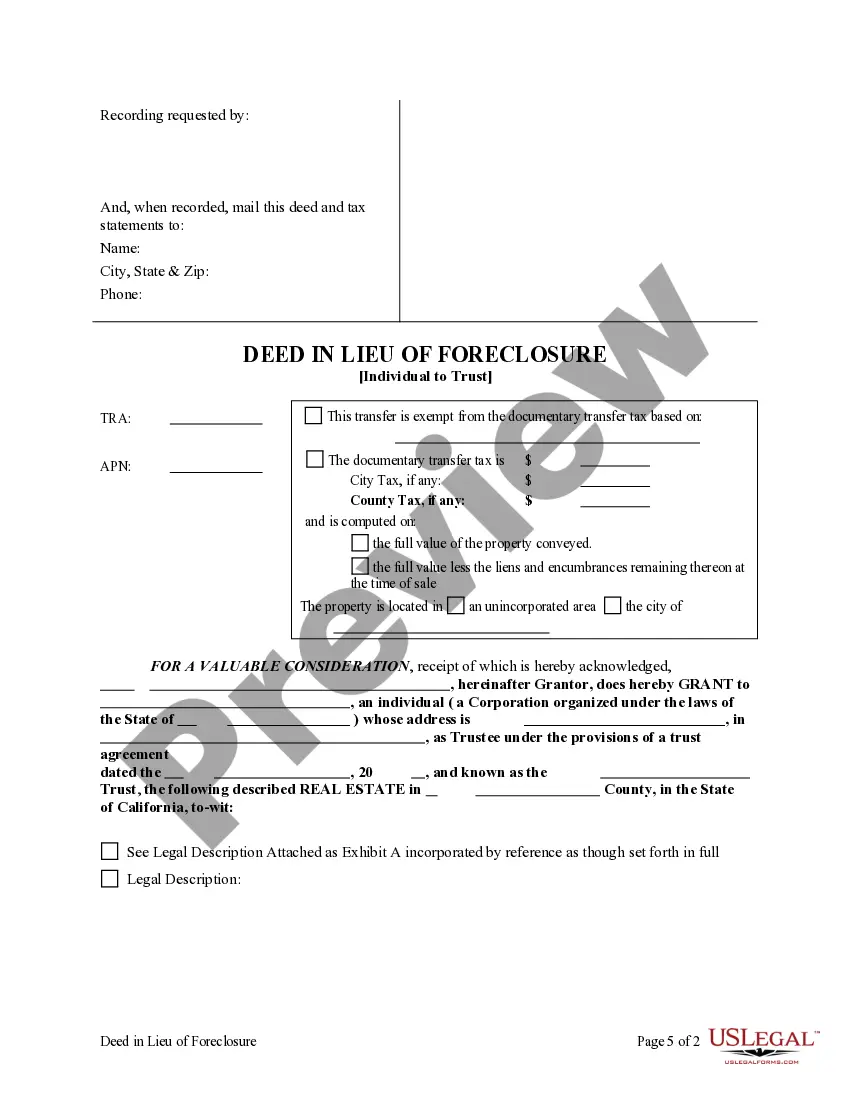

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust

Description

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

We consistently seek to reduce or evade legal repercussions when navigating intricate legal or financial situations.

To achieve this, we seek attorney solutions that are generally quite expensive.

However, not all legal challenges are quite this convoluted.

Many of them can be managed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust or any other document easily and securely.

- US Legal Forms is an online directory of current DIY legal documents ranging from wills and power of attorney to incorporation articles and petitions for dissolution.

- Our platform empowers you to handle your issues autonomously without the need for a lawyer's assistance.

- We provide access to legal document templates that aren’t always readily available.

- Our templates are tailored to specific states and regions, which greatly enhances the search experience.

Form popularity

FAQ

Transferring property to a trust in California requires preparing a new deed that specifies the trust as the primary grantee. Complete the deed with accurate property details and signatures, and then notarize it. Finally, file the deed with the county recorder to formalize the transfer. Using a Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust as a reference can make this process smoother.

Drafting a trust deed involves outlining critical details like the parties' names, property description, and the trust's purpose. You should include the rights and duties of the trustee and any specific instructions regarding the property's management. For accuracy, consider consulting legal resources or templates for the Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust, which can aid in ensuring compliance with local regulations.

To write a trust deed, begin by stating the names of the parties involved, including the grantor and the trustee. Clearly describe the property to be transferred and define the terms of the trust. It's essential to comply with California laws to ensure the trust deed is enforceable. Consider using the Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust for guidance on drafting this important document.

When writing a deed in lieu of foreclosure letter, start with a clear statement expressing your intent to transfer the property to the lender. Include essential details like the property's address and the reasons for the transfer. Being concise and transparent can facilitate the process and help avoid complications. The Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust may provide insights on how to structure this letter effectively.

To transfer a deed to a trust in California, you begin by obtaining the current deed and preparing a new deed that names the trust as the grantee. You will also need to sign the new deed before a notary to ensure its validity. Finally, file the new deed with the county recorder's office, which makes the transfer official. Utilizing the Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust can simplify this process.

A trust deed is a legal document that facilitates the transfer of property to a trust. For instance, a homeowner may create a Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust to ensure their property is held in trust for their beneficiaries. This document outlines the terms under which the property is transferred and specifies the trustee's responsibilities.

To file a Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust, start by gathering all necessary documents related to your mortgage and property. Next, contact your lender to discuss your intent and receive their approval, as they will likely need to agree to the terms. Prepare the deed by filling out the appropriate forms, which you can easily find on USLegalForms, ensuring all details are accurate. Finally, submit the completed deed to your local county recorder's office to complete the process.

One disadvantage of a deed in lieu foreclosure is that it may affect your credit score more than you expect. While this process allows for a smoother transition away from a troubled mortgage, lenders may still report it negatively to credit agencies. If you are considering a Vallejo California Deed in Lieu of Foreclosure - Individual to a Trust, being aware of this impact is crucial for your financial future. Utilizing resources like US Legal Forms can help you navigate these complexities more effectively.