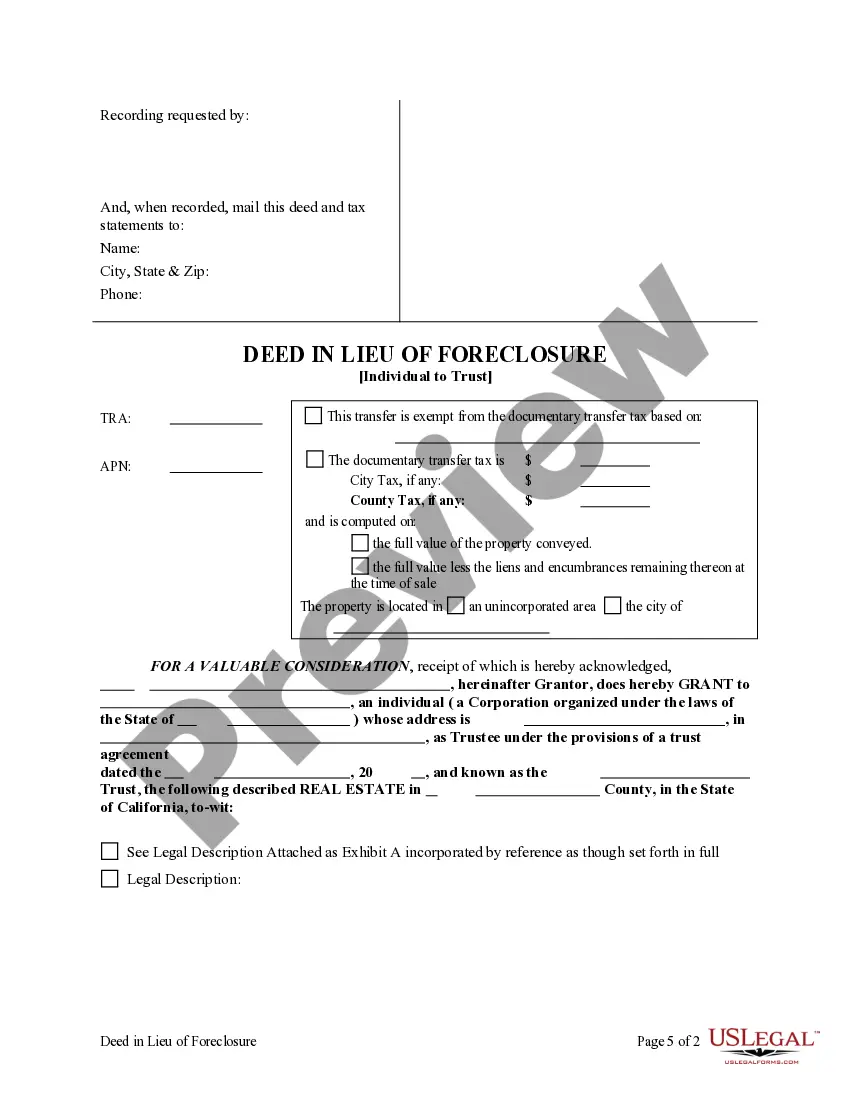

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust

Description

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

If you are looking for an applicable form template, it’s challenging to find a superior source than the US Legal Forms website – likely the largest online repositories.

With this repository, you can discover countless form examples for corporate and personal needs categorized by types and states, or keywords.

Utilizing our premium search feature, locating the latest Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Select the file format and save it to your device.

- Additionally, the significance of each record is verified by a team of professional attorneys who frequently evaluate the templates on our platform and update them in line with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the initial time, simply adhere to the directions outlined below.

- Ensure you have selected the sample you need. Review its details and utilize the Preview feature to examine its content. If it does not fulfill your criteria, use the Search option located at the top of the screen to find the correct document.

- Confirm your selection. Click the Buy now button. Then, select your desired subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

To place your property in a trust in California, begin by choosing the type of trust that suits your needs, such as a revocable living trust. Next, you will need to prepare a trust deed that includes details about the property and the trustee. Once the deed is drafted, sign it in front of a notary and then file it with your county recorder's office. By following these steps, you can effectively manage your property through a Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust, ensuring that your assets are protected for your beneficiaries.

In California, trust deeds can indeed be foreclosed, similar to traditional mortgages. If the borrower defaults, the lender can initiate a non-judicial foreclosure process. To prevent this scenario, it's vital to consider a Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust as a proactive approach. By doing so, you might avoid the complications of foreclosure altogether and protect your assets.

Transferring a deed to a trust in California involves preparing a deed that reflects the trust as the new owner. You will typically use a quitclaim deed or a grant deed to effectuate this transfer. After completing the deed, file it with the county recorder's office to ensure the change is officially recognized. Taking these steps is essential when managing your Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust.

While transferring your house into a trust can offer benefits, certain disadvantages exist. For instance, you may incur costs related to creating and maintaining the trust. Additionally, creditors may have rights to the trust assets under certain conditions, which could affect your Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust. Consulting a legal expert can help clarify how these aspects impact your decision.

To transfer a house to a trust in California, you must first create the trust document and appoint a trustee. Then, you need to complete a grant deed or quitclaim deed designating the trust as the new owner. Finally, file the deed with your local county recorder's office. This process plays a crucial role in ensuring your Vacaville California Deed in Lieu of Foreclosure - Individual to a Trust is properly established.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. inlieu of foreclosure may help you avoid being personally liable for any amount remaining on the mortgage.

How to Foreclose on a Deed of Trust Step 1 ? Notice of Default. Record a Notice of Default with the county recorder.Step 2 ? Notice of Sale.Step 3 ? Auction.Step 4 ? Obtain Possession of Property.

1) A D.O.T. is much easier to foreclose upon then a mortgage because the process to foreclose on a D.O.T. bypasses the judicial process. Assuming the Trustee gives the right notices (Notice of Default and Notice of Sale) the process will go to sale without court involvement at all.