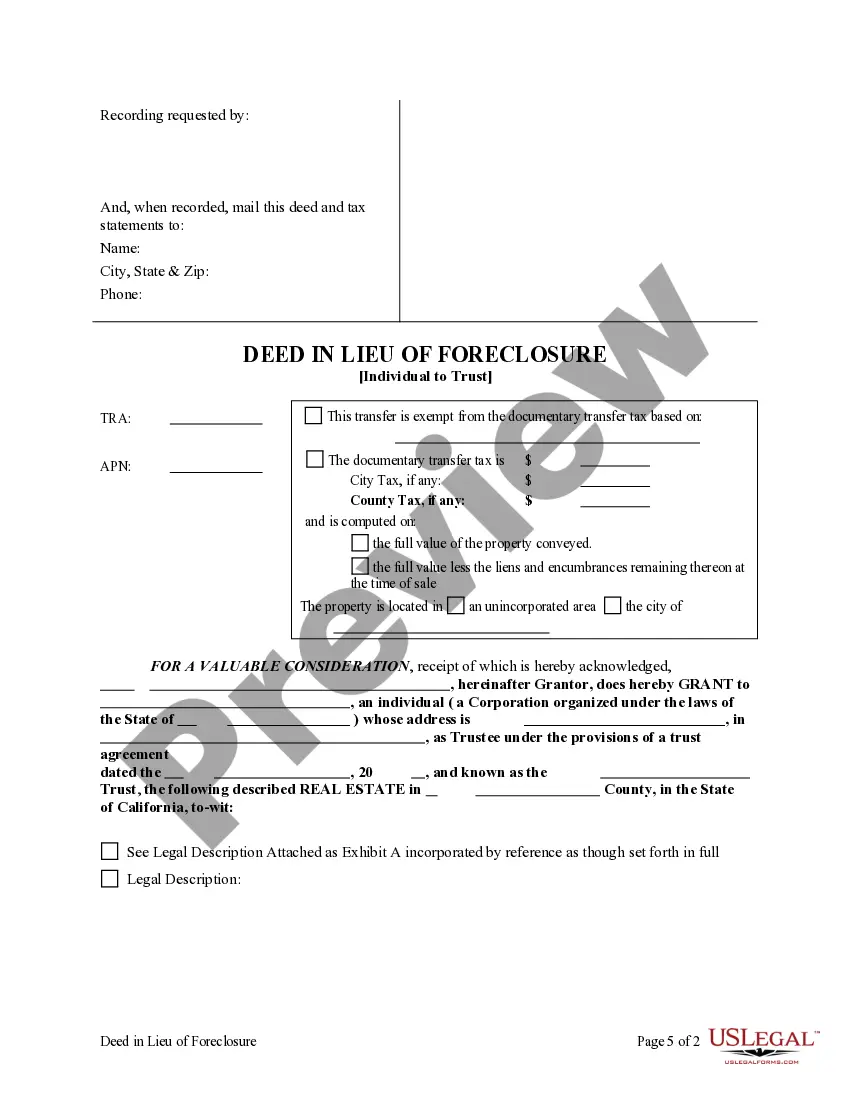

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Roseville California Deed in Lieu of Foreclosure — Individual to a Trust If you are a homeowner in Roseville, California facing the possibility of foreclosure, one alternative to consider is the Deed in Lieu of Foreclosure option. This specific type of Deed in Lieu of Foreclosure involves an individual transferring the title and ownership of their property to a trust rather than going through the traditional foreclosure process. This can be a solution for homeowners who are struggling to keep up with their mortgage payments and wish to avoid the negative consequences of foreclosure. Benefits of Roseville California Deed in Lieu of Foreclosure — Individual to a Trust 1. Avoiding Foreclosure: By opting for a Deed in Lieu of Foreclosure, homeowners can prevent their property from being seized by the bank or lender through foreclosure proceedings. This can protect their credit score and prevent the potential long-term negative impact that foreclosure may have on their financial future. 2. Simplified Process: Compared to foreclosure, a Deed in Lieu of Foreclosure generally offers a more straightforward and less time-consuming process. It involves negotiating with the lender to transfer the ownership of the property to a trust, which can expedite resolution for both parties involved. 3. Protection of Trust Assets: By transferring the property to a trust, homeowners can ensure that their assets are protected. The trust can be established with specific provisions to safeguard the property and ensure its effective management and distribution, providing homeowners with peace of mind. Types of Roseville California Deed in Lieu of Foreclosure — Individual to a Trust 1. Revocable Living Trust: This type of trust allows the homeowner to maintain control over their property while also planning for its future distribution. It can be changed or revoked by the individual at any point during their lifetime, providing flexibility and reassurance. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be altered or terminated by the homeowner. It offers enhanced asset protection and potential tax benefits. Once the property is transferred to an irrevocable trust, it is considered separate from the homeowner's estate. 3. Testamentary Trust: This type of trust is established through a will and only becomes effective after the homeowner's passing. With a testamentary trust, the property can be transferred to the trust upon the homeowner's death, ensuring its proper management, distribution, or sale as per their wishes. In conclusion, Roseville California Deed in Lieu of Foreclosure — Individual to a Trust is a viable alternative for homeowners facing financial hardship. By transferring the property to a trust, homeowners can avoid foreclosure, simplify the process, and safeguard their assets. The different types of trusts, such as revocable living trusts, irrevocable living trusts, and testamentary trusts, offer various benefits and options for homeowners to choose from based on their specific needs and goals.Roseville California Deed in Lieu of Foreclosure — Individual to a Trust If you are a homeowner in Roseville, California facing the possibility of foreclosure, one alternative to consider is the Deed in Lieu of Foreclosure option. This specific type of Deed in Lieu of Foreclosure involves an individual transferring the title and ownership of their property to a trust rather than going through the traditional foreclosure process. This can be a solution for homeowners who are struggling to keep up with their mortgage payments and wish to avoid the negative consequences of foreclosure. Benefits of Roseville California Deed in Lieu of Foreclosure — Individual to a Trust 1. Avoiding Foreclosure: By opting for a Deed in Lieu of Foreclosure, homeowners can prevent their property from being seized by the bank or lender through foreclosure proceedings. This can protect their credit score and prevent the potential long-term negative impact that foreclosure may have on their financial future. 2. Simplified Process: Compared to foreclosure, a Deed in Lieu of Foreclosure generally offers a more straightforward and less time-consuming process. It involves negotiating with the lender to transfer the ownership of the property to a trust, which can expedite resolution for both parties involved. 3. Protection of Trust Assets: By transferring the property to a trust, homeowners can ensure that their assets are protected. The trust can be established with specific provisions to safeguard the property and ensure its effective management and distribution, providing homeowners with peace of mind. Types of Roseville California Deed in Lieu of Foreclosure — Individual to a Trust 1. Revocable Living Trust: This type of trust allows the homeowner to maintain control over their property while also planning for its future distribution. It can be changed or revoked by the individual at any point during their lifetime, providing flexibility and reassurance. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be altered or terminated by the homeowner. It offers enhanced asset protection and potential tax benefits. Once the property is transferred to an irrevocable trust, it is considered separate from the homeowner's estate. 3. Testamentary Trust: This type of trust is established through a will and only becomes effective after the homeowner's passing. With a testamentary trust, the property can be transferred to the trust upon the homeowner's death, ensuring its proper management, distribution, or sale as per their wishes. In conclusion, Roseville California Deed in Lieu of Foreclosure — Individual to a Trust is a viable alternative for homeowners facing financial hardship. By transferring the property to a trust, homeowners can avoid foreclosure, simplify the process, and safeguard their assets. The different types of trusts, such as revocable living trusts, irrevocable living trusts, and testamentary trusts, offer various benefits and options for homeowners to choose from based on their specific needs and goals.