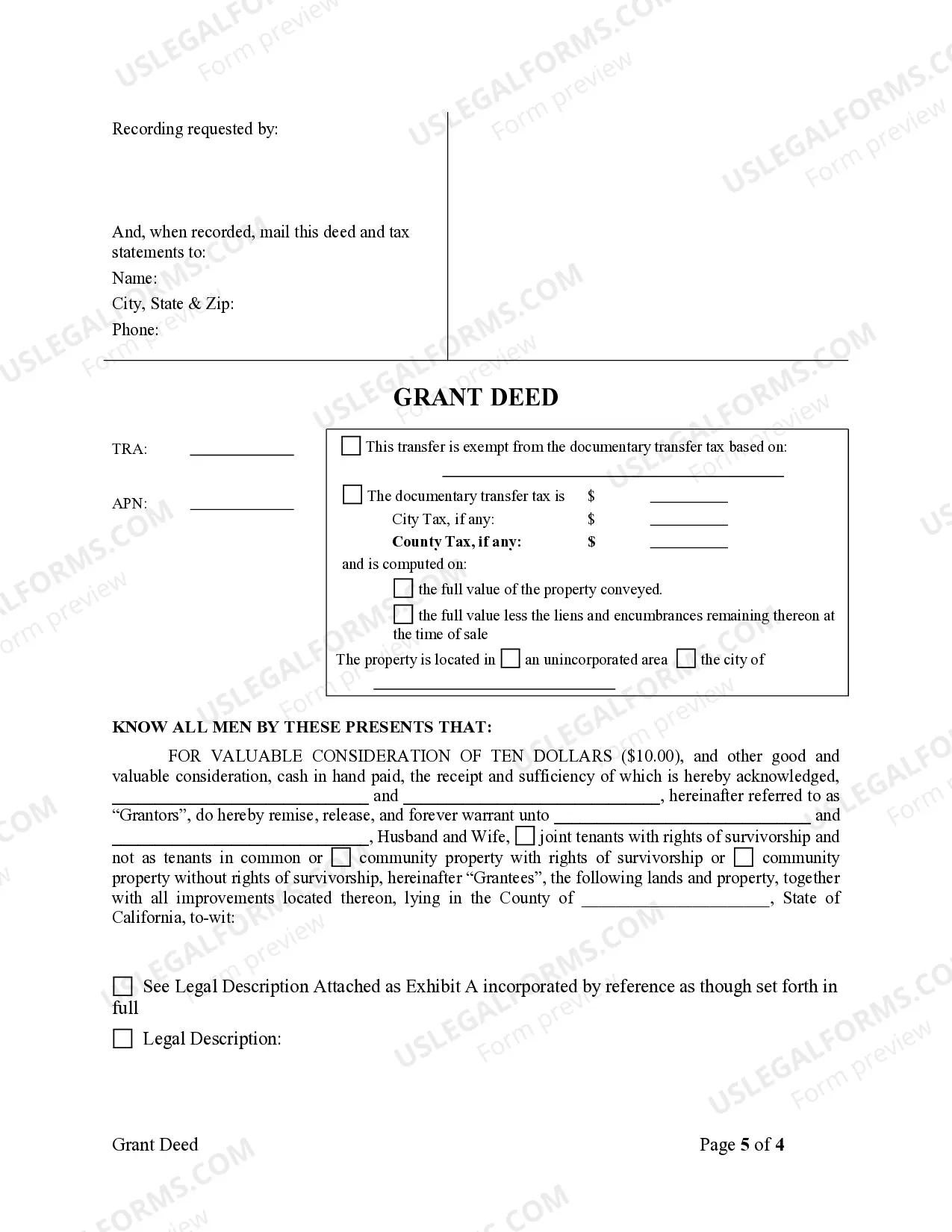

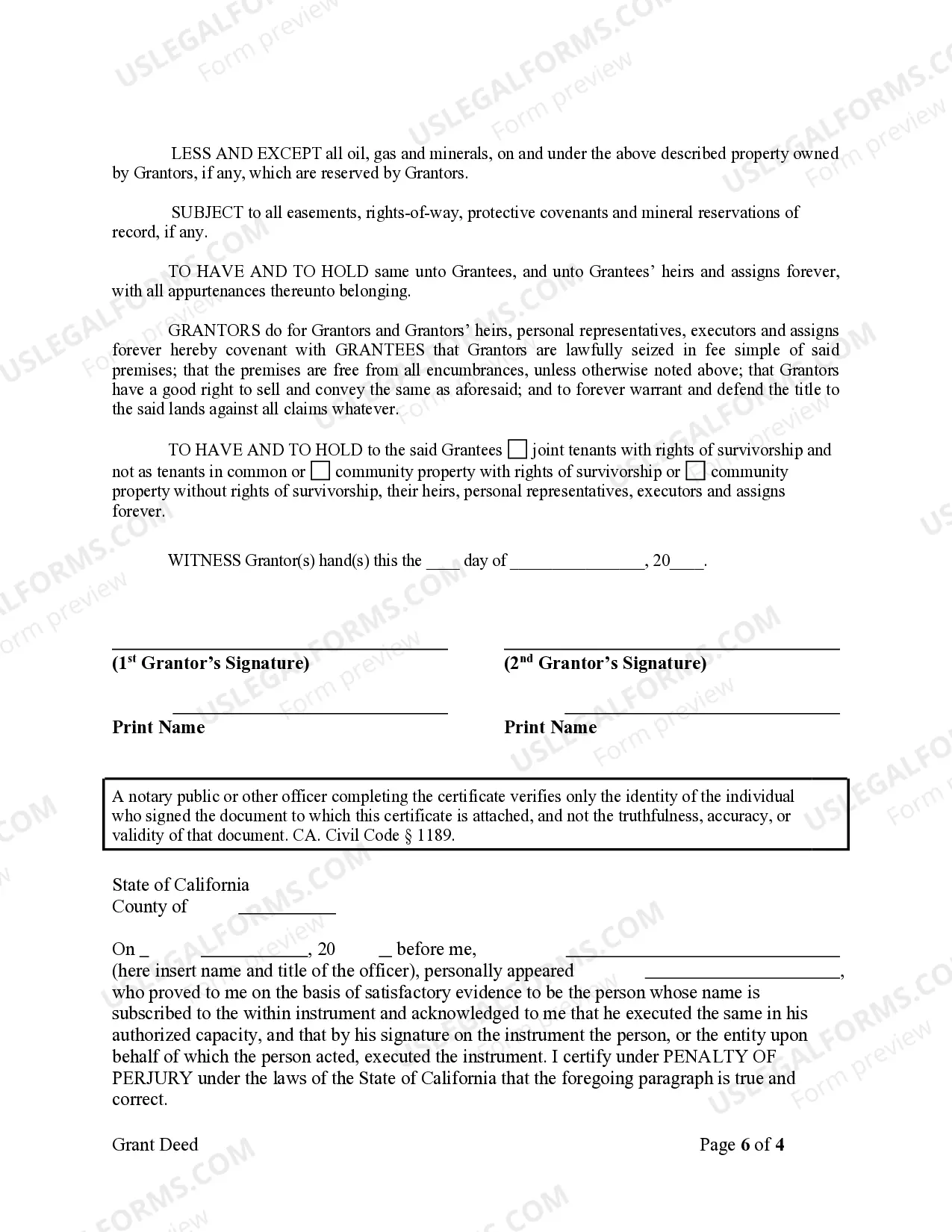

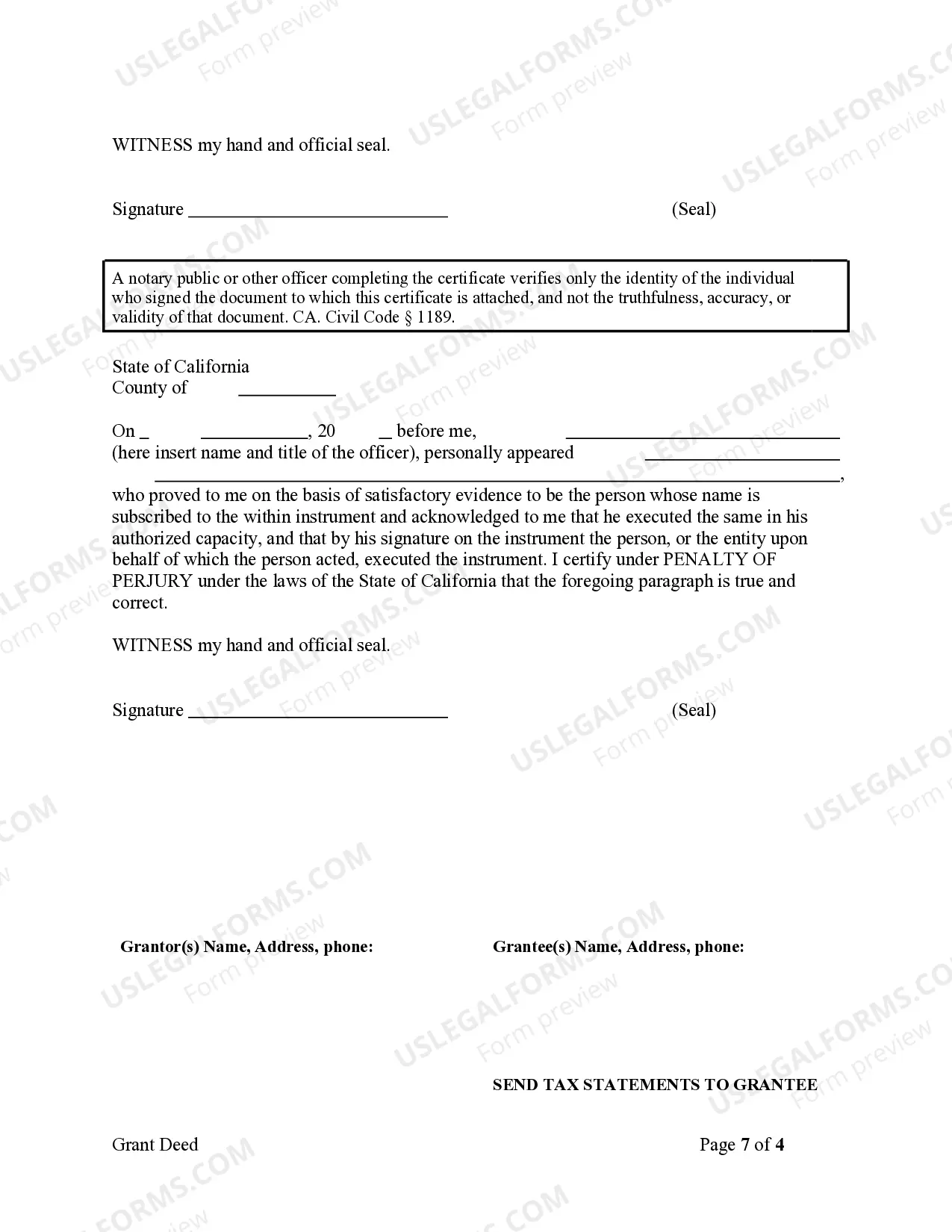

This Warranty Deed from two Individuals to Husband and Wife form is a Warranty Deed where the Grantors are two individuals and the Grantees are Husband and Wife. Grantors convey and warrant the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

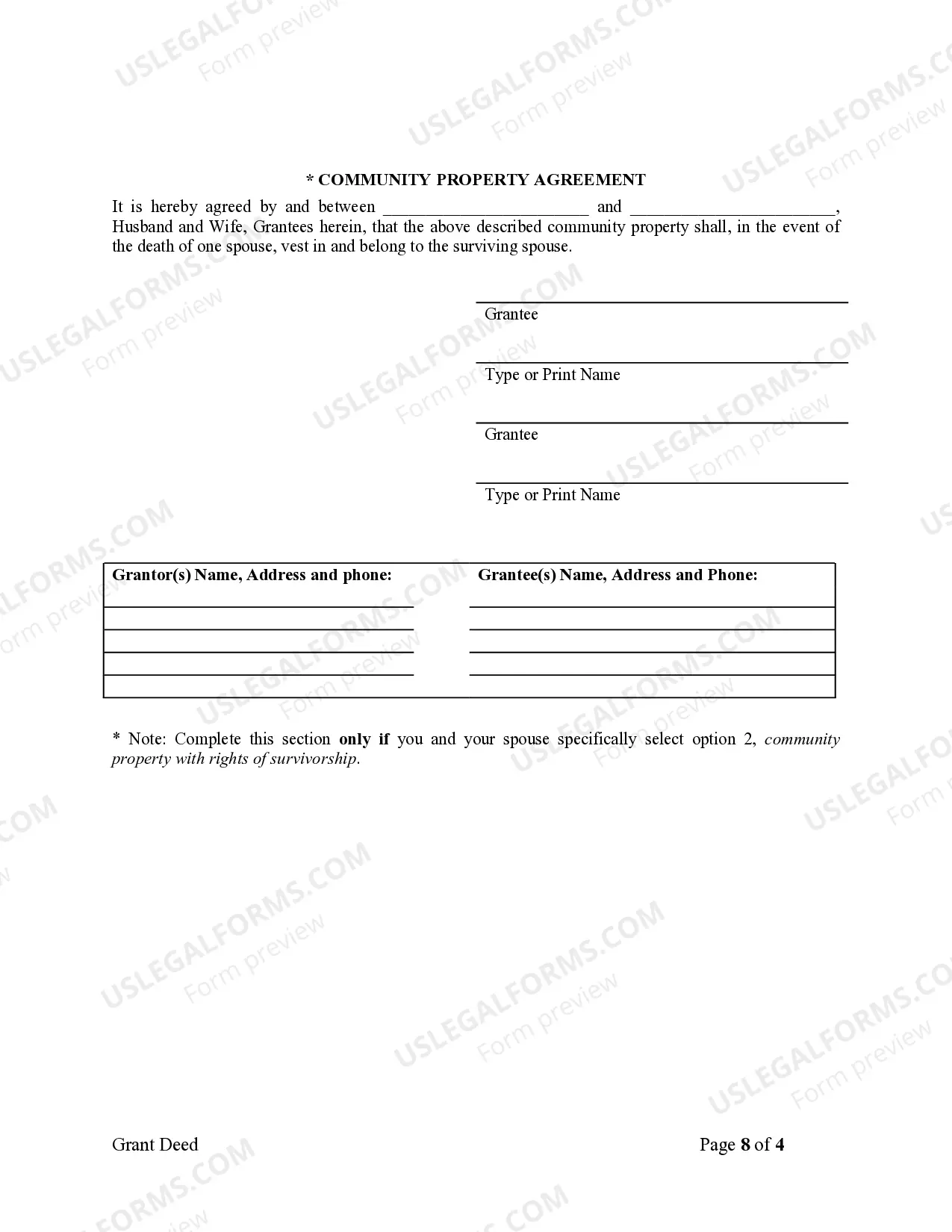

A Murrieta California Grant Deed from Two Individuals to Husband and Wife is a legal document that conveys ownership of a property from two individuals to a married couple. This type of deed transfers the entire ownership interest in the property, guaranteeing the couple full rights and title to the real estate. A Murrieta California Grant Deed from Two Individuals to Husband and Wife serves as a legally binding agreement between the granters (the two individuals transferring the property) and the grantees (the married couple receiving the property). This document must comply with the specific regulations and requirements set forth by the state of California. There are two main types of Murrieta California Grant Deed from Two Individuals to Husband and Wife: 1. General Grant Deed: This type of deed guarantees that the property is free from any encumbrances or liens, except for those that are specifically mentioned in the deed. A General Grant Deed provides the highest level of protection for the grantees, as it ensures that the transfer of ownership is clean and without any hidden surprises. 2. Special Grant Deed: Also known as a Limited Grant Deed, this type of deed guarantees that the property is free from any encumbrances or liens, but only during the granters' period of ownership. Once the property is transferred to the husband and wife, any future liens or encumbrances that arise would not be the responsibility of the granters. However, unlike a General Grant Deed, a Special Grant Deed does not provide as extensive protection to the grantees. When considering the use of a Murrieta California Grant Deed from Two Individuals to Husband and Wife, it is essential to consult with a qualified attorney or real estate professional to ensure compliance with all legal requirements. Additionally, all parties involved should thoroughly review and understand the terms and conditions outlined in the deed before proceeding with the transfer of ownership.A Murrieta California Grant Deed from Two Individuals to Husband and Wife is a legal document that conveys ownership of a property from two individuals to a married couple. This type of deed transfers the entire ownership interest in the property, guaranteeing the couple full rights and title to the real estate. A Murrieta California Grant Deed from Two Individuals to Husband and Wife serves as a legally binding agreement between the granters (the two individuals transferring the property) and the grantees (the married couple receiving the property). This document must comply with the specific regulations and requirements set forth by the state of California. There are two main types of Murrieta California Grant Deed from Two Individuals to Husband and Wife: 1. General Grant Deed: This type of deed guarantees that the property is free from any encumbrances or liens, except for those that are specifically mentioned in the deed. A General Grant Deed provides the highest level of protection for the grantees, as it ensures that the transfer of ownership is clean and without any hidden surprises. 2. Special Grant Deed: Also known as a Limited Grant Deed, this type of deed guarantees that the property is free from any encumbrances or liens, but only during the granters' period of ownership. Once the property is transferred to the husband and wife, any future liens or encumbrances that arise would not be the responsibility of the granters. However, unlike a General Grant Deed, a Special Grant Deed does not provide as extensive protection to the grantees. When considering the use of a Murrieta California Grant Deed from Two Individuals to Husband and Wife, it is essential to consult with a qualified attorney or real estate professional to ensure compliance with all legal requirements. Additionally, all parties involved should thoroughly review and understand the terms and conditions outlined in the deed before proceeding with the transfer of ownership.