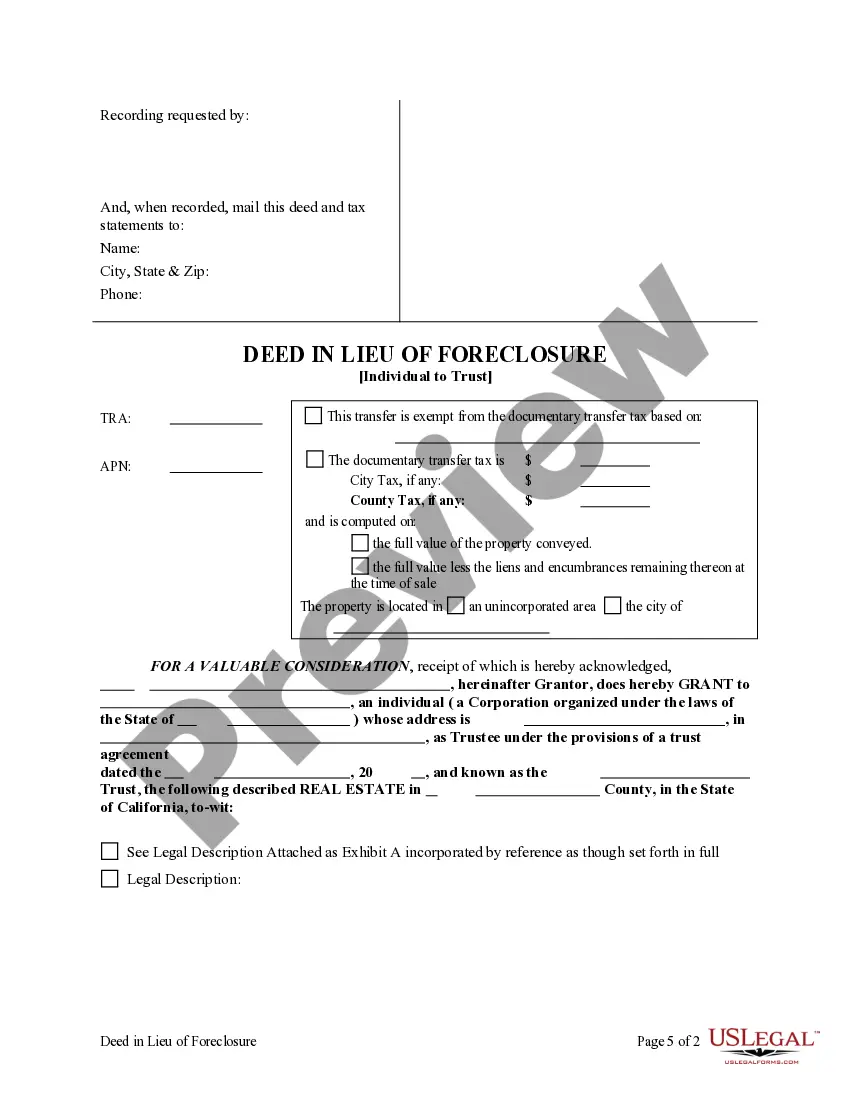

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Orange California Deed in Lieu of Foreclosure - Individual to a Trust

Description

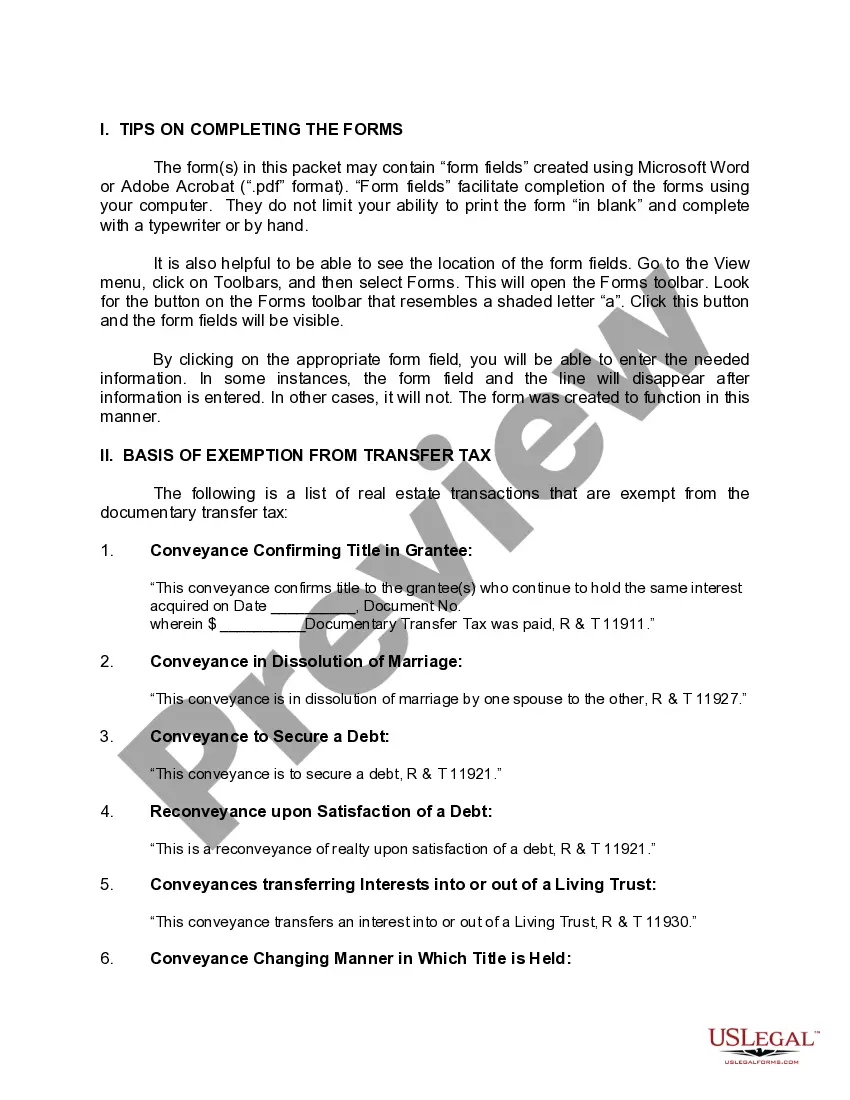

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

Locating authenticated templates tailored to your local statutes can be difficult unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents catering to both personal and professional needs as well as various real-life situations.

All the papers are appropriately organized by usage area and jurisdiction, making it simple and quick to search for the Orange California Deed in Lieu of Foreclosure - Individual to a Trust.

Maintaining paperwork orderly and compliant with legal standards is extremely important. Leverage the US Legal Forms library to always have crucial document templates readily available for any requirements!

- For those already familiar with our service who have utilized it previously, obtaining the Orange California Deed in Lieu of Foreclosure - Individual to a Trust requires just a few clicks.

- Log in to your account, select the document, and click Download to save it to your device.

- New users will need to follow a couple more steps in the process.

- Adhere to the guidelines below to commence with the most comprehensive online form library.

- Check the Preview mode and form description. Ensure that you have selected the correct one that satisfies your needs and fully aligns with your local jurisdiction requirements.

Form popularity

FAQ

While putting your house in a trust can offer benefits, there are disadvantages to consider. The process can involve costs for setting up and maintaining the trust, including legal fees. Additionally, transferring your home to a trust may complicate the financing process. It's essential to weigh these factors, especially in terms of the Orange California Deed in Lieu of Foreclosure - Individual to a Trust, to make an informed decision.

Writing a trust deed requires clearly stating the names of the trustor, trustee, and beneficiary, along with a detailed description of the property being transferred. You should also specify the terms of the trust and how the property will be managed. For a streamlined process, consider using available templates or services like US Legal Forms that guide you through each step. Incorporating the Orange California Deed in Lieu of Foreclosure - Individual to a Trust can also fit well into this arrangement.

To transfer a deed to a trust in California, prepare and execute a new deed that transfers ownership from yourself to the trust. Make sure to include specific trust details in the deed and sign it in front of a notary public. Once completed, file the deed with the county's recorder office to make it official. This process can involve the Orange California Deed in Lieu of Foreclosure - Individual to a Trust as part of your strategy.

Transferring a house to a trust in California involves executing a grant deed that designates the trust as the new owner. You must ensure that the deed is properly filled out and recorded with the county recorder's office. This process solidifies the ownership within the trust and allows for easier management of your assets. Utilizing the Orange California Deed in Lieu of Foreclosure - Individual to a Trust can simplify the transition.

To transfer your property into a trust in California, you need to create a trust document that outlines the terms and beneficiaries. Next, you must execute a deed to transfer title from your name to the trust, ensuring it follows California’s legal requirements. After that, file this deed with your county recorder's office to complete the transfer. Utilizing resources like USLegalForms can guide you through the process of creating an Orange California Deed in Lieu of Foreclosure - Individual to a Trust, making the entire procedure smoother.

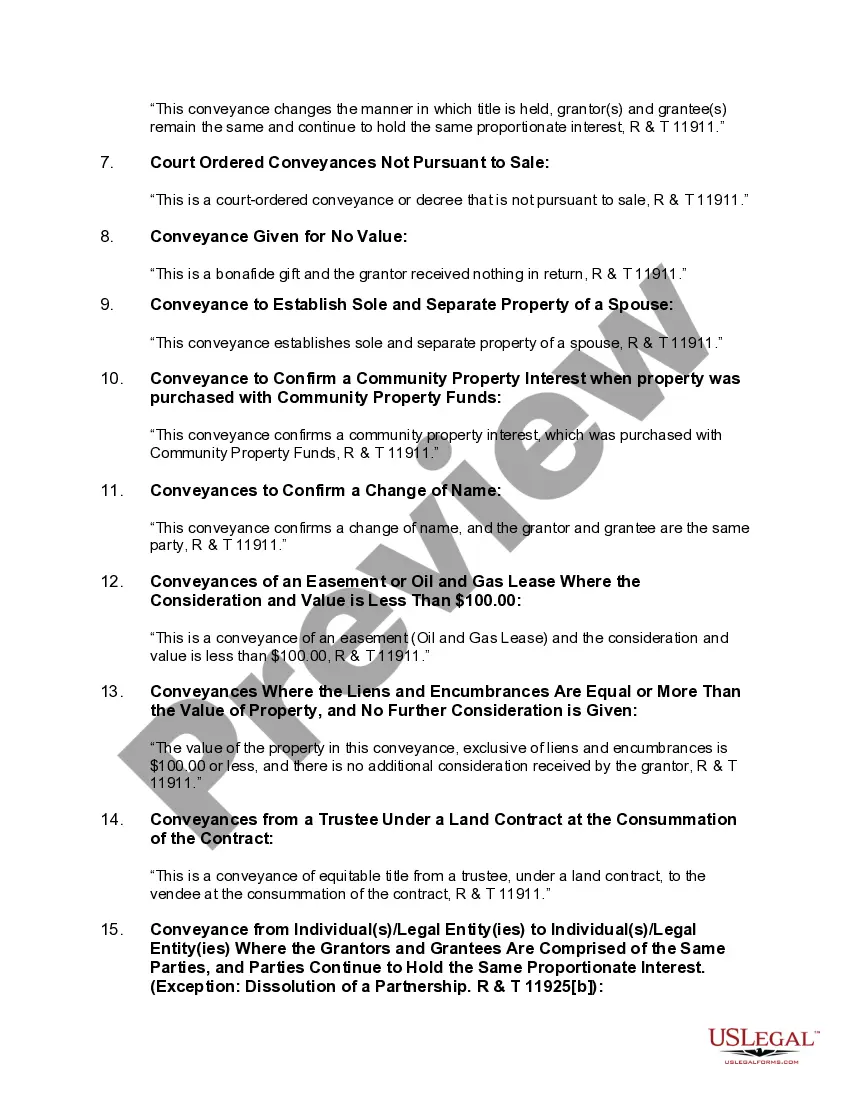

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

The purchaser has no responsibility because the purchaser receives the property title without the mortgage and junior liens. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? The lender takes the real estate subject to all junior liens.

How to Foreclose on a Deed of Trust Step 1 ? Notice of Default. Record a Notice of Default with the county recorder.Step 2 ? Notice of Sale.Step 3 ? Auction.Step 4 ? Obtain Possession of Property.

The greatest risk to a lender making a real estate loan is that a property pledged as collateral will be abandoned by the borrower.

Mainly, a deed in lieu is a mutual agreement between a homeowner and their lender, while in a foreclosure, the lender involuntarily takes back the property after an extended period of nonpayment by the homeowner. This process helps borrowers minimize the impact on their credit score.