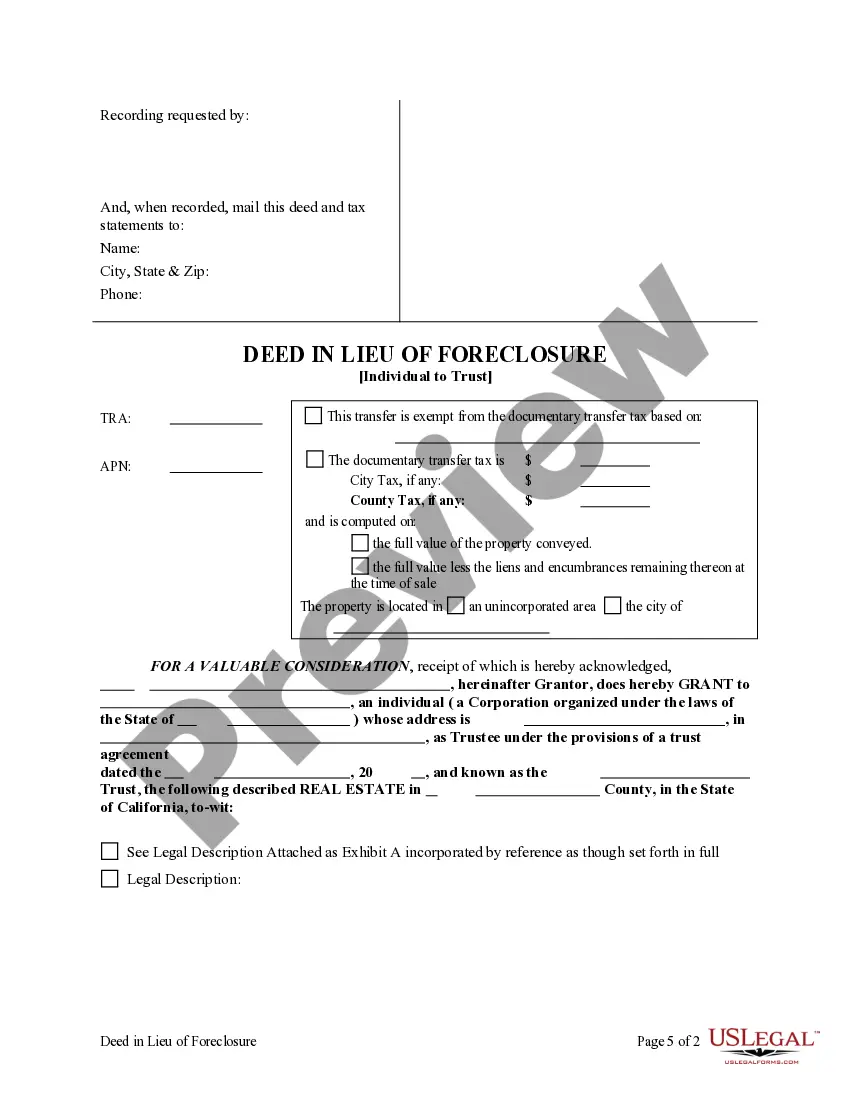

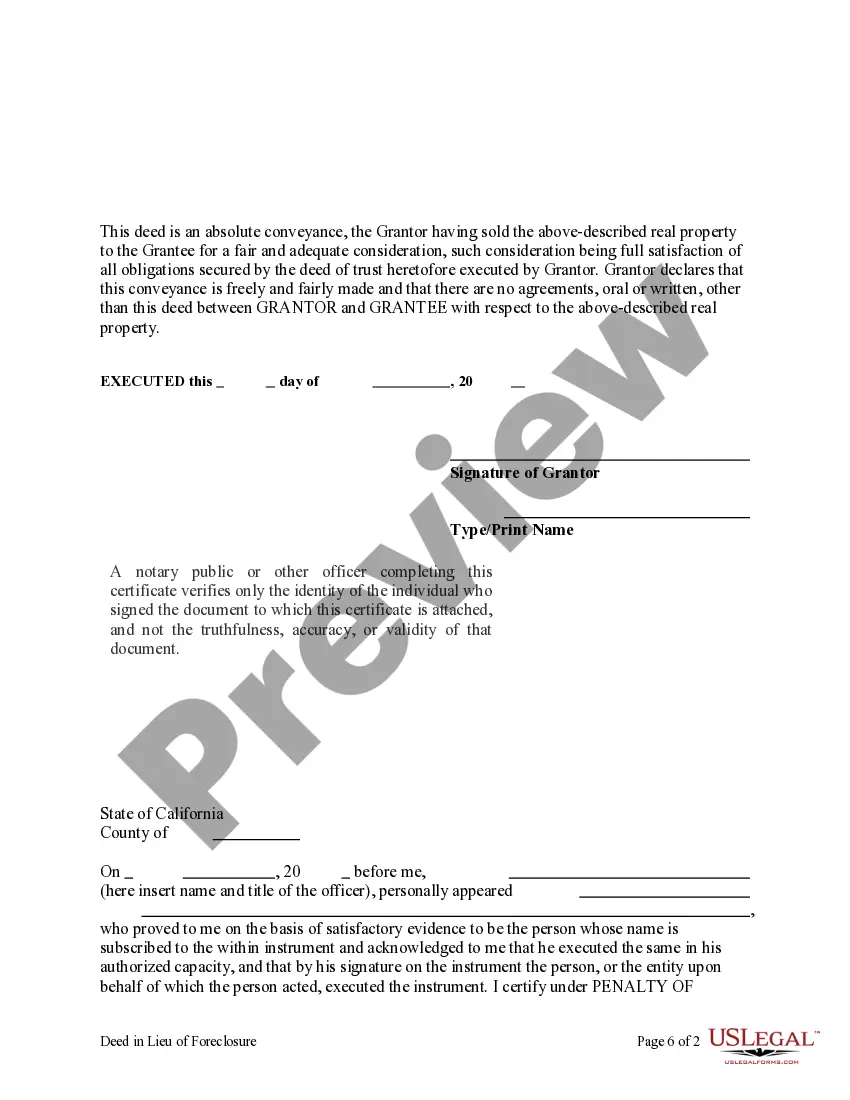

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust

Description

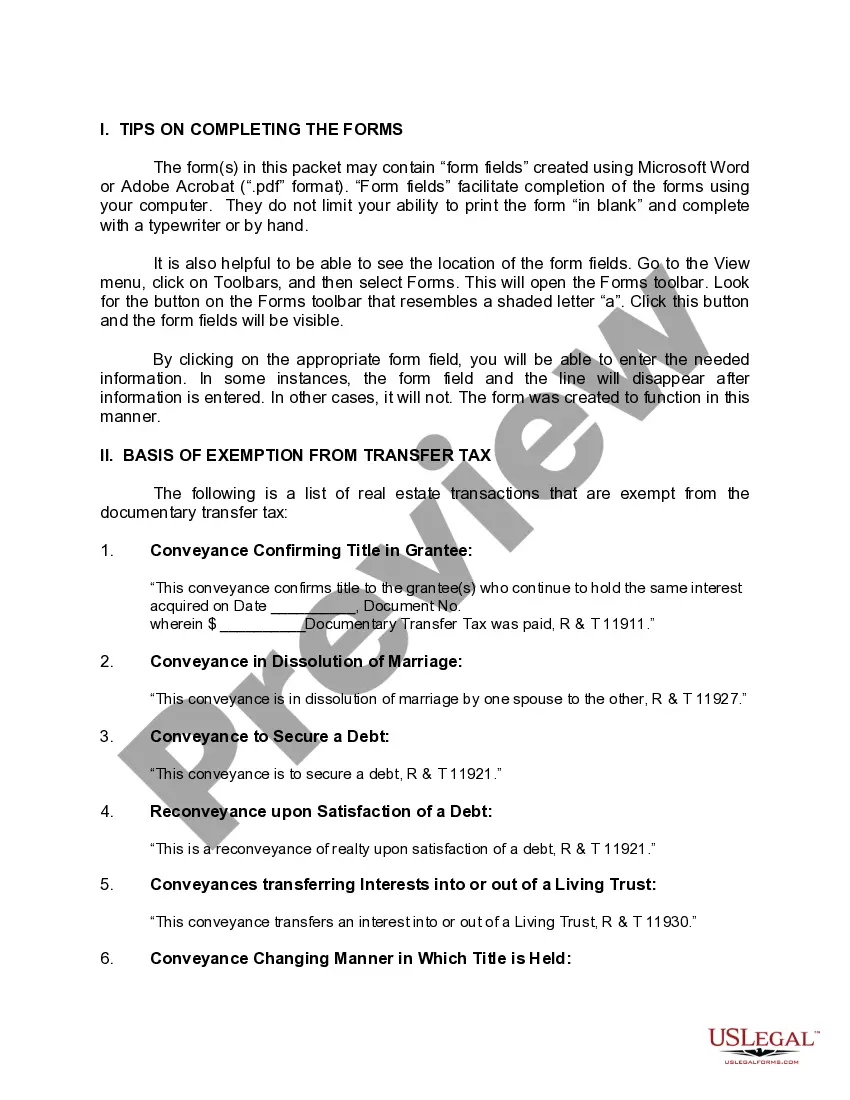

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

Regardless of one’s social or professional standing, finishing legal paperwork is an unfortunate obligation in today’s society.

Frequently, it’s nearly impossible for individuals without any legal background to generate such documents from scratch, largely due to the complex terminology and legal nuances involved.

This is where US Legal Forms steps in to provide assistance.

Ensure that the template you selected is suitable for your region because the laws of one state or region may not apply to another.

Review the form and read a brief overview (if available) of the situations the document can be utilized for.

- Our platform offers a vast collection of over 85,000 state-specific templates that cater to nearly any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors looking to save time using our DIY documents.

- Regardless of whether you require the Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust or any other document that will be recognized in your state or municipality, with US Legal Forms, everything is accessible.

- Here’s how to obtain the Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust swiftly using our reliable platform.

- If you are already a customer, simply Log In to your account to acquire the relevant form.

- However, if you are not familiar with our library, please follow these steps before obtaining the Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust.

Form popularity

FAQ

The timeline for the deed in lieu of foreclosure process can vary widely but typically ranges from a few weeks to a few months. Factors affecting this timeframe include lender responsiveness and the complexity of the individual case. By leveraging resources from USLegalForms, individuals can better navigate the complexities associated with Thousand Oaks, California Deed in Lieu of Foreclosure - Individual to a Trust, potentially expediting the process.

A lender is not obligated to accept a deed in lieu of foreclosure. They can decline this option if they believe it does not serve their financial interest. Understanding this dynamic is essential for those navigating Thousand Oaks, California Deed in Lieu of Foreclosure - Individual to a Trust, as it highlights the importance of proper negotiation and documentation.

One major disadvantage for lenders accepting a deed in lieu of foreclosure is the potential loss of negotiating power. When lenders opt for this route, they may miss out on recovering the full amount owed. As such, utilizing services like USLegalForms can assist lenders in understanding the implications and navigating the process of Thousand Oaks, California Deed in Lieu of Foreclosure - Individual to a Trust.

Negotiating a deed in lieu of foreclosure involves open communication with your lender. When you approach them, it's crucial to present your financial situation clearly and demonstrate your willingness to avoid foreclosure. In Thousand Oaks, California Deed in Lieu of Foreclosure - Individual to a Trust cases, presenting a compelling case can often lead to favorable terms for both parties.

A deed of trust foreclosure often completes faster than a mortgage foreclosure because it involves fewer legal steps. In Thousand Oaks, California Deed in Lieu of Foreclosure - Individual to a Trust, lenders can bypass the courts, streamlining the process and reducing time. This efficiency benefits both the borrower and the lender by expediting resolution and minimizing costs.

Yes, it is possible to buy a house after a deed in lieu of foreclosure, but there may be waiting periods and credit score implications. Generally, lenders will look for a significant improvement in your financial situation before approving a new mortgage. If you're navigating these waters, understanding your options with a Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust can support your future home-buying efforts.

Yes, a trust deed can be foreclosed in California through a non-judicial process, which occurs outside of court. This method allows lenders to reclaim property more quickly than a judicial foreclosure. If you are facing this situation, consider evaluating a Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust as a viable alternative to avoid foreclosure.

A deed of trust may be deemed invalid if it does not meet California's statutory requirements, such as improper notarization or lack of mutual consent between the parties involved. Additionally, inconsistencies in the trust deed's terms may lead to its invalidation. Make sure to consult resources like USLegalForms to ensure your Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust adheres to all legal standards.

One primary disadvantage of a trust deed is that it may limit your options for refinancing or selling the property. If you do not stay current on payments, the lender can take action more swiftly than with a mortgage. Understanding how a Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust works can provide vital alternatives to mitigate these disadvantages.

To record a deed of trust in California, you need to submit it to the county recorder's office in the county where the property is located. When handling a Thousand Oaks California Deed in Lieu of Foreclosure - Individual to a Trust, ensure that the deed is properly executed and notarized. Once submitted, the recorder will file the document, creating a public record of the trust deed.