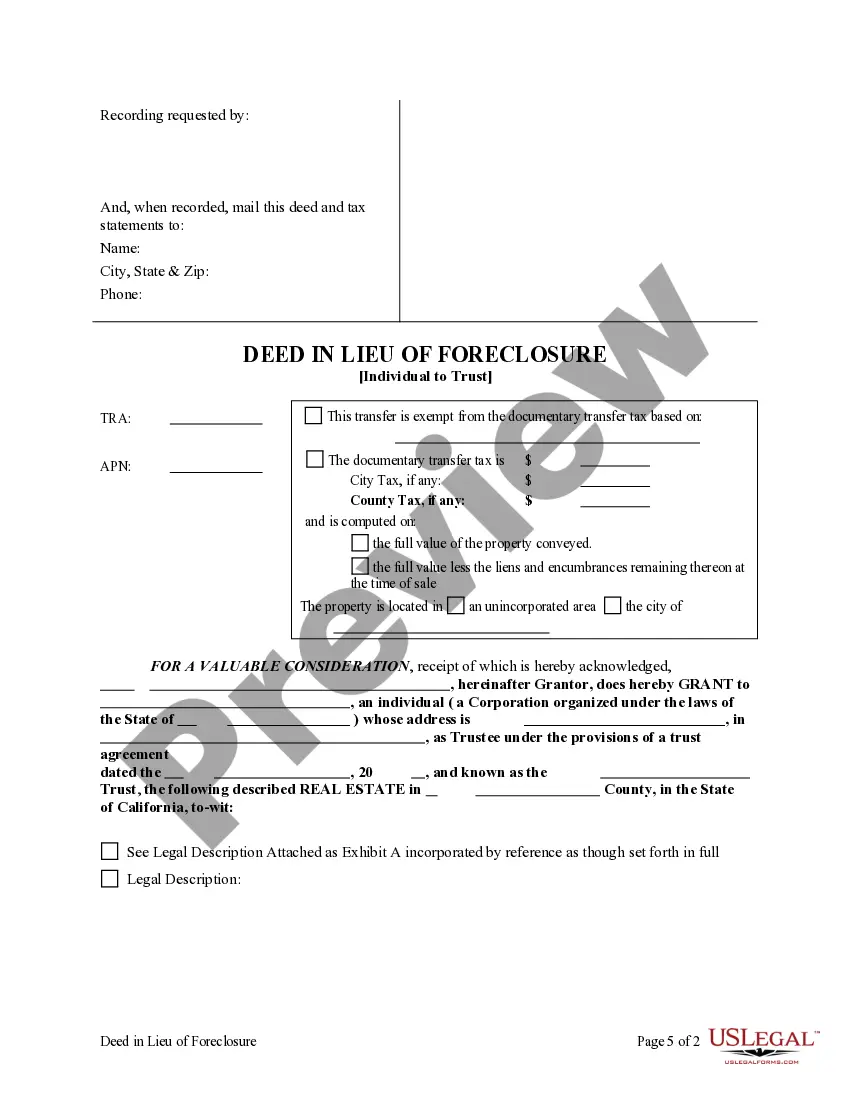

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Title: Understanding Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust Introduction: When facing financial turmoil and unable to keep up with mortgage payments, homeowners in Oceanside, California may consider alternatives to foreclosure. One viable option is the Deed in Lieu of Foreclosure — Individual to a Trust. In this comprehensive guide, we will delve into the intricacies of this process, explain its benefits, and explore any variations or alternatives available. 1. Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust: Explained The Deed in Lieu of Foreclosure — Individual to a Trust refers to the transfer of property ownership from an individual homeowner to a trust, typically with a beneficial interest assigned to the original homeowner. This arrangement enables homeowners to avoid foreclosure, maintain control over the property, and potentially negotiate favorable terms with the lender. 2. Benefits of Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust 2.1. Avoiding Foreclosure: By opting for a Deed in Lieu of Foreclosure, homeowners can prevent the adverse consequences of a foreclosure, such as damaged credit scores and the potential for deficiency judgments. 2.2. Control and Decision-making: Transferring property ownership to a trust allows a homeowner to remain actively involved in property management decisions, preserving a sense of control and possibly facilitating future refinancing or reacquisition. 2.3. Potential Financial Assistance: Some lenders may provide financial incentives to homeowners who choose a Deed in Lieu of Foreclosure, such as relocation assistance or waiver of any outstanding mortgage debt. 3. Variations and Alternatives to Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust 3.1. Deed in Lieu of Foreclosure — Individual to Lender: In situations where the homeowner does not wish to establish a trust, an alternative option involves transferring ownership directly to the lender. 3.2. Deed in Lieu of Foreclosure — Individual to Third Party: In certain scenarios, homeowners may choose to transfer property ownership to an individual or entity unrelated to the lender, providing an opportunity to sell the property or satisfy a debt obligation. 3.3. Oceanside California Short Sale: While not technically a Deed in Lieu of Foreclosure, a short sale involves selling the property for less than the outstanding mortgage balance. This option can help homeowners avoid foreclosure and mitigate the impact on credit scores. Conclusion: Understanding the nuances of Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust is crucial for homeowners navigating financial difficulties. By considering this alternative, homeowners can protect their credit, maintain control over the property, and negotiate beneficial terms with lenders. Variations such as transferring ownership to the lender or a third party, as well as alternative options like a short sale, provide additional avenues for homeowners to explore. Seek professional advice to ascertain which path aligns best with your unique circumstances.Title: Understanding Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust Introduction: When facing financial turmoil and unable to keep up with mortgage payments, homeowners in Oceanside, California may consider alternatives to foreclosure. One viable option is the Deed in Lieu of Foreclosure — Individual to a Trust. In this comprehensive guide, we will delve into the intricacies of this process, explain its benefits, and explore any variations or alternatives available. 1. Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust: Explained The Deed in Lieu of Foreclosure — Individual to a Trust refers to the transfer of property ownership from an individual homeowner to a trust, typically with a beneficial interest assigned to the original homeowner. This arrangement enables homeowners to avoid foreclosure, maintain control over the property, and potentially negotiate favorable terms with the lender. 2. Benefits of Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust 2.1. Avoiding Foreclosure: By opting for a Deed in Lieu of Foreclosure, homeowners can prevent the adverse consequences of a foreclosure, such as damaged credit scores and the potential for deficiency judgments. 2.2. Control and Decision-making: Transferring property ownership to a trust allows a homeowner to remain actively involved in property management decisions, preserving a sense of control and possibly facilitating future refinancing or reacquisition. 2.3. Potential Financial Assistance: Some lenders may provide financial incentives to homeowners who choose a Deed in Lieu of Foreclosure, such as relocation assistance or waiver of any outstanding mortgage debt. 3. Variations and Alternatives to Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust 3.1. Deed in Lieu of Foreclosure — Individual to Lender: In situations where the homeowner does not wish to establish a trust, an alternative option involves transferring ownership directly to the lender. 3.2. Deed in Lieu of Foreclosure — Individual to Third Party: In certain scenarios, homeowners may choose to transfer property ownership to an individual or entity unrelated to the lender, providing an opportunity to sell the property or satisfy a debt obligation. 3.3. Oceanside California Short Sale: While not technically a Deed in Lieu of Foreclosure, a short sale involves selling the property for less than the outstanding mortgage balance. This option can help homeowners avoid foreclosure and mitigate the impact on credit scores. Conclusion: Understanding the nuances of Oceanside California Deed in Lieu of Foreclosure — Individual to a Trust is crucial for homeowners navigating financial difficulties. By considering this alternative, homeowners can protect their credit, maintain control over the property, and negotiate beneficial terms with lenders. Variations such as transferring ownership to the lender or a third party, as well as alternative options like a short sale, provide additional avenues for homeowners to explore. Seek professional advice to ascertain which path aligns best with your unique circumstances.